Looking for one marketplace-focused solution, which is also fully compliant with the PSD2 regulatory requirements?

You’re in the right place!

Our solution for marketplace platforms has been designed to seamlessly integrate with Mirakl’s e-marketplace products and allows for fully customizable marketplace onboarding and split payments processes.

Mirakl Marketplace Platform is one of the most modern, flexible, and feature-rich Marketplace solution available, with years of best practices built in and also offering clients unparalleled expertise from their team of 30+ business, technical, and operational marketplace experts.

Not using Mirakl? No problem: we also offer Marketplace APIs to help you manage marketplace payments. More info here: https://docs-apm.nuvei.com/category/marketplace-api/.

The solution provides access to credit card payments and alternative payment methods for a Marketplace in a simple yet reliable legal and technical setup.

We are committed to help marketplaces run their business without worrying about the associated regulatory requirements from the new PSD2 directive which have come into force beginning 2018.

Nuvei solution ensures that all of the participating shops as well as the marketplace will benefit of a seamlessly onboarding process, reliable and secure transaction processing, reconciliation to the penny and prompt settlements.

The Mirakl plugin features:

- automated import of all the the newly created shops and required documents from Mirakl to Smart2pay platform – leading to a fully customizable and seamless onboarding process.

- automated shop approval notification which contains all info you need to start processing right away. More info here: Mirakl Notification for Shop Approval.

- automated import of all payment instructions to marketplace participants and handling all the commission fees for the marketplace operator. Please discuss with our technical support the setup of your Mirakl voucher generation process.

- supporting a wide range of payment methods from credit card payment to alternative payment methods with an all-in-one unified API and settlement flow.

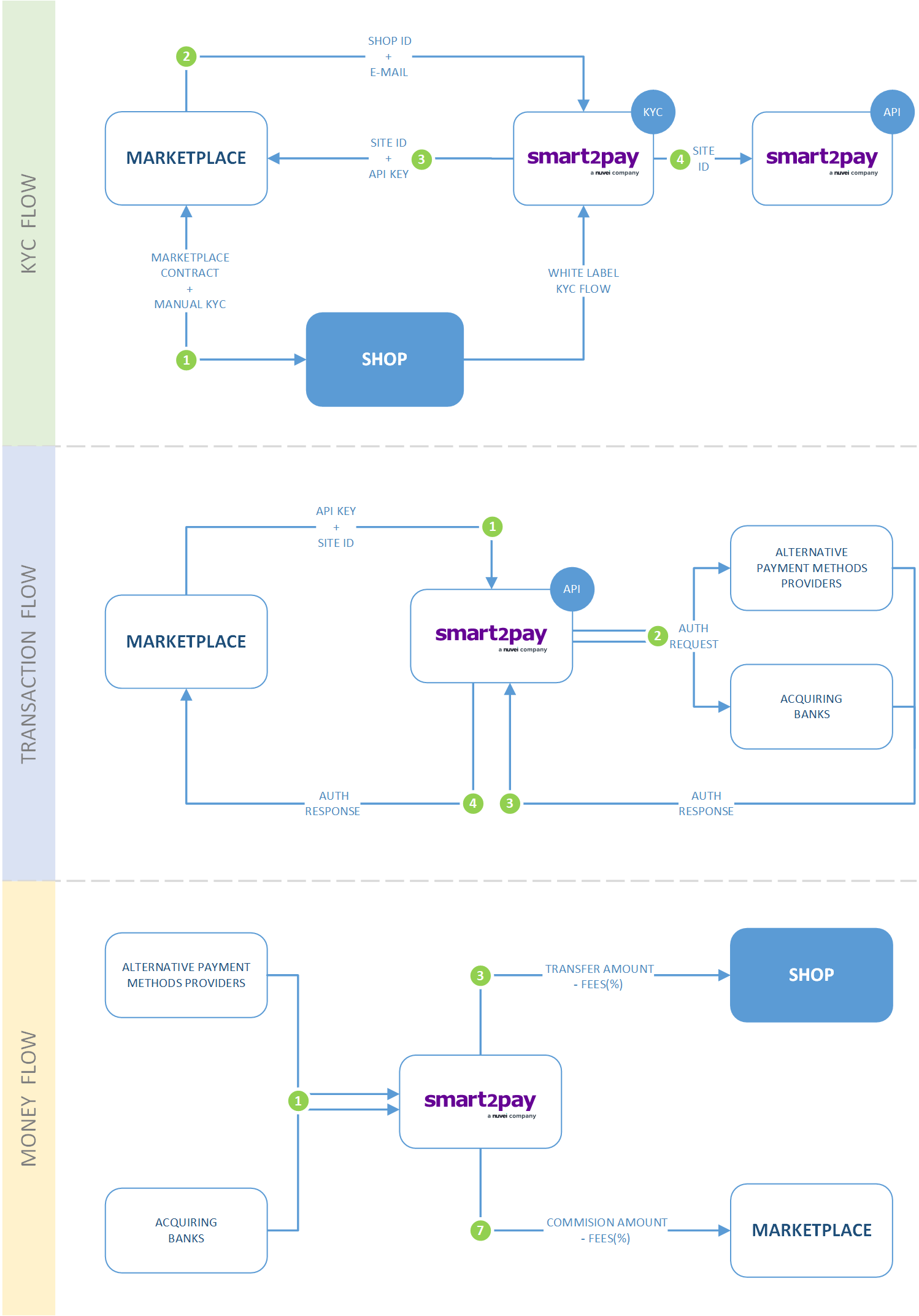

Here is how it works:

The technical process (KYC Flow) with all the necessary steps is described next:

-

All KYC processes related to marketplace onboarding of the participating shops take place in Mirakl KYC system. All KYC processes related to payments take place in Nuvei KYC system.

- Mirakl Marketplace accepts a new shop on its platform and creates an entry in its database.

- Mirakl Marketplace exposes an API which Nuvei KYC platform calls several times per day to pull information about the newly created shops.

- Nuvei KYC platform pulls all available information about the shop (ShopID, Alias, shop representative e-mail, documents etc.). If all the required information is not available, the merchant representative will have to fill it in on Nuvei KYC platform.

- Nuvei will create an account for the shop in the Nuvei KYC platform and send an e-mail to the shop representative with the login details.

- The shop representative will fill in any missing company related data and upload KYC/UBO specific documentation.

- The shop representative signs online the Merchant agreement for Payment processing.

- Nuvei Risk team reviews the company.

- In case of approval, a siteID is generated in the Nuvei platform.

- Nuvei will do a push notification to a page designated by Mirakl with the following info ShopID, SiteID, APIKEY. The last two parameters need to be used when calling Nuvei REST API when processing the payments. Mirakl Marketplace needs to respond with HTTP return code 204 (No content) to the POST notification.

Please contact our support team at technicalsupport-s2p@nuvei.com to schedule a more in depth demo on how we help your marketplace to process payments and perform split settlements.