Welcome to Nuvei Online Documentation which will help you integrate GlobalPay, NuveiTM’s latest payment platform.

Once you are registered you will be able to configure your websites and operate the transactions at https://globaldashboardtest.nuvei.com/.

You can start integration with GlobalPay payment platform using our REST API, Nuvei SDK-PHP, or one of our plugins for e-commerce web shops. For more details about Nuvei SDK-PHP and Nuvei Plugins click on the images below.

The GlobalPay REST API is based on a request/response mechanism that uses HTTP protocol. This means that the API is using different HTTP methods to perform different actions (such as: GET, POST, PUT, DELETE), resource-oriented URLs and HTTP response codes to indicate API errors. Also, authentication to the API occurs via HTTP Basic Auth (HTTP Basic access authentication).

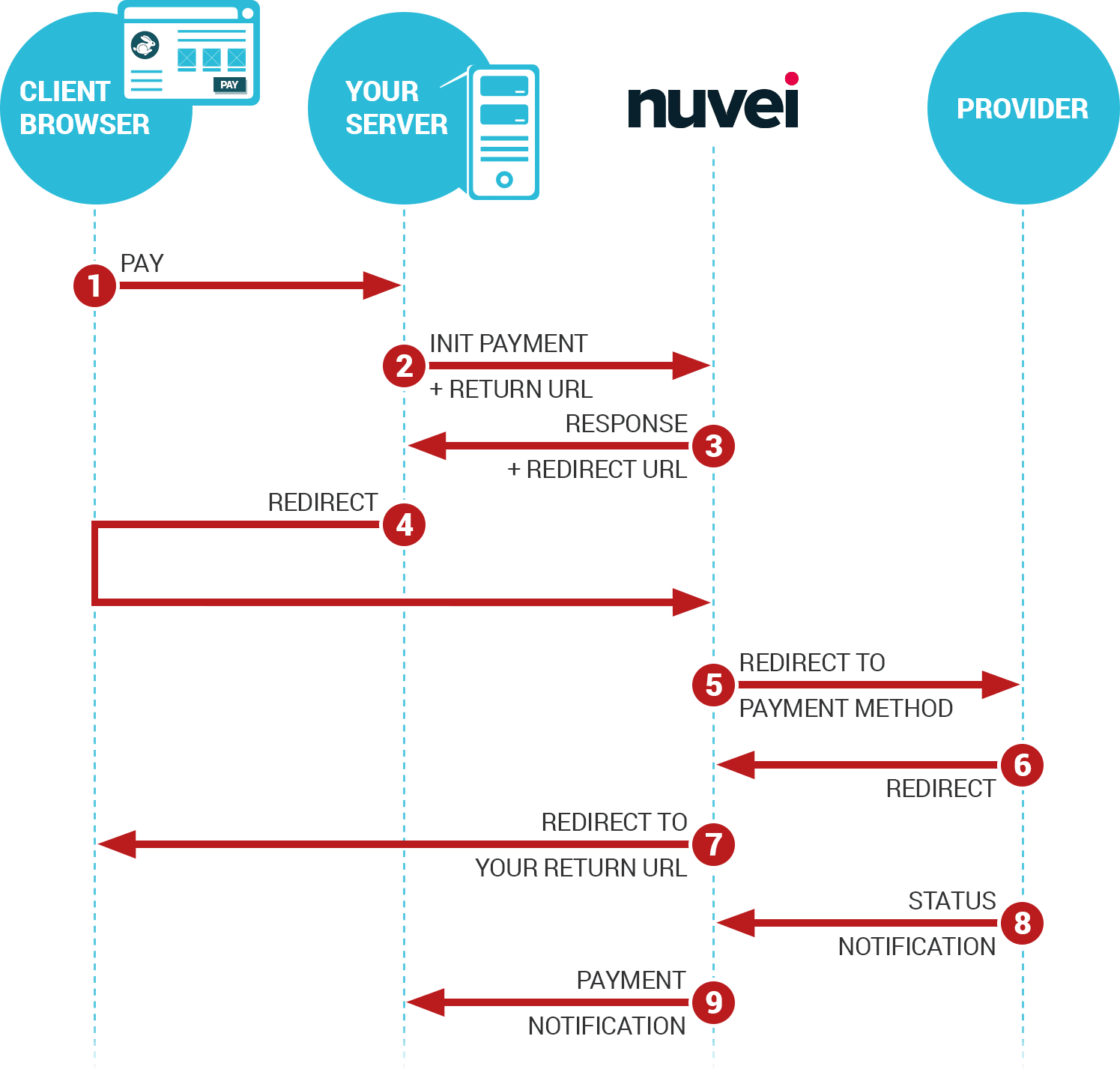

To initiate a transaction, you need to create a payment object. The parameters of the payment need to be sent in the message body as a JSON object.

For all requests Basic Authentication is used with a secret API Key. Please make sure the API keys are kept secret and regenerate at once if security has been compromised! All requests must be initiated using HTTPS protocol!

We are working with two platforms Test and Live. The integration and testing phase will first be done on the test server. As soon as the development and testing phase are successfully completed you will need to follow the same steps for integration on the live platform. You will also have to whitelist GlobalPay’s IPs for Test and Live Environment. For more information please visit our section GlobalPay’s Environments and IPs.

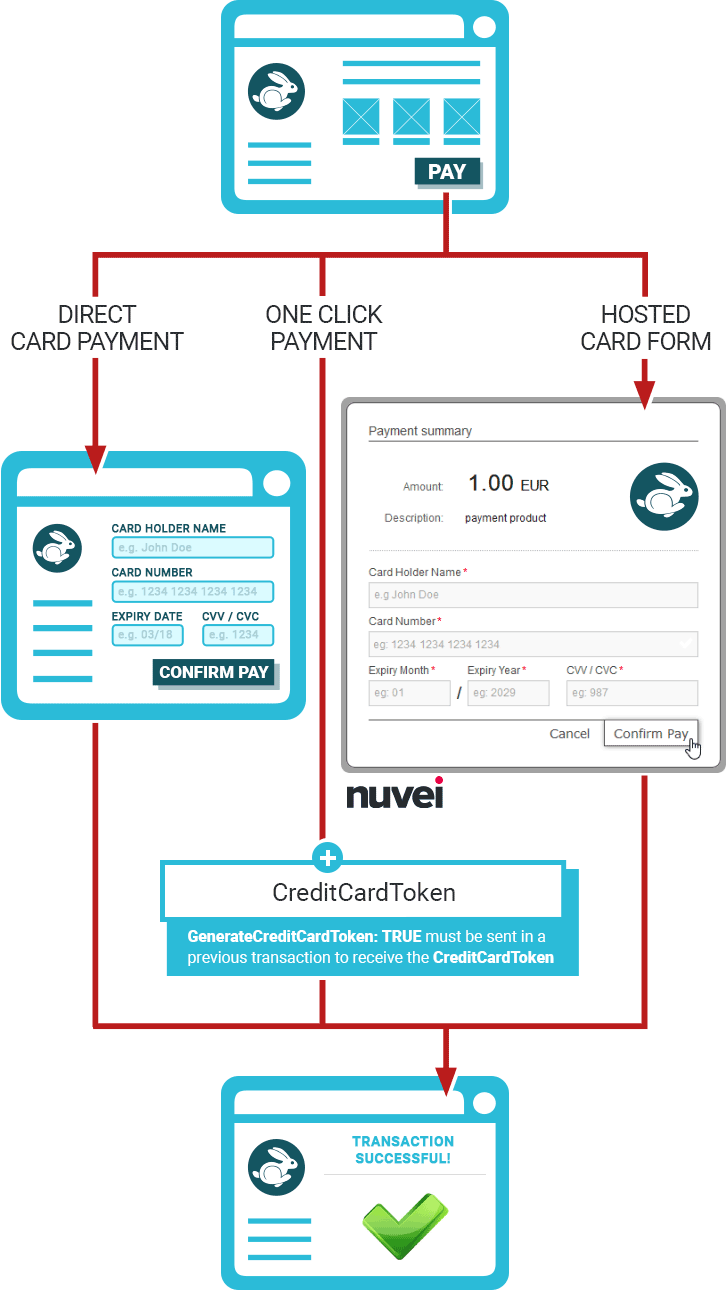

GlobalPay REST API exposes the following resources: payments (one-off or recurring), refunds, refund types, preapprovals (used for recurring billing), payment methods, customers, billing addresses, shipping addresses. Here you will find how you can control each of these resources.

Playground transactions and test transactions do not involve real money. Their purpose is to get you accustomed on how to process live transactions.