- The Settlement invoice reports are a great tool that allows you to verify each transaction and activity in detail, including:

- Any type of fee that applies at transaction level is reported with great granularity;

- Information about all the payment methods traded are available in only one report;

- The report is the confirmation that the payout to you has been made and thus can be reconciled with the entry into the bank account.

Settlement invoice reports are available in XLS, PDF and CSV format. The settlement invoices reports are generated depending on the settlement cycle of each payment method.

Examples of our standard weekly and monthly settlement cycles are provided below:

- Weekly settlement cycle

- Transactions period: Friday, May 18th, 2018 00:00 UTC (day 1) – Thursday, May 24th, 2018 23:59 UTC (day 7);

- Invoice date: Tuesday, May 29th (day 12).

The settlement invoice follows our standards weekly settlement cycle, which means that all transactions processed from Friday (day 1) – Thursday (day 7) period, and settled to Nuvei (before and after day 7) are invoiced and settled to your account on the following Tuesday (day 12):

- Monthly settlement cycle

- Transactions period: July 1st, 2018 00:00 UTC (day 1) – July 31st, 2018 23:59 UTC (last day of the month);

- Invoice date: August 20 – 25th.

The settlement invoice follows our standards monthly settlement cycle, which means that all transactions processed from July 1st to July 31st period, and settled to Nuvei (before and after July 31st) are invoiced and settled to your account between August 20 – 25th:

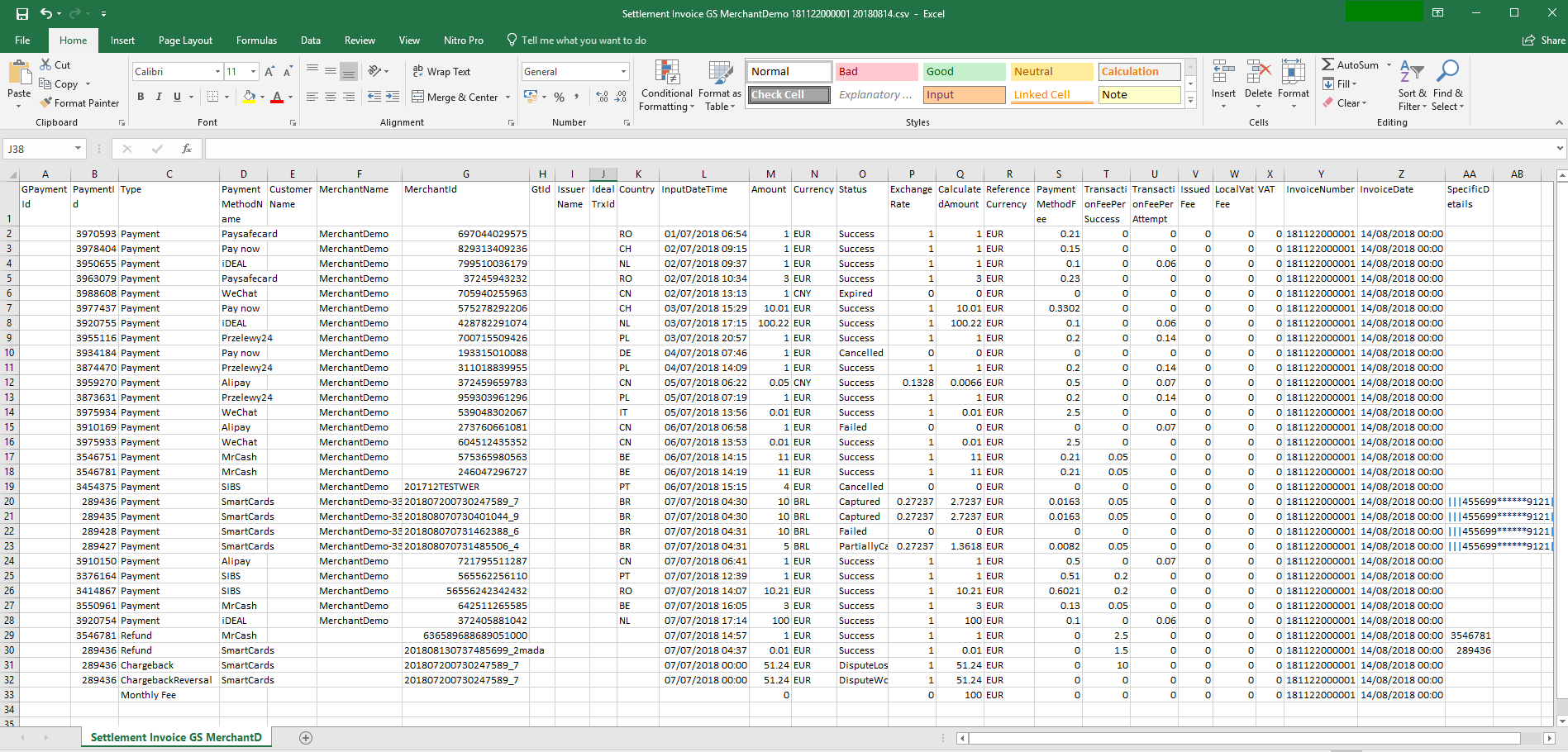

Below there are examples of Settlement invoice reports in all supported formats:

- XLS Format: Settlement Invoice GS MerchantDemo 181122000001 20180814;

- PDF Format: Settlement Invoice GS MerchantDemo 181122000001 20180814;

- CSV Format: Settlement Invoice GS MerchantDemo 181122000001 20180814.

The XLS and PDF files are sent by e-mail to a group of people in your organization. Please send an e-mail to technicalsupport-s2p@nuvei.com and inform which people should be receiving this e-mail.

- The XLS file of each settlement invoice contains details about the successful transactions invoiced per payment method and per SiteID, the fees applied per payment method for each SiteID and the general Nuvei account fees. The information appears on separate sheets, as follows:

- SettlementInvoice = a summary of all information listed in the settlement invoice;

- Payments = total gross amounts (transactions) you processed via different payment methods and total refunds;

- Transaction Fees = the fees charged for transactions processed (according to the signed agreement);

- Different sheets with transactions processed via a specific payment method (one for each). All payment methods sheets contain certain details per transaction to reconcile them with your system (e.g. PaymentID, InputDateTime, Amount, Currency, Status, Exchange rate, Amount in EUR).

- Enquiries|Refunds|Reversed|CFTs = details about refunds, payment enquiries, chargebacks, etc.

- Preapprovals|Mandates = details about preapprovals and mandates.

The CSV files are uploaded on an SFTP server where you can download them from and process them automatically. Please request login details from technicalsupport-s2p@nuvei.com.

The Settlement invoice report file contains the following fields:

- GPaymentId– ID of the payment in Europay system (can be empty if you are using GlobalPay);GPaymentIdDefinitionThe ID of the payment in Europay system (can be empty if you are using GlobalPay).Typeint

- PaymentId– ID of the payment in GlobalPay system;PaymentIdDefinitionGlobalPay transaction ID, a unique number that identifies the transaction in the GlobalPay system.TypeintRegex^\d{1,12}$

- Type– Describes the entry type:TypeDefinitionDescribes the entry type:

- Entries depending on a transaction (row has GPaymentID and/or PaymentID): Payment, Refund, Chargeback, Chargeback Reversal, Enquiry;

- Generic entries: Monthly fee, Account Setup Fee, Account Opening Fee, Account Closing Fee, Account and Transactions Fee VAT, Repatriation Fee, IOF, etc.;Typestring- Entries depending on a transaction (row has GPaymentID and/or PaymentID): Payment, Refund, Chargeback, Chargeback Reversal, Enquiry;

- Generic entries: Monthly fee, Account Setup Fee, Account Opening Fee, Account Closing Fee, Account and Transactions Fee VAT, Repatriation Fee, IOF, etc.;

- PaymentMethodName– The name of the payment method used for current transaction;PaymentMethodNameDefinitionThe name of the payment method used for the current transaction.Typestring

- CustomerName– When available, the Customer Name is being displayed in this field;CustomerNameDefinitionWhen available, the Customer Name is being displayed in this field.Typestring

- MerchantName– Your merchant alias in our system;MerchantNameDefinitionYour merchant alias in our system.Typestring

- MerchantId– Your Merchant Transaction ID – can be used for reconciliation;MerchantIdDefinitionYour Merchant Transaction ID – can be used for reconciliation.Typestring

- GtId– obsolete ID that is not used anymore;GtIdDefinitionOobsolete ID that is not used anymore

- IssuerName– When available, this field contains the name of the buyer bank;IssuerNameDefinitionWhen available, this field contains the name of the buyer bank.Typestring

- IdealTrxId– For iDeal transactions only, it contains the ID of the transaction from the provider;IdealTrxIdDefinitionFor iDeal transactions only, it contains the ID of the transaction from the provider.Typeint

- Country– When available, it containts the customer billing country;CountryDefinitionCustomer‘s country. Format is according to ISO-3166-1 alpha-2, a two-letter code.TypestringRegex^[a-zA-Z]{2}$

- InputDateTime– The data and time when the transaction was initiated in our system (UTC);InputDateTimeDefinitionThe data and time when the transaction was initiated in our system (UTC).Typedatetime

- Amount– The amount of the transaction in the currency in which the transaction was initiated;AmountDefinitionThe amount of the transaction in the currency in which the transaction was initiatedTypeintRegex^\d{1,12}$

- Currency– The currency in which the transaction was initiated;CurrencyDefinitionThe currency in which the transaction was initiated. Format is according to ISO 4217, a three-letter code.TypestringRegex^[A-Z]{3}$

- Status– The status of the transaction. Can be one of: Open, Success, Captured, Paid, Partially Captured, Failed, Cancelled, Expired, Dispute Lost, Dispute Won.StatusDefinitionThe status of the transaction. Can be one of: Open, Success, Captured, Paid, Partially Captured, Failed, Cancelled, Expired, Dispute Lost, Dispute Won.Typestring

- ExchangeRate– The exchange rate used to convert from Currency to Settlement Currency (Reference Currency);ExchangeRateDefinitionThe exchange rate used to convert from Currency to Settlement Currency (Reference Currency).

- CalculatedAmount– The amount of the transaction in the Settlement Currency (Reference Currency);CalculatedAmountDefinitionThe amount of the transaction in the Settlement Currency (Reference Currency).TypeintRegex^\d{1,12}$

- ReferenceCurrency– Your settlement currency for the current transaction;ReferenceCurrencyDefinitionYour settlement currency for the current transaction. Format is according to ISO 4217, a three-letter code.TypestringRegex^[A-Z]{3}$

- PaymentMethodFee– The payment method fee charged for the current transaction;PaymentMethodFeeDefinitionThe payment method fee charged for the current transaction.

- TransactionFeePerSuccess– The transaction fee that is applied for successful transactions (completed);TransactionFeePerSuccessDefinitionThe transaction fee that is applied for successful transactions (completed).

- TransactionFeePerAttempt– The transaction fee that is applied for each successful and unsuccessful transaction processed through Smart2Pay;TransactionFeePerAttemptDefinitionThe transaction fee that is applied for each successful and unsuccessful transaction processed through Smart2Pay.

- IssuedFee– An additional transaction fee used for specific payment methods;IssuedFeeDefinitionAn additional transaction fee used for specific payment methods

- LocalVatFee– The local value-added tax (VAT) applied for Payment Method Fee and/or for transaction’s value for specific countries, depending on the case;LocalVatFeeDefinitionThe local value-added tax (VAT) applied for Payment Method Fee and/or for transaction’s value for specific countries, depending on the case.

- VAT– Value-added tax (VAT) charged by Nuvei for PaymentMethodFee, TransactionFeePerSuccess, TransactionFeePerAttempt and Account Fees according to EU Vat regulations if necessary – field currently not used, but the information is available as additional rows at the bottom of the file;VATDefinitionValue-added tax (VAT) charged by Smart2Pay for PaymentMethodFee, TransactionFeePerSuccess, TransactionFeePerAttempt and Account Fees according to EU Vat regulations if necessary – field currently not used, but the information is available as additional rows at the bottom of the file.

- InvoiceNumber– The number of the invoice;InvoiceNumberDefinitionThe number of the invoice

- InvoiceDate– The date the invoice was issued.InvoiceDateDefinitionThe date the invoice was issuedTypedatetime

- SpecificDetails– Specific details provided;SpecificDetailsDefinitionSpecific details provided.Typestring