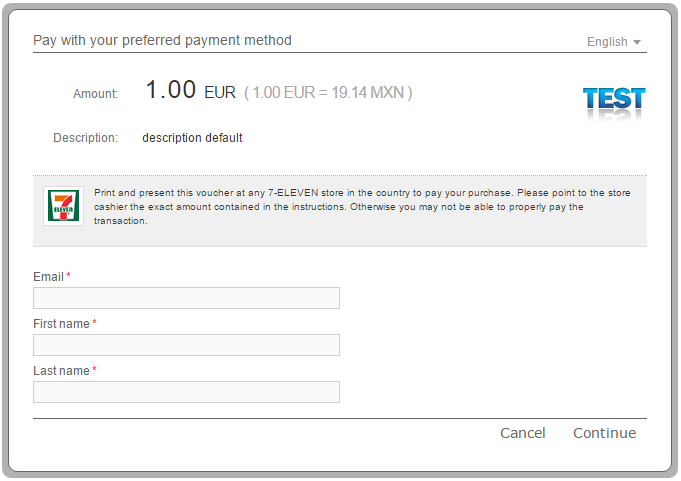

In order for you to test 7-Eleven Pago en efectivo payment method successfully, you don’t need any given test data.

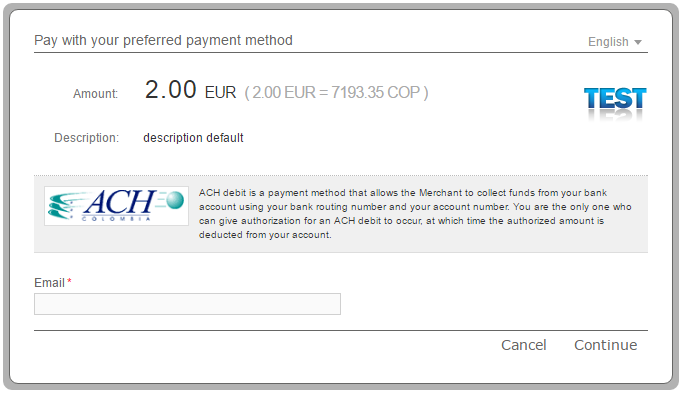

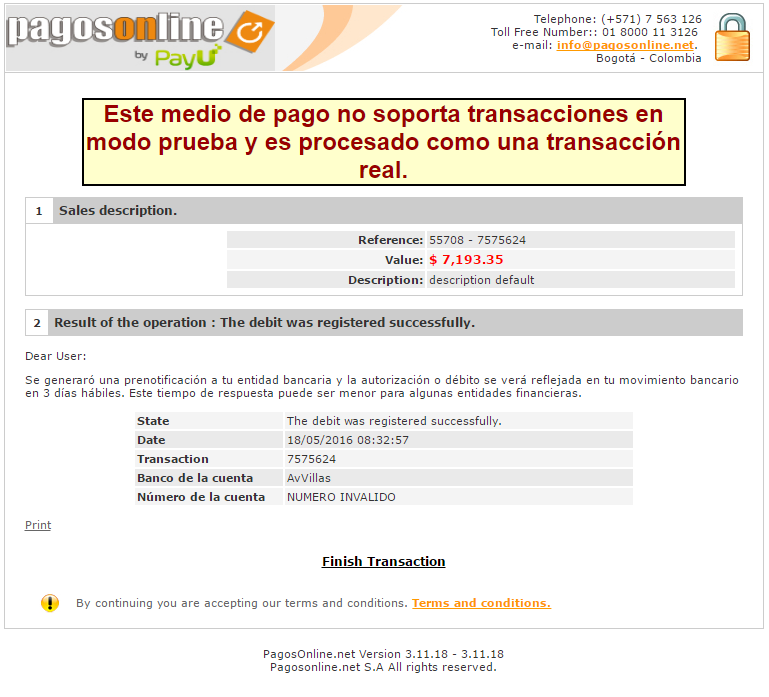

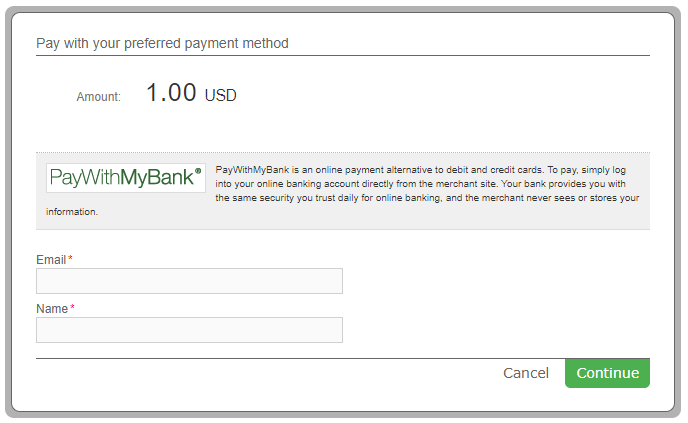

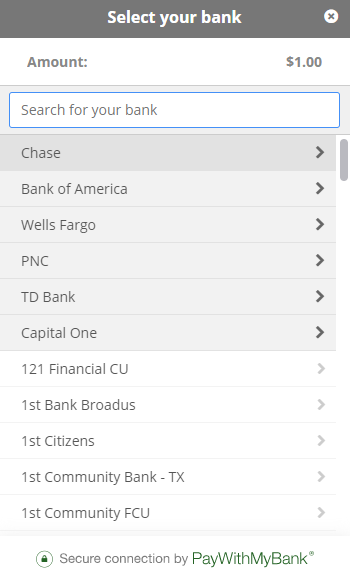

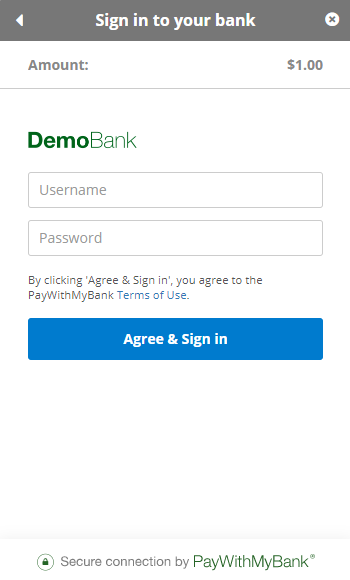

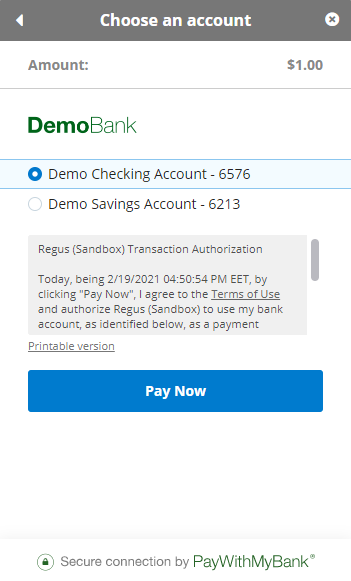

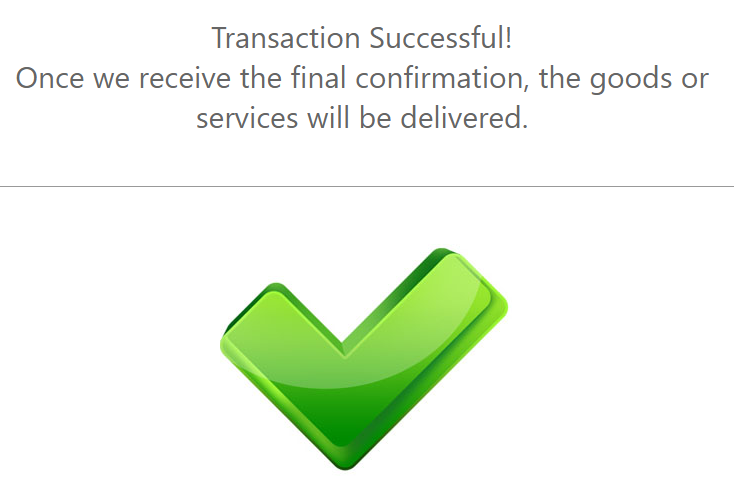

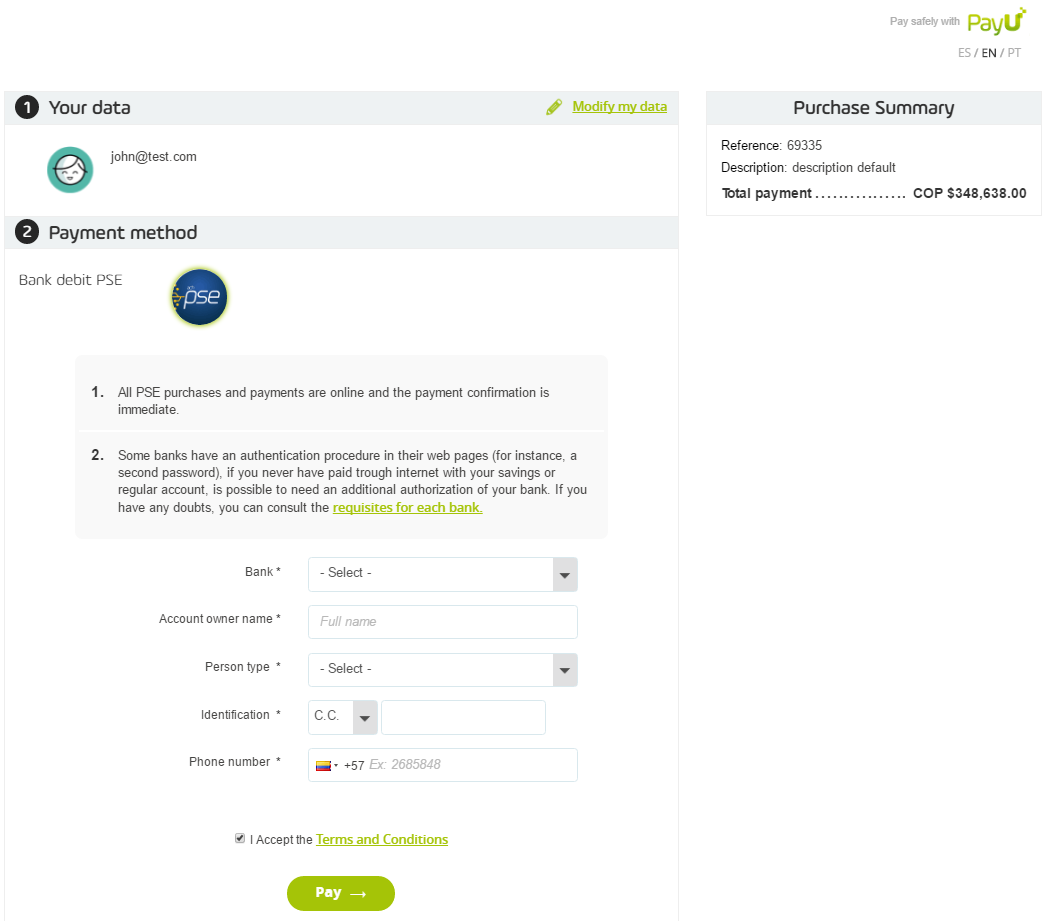

ACH Debit Test Data

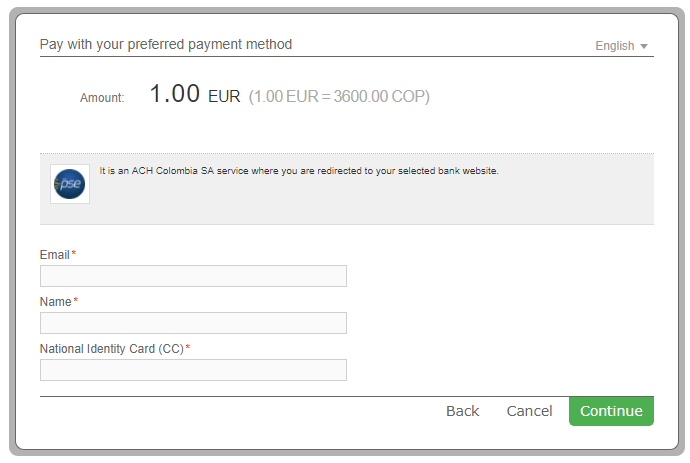

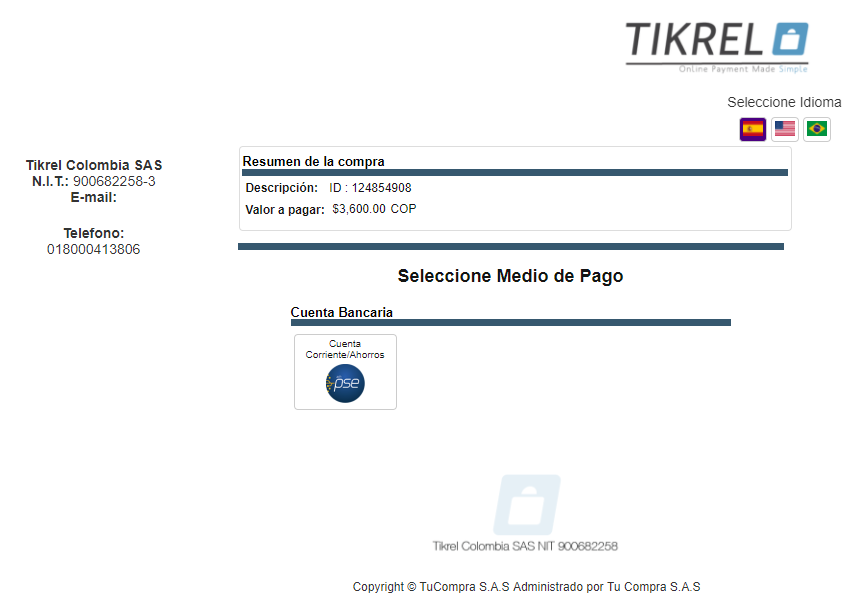

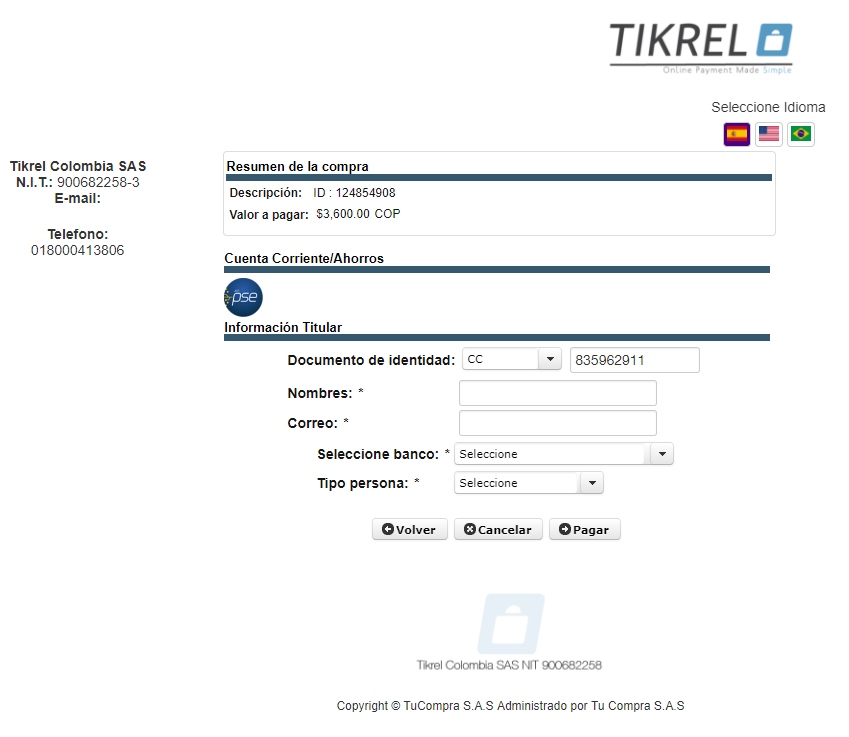

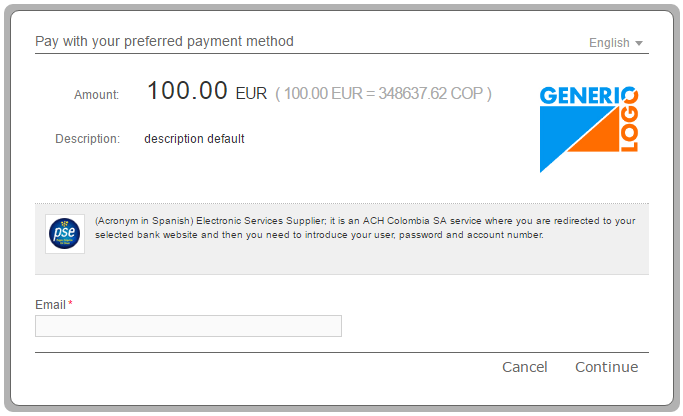

For ACH Debit payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

ACH Debit Payment Flow

-

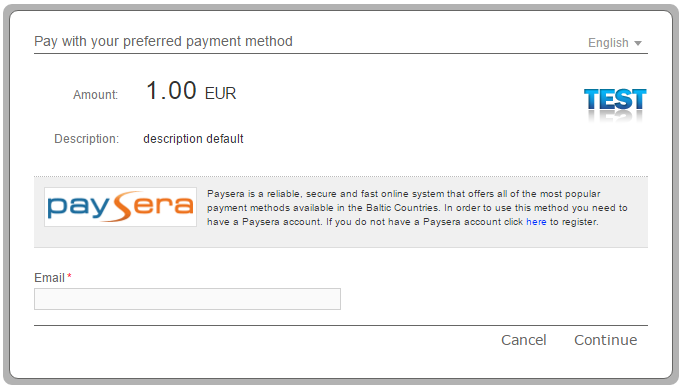

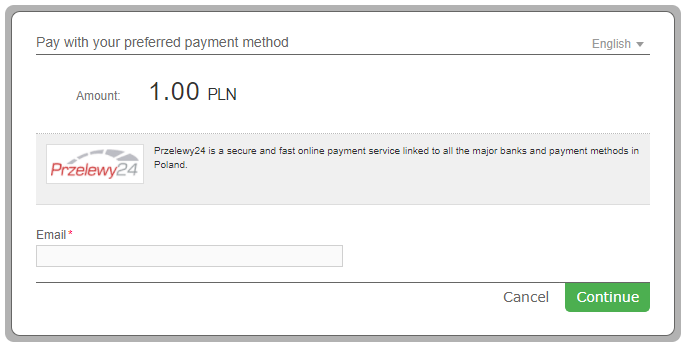

The Customer enters his email address.

-

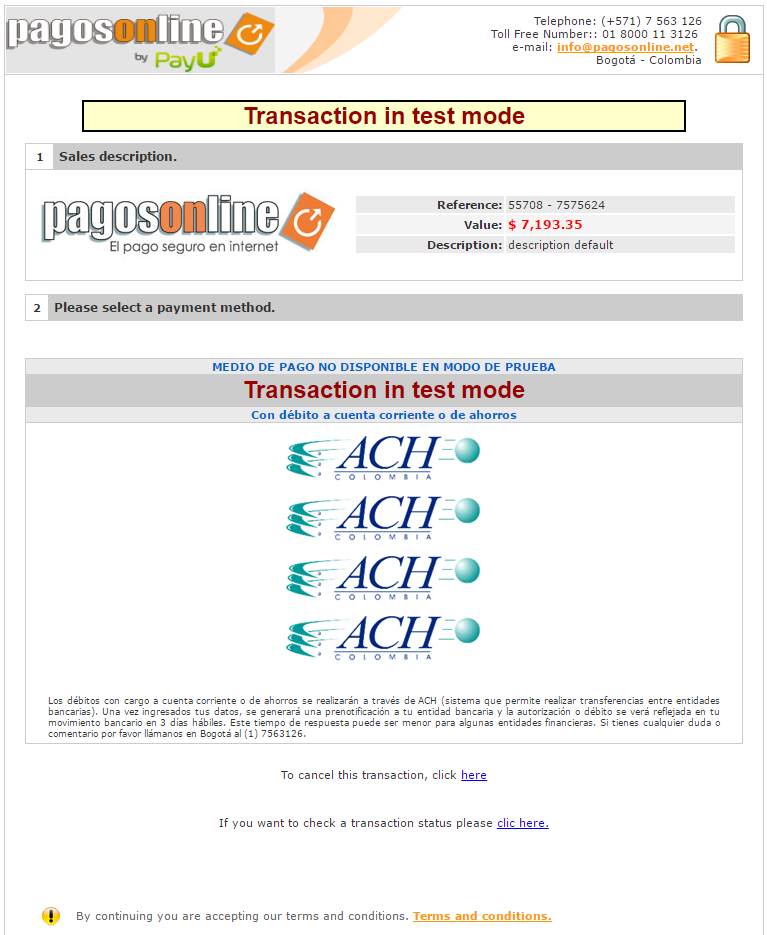

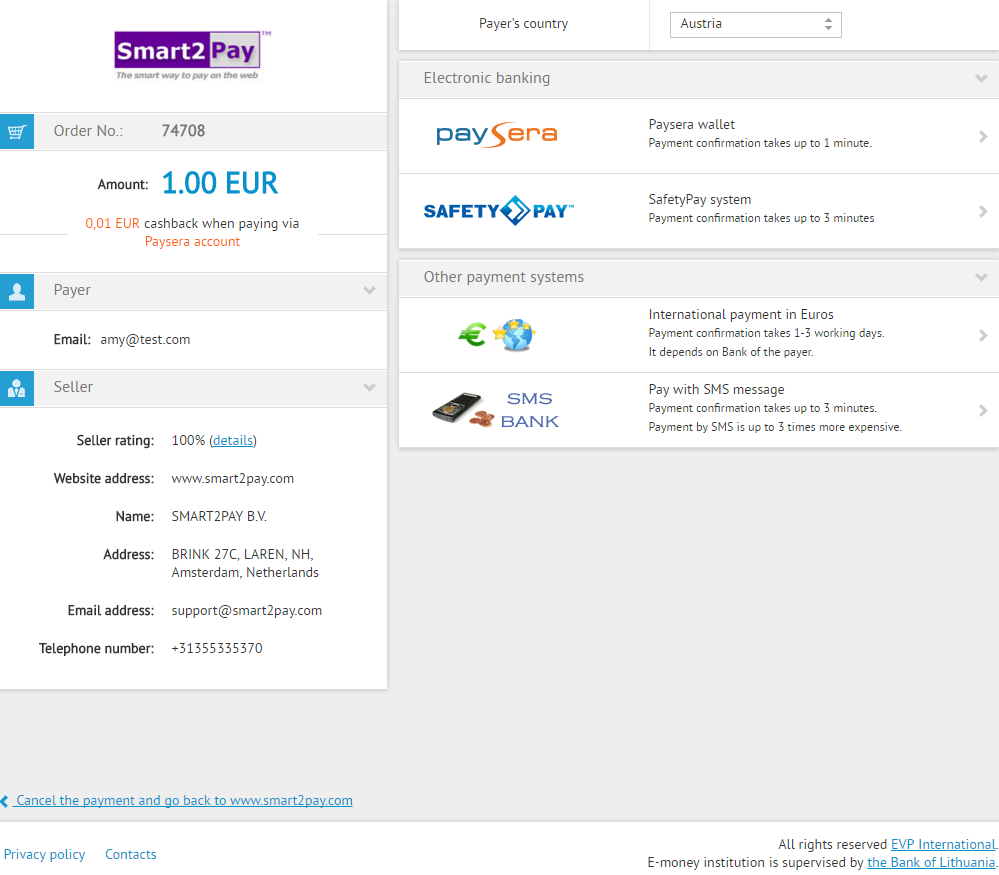

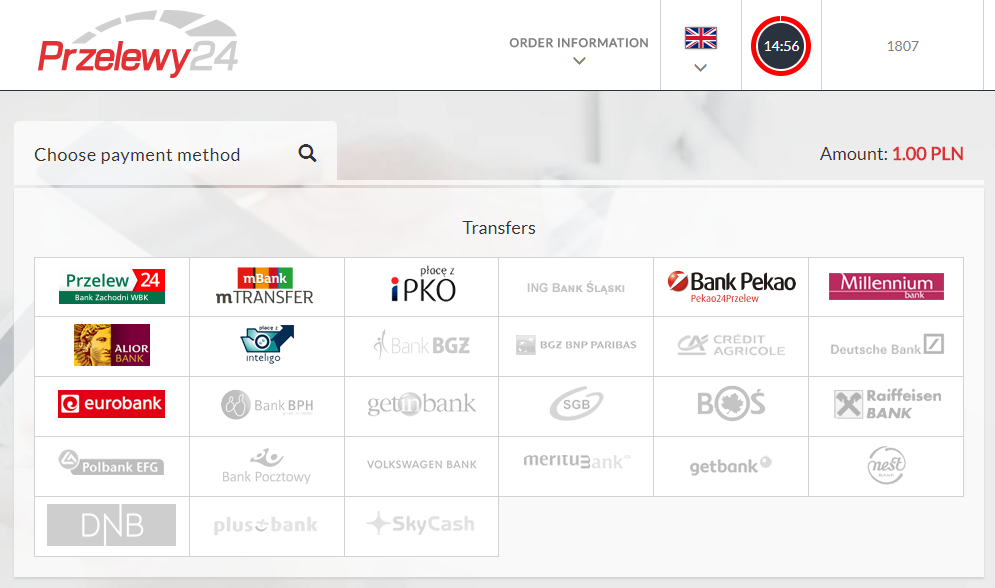

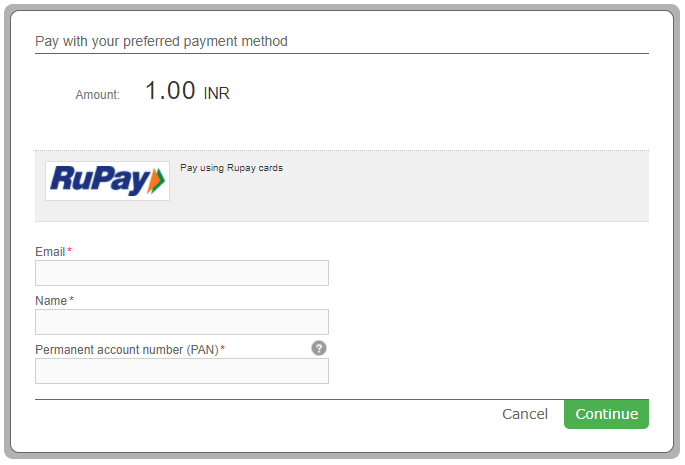

The customer selects his preferred payment method from the list.

-

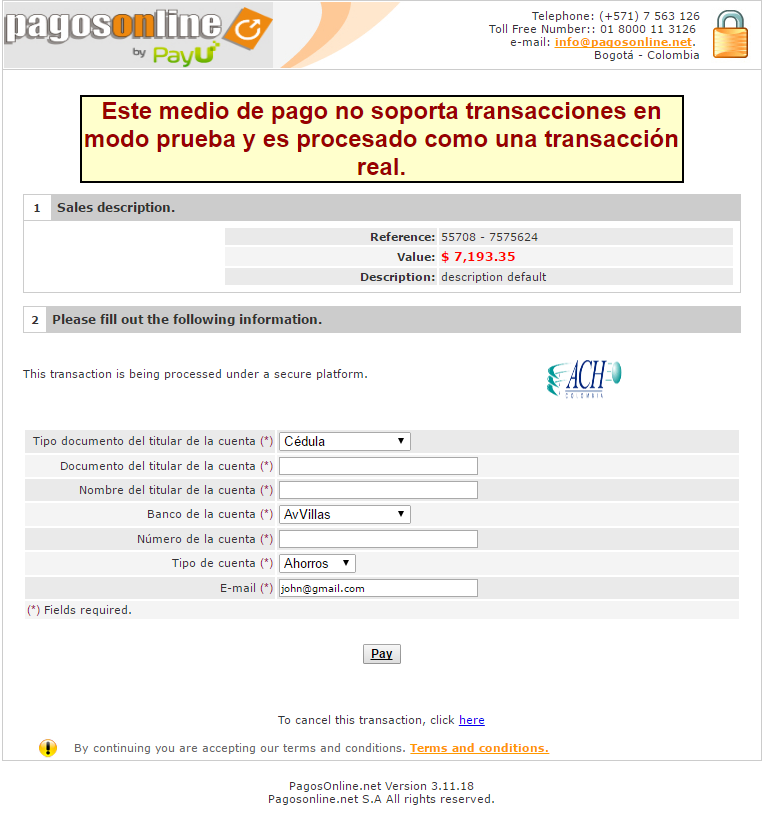

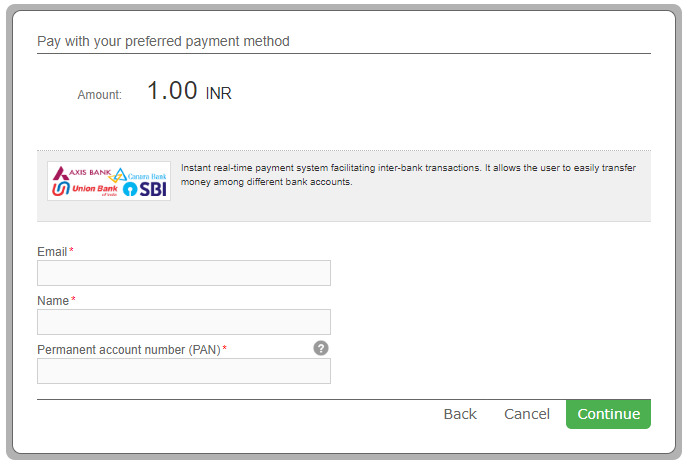

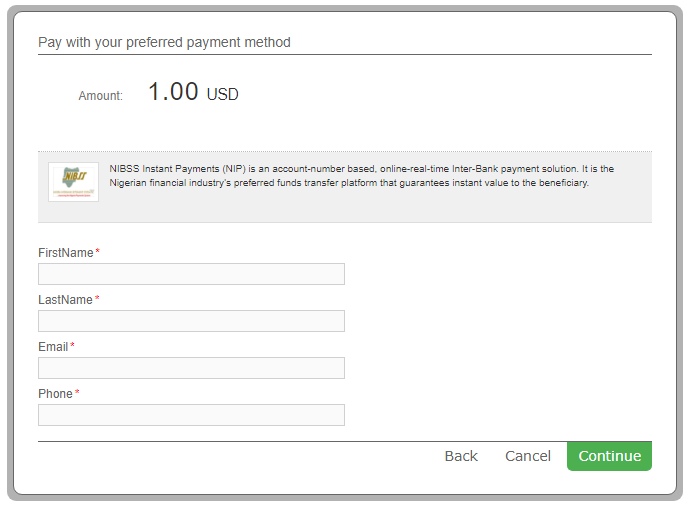

After selecting the payment method, the customer enters the required information and proceeds with the payment.

-

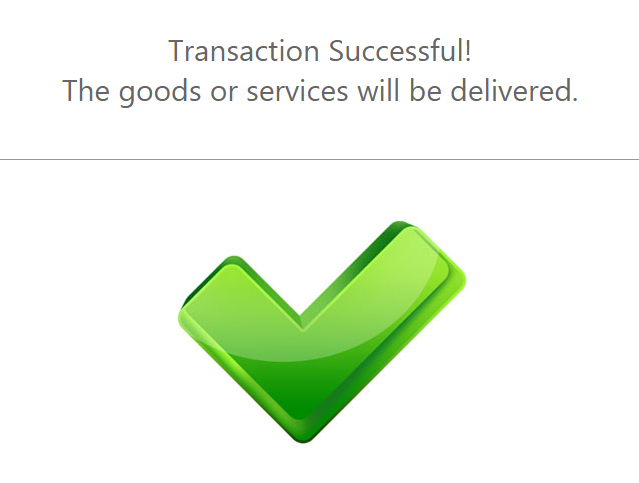

The customer receives a message that the payment was successfully processed. He also has the possibility to print the transaction details.

-

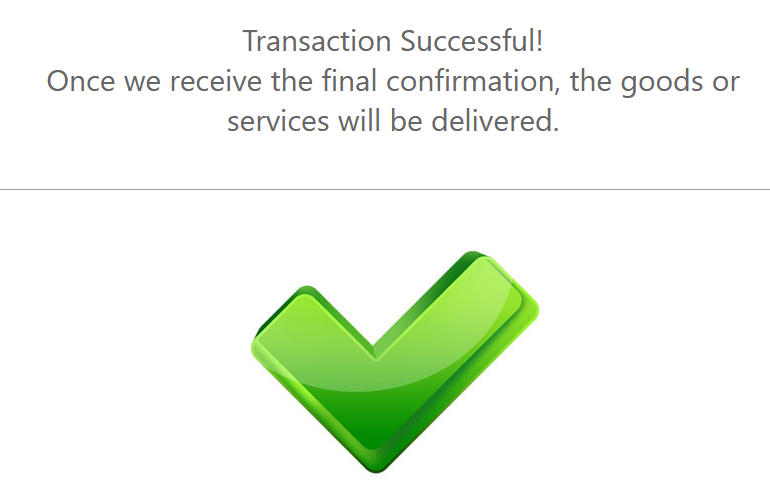

Upon completion of the payment flow, the customer is redirected back to your ReturnURL.

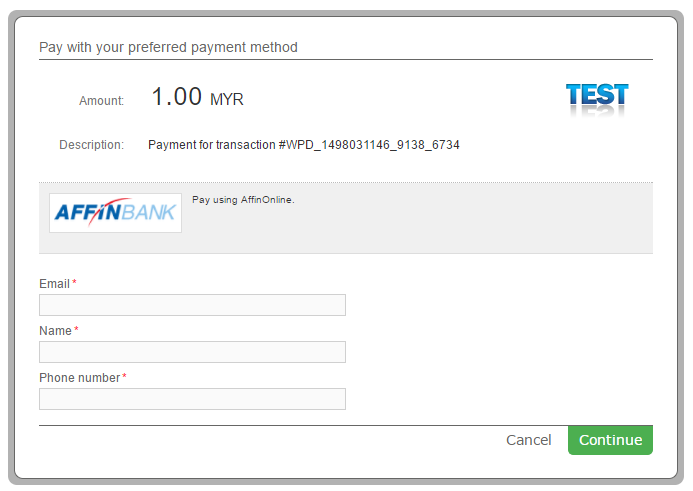

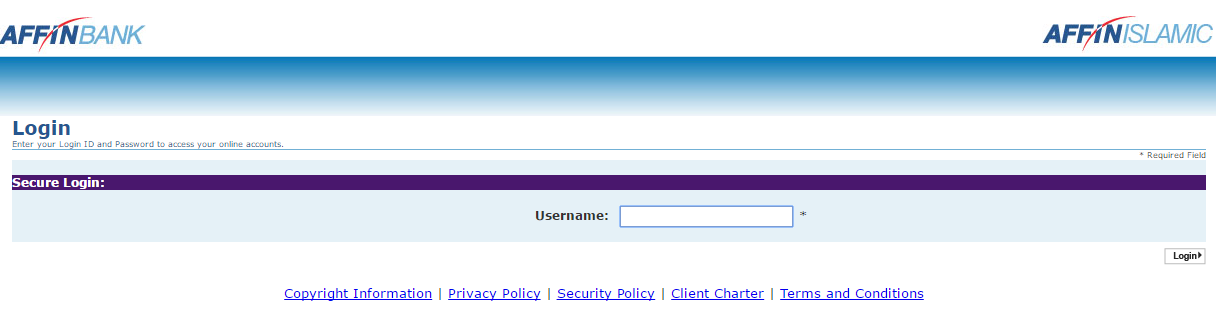

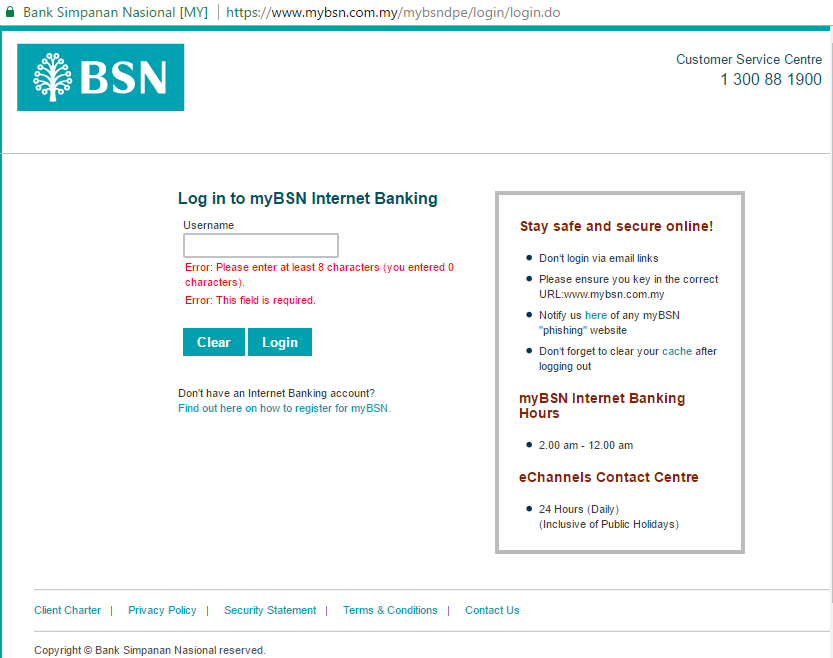

AffinOnline Test Data

For AffinOnline payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

AffinOnline Payment Flow

-

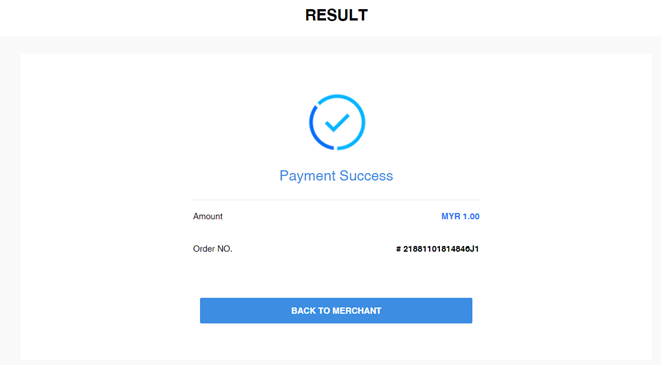

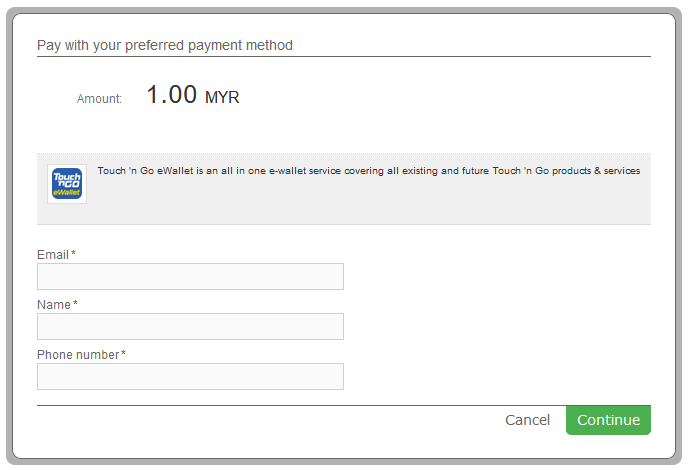

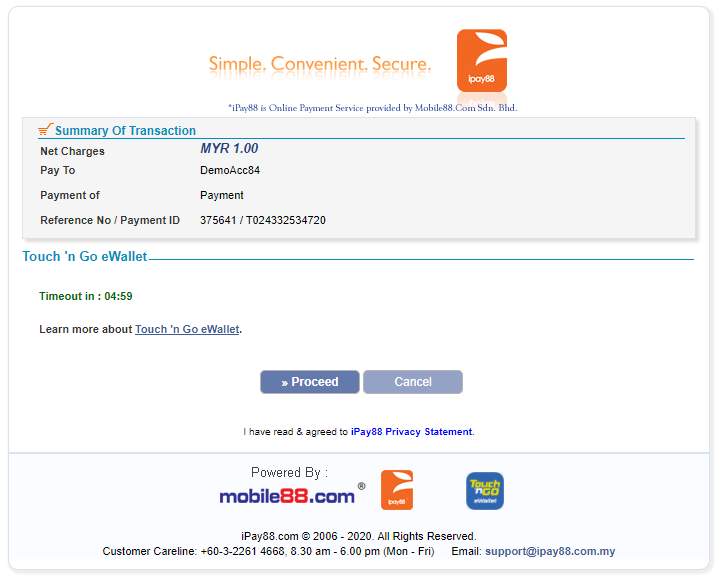

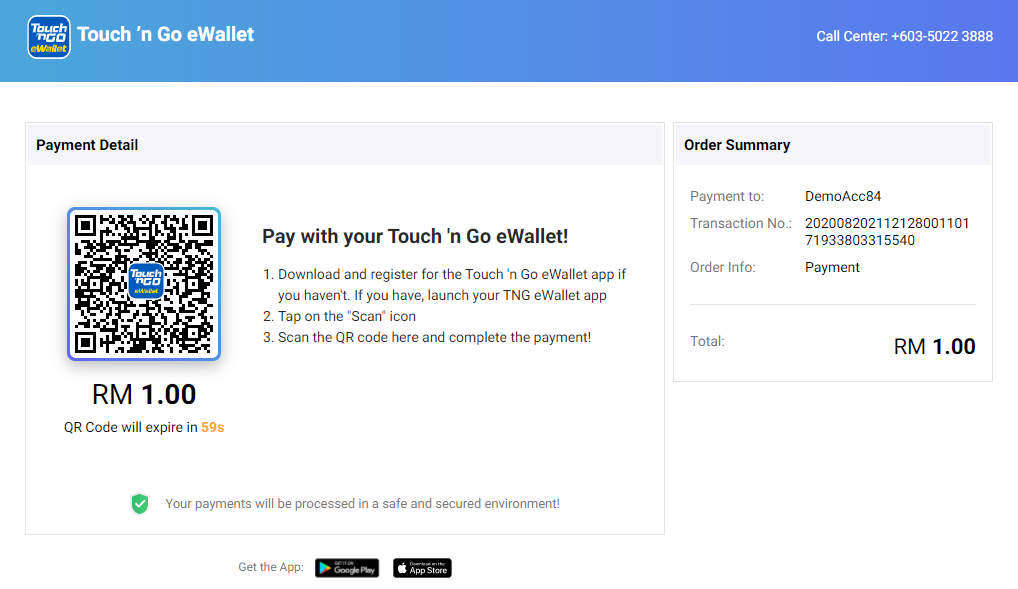

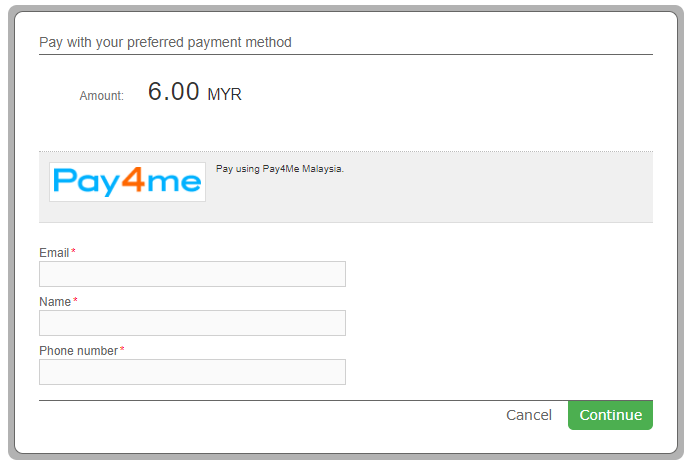

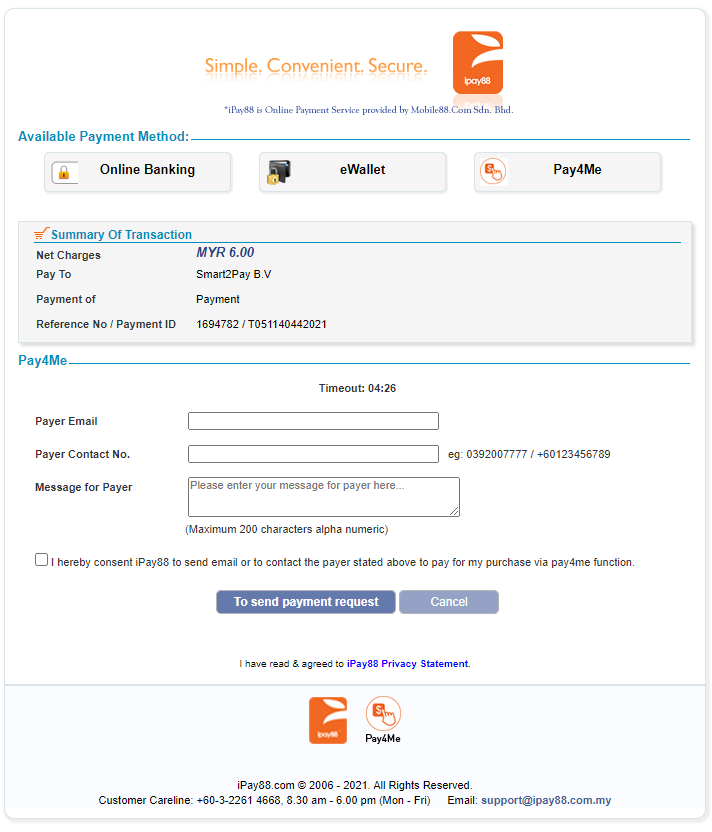

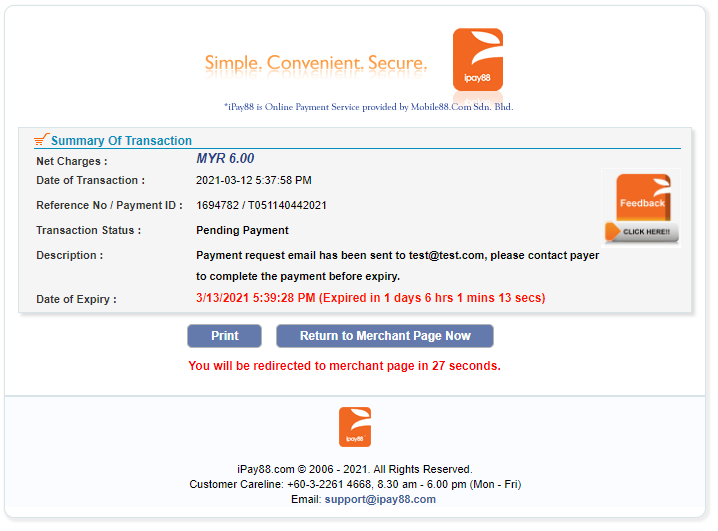

The customer enters his email address, name and phone number.

-

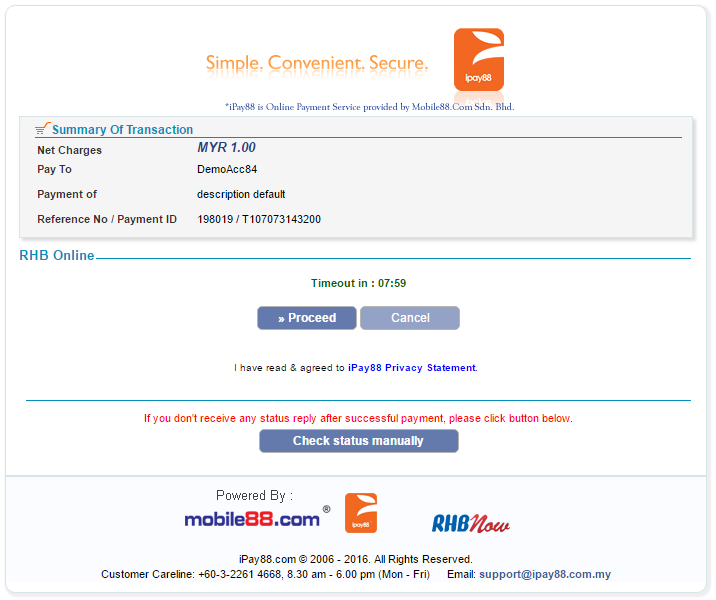

The customer is shown the details of his payment and proceeds to pay with AffinOnline.

-

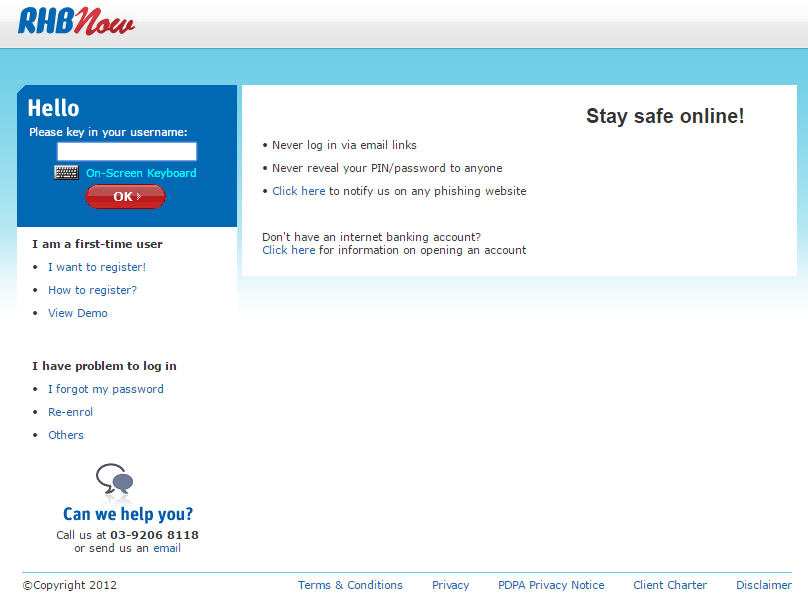

The customer logs in to his AffinOnline account by entering his Username and completes the payment.

-

Upon completion of the payment flow, the customer is redirected back to your ReturnURL.

Airtel Money (Kenya) Test Data

In order for you to test Airtel Money payment method available in Kenya, please use the below test data.

| Airtel Money (Kenya) Test Data | |

|---|---|

| Data | Value |

| Phone | 254725362916 |

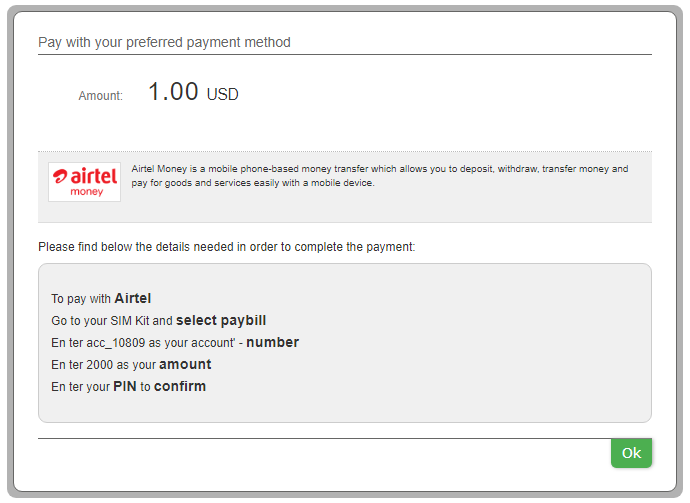

Airtel Money (Kenya) Payment Flow

-

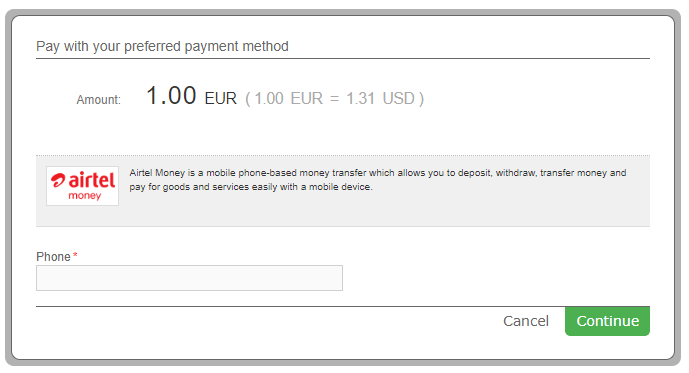

The customer fills in the Phone number.

-

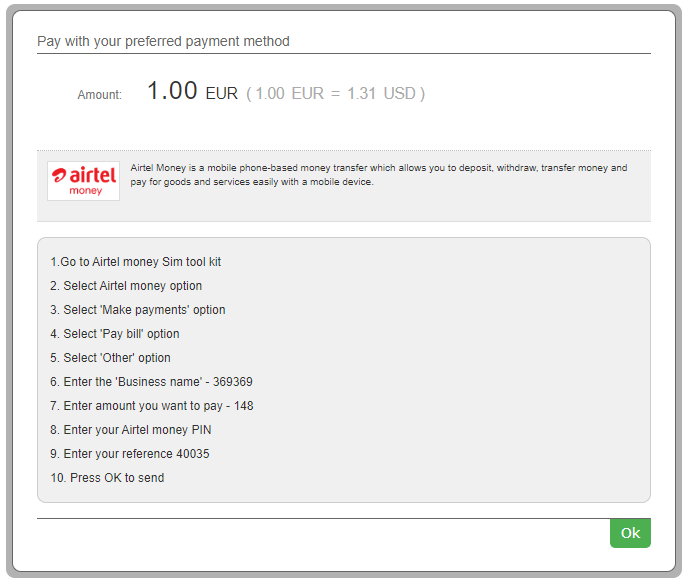

The customer receives the details needed to complete the payment.

-

Upon completion of the payment flow, the customer is redirected back to your ReturnURL.

Airtel Money Test Data

In order for you to test Airtel Money payment method available in Tanzania, please use the below test data.

| Airtel Money (Tanzania) Test Data | |

|---|---|

| Data | Value |

| Phone | 255737306783 |

Please click on the appropriate link below, to see how Airtel Money payment method works in Kenya, Ghana and Uganda:

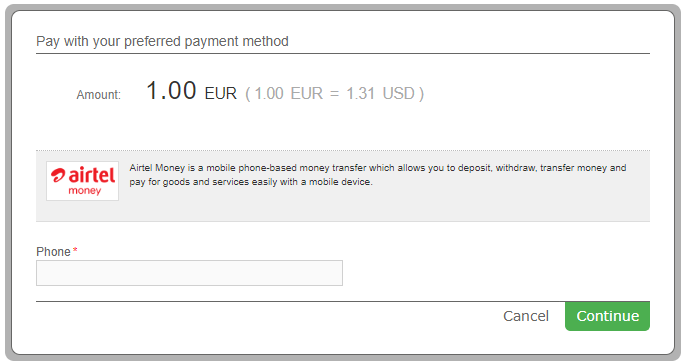

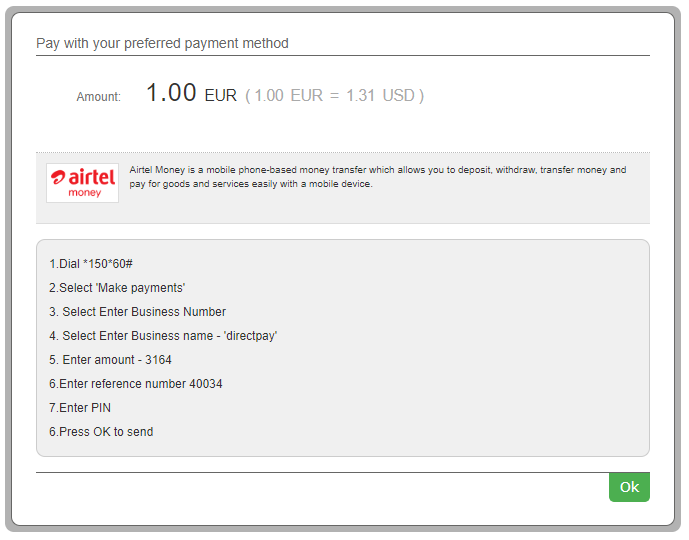

Airtel Money (Tanzania) Payment Flow

Airtel Money Test Data

In order for you to test Airtel Money payment method available in Tanzania, please use the below test data.

| Airtel Money (Tanzania) Test Data | |

|---|---|

| Data | Value |

| Phone | 255737306783 |

For Airtel Money payment method available in Kenya, you can see how it works with the payment flow given here: Airtel Money (Kenya) Payment Flow (2).

Airtel Money (Tanzania) Payment Flow

- The customer fills in his phone number.

- The customer receives the details needed to complete the payment.

- Upon completion of the payment flow, the customer is redirected back to your ReturnURL.

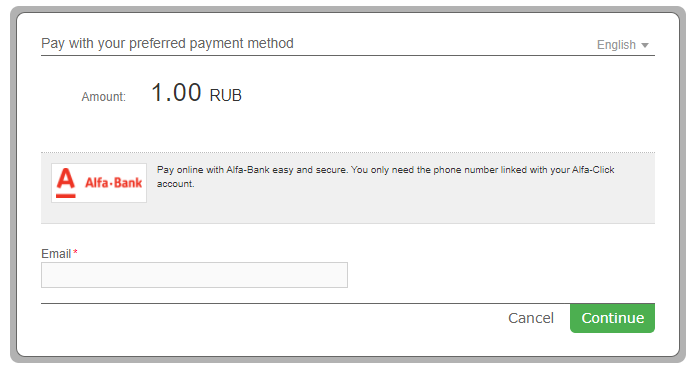

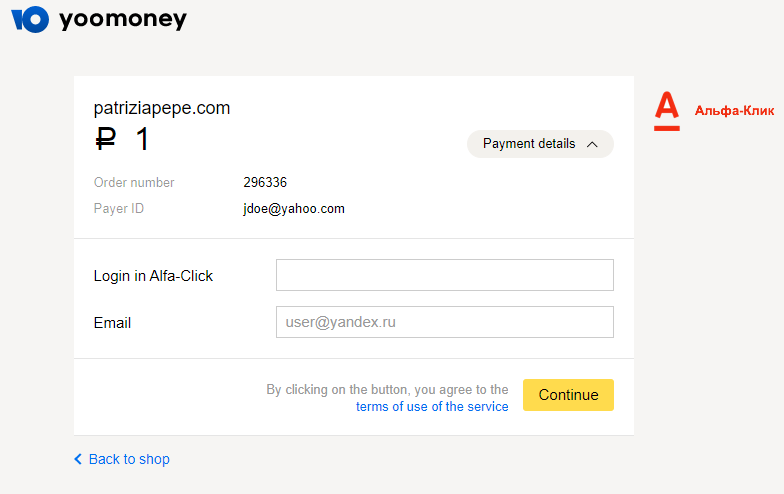

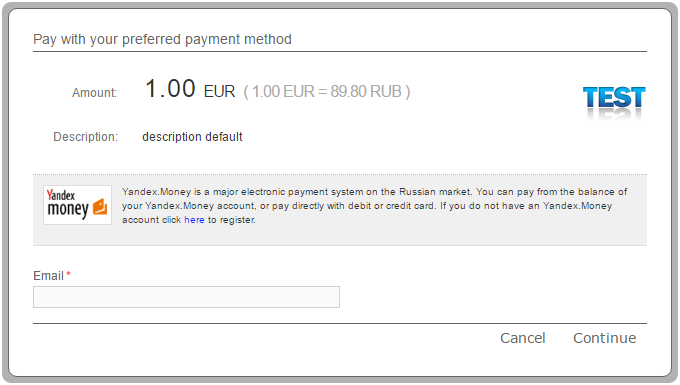

Alfa-Click Test Data

For Alfa-Click payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

Alfa-Click Payment Flow

-

The Customer enters his email address.

-

The Customer reviews the payment details and logins to his Alfa-Click account in order to complete the transaction.

- Upon completion of the payment flow, the customer is redirected to your ReturnUrl.

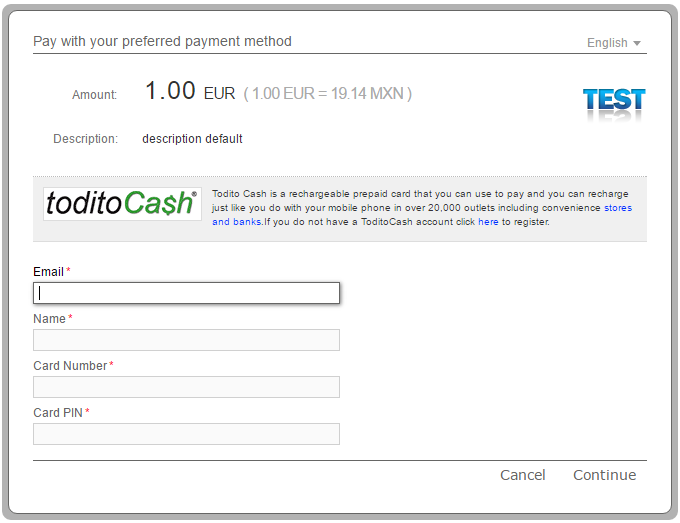

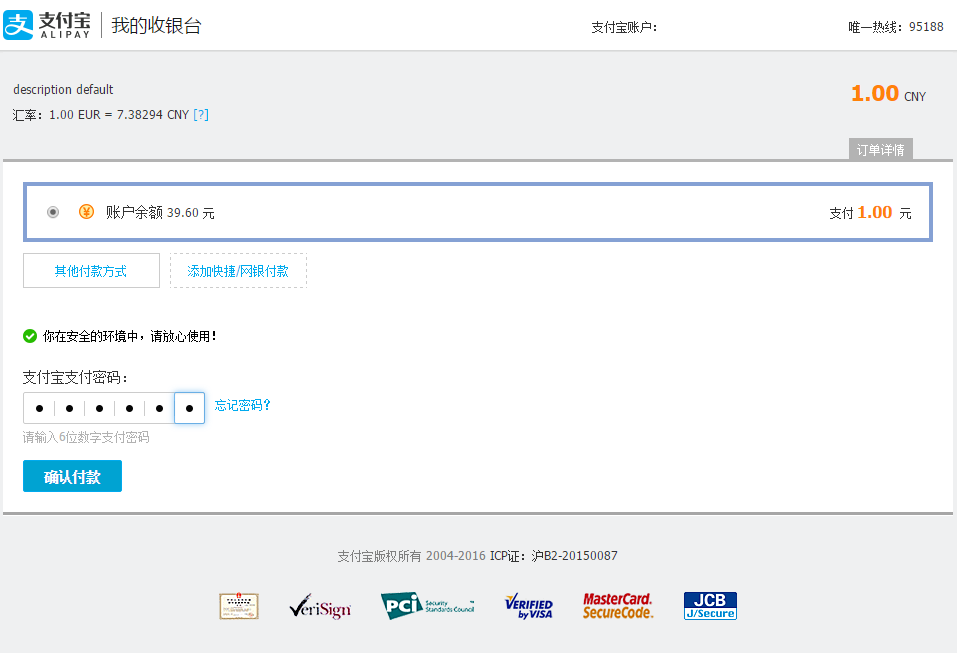

Alipay Test Data

In order for you to test Alipay payment method successfully, please use the below test data.

| Alipay Test Data | ||

|---|---|---|

| Data | Value | |

| Email address: | cnbuyer_3467@alitest.com | |

| Login password: | a111111 | |

| Payment password: | b111111 | |

| Alipay New Test Data | ||

|---|---|---|

| Data | Value | |

| Email address: | forex_1699541344189@alitest.com | |

| Login password: | 111111 | |

| Payment password: | 111111 | |

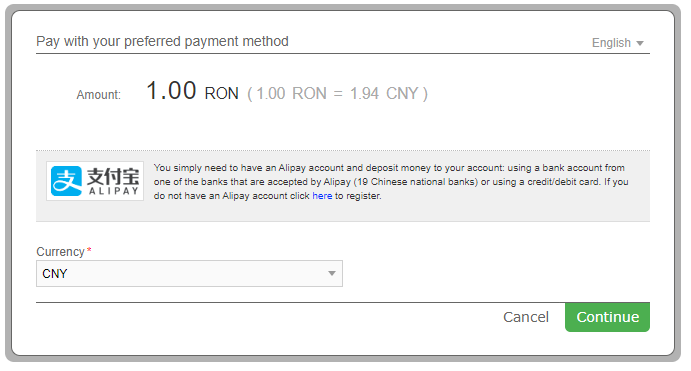

Alipay Payment Flow

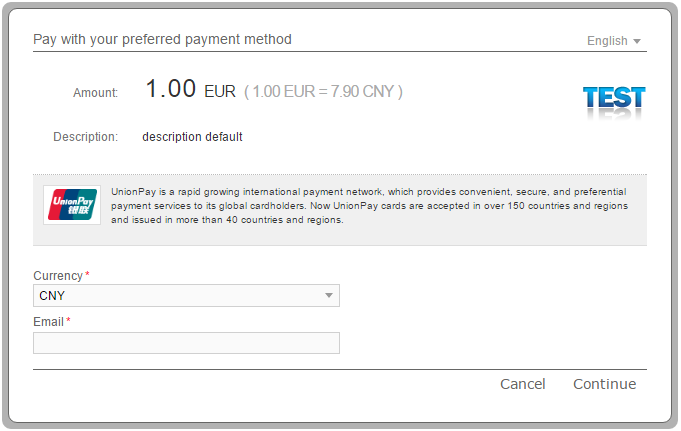

- The Customer selects his preferred currency from the list and continues the payment by clicking on the Continue button.

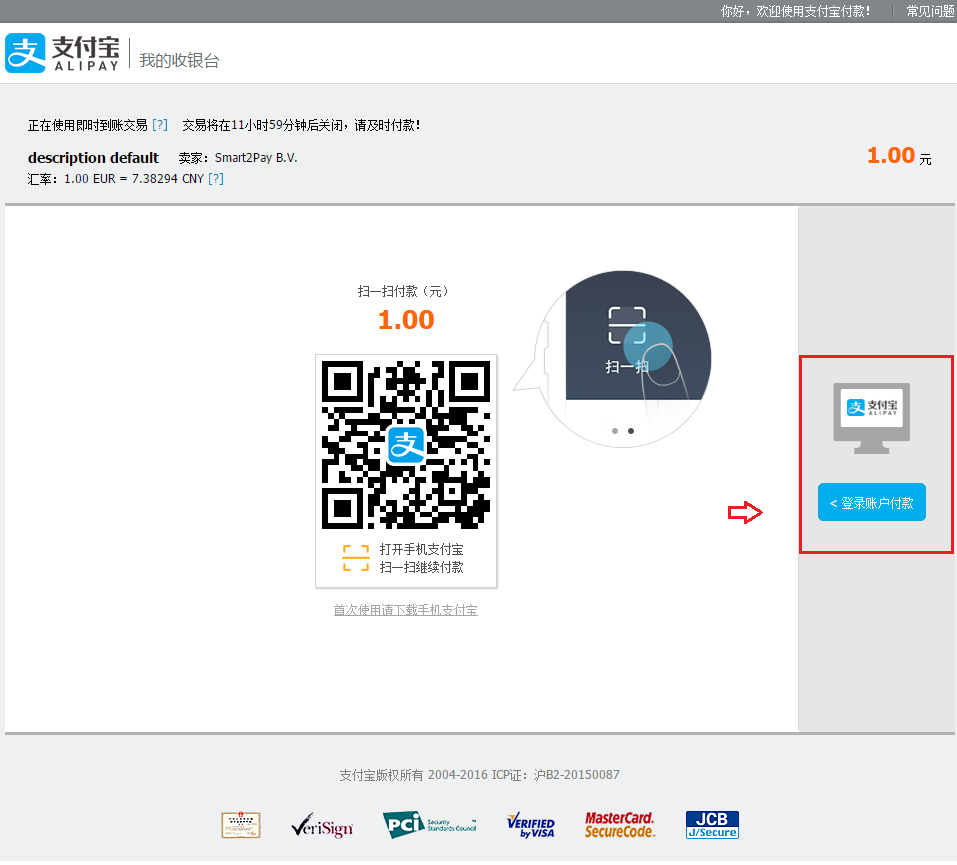

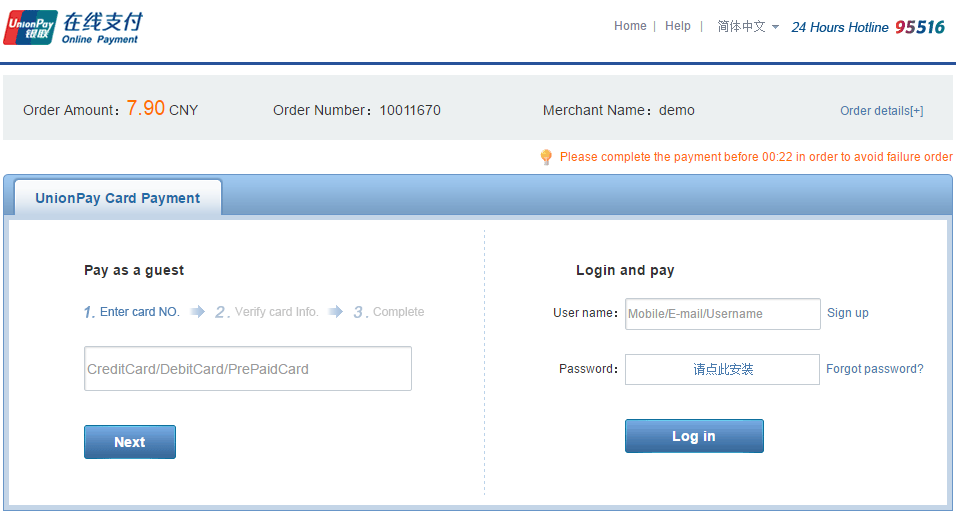

- Once the customer arrives at the provider’s page he has two choices: to continue with the payment using the mobile version or using the desktop version.

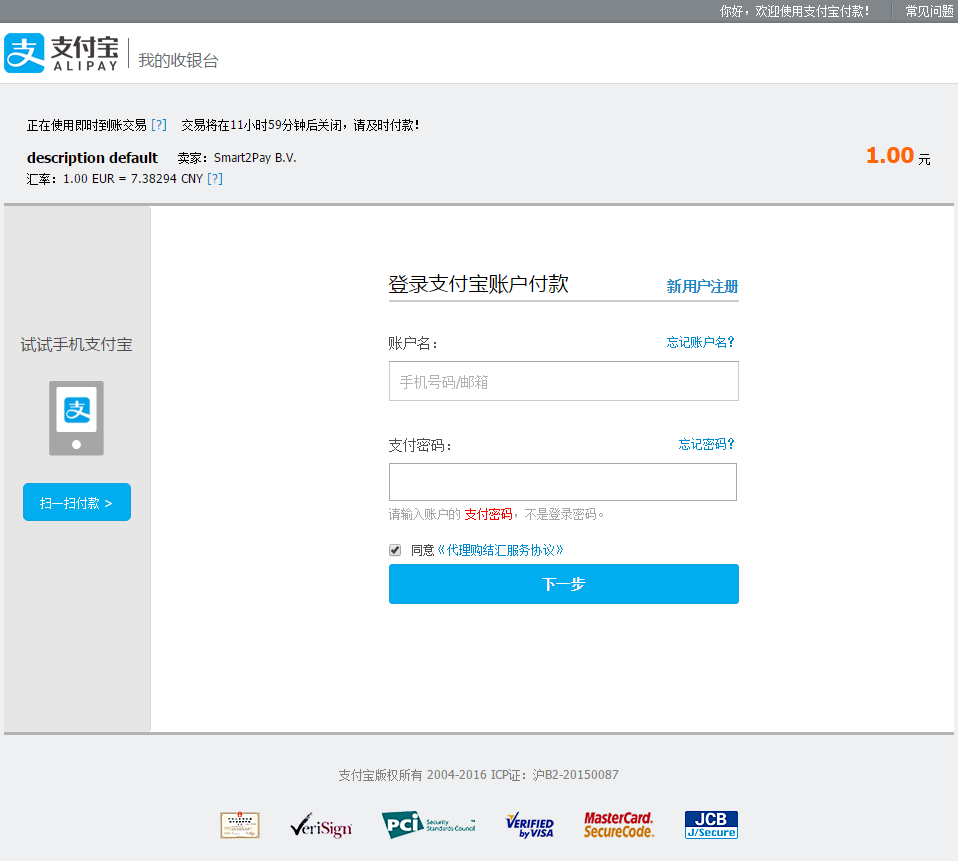

- The customer logs in to his Alipay account by entering his email address and login password.

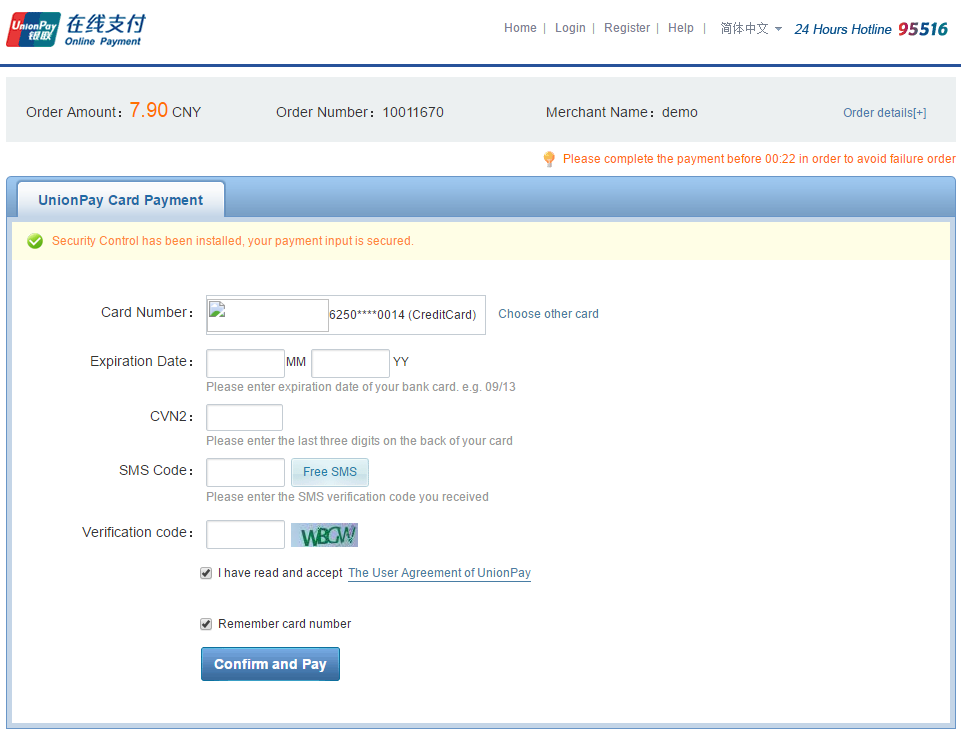

- The customer confirms the payment by entering the payment password.

- The payment is processing.

- In a few seconds the customer will be redirected back to your ReturnURL.

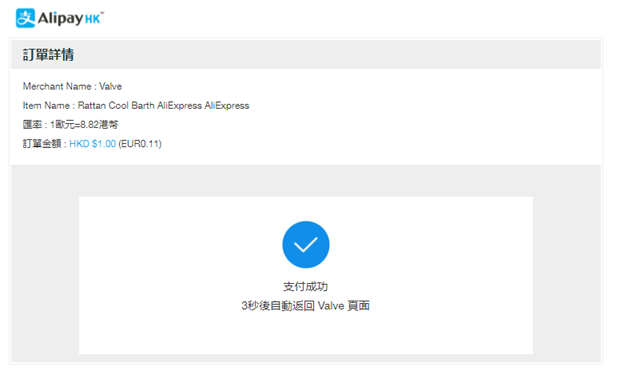

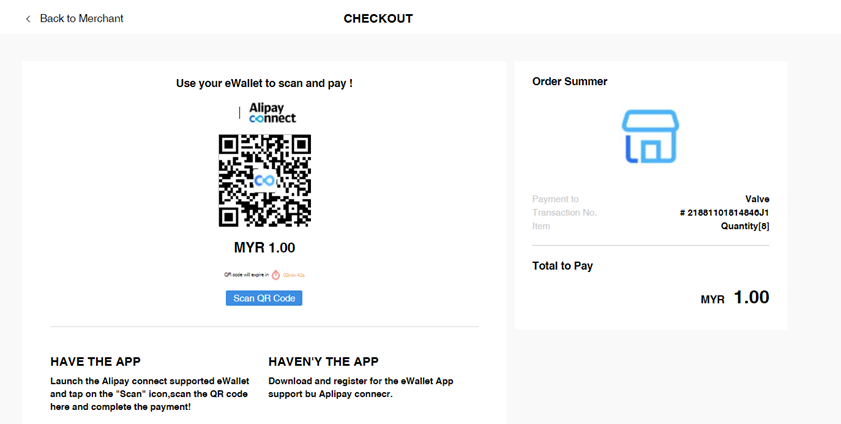

AlipayHK Test Data

In order for you to test the AlipayHK payment method successfully, please use the below test data.

| AlipayHK Test Data | ||

|---|---|---|

| Data | Value | |

| Phone Number: | Enter any 10 digit number. Example: 1234567812 | |

| Authentication code: | Enter any 6 digit number. Example: 123456 | |

| Payment password: | Enter any 6 digit number. Example: 123456 | |

AlipayHK Payment Flow

- The customer is redirected to the AlipayHK website where they are prompted to scan a QR code using the AlipayHK app.

- The customer is redirected to AlipayHK page. The user needs to add their phone number attached to the AlipayHK wallet and request a verification code.

- The customer needs to enter the verification code received via SMS on the phone number linked to the AlipayHK wallet.

- The user confirms the payment and the Amount to be charged.

- The user needs to enter the payment password.

- The user is redirected to the payment confirmation page where he can see the payment amount details.

- The payment is successful and the user is redirected to the AlipayHK payment confirmation page.

- Upon completion of the payment flow, the customer is redirected to your ReturnUrl.

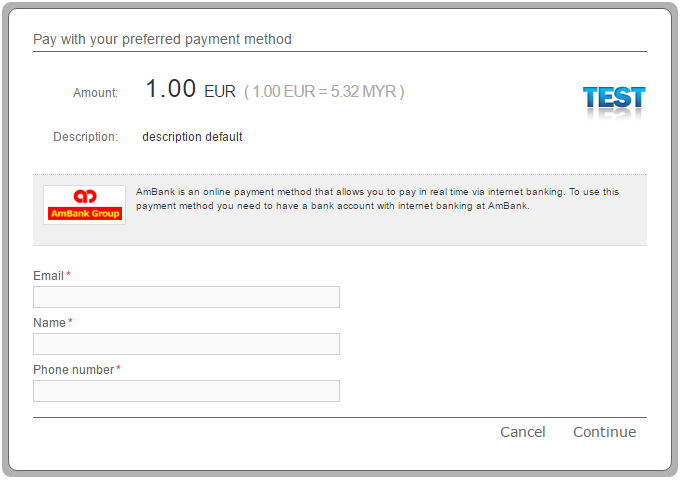

AmBank Test Data

For AmBank payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

AmBank Payment Flow

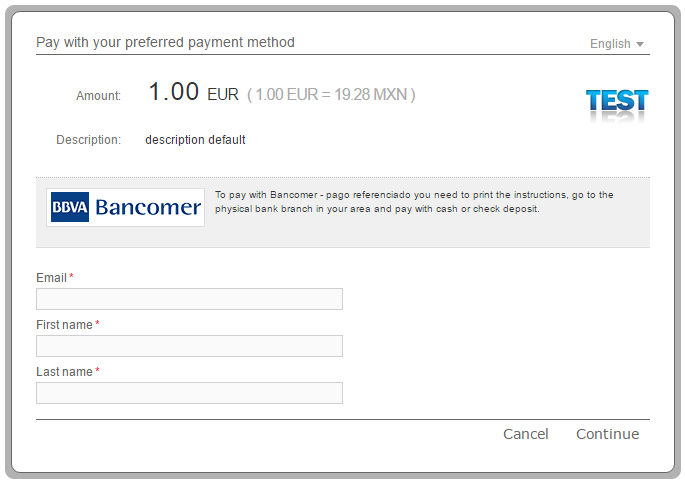

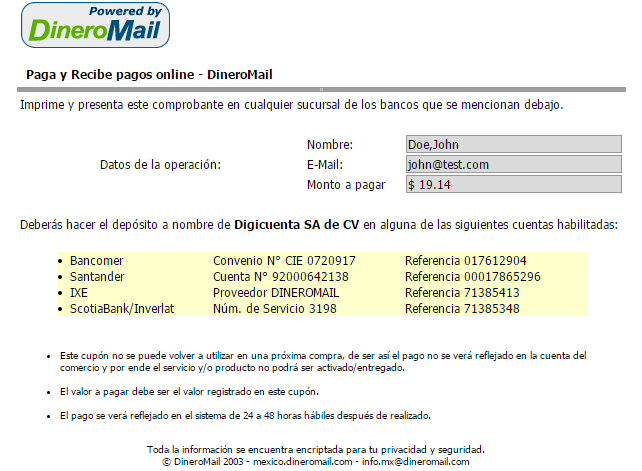

Bancomer Pago referenciado Test Data

In order for you to test Bancomer Pago referenciado payment method successfully, you don’t need any given test data.

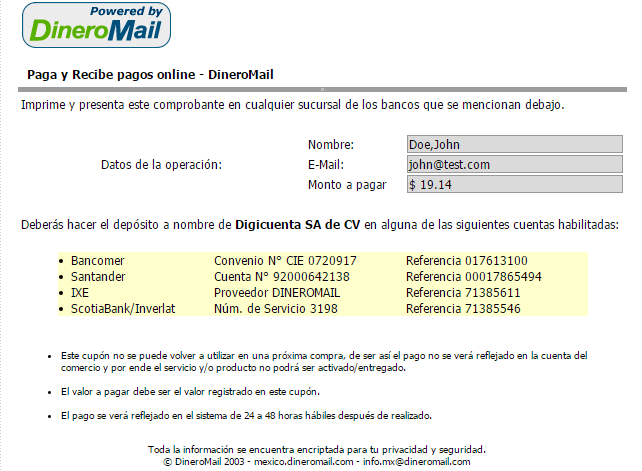

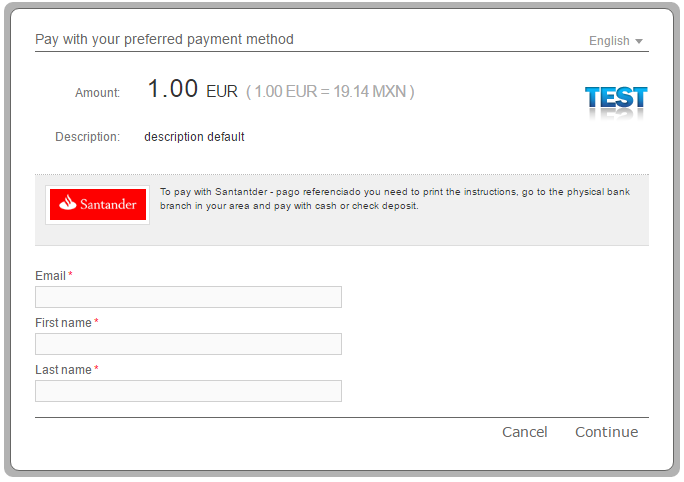

Bancomer Pago referenciado Payment Flow

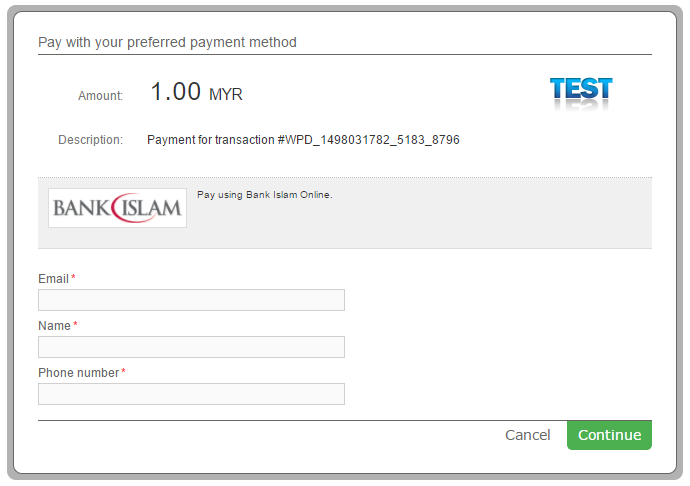

Bank Islam Online Test Data

For Bank Islam Online payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

Bank Islam Online Payment Flow

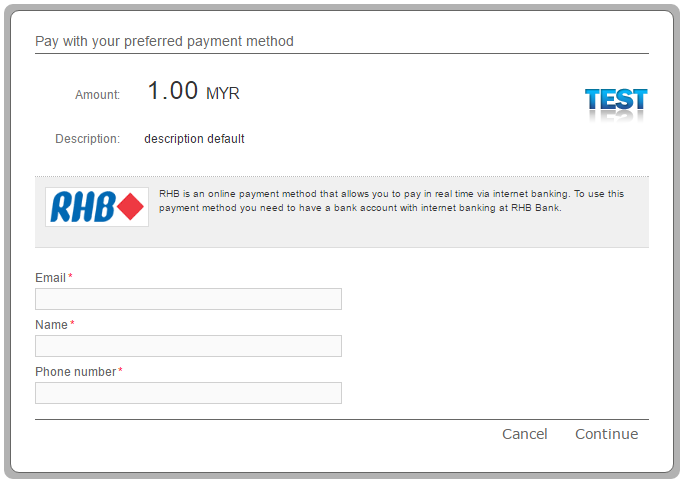

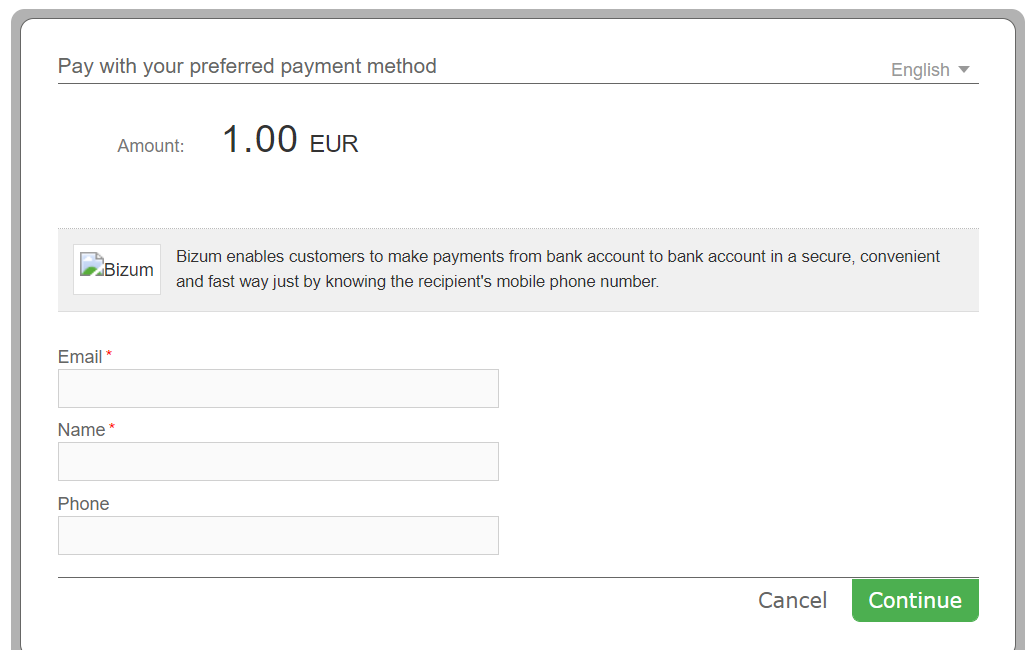

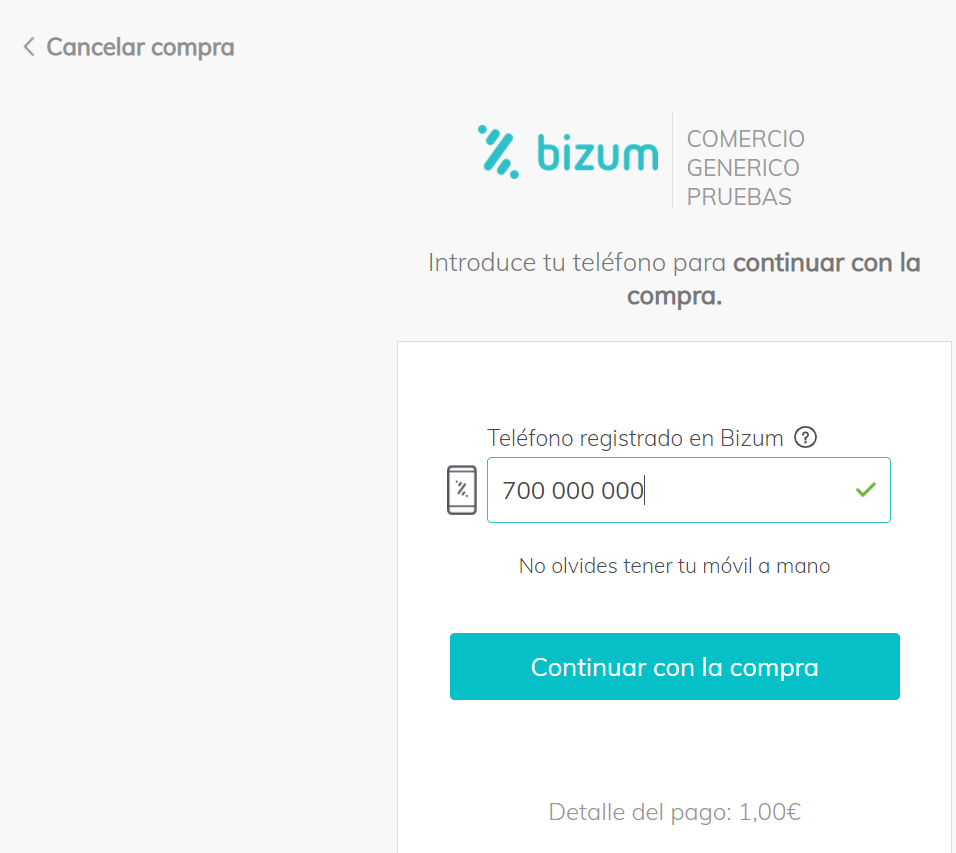

-

The customer enters his email address, name and phone number.

-

The customer is shown the details of his payment and proceeds to pay with Bank Islam Online.

-

The customer logs in to his account by entering his User ID and completes the payment.

-

Upon completion of the payment flow, the customer is redirected back to your ReturnURL.

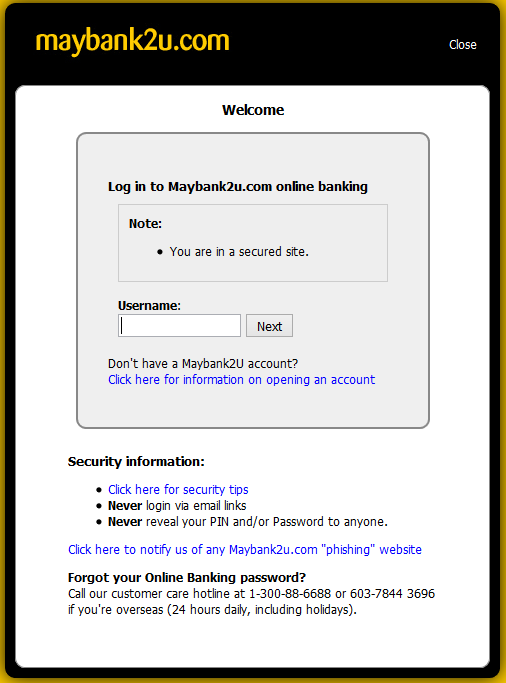

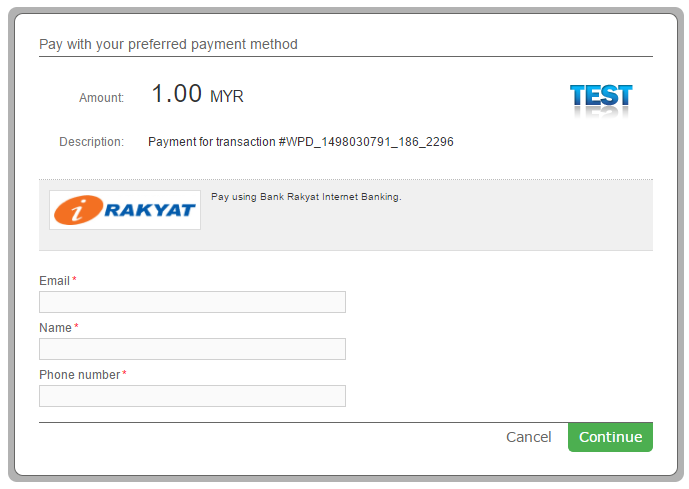

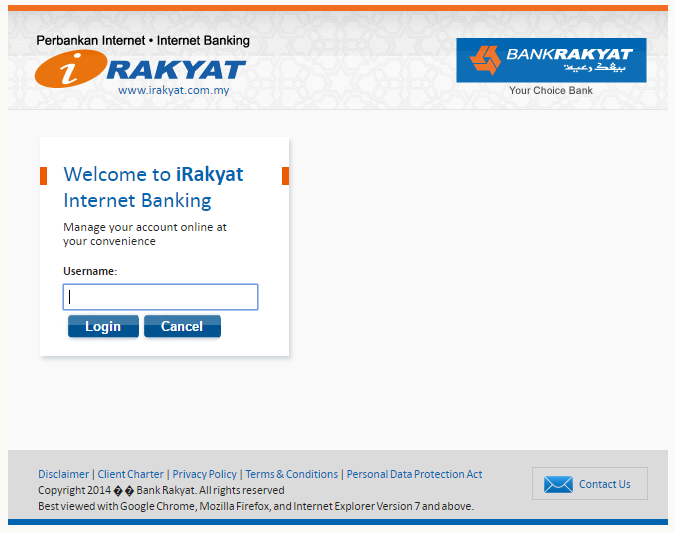

Bank Rakyat Internet Banking Test Data

For Bank Rakyat Internet Banking payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

Bank Rakyat Internet Banking Payment Flow

-

The customer enters his email address, name and phone number.

-

The customer is shown the details of his payment and proceeds to pay with Bank Rakyat Internet Banking.

-

The customer logs in to his Rakyat Internet Banking account by entering his Username and completes the payment.

-

Upon completion of the payment flow, the customer is redirected back to your ReturnURL.

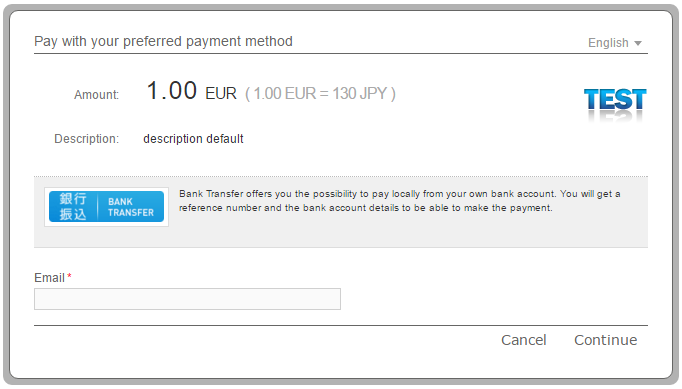

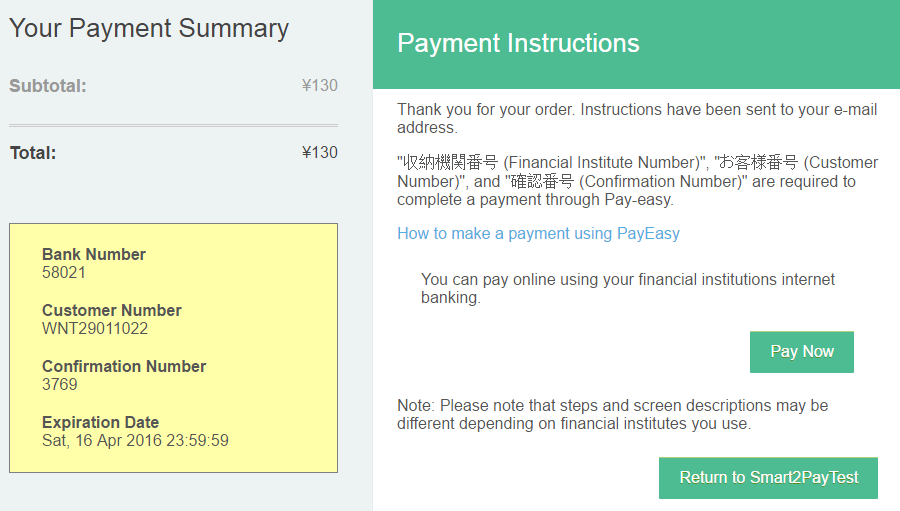

Bank Transfer Japan Test Data

In order for you to test the Bank Transfer Japan payment method successfully, please use the below test data.

| Bank Transfer Japan Test Data | ||

|---|---|---|

| Data | Value | |

| Last Name: | Enter any name. | |

| First Name: | Enter any name. | |

| Phone Number: | Enter any 10 digit number. Example: 1234567812 | |

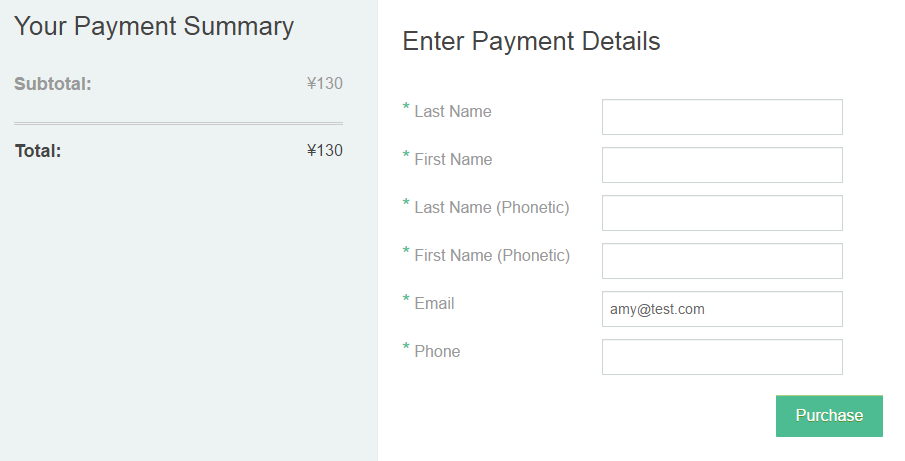

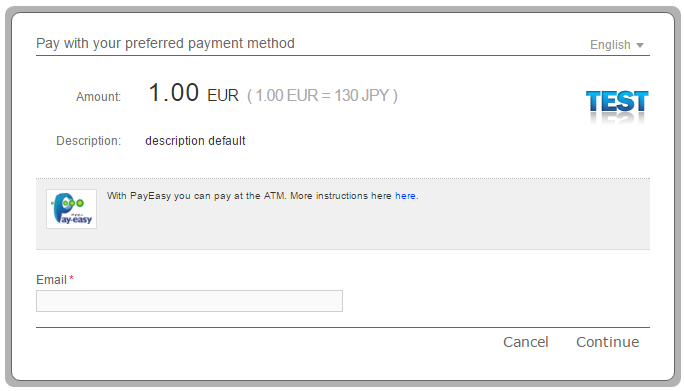

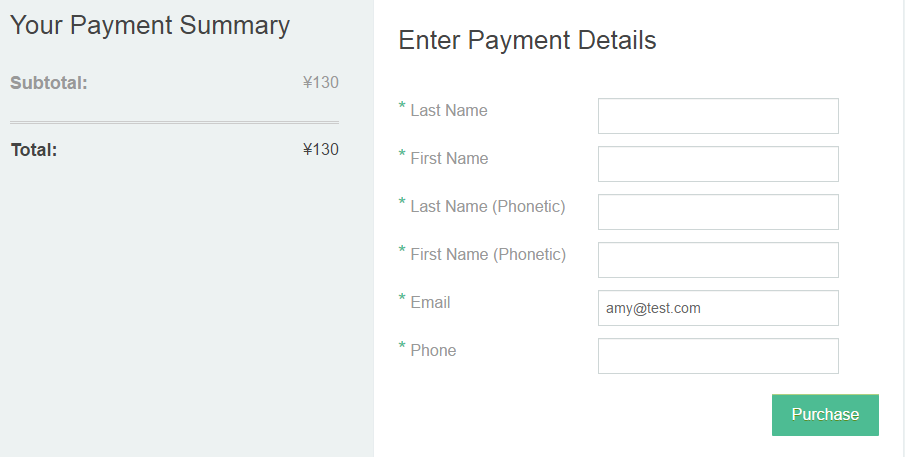

Bank Transfer Japan Payment Flow

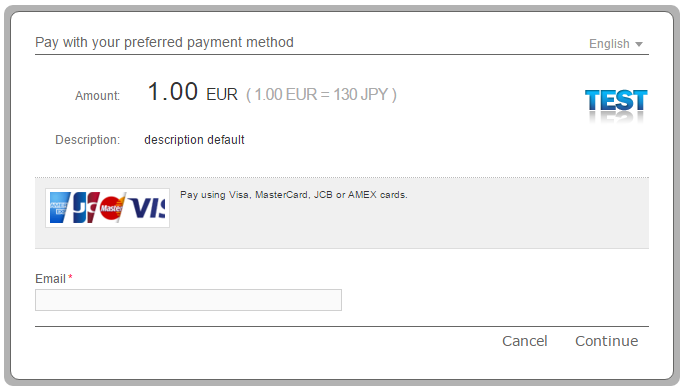

-

The Customer enters his email address.

-

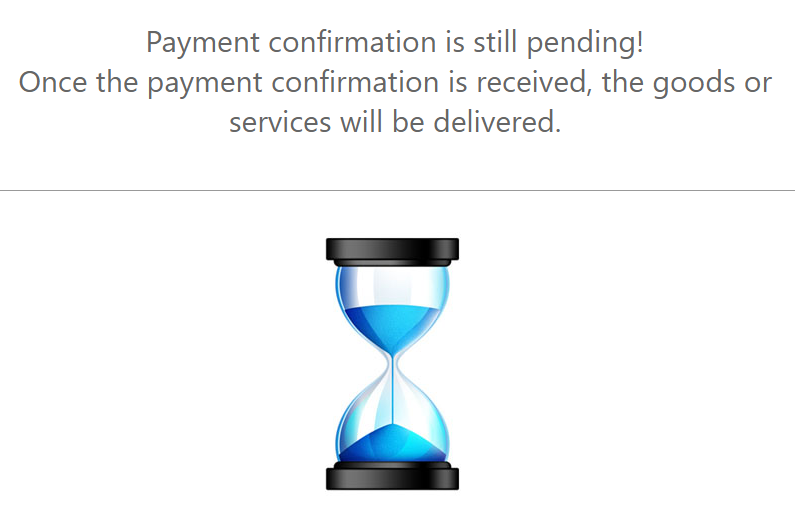

The Customer enters the payment details. He must fill the form with his last name, first name and a valid phone. For test purposes, please provide any first and last name and also any 10 digit phone number.

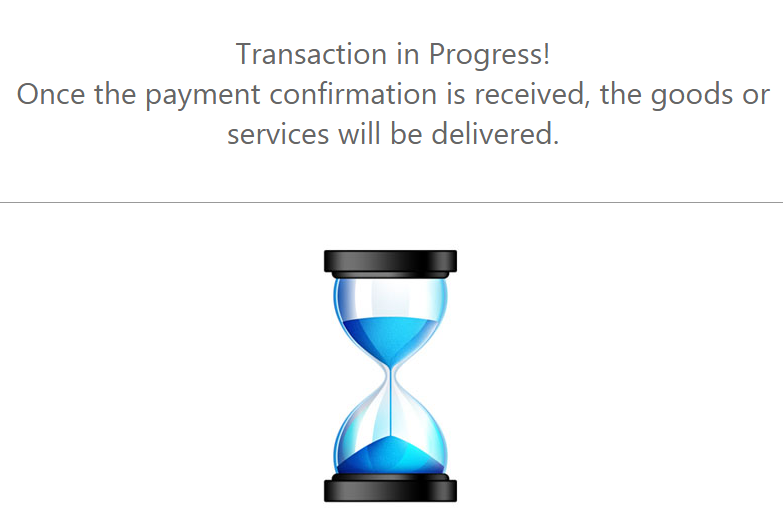

-

The Customer sees the payment summary and details. He will receive an email containing further instructions for completing the purchase.

-

Upon completion of the payment flow, the customer is redirected to your ReturnUrl.

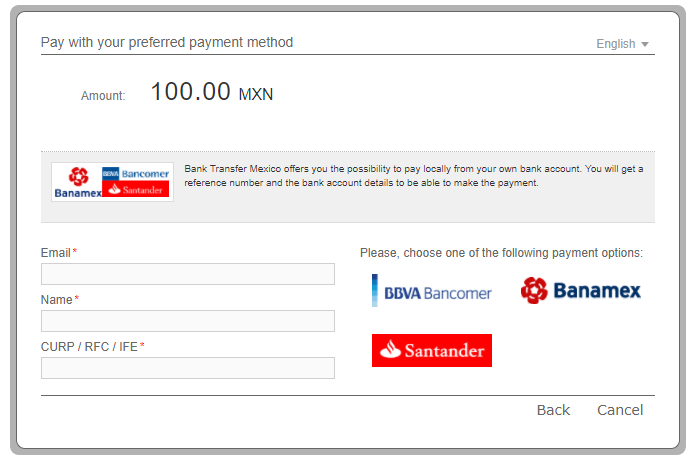

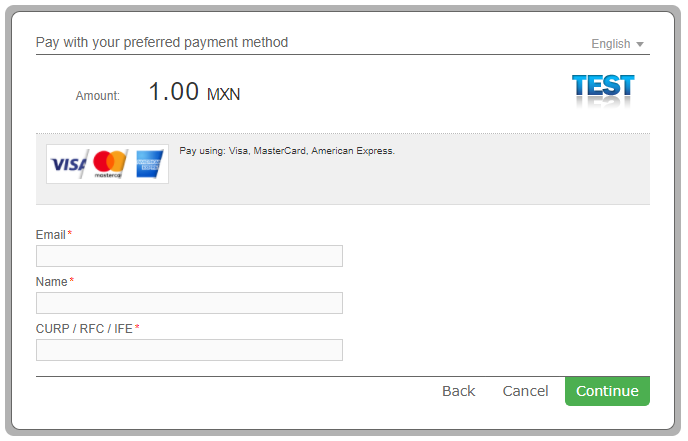

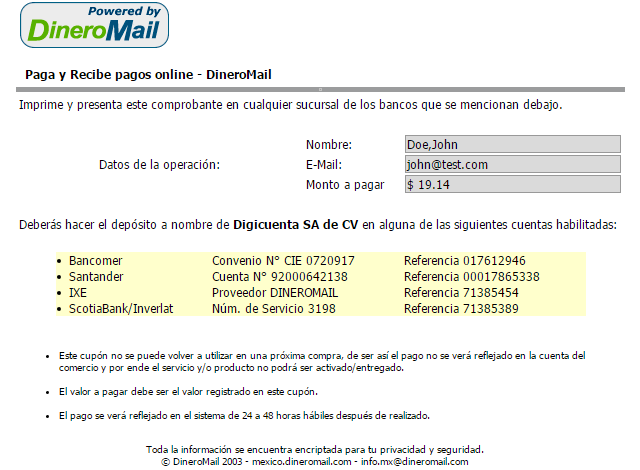

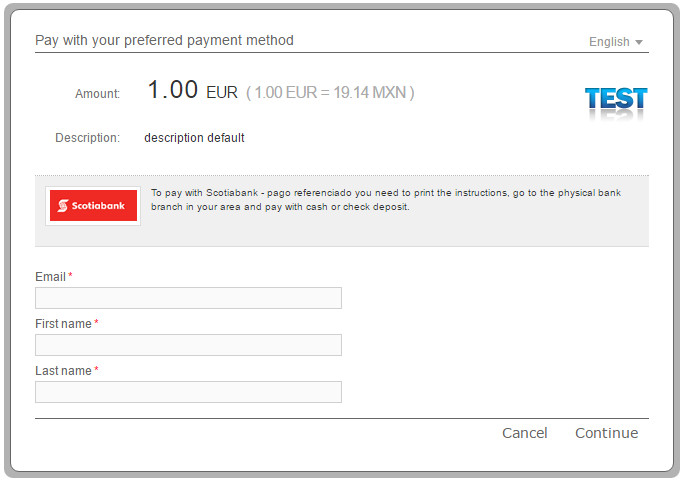

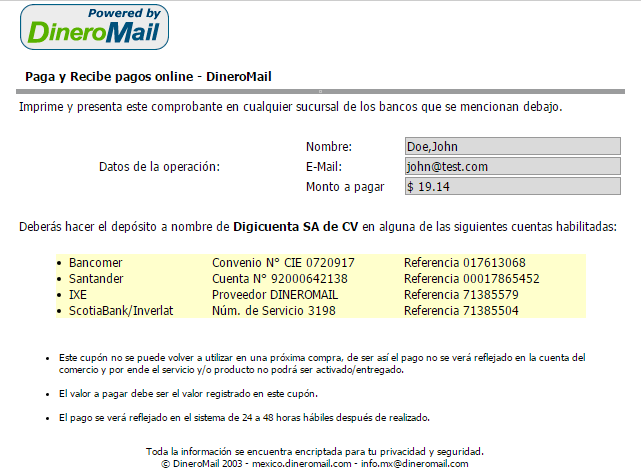

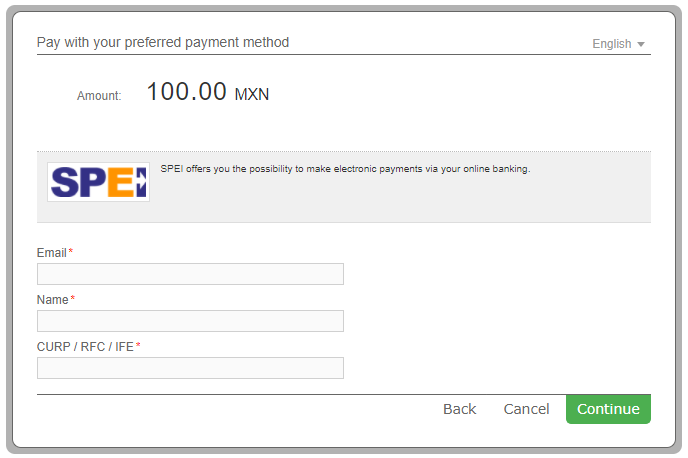

Bank Transfer Mexico Test Data

For Bank Transfer Mexico payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

Bank Transfer Mexico Payment Flow

-

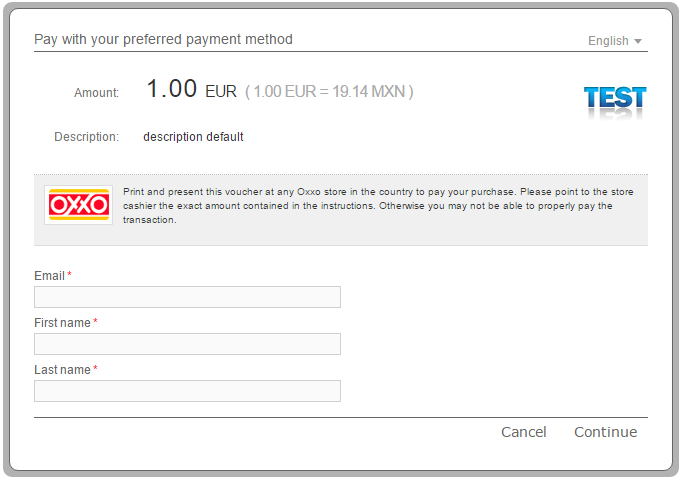

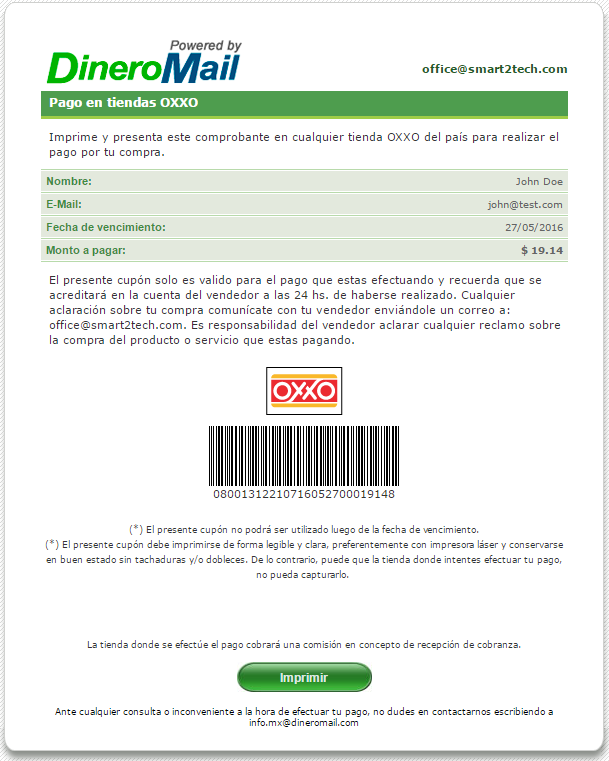

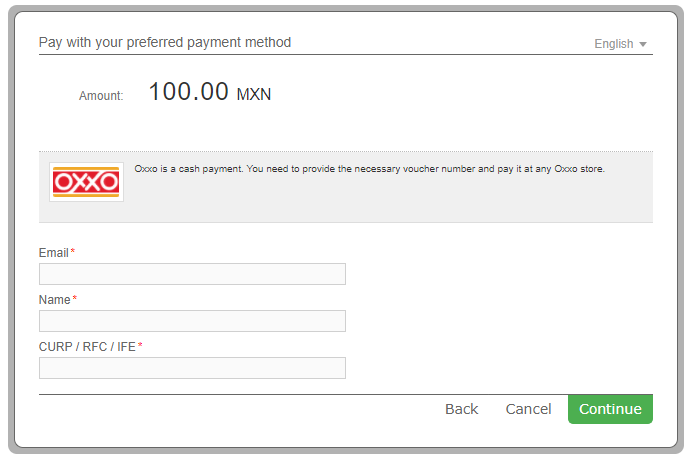

The customer enters his Email Address, Name and CURP/RFC/IFE, and chooses his preferred payment option from the given list.

Please note that for Mexico the Customer Social Security Number parameter consists of CURP/RFC/IFE. For more information about the CURP/RFC/IFE please click here. -

The customer can print the payment details and complete the payment in the next 48 hours at the corresponding bank. Payment confirmation may take between 24 and 48 business hours.

-

Upon completion of the payment flow the customer is redirected back to your ReturnURL.

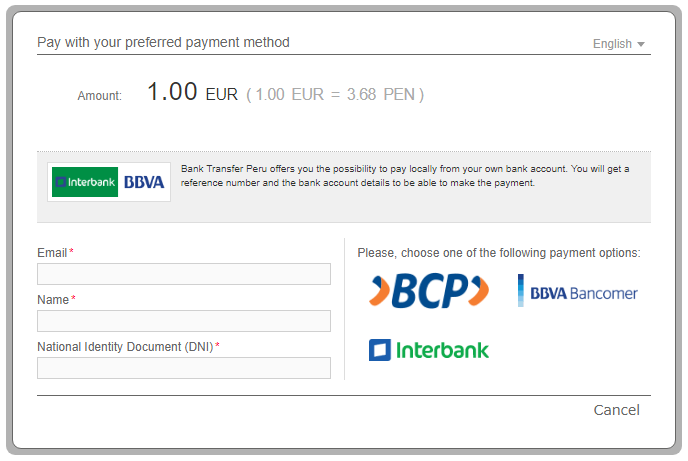

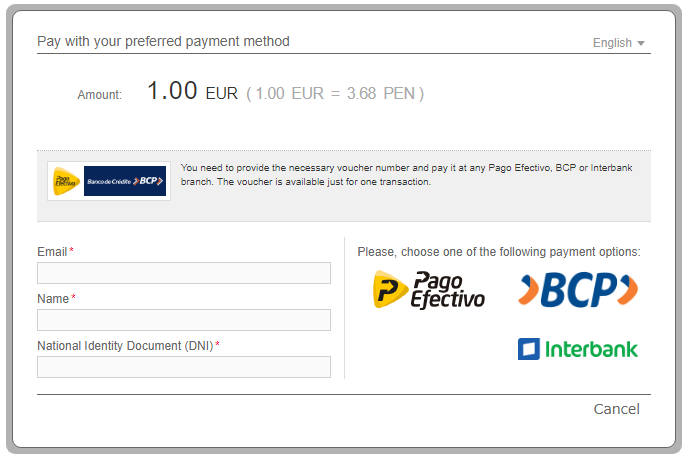

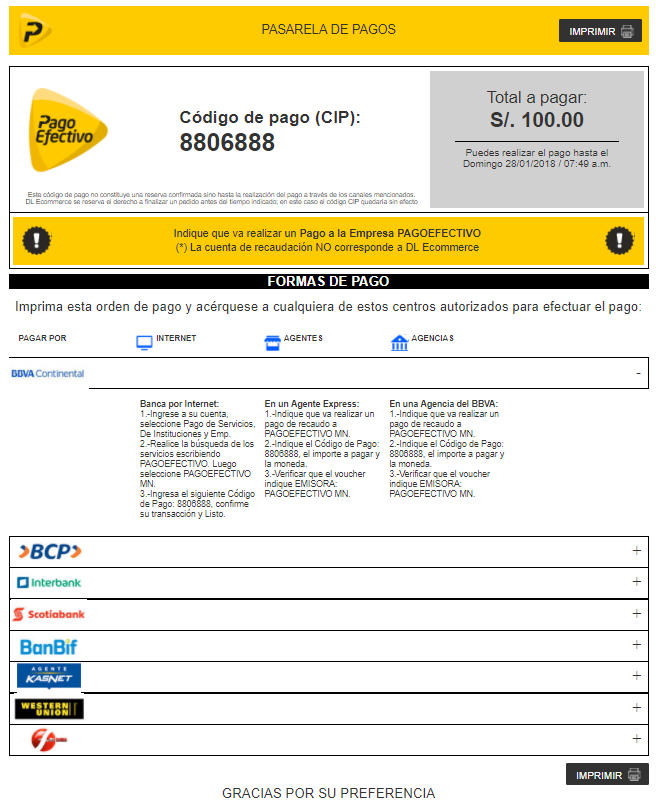

Bank Transfer Peru Test Data

For Bank Transfer Peru payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

Bank Transfer Peru Payment Flow

-

The customer enters his Email Address, Name and DNI. Please note that for Peru the Customer Social Security Number parameter consists of DNI. For more information about the DNI please click here.

-

The customer receives the printable payment details in order to complete the payment.

-

Upon completion of the payment flow the customer is redirected back to your ReturnURL.

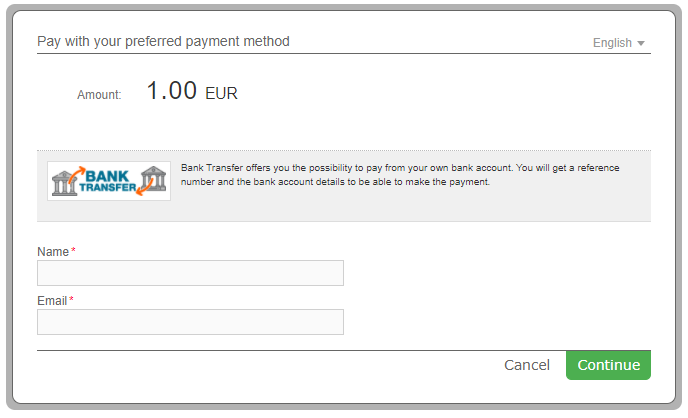

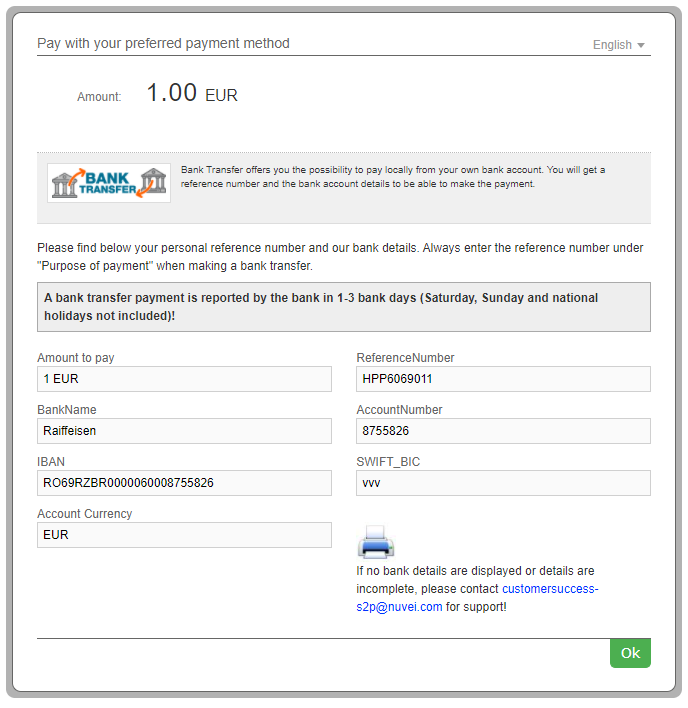

Bank Transfer Test Data

In order for you to test Bank Transfer payment method successfully, you don’t need any given test data.

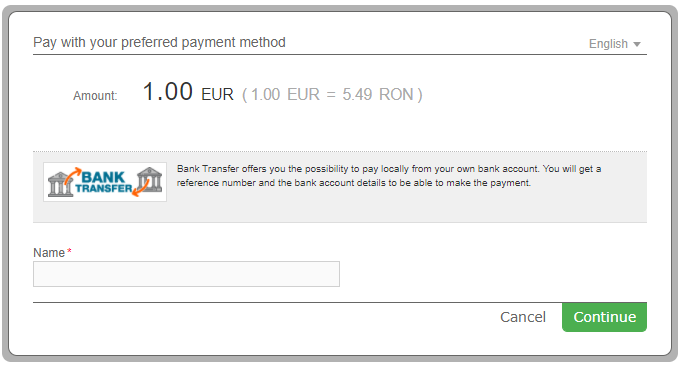

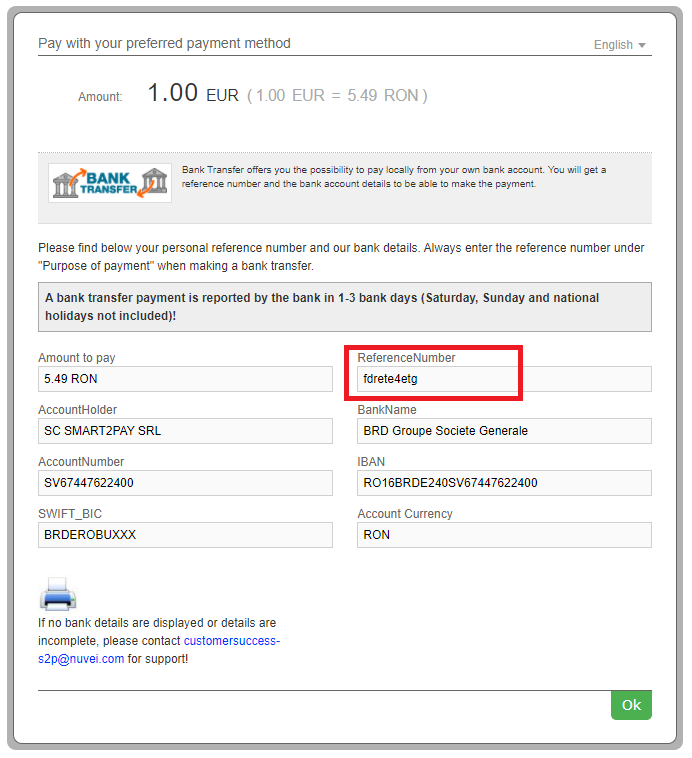

Bank Transfer Payment Flow

-

The customer will be redirected to the payment page where he enters his name.

-

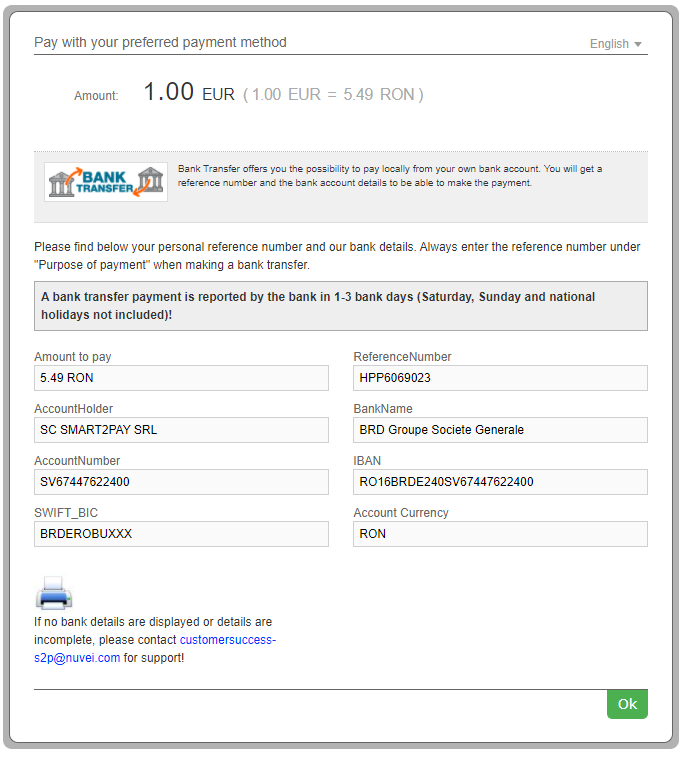

The customer receives the details to make the payment of the transaction. He also has the possibility to print the payment details.

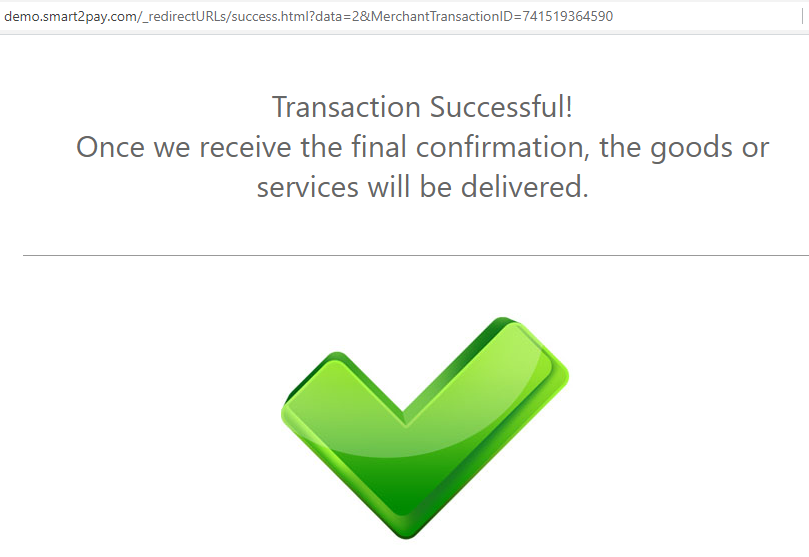

-

Upon completion of the payment flow, the customer is redirected back to your ReturnURL.

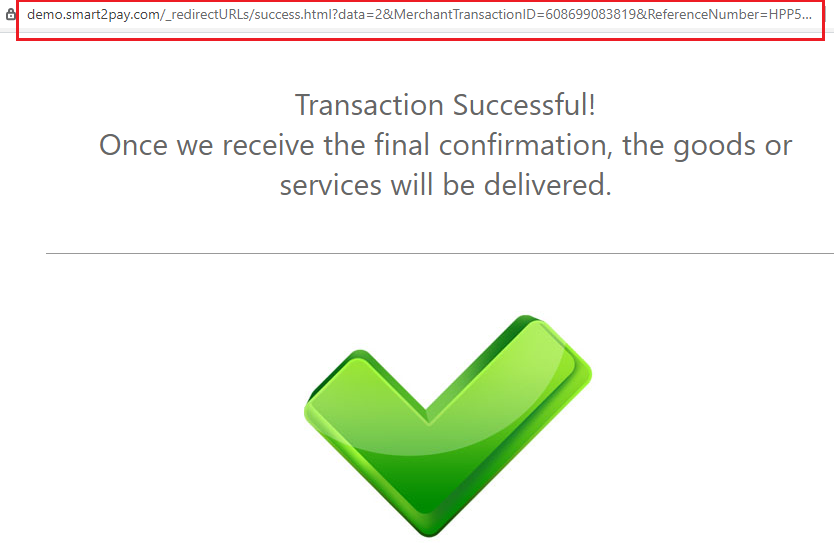

- There is another possibility to complete a Bank Transfer payment flow where you can send your own Reference Number in the request.

-

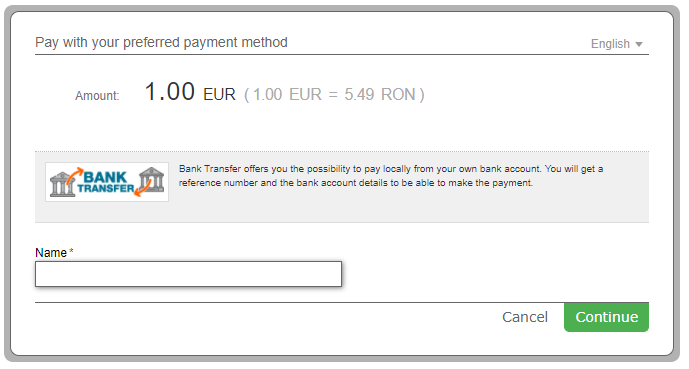

The customer will be redirected to the payment page where he enters his name.

-

The customer receives the payment details with his specific Reference Number. He also has the possibility to print the payment details.

-

Upon completion of the payment flow, the customer is redirected back to your ReturnURL.

- There is even one more simple possibility to complete a Bank Transfer payment flow where you can display the payment instructions on your own page by sending the mandatory parameter Customer and use the information received in Response for ReferenceDetails.

-

The customer will see and complete the payment instructions on your own page.

-

Upon completion of the payment flow, the customer is redirected back to your ReturnURL.

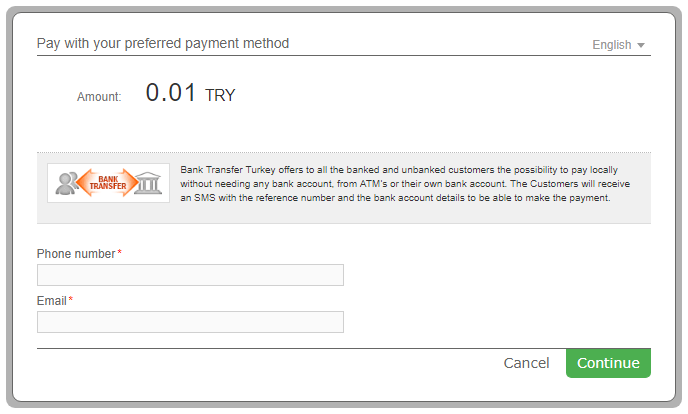

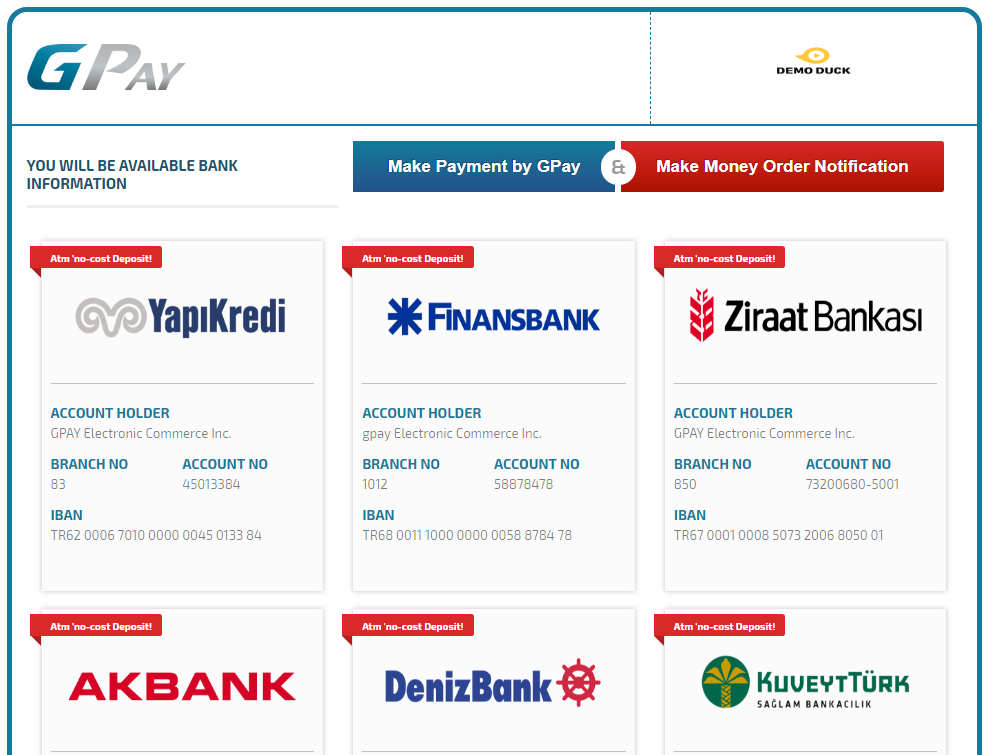

Bank Transfer Turkey Test Data

For Bank Transfer Turkey payment method test data is available on demand. Please contact our support department at technicalsupport-s2p@nuvei.com for more information.

Bank Transfer Turkey Payment Flow

- The customer enters his phone number and his email address.

- The customer chooses the desired bank from the list provided.

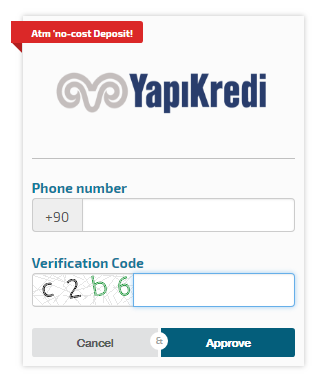

- The customer enters his phone number and the verification code and clicks on the Approve button.

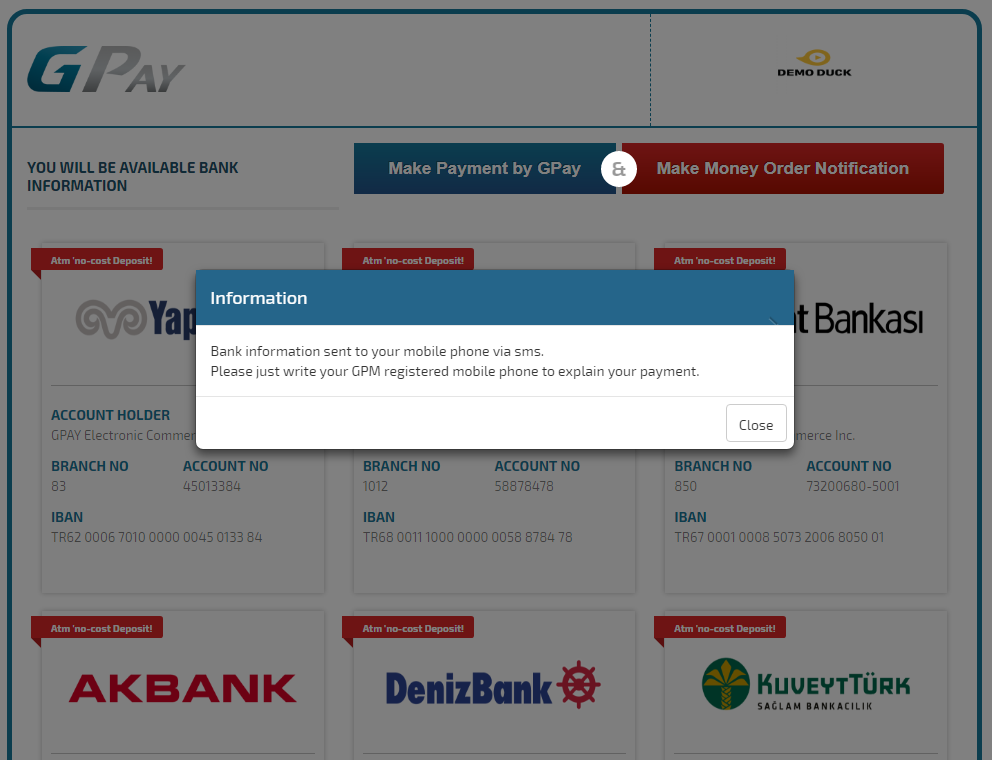

- The customer will receive a message that the bank information were sent to his mobile phone via sms. He just needs to write his GPM registered mobile phone to explain his payment.

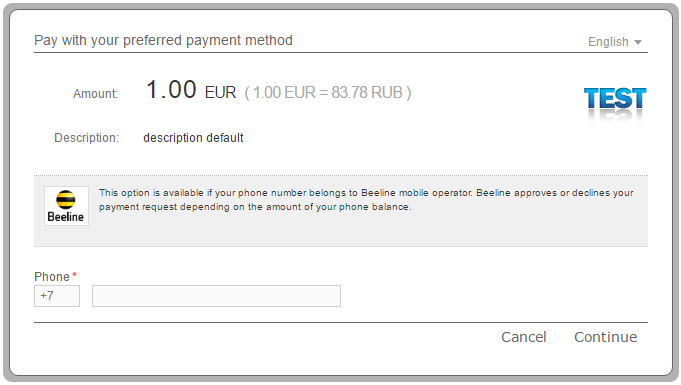

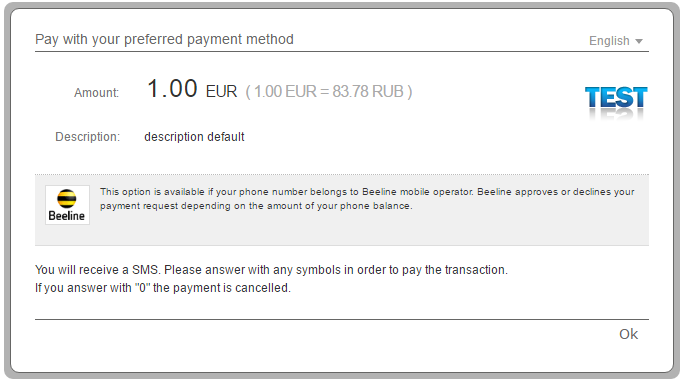

Beeline Test Data

For Beeline payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

Beeline Payment Flow

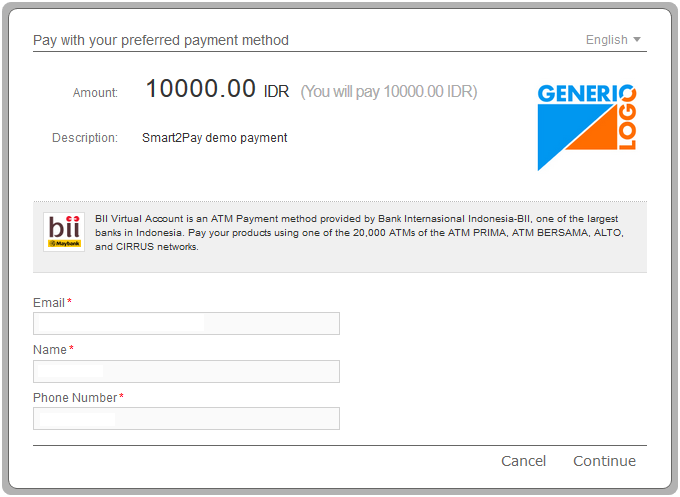

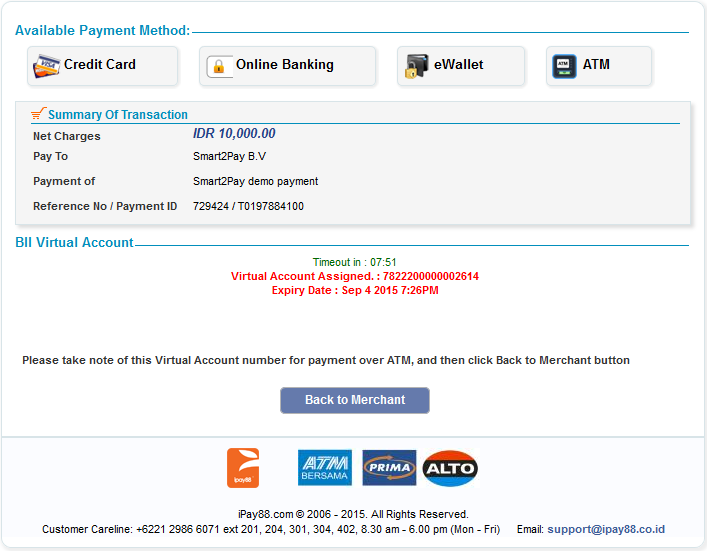

BII VA Test Data

For BII VA payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

BII VA Payment Flow

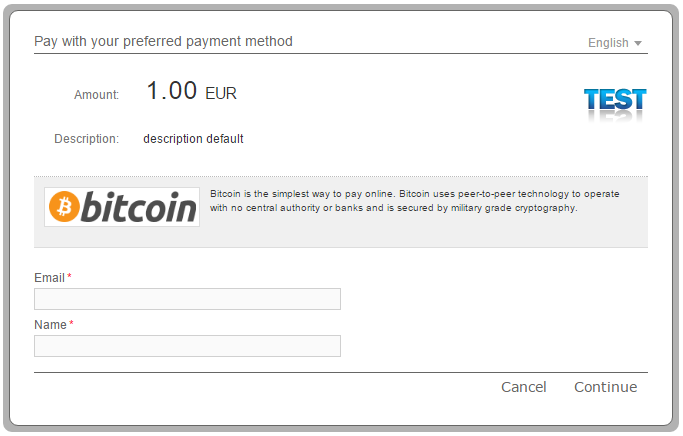

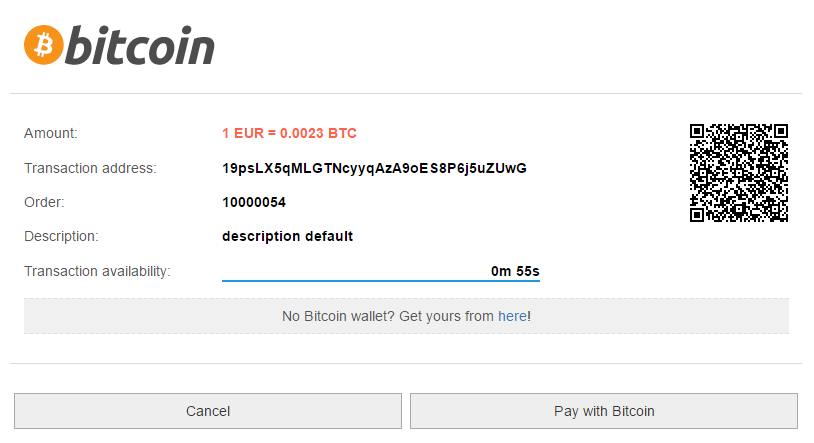

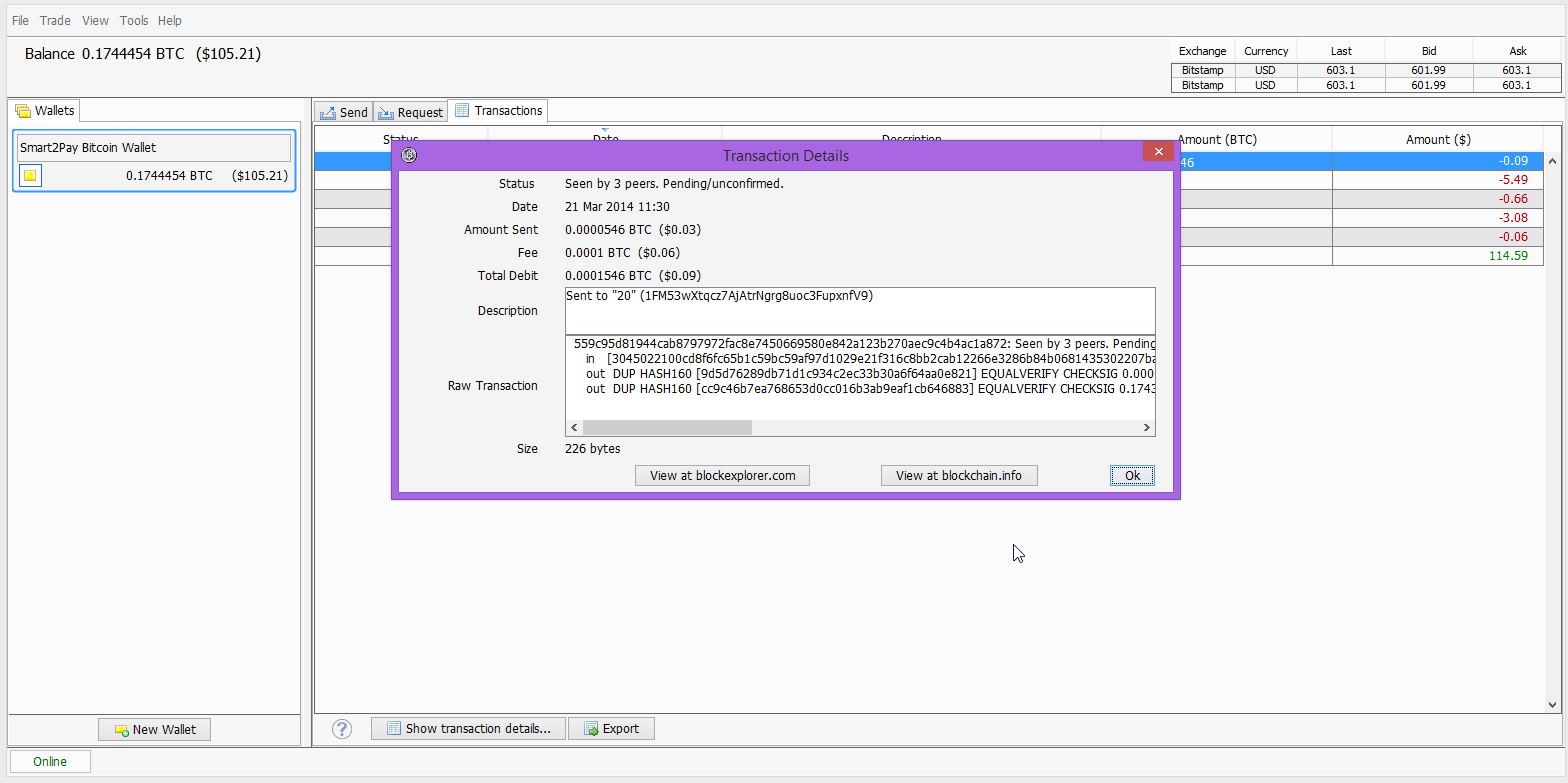

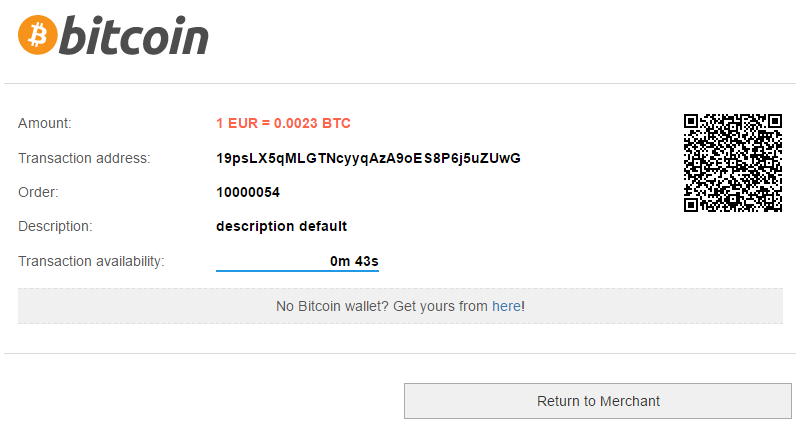

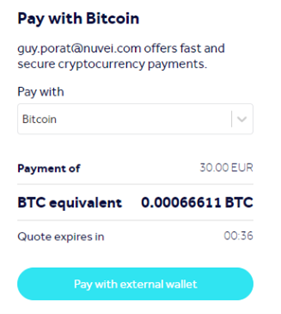

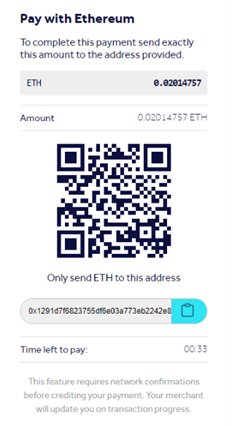

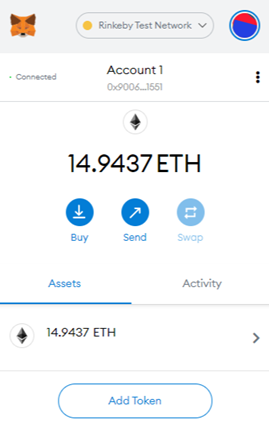

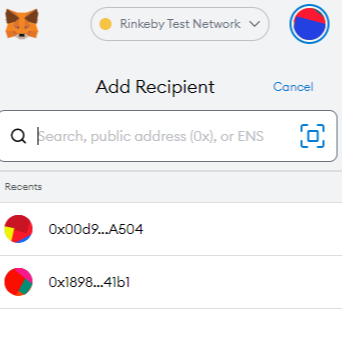

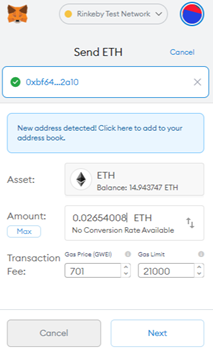

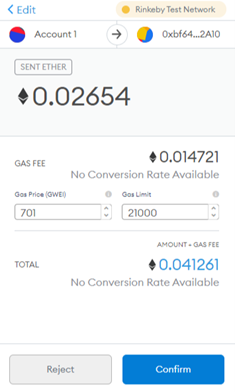

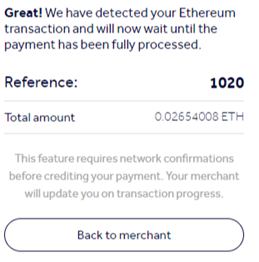

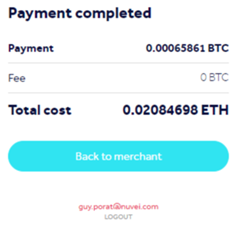

Bitcoin Test Data

For Bitcoin payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

Bitcoin Payment Flow

-

The Customer enters his email address and name.

-

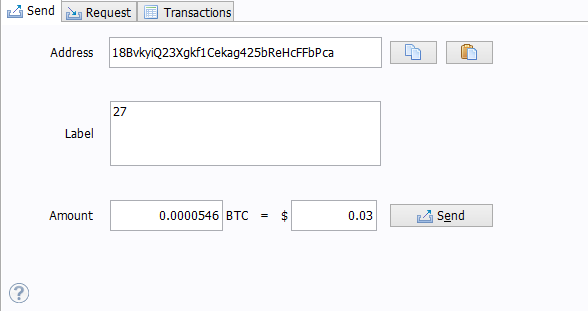

The customer clicks Pay with Bitcoin to continue the payment.

-

The customer’s preferred Bitcoin application opens automatically with the payment parameters prefilled.

-

The customer has the possibility to monitor the status of the payment.

-

The customer can return to the merchant website by clicking “Return to Merchant” button.

-

Upon completion of the payment flow, the customer is redirected to your ReturnUrl.

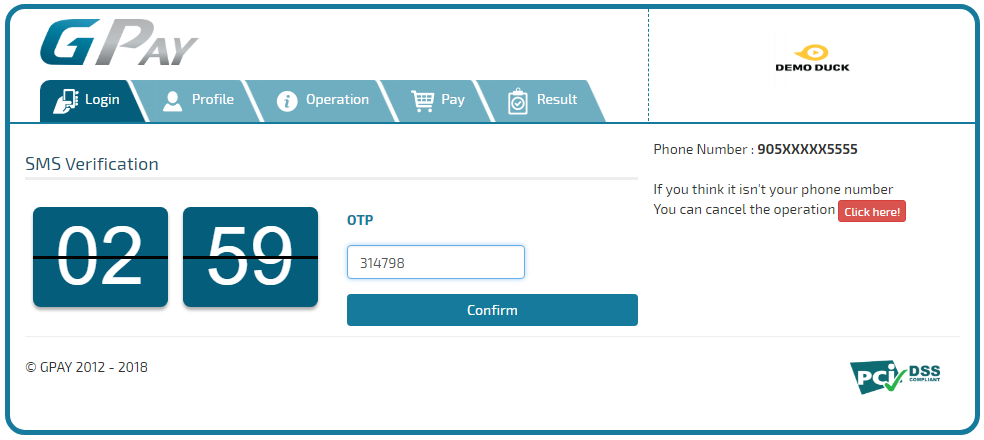

BKM Express Test Data

For BKM Express payment method test data is available on demand. Please contact our support department at technicalsupport-s2p@nuvei.com for more information.

BKM Express Payment Flow

- The customer enters his phone number and his email address.

- The customer receives a 6-digit verification code at the phone number that he previously added. He needs to enter the 6-digit code and click the Confirm button.

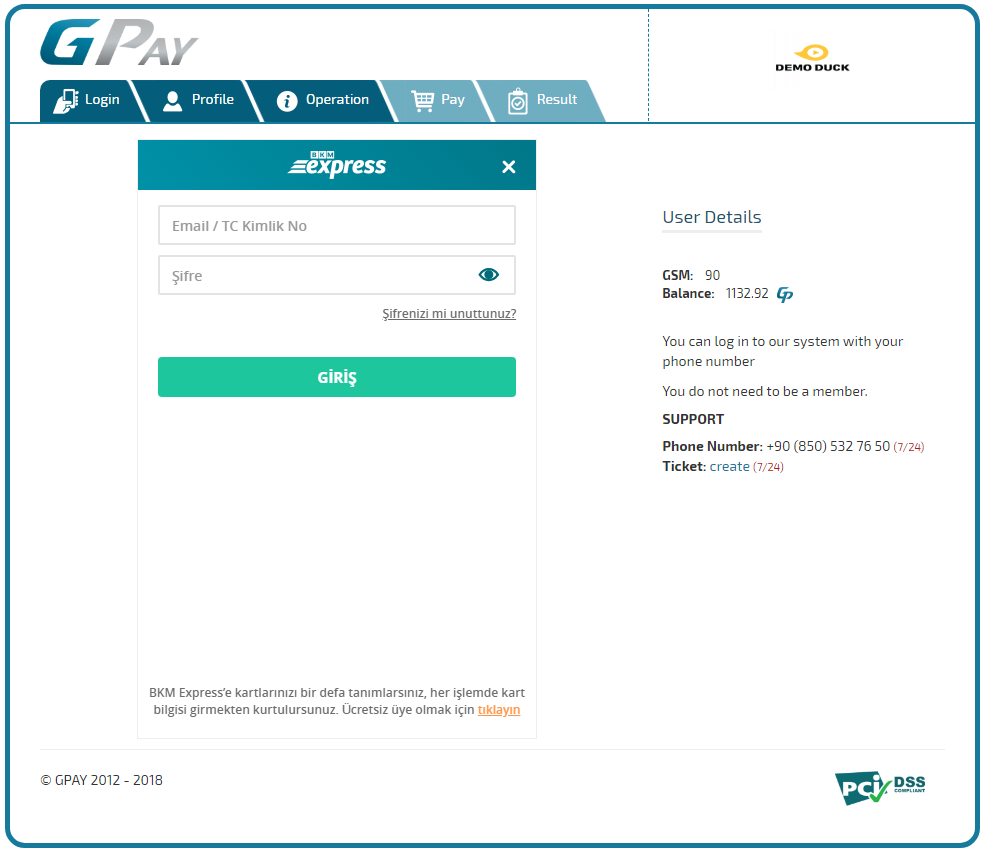

- The Customer logs in to his BKM Express account with his email address and password.

- The customer verifies the payment information and the user details and completes the transaction by clicking on the Perform Payment button.

- Upon completion of the payment flow, the customer is redirected to your ReturnUrl.

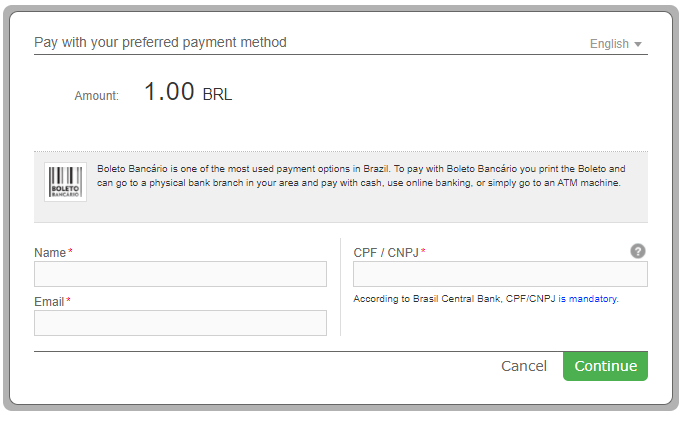

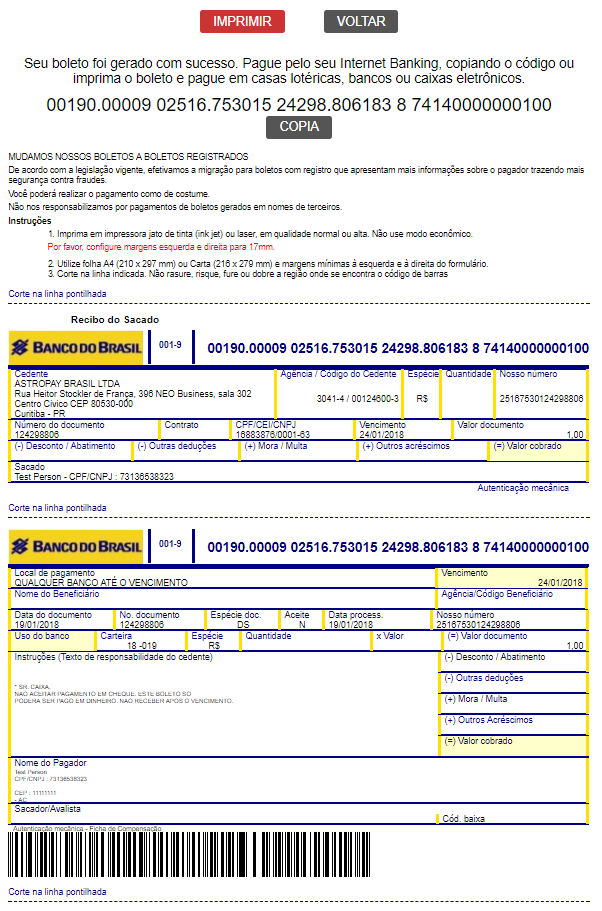

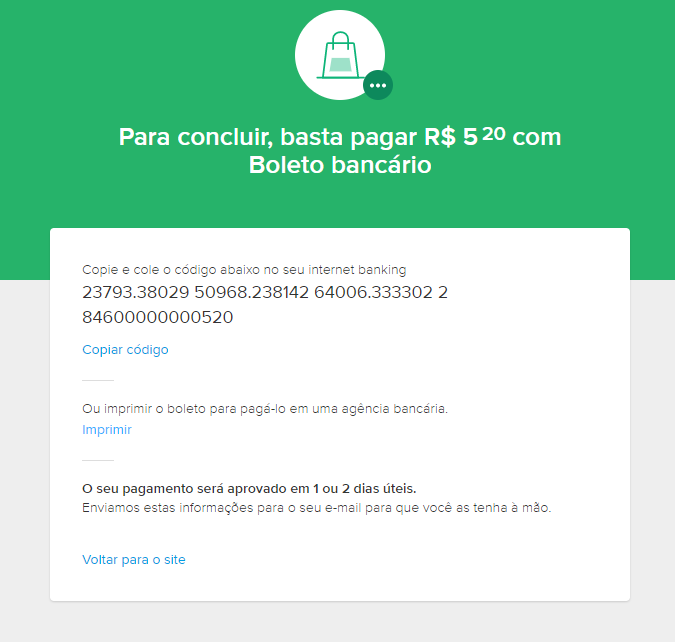

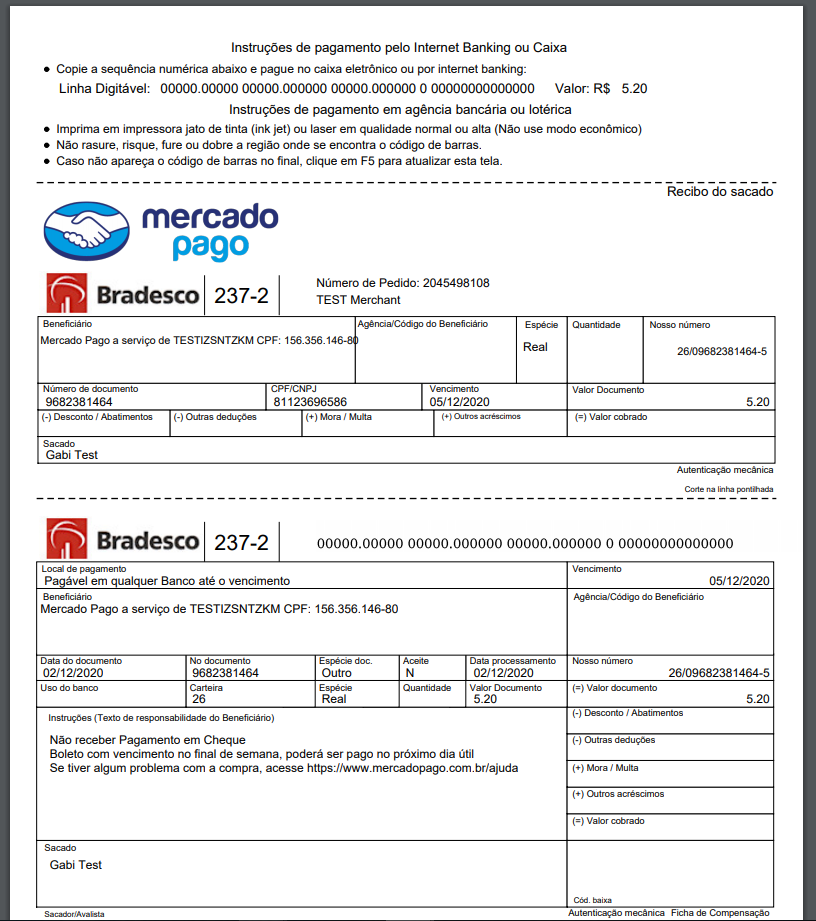

Boleto Bancario Brazil Test Data

For Boleto Bancario Brazil payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

Boleto Bancario Brazil Payment Flow

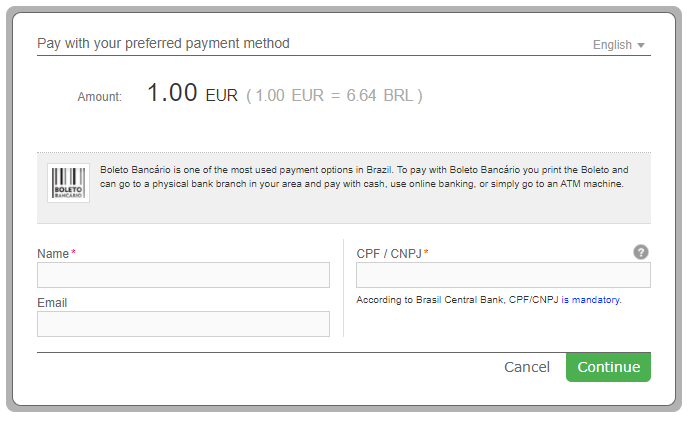

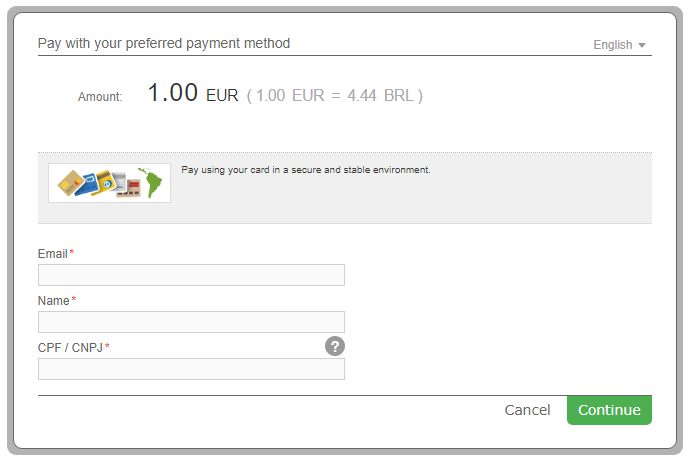

- The customer enters his Email Address, Name and CPF/CNPJ.

Please note that for Brazil the Customer Social Security Number parameter consists of CPF/CNPJ. For more information about the CPF/CNPJ please click here. - The customer verifies the transaction details and confirms the payment. He also has the possibility to change the payment method if needed.

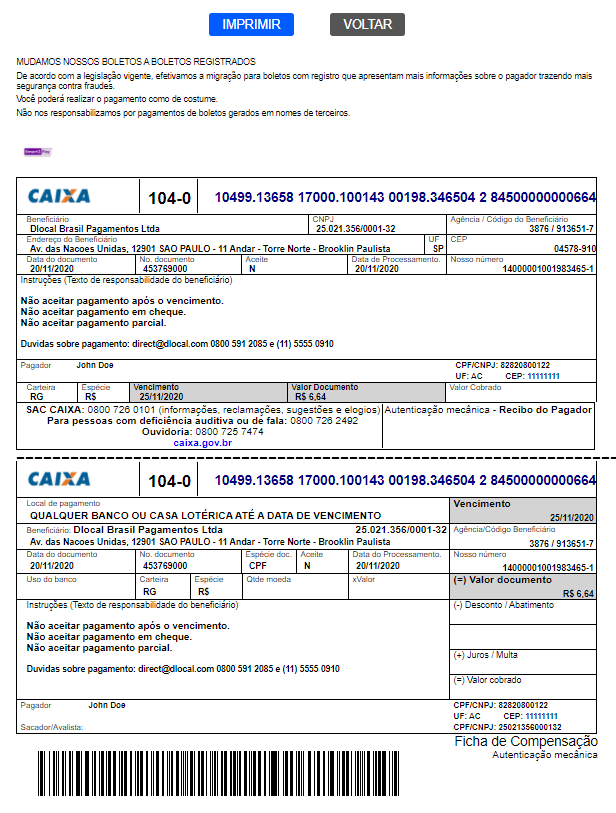

- The customer is redirected to the payment confirmation page where he can choose to complete the payment by using the payment code received (payment through internet banking) or by printing the Boleto (payment at any bank agency).

- The customer receives the Boleto with all the necessary payment details. In order to complete the payment, he needs to print the Boleto and go to a physical bank branch in his area and pay.

Boleto Bancário Test Data

In order for you to test Boleto Bancário payment method successfully, please use the below test data.

| Boleto Bancário Test Data | ||||||

|---|---|---|---|---|---|---|

| Data | Value | |||||

| Name: | Enter any name, example: John Doe | |||||

| CPF: | 31130088910 | 63598982330 | ||||

| The CPF can be submitted with or without separators. | ||||||

| CNPJ: | 96705418000173 | 47248656000191 | ||||

| The CNPJ can be submitted with or without separators. | ||||||

| The CPJ / CNPJ number is collected and sent in the payment request using the CustomerSocialSecurityNumber parameter from the Customer object. | ||||||

Please note that according to the Brazilian Federation of Banks the CPF/CNPJ is mandatory for processing Boletos.

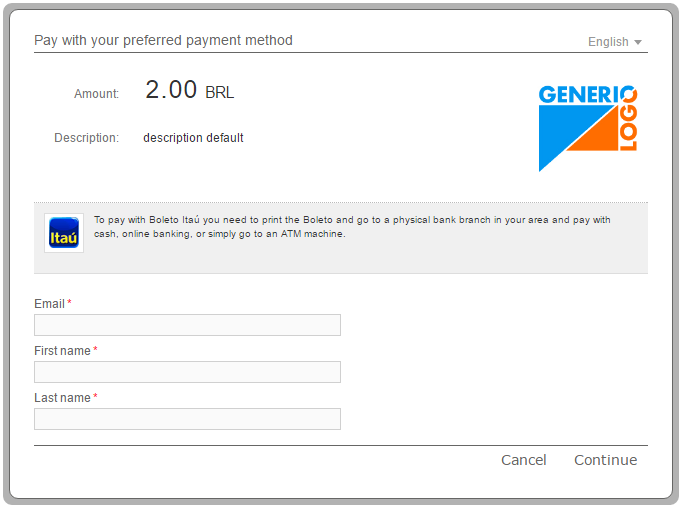

Boleto Bancário Payment Flow

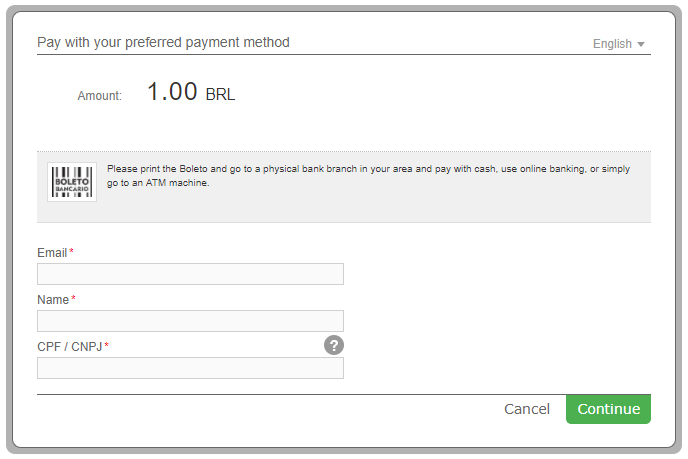

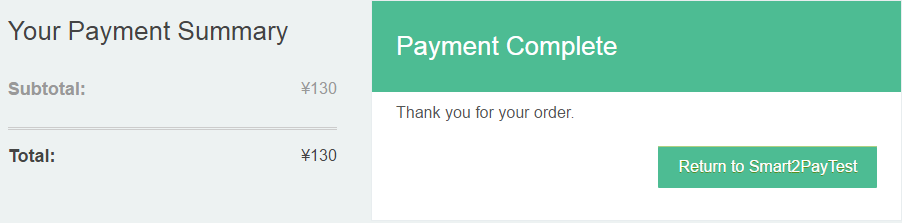

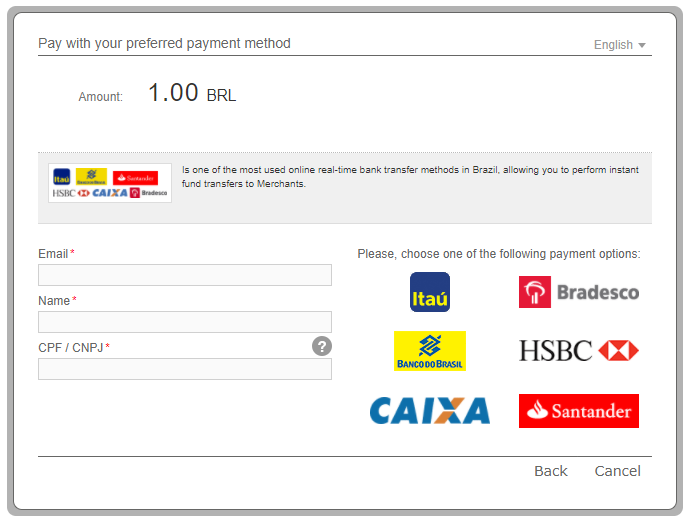

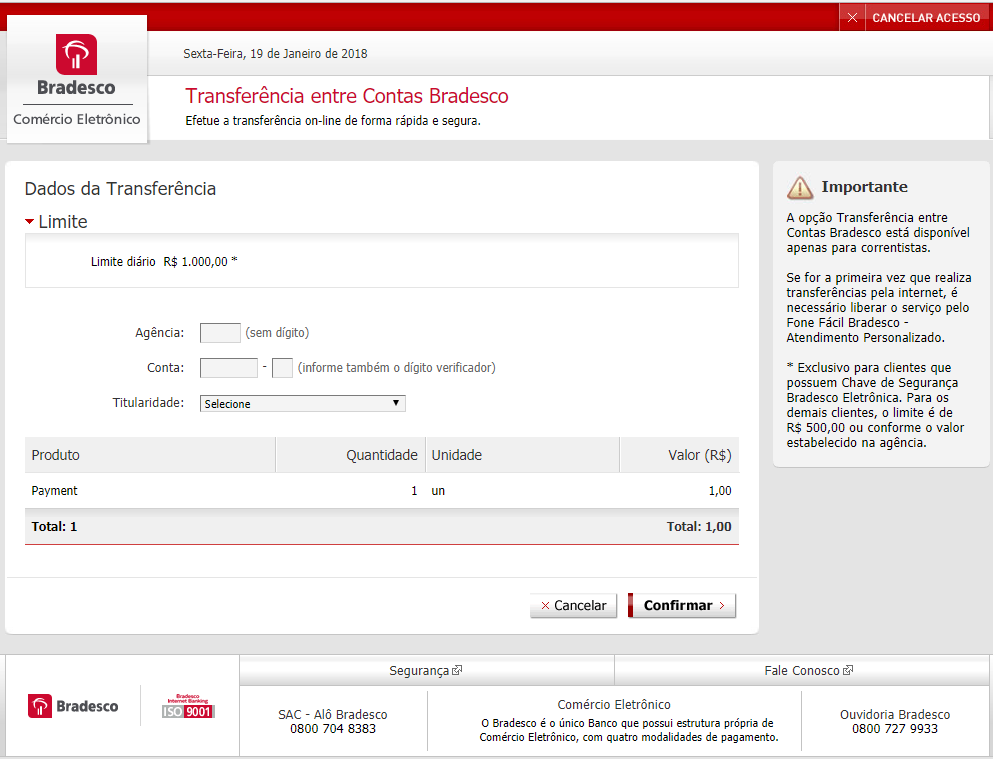

- The customer enters his Email Address, Name and CPF/CNPJ, and chooses his preferred payment option from the given list. Please note that for Brazil the Customer Social Security Number parameter consists of CPF/CNPJ. For more information about the CPF/CNPJ please click here.

- The customer receives the Boleto with all the necessary payment details. In order to complete the payment, he has the following options: to print the Boleto and go to a physical bank branch in his area and pay with cash or cheque, pay online using internet banking, or pay via an ATM machine.

- Upon completion of the payment flow the customer is redirected back to your ReturnURL.

Boleto Brazil Test Data

For Boleto Brazil payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

Boleto Brazil Payment Flow

-

The customer enters his Email Address, Name and CPF/CNPJ.

Please note that for Brazil the Customer Social Security Number parameter consists of CPF/CNPJ. For more information about the CPF/CNPJ please click here. -

The customer receives the Boleto with all the necessary payment details. In order to complete the payment, he needs to print the Boleto and go to a physical bank branch in his area and pay with cash, use online banking, or simply go to an ATM machine.

-

Upon completion of the payment flow the customer is redirected back to your ReturnURL.

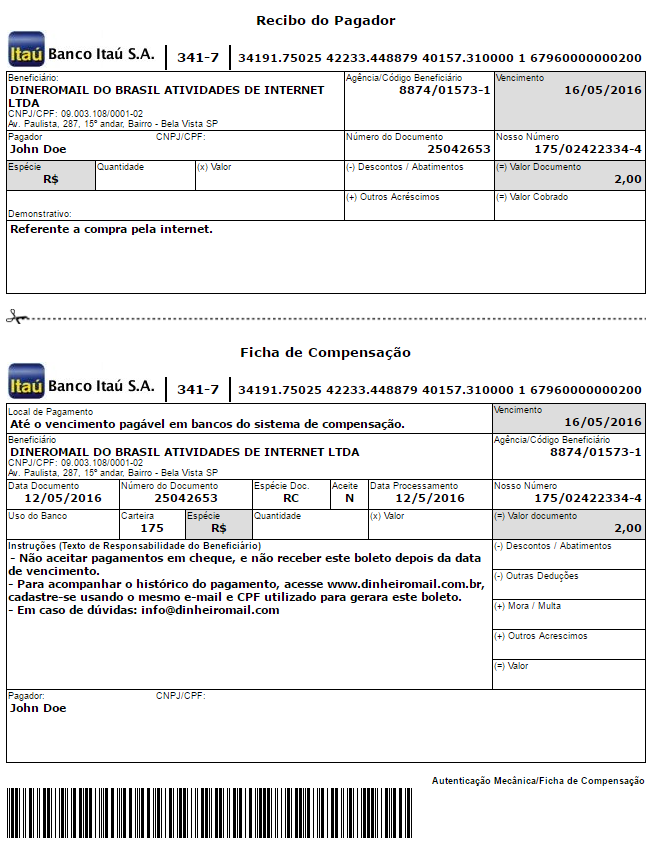

Boleto Itaú Test Data

In order for you to test Boleto Itaú payment method successfully, you don’t need any given test data.

Boleto Itaú Payment Flow

-

The customer enters the required details: email address, first name and last name.

-

The customer receives the Boleto with all the necessary payment details. In order to complete the payment, he needs to print the Boleto and go to a physical bank branch in his area and pay with cash, use online banking, or simply go to an ATM machine.

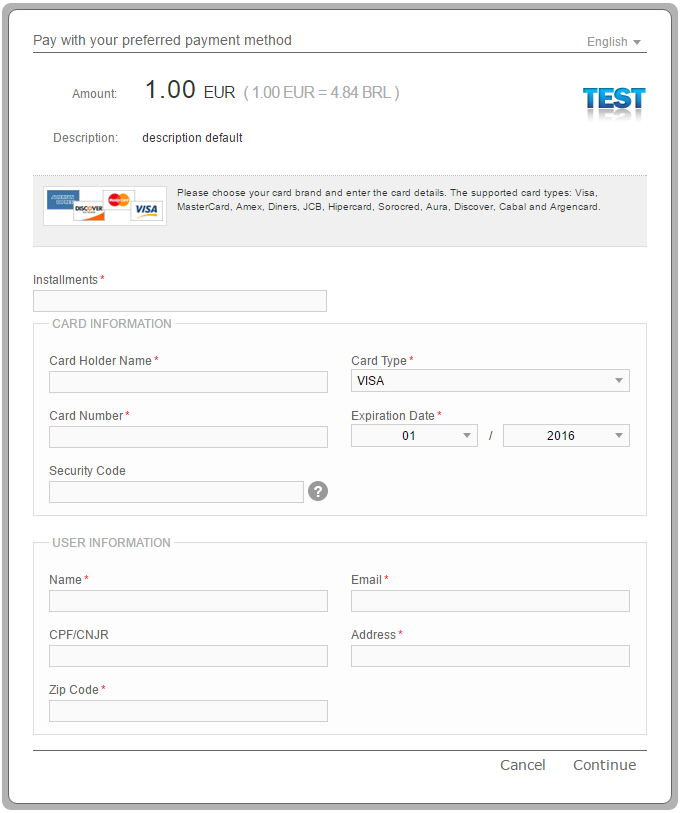

Cards Brazil Test Data

For Cards Brazil payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

Cards Brazil Payment Flow

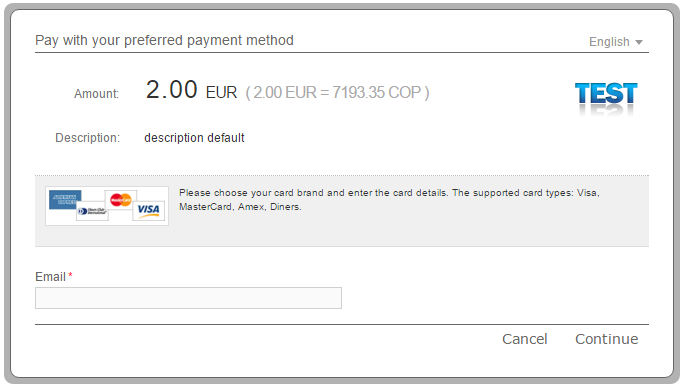

Cards Colombia Test Data

For Cards Colombia payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

Cards Colombia Payment Flow

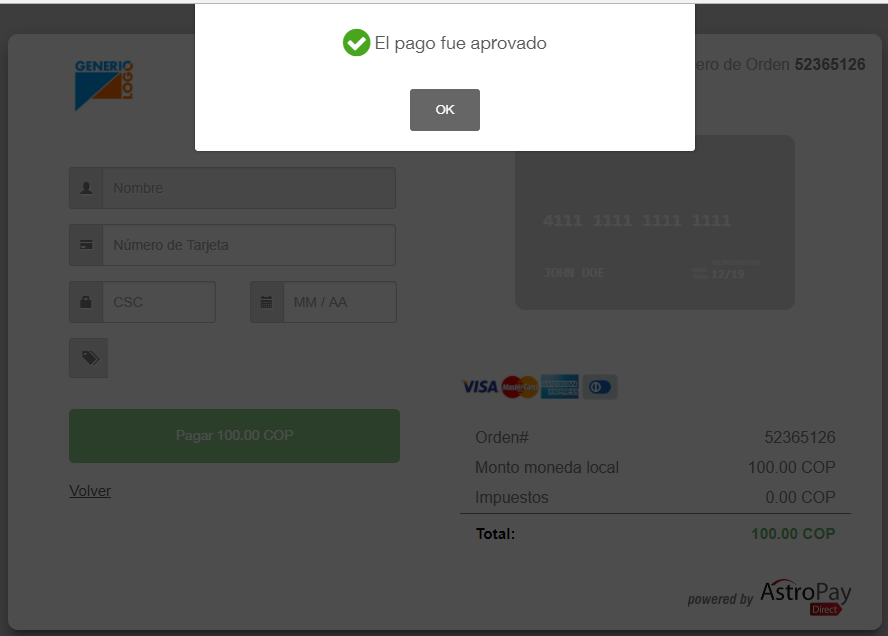

-

The customer enters his Email Address, Name and CC. Please note that for Colombia the CustomerSocialSecurityNumber parameter consists of CC. For more information about the CC please click here.

-

The customer enters his email address, name and card details: Card Number, CVC (CSC) and Expiration Date. He finalizes the payment by using the Pay button.

-

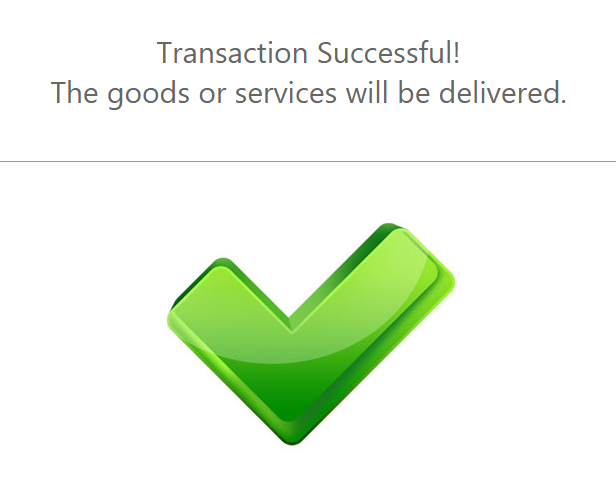

The customer receives a message that the payment has been completed correctly.

-

Upon completion of the payment flow the customer is redirected back to your ReturnURL.

Cards Japan Test Data

In order for you to test the Cards Japan payment method successfully, please use the below test data.

| Cards Japan Test Data | |

|---|---|

| Data | Value |

| Last Name: | Enter any name |

| First Name: | Enter any name |

| Credit Card Number: | JCB: 3530111333300000 |

| American Express: 378282246310005 | |

| VISA: 4111111111111111 | |

| Master Card: 5555555555554444 | |

| Diners Club: 30569309025904 | |

| Insufficient funds: 4123111111111000 | |

| Exceeds card limit: 4123111111111018 | |

| Bad verification value: 4123111111111034 | |

| Card expired: 4123111111111042 | |

| Cannot use card: 4123111111111059 | |

| Invalid card: 4123111111111067 | |

| Card Security Code: | Any 3 digit number. Example: 123 |

| Expiration date: | Choose a month and a year at least equal than the current month and year |

Cards Japan Payment Flow

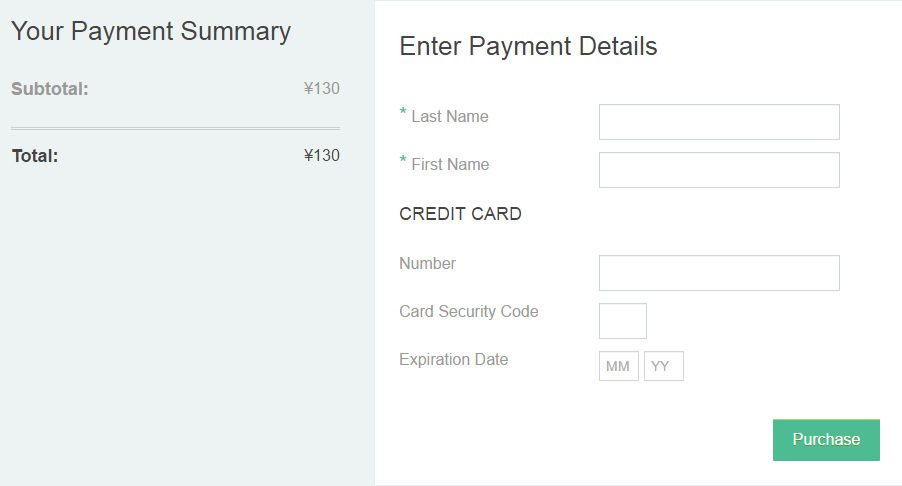

-

The Customer enters his email address.

-

The Customer enters the payment details. He must fill the form with his last name, first name and a valid credit card number. For test purposes, please provide any first and last name and one of the test credit card numbers given above.

-

The customer is redirected to the provider’s confirmation page.

-

Upon completion of the payment flow, the customer is redirected to your ReturnUrl.

Cards LATAM Test Data

For Cards LATAM payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

Cards LATAM Payment Flow

-

The customer enters his Email Address, Name and his Customer Social Security Number, and chooses his preferred payment option from the given list. See below, depending on the selected country, the values for the CustomerSocialSecurityNumber parameter.

Country Customer Social Security Number Argentina For Argentina the CustomerSocialSecurityNumber parameter consists of DNI. For more information about the DNI please click here. Brazil For Brazil the CustomerSocialSecurityNumber parameter consists of CPF/CNPJ. For more information about the CPF/CNPJ please click here. Chile For Chile the CustomerSocialSecurityNumber parameter consists of RUT. For more information about the RUT please click here. Colombia For Colombia the CustomerSocialSecurityNumber parameter consists of CC. For more information about the CC please click here. Mexico For Mexico the CustomerSocialSecurityNumber parameter consists of CURP/RFC/IFE. For more information about the CURP/RFC/IFE please click here. Uruguay For Uruguay the CustomerSocialSecurityNumber parameter consists of CI. For more information about the CI please click here. Peru For Peru the CustomerSocialSecurityNumber parameter consists of DNI. For more information about the DNI please click here. -

The customer enters his name and card details: Card Number, CVC (CSC) and Expiration Date. He finalizes the payment by using the Pay button.

-

Upon completion of the payment flow the customer is redirected back to your ReturnURL.

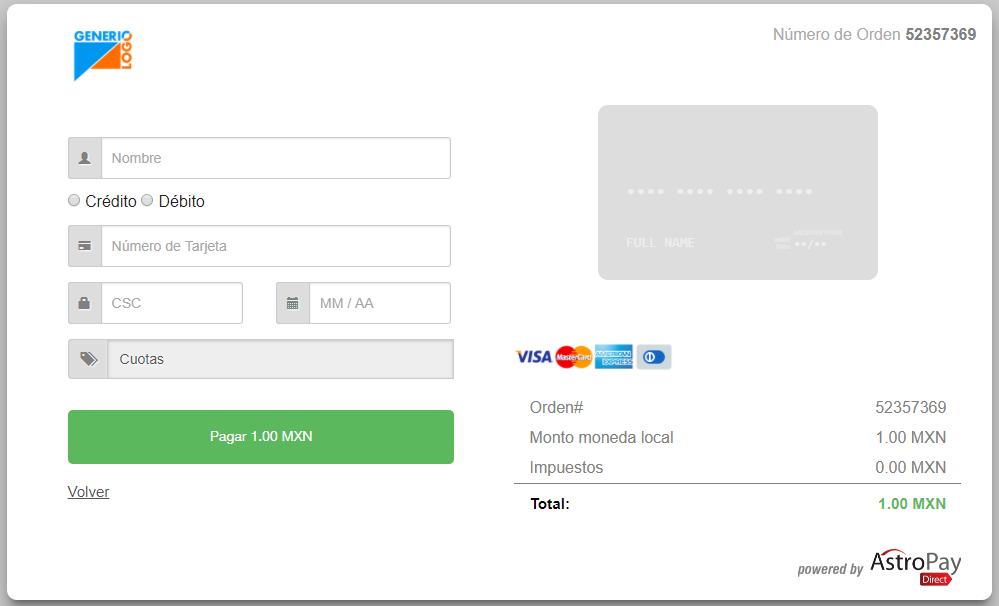

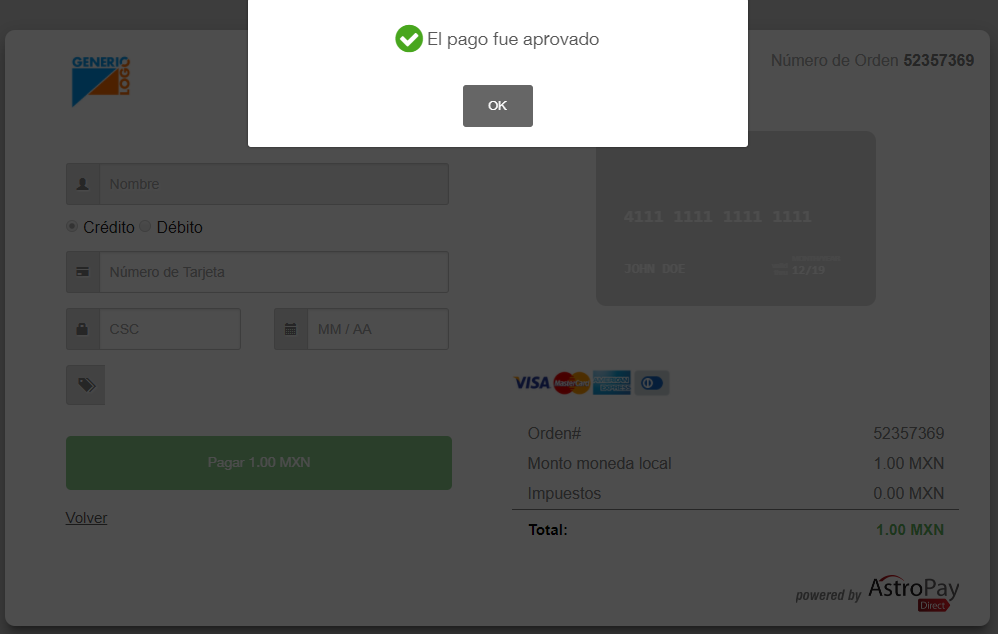

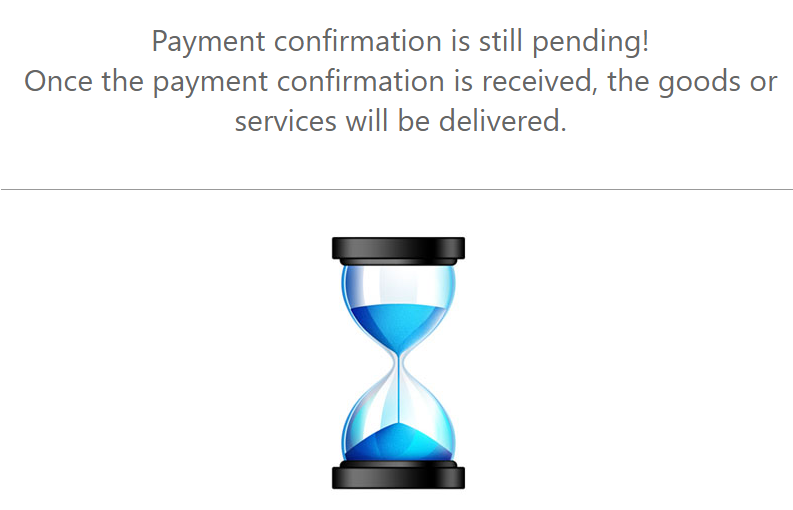

Cards Mexico Test Data

For Cards Mexico payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

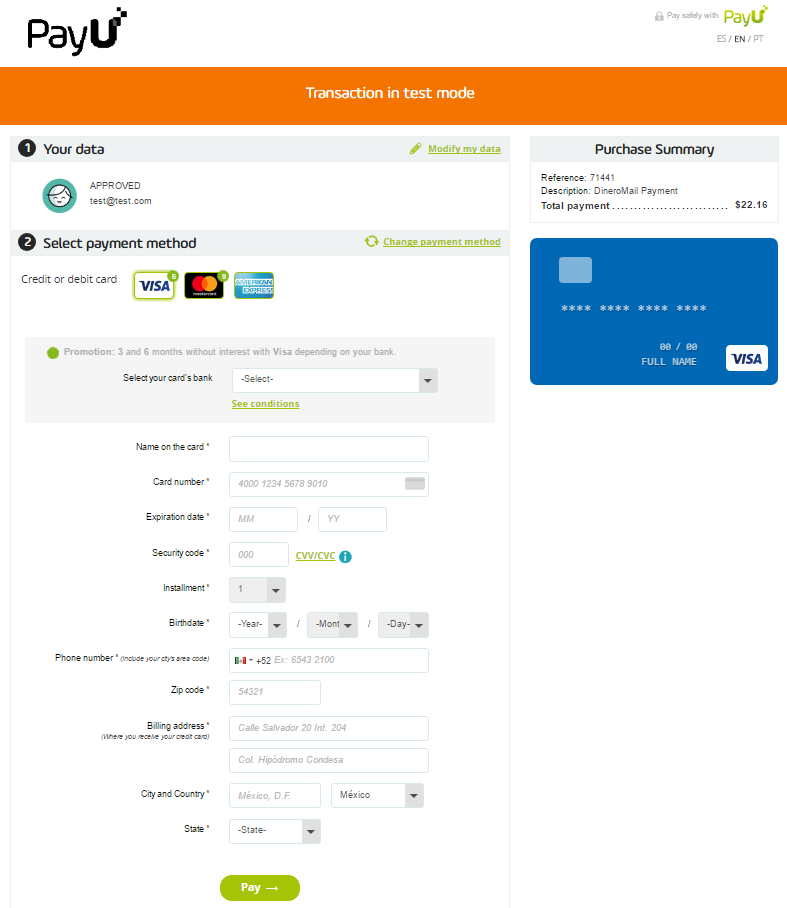

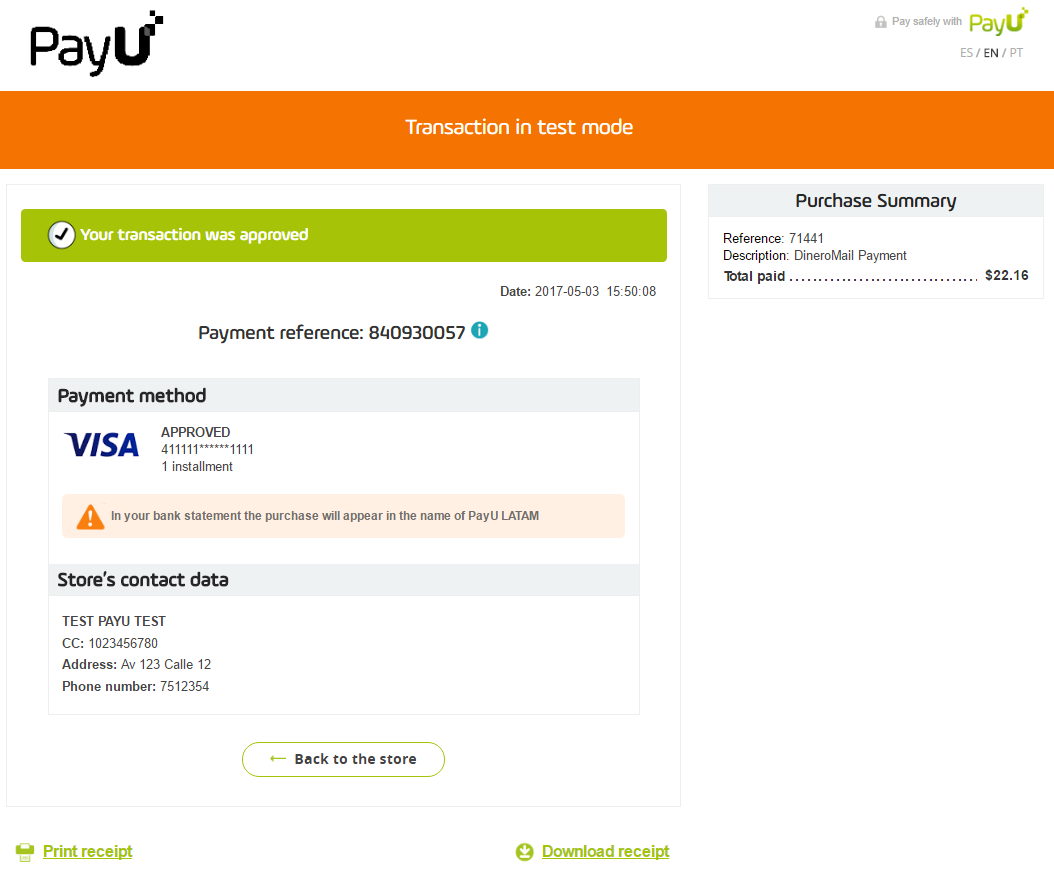

Cards Mexico Payment Flow

-

The customer enters his Email Address, Name and CURP/RFC/IFE. Please note that for Mexico the Customer Social Security Number parameter consists of CURP/RFC/IFE. For more information about the CURP/RFC/IFE please click here.

-

The customer enters his email address, name and card details: Card Number, CVC (CSC) and Expiration Date. He finalizes the payment by using the Pay button.

-

The customer receives a message that the payment has been completed correctly.

-

Upon completion of the payment flow the customer is redirected back to your ReturnURL.

Cards Peru Test Data

For Cards Peru payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

Cards Peru Payment Flow

-

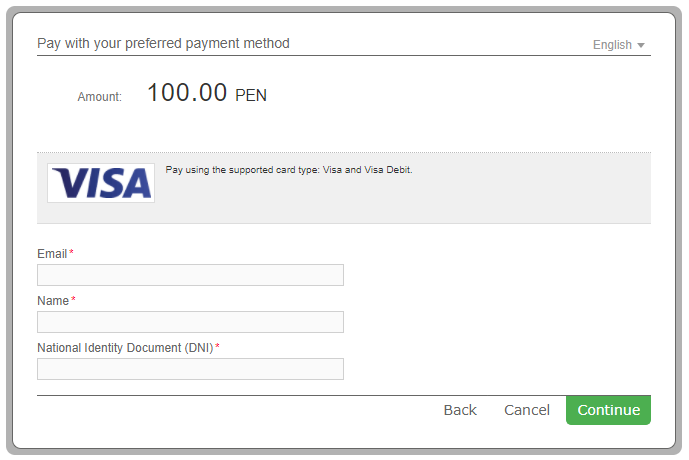

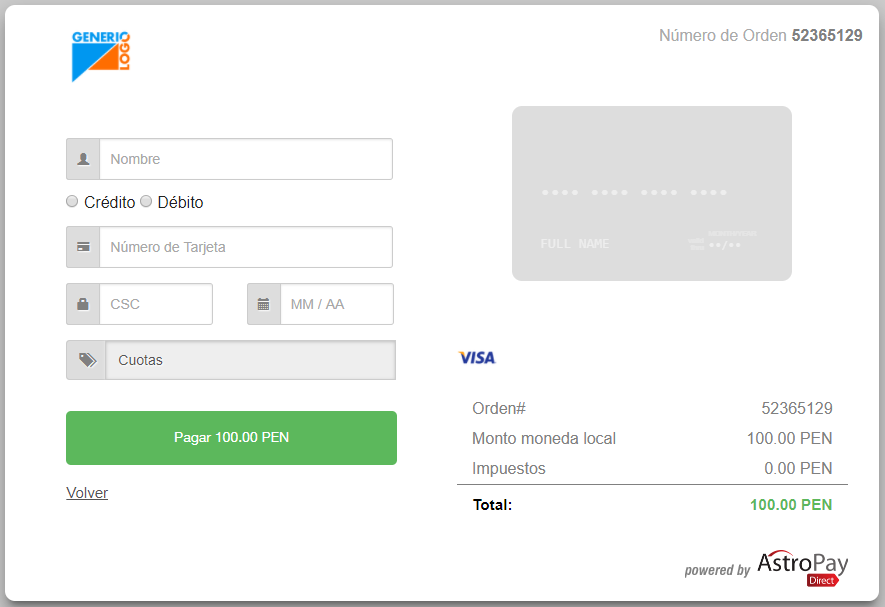

The customer enters his Email Address, Name and DNI. Please note that for Peru the Customer Social Security Number parameter consists of DNI. For more information about the DNI please click here.

-

The customer enters his email address, name and card details: Card Number, CVC (CSC) and Expiration Date. He finalizes the payment by using the Pay button.

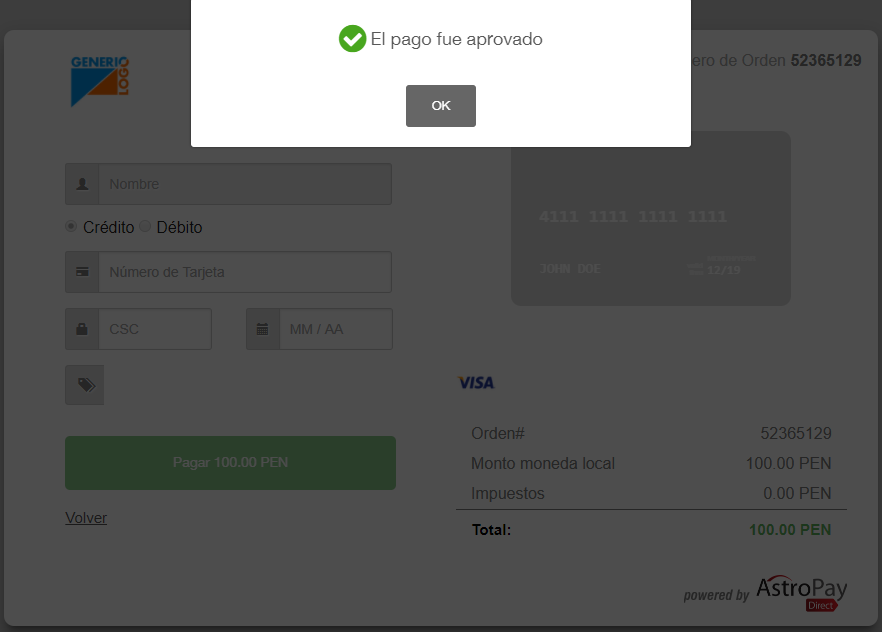

-

The customer receives a message that the payment has been completed correctly.

-

Upon completion of the payment flow the customer is redirected back to your ReturnURL.

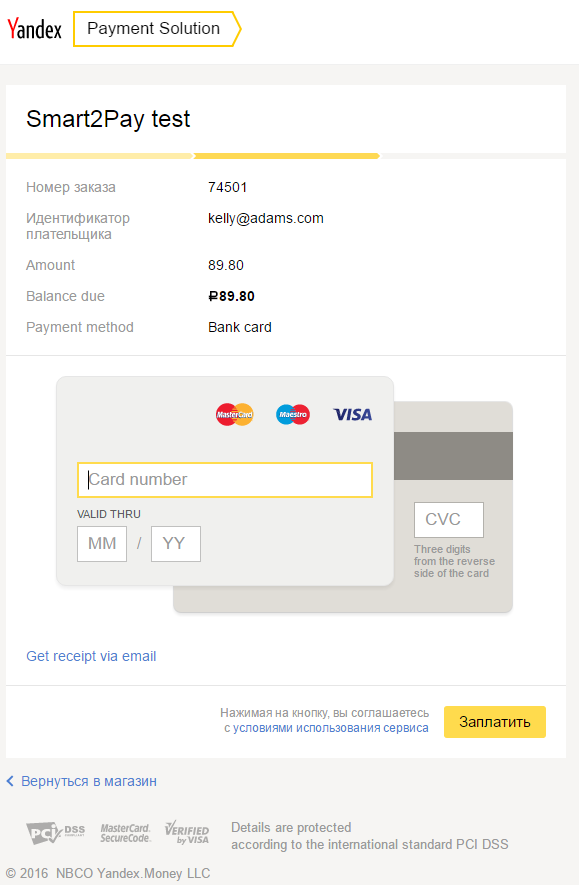

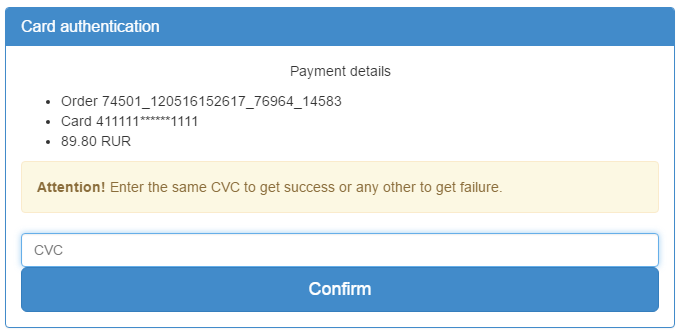

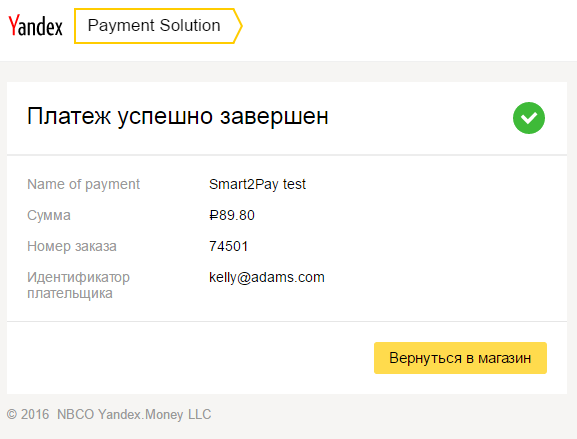

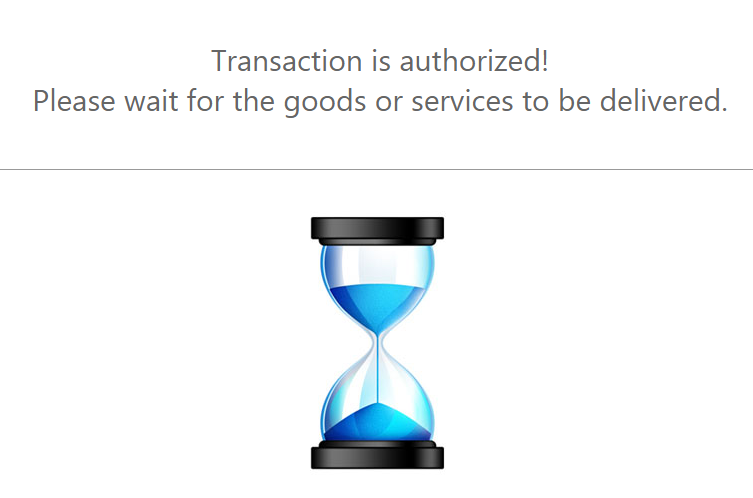

Cards Russia Test Data

For Cards Russia payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

Cards Russia Payment Flow

-

The Customer enters his email address.

-

The customer enters the card details: card number, expiration date and CVC.

-

The customer verifies the payment details, enters the same CVC and confirms the payment.

-

The customer receives the payment confirmation.

-

You will receive a notification with the Authorized status. Meanwhile the customer is redirected to your ReturnURL.

-

The last step of the payment flow is the capture action when the transaction becomes successful. Simply do a blank REST POST – POST /v1/payments/{id}/capture, where the ID is the GlobalPay Payment ID. In the response we will return the new status as being Success.

By default, a deferred payment holds the money for 7 days (this is standard for the Visa and MasterCard payment systems). After this time, the issuing bank can unblock the money at any time.

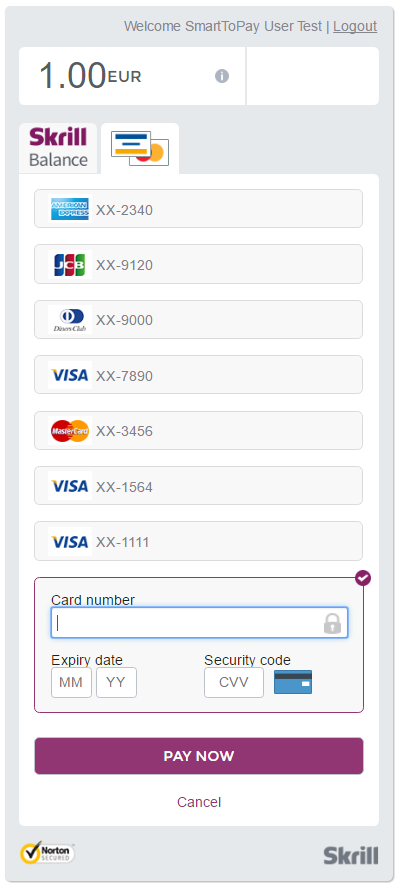

Cards Test Data

In order for you to test Cards payment method successfully, please use the below test data.

| Cards Test Data | ||

|---|---|---|

| Data | Value | |

| Card Number (VISA): | 4111111111111111 | |

| Expiration Date: | Choose a month and a year at least equal than the current month and year | |

| Card CVV/CVC: | Any 3 digit number. Example: 123 | |

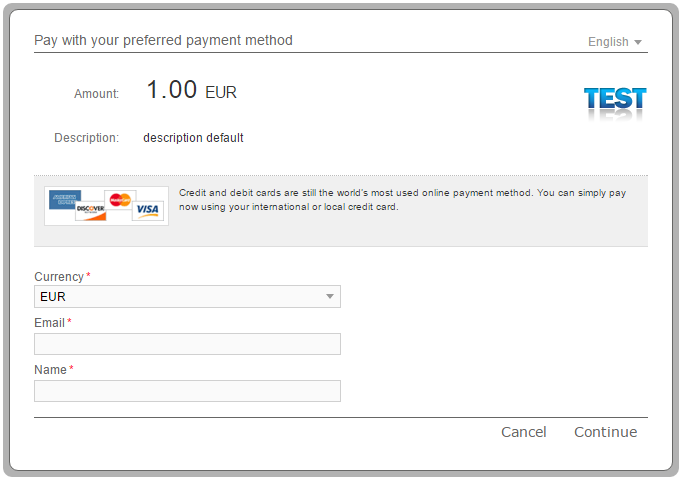

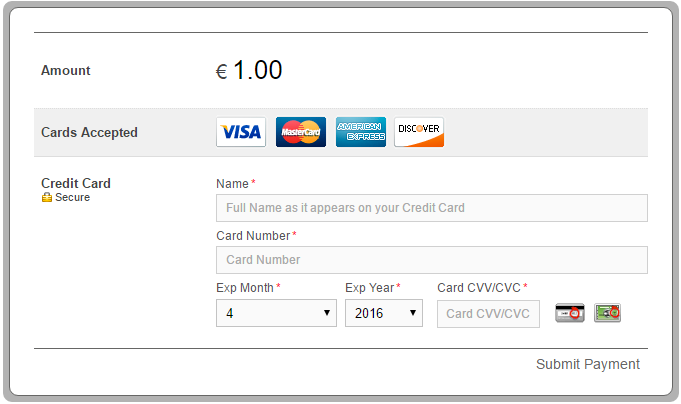

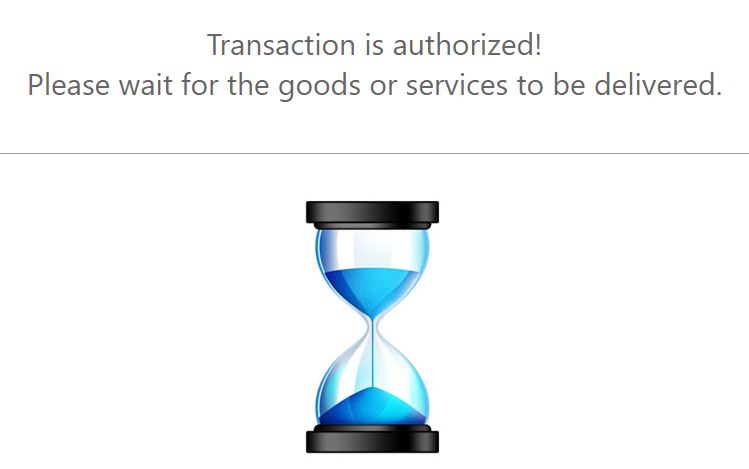

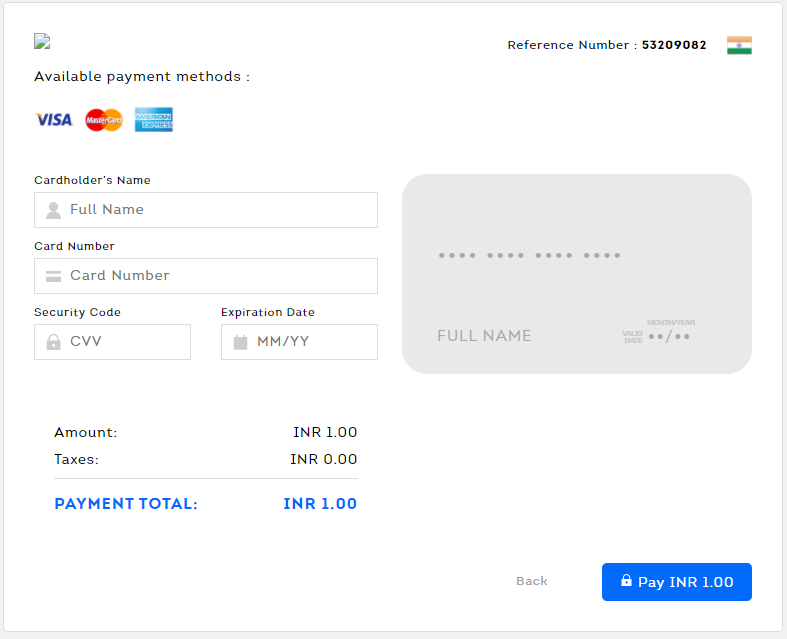

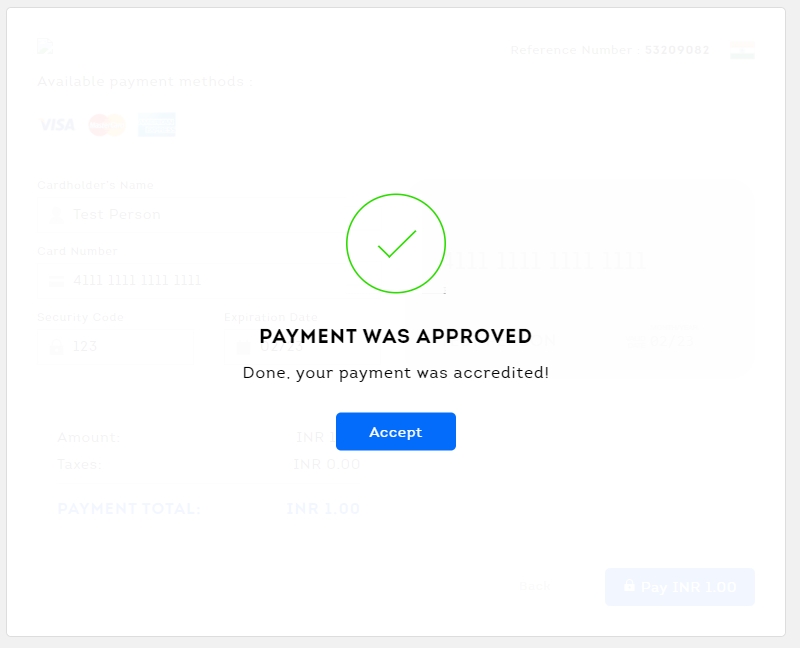

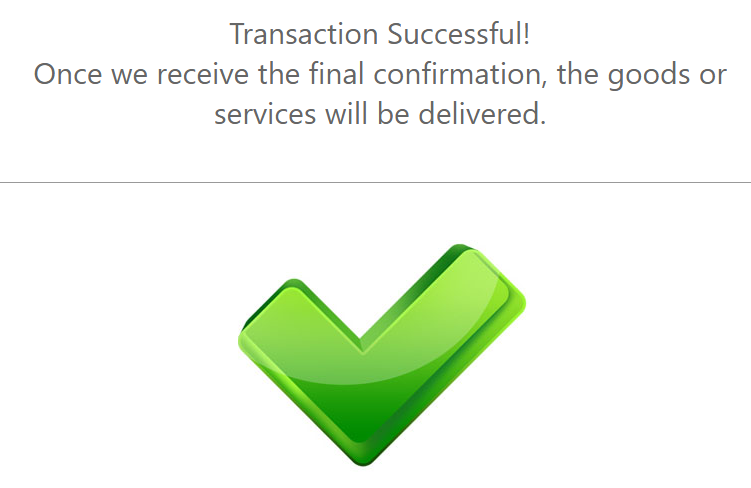

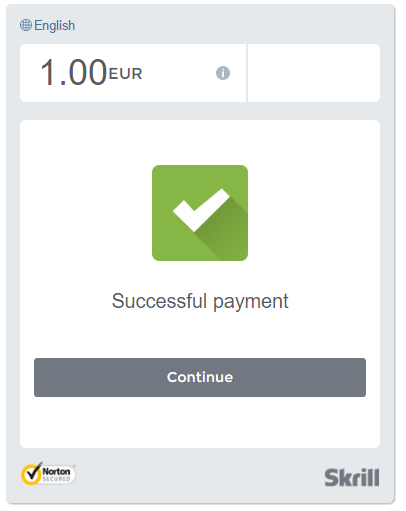

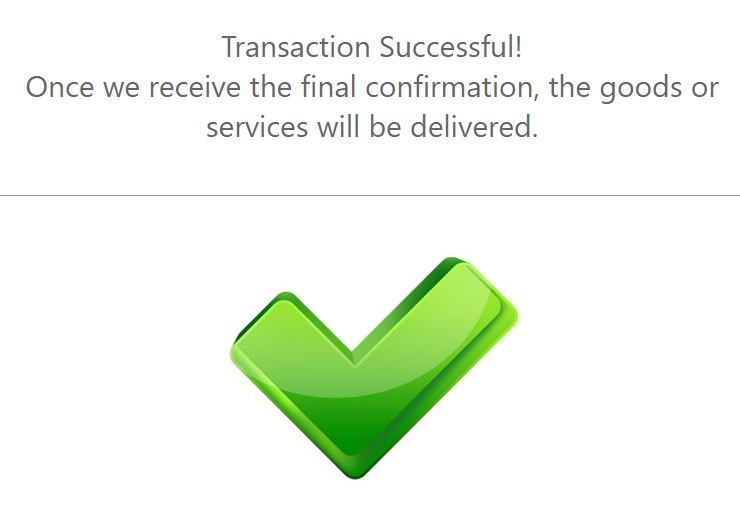

Cards Payment Flow

-

The customer chooses his preferred currency from the list and enters his email address and name.

-

The customer enters the required card details to make the payment, such as name, card number, expiration date and card CVV/CVC.

-

Upon completion of the payment flow, the customer is redirected back to your ReturnURL.

Cards Turkey Test Data

For Cards Turkey payment method test data is available on demand. Please contact our support department at technicalsupport-s2p@nuvei.com for more information.

Cards Turkey Payment Flow

- The customer enters his phone number and his email address.

- The customer receives a 6-digit verification code at the phone number that he previously added. He needs to enter the 6-digit code and click the Confirm button.

- The Customer enters his credit card details and confirms the payment.

- Upon completion of the payment flow, the customer is redirected to your ReturnUrl.

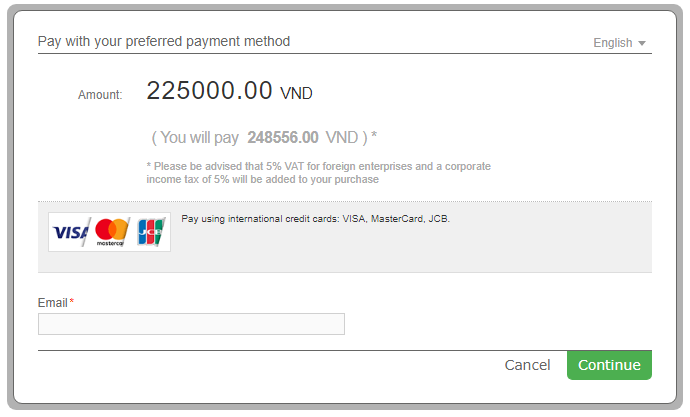

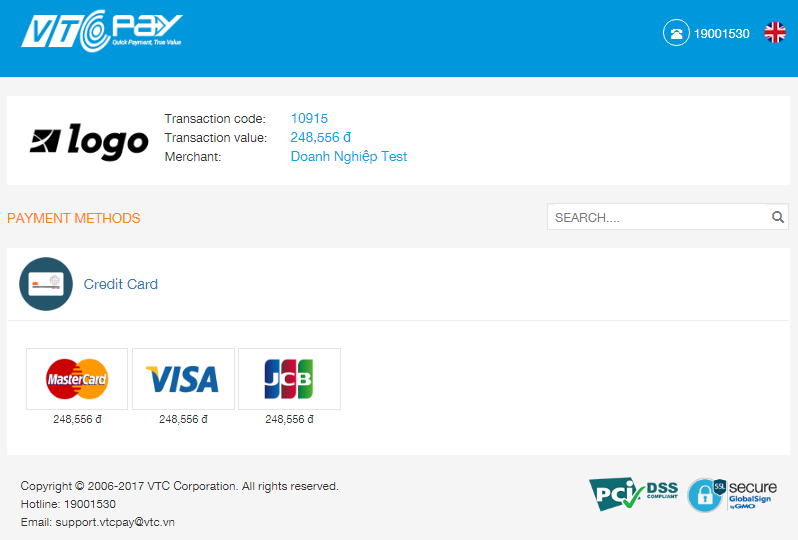

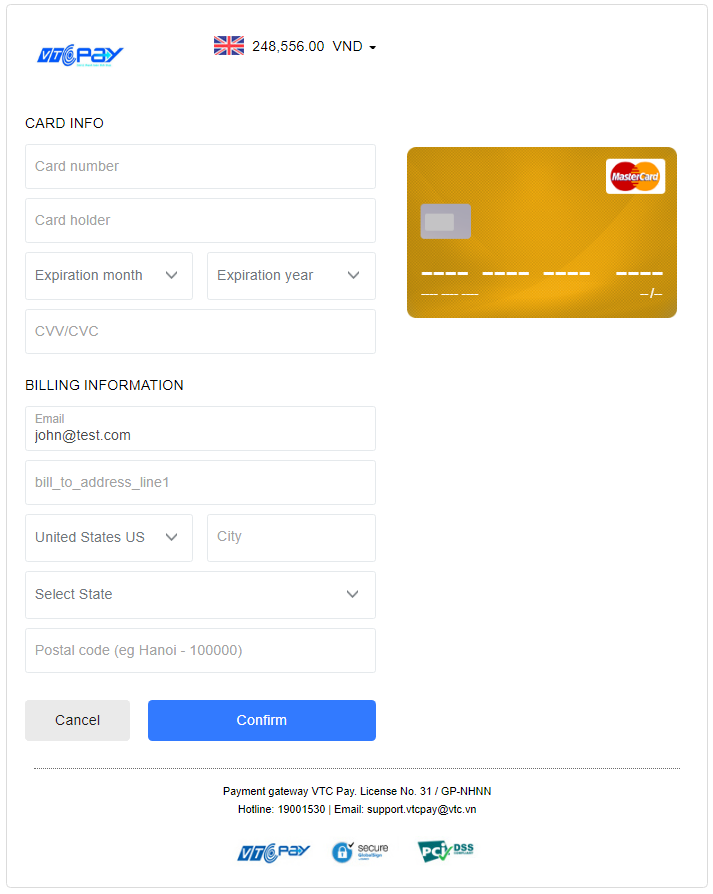

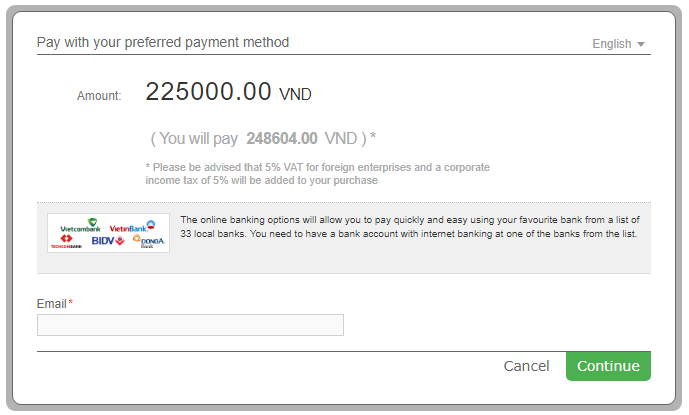

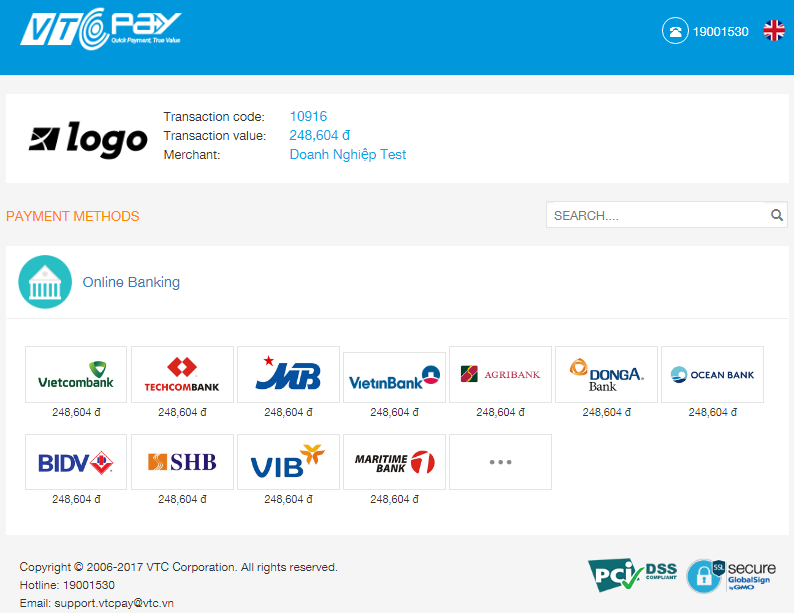

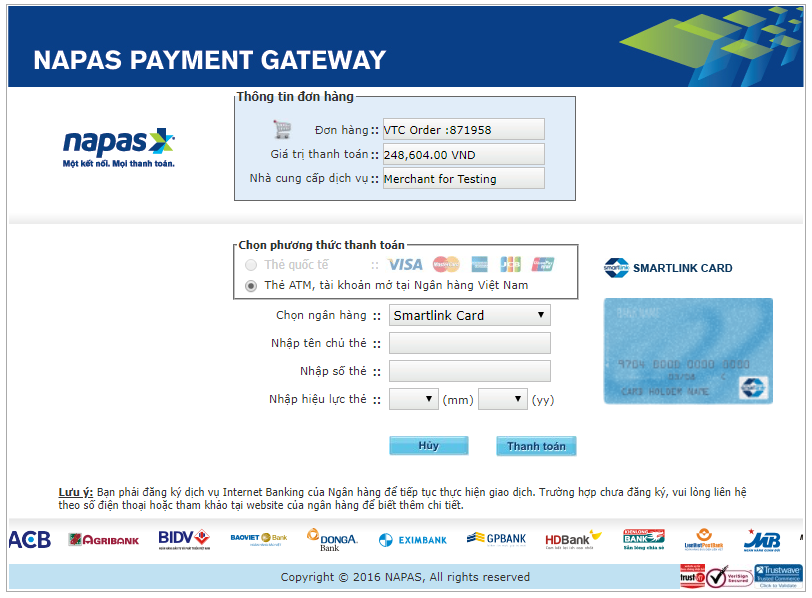

Cards Vietnam Test Data

For Cards Vietnam payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

Cards Vietnam Payment Flow

-

The customer enters his Email Address (the below page can be skipped by sending the parameter in the payment request).

-

The customer has to choose his preferred payment option from the given list.

-

The customer needs to enter the necessary credit card information and billing information. Then he needs to confirm the payment.

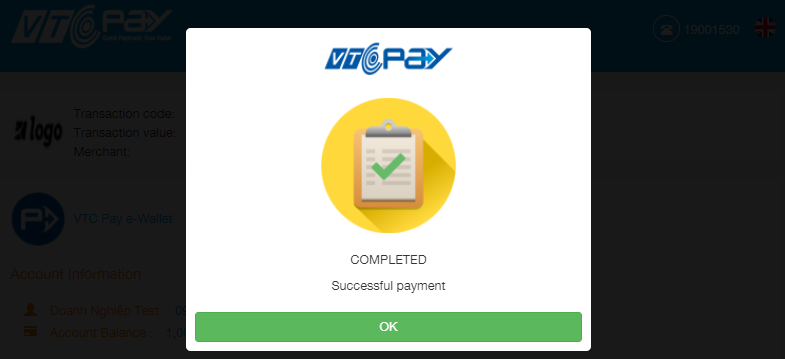

-

The customer receives a message that the payment was successfully processed.

-

Upon completion of the payment flow, the customer is redirected back to your ReturnURL.

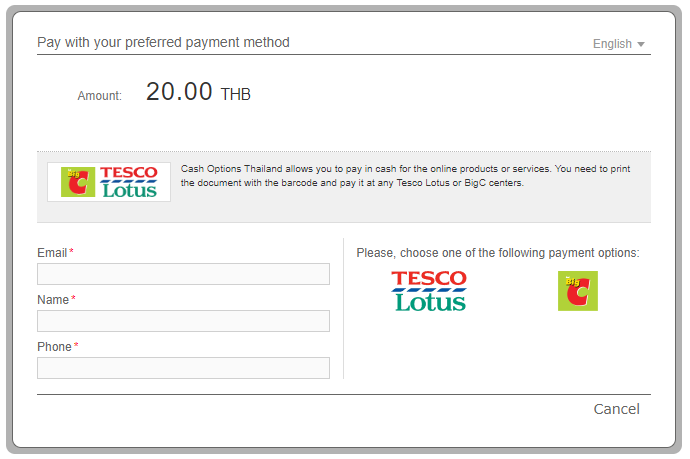

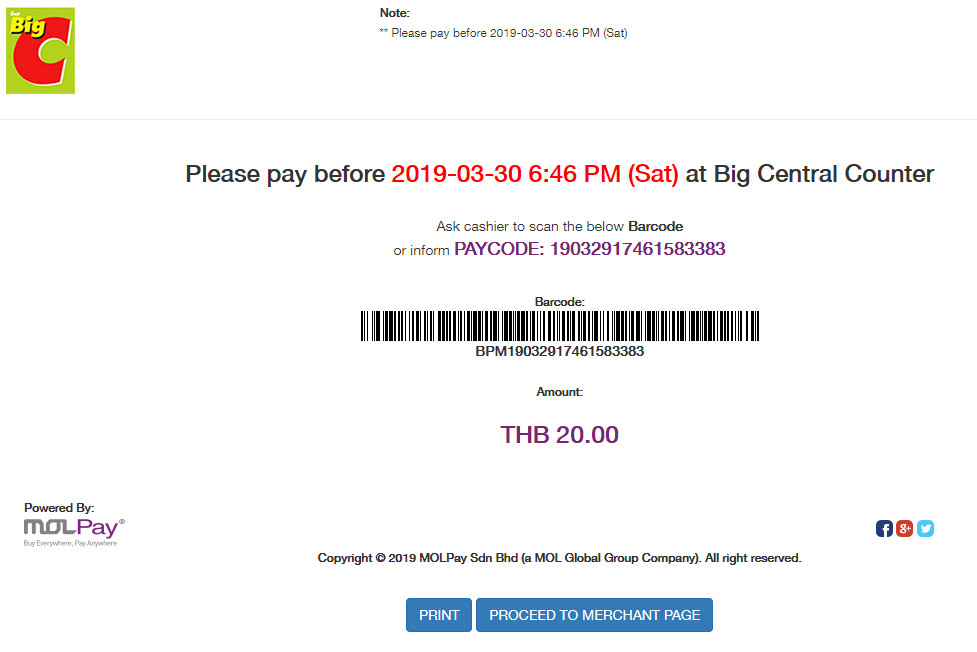

Cash Option Thailand Test Data

For Cash Option Thailand payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

Cash Option Thailand Payment Flow

-

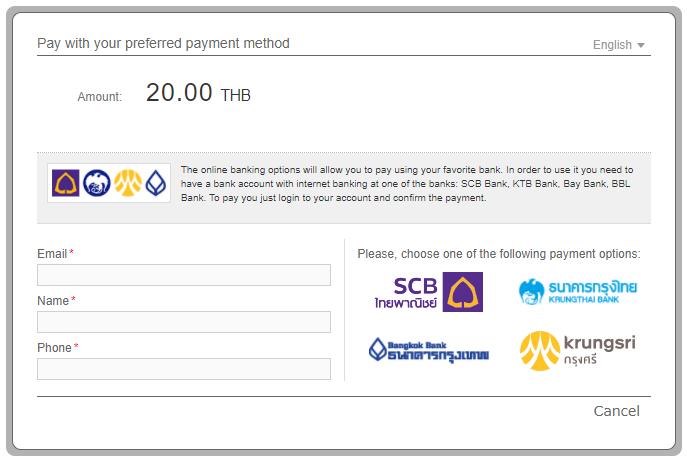

The customer enters his Email Address, Name and Phone Number, and chooses his preferred payment option from the given list.

-

The customer receives the printable payment details and the payment instructions. He needs to print the voucher and present it to the cashier at any Big Central Counter branch.

-

Upon completion of the payment flow the customer is redirected back to your ReturnURL.

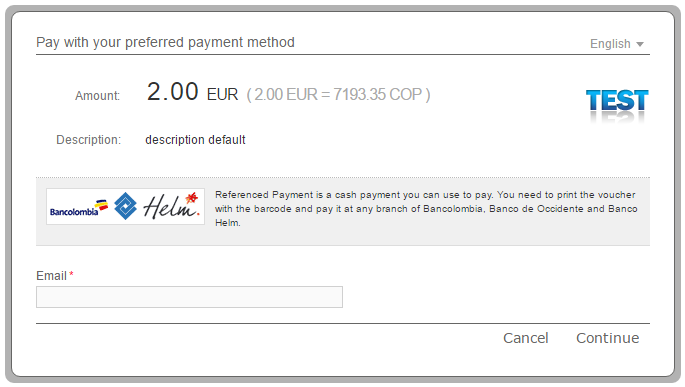

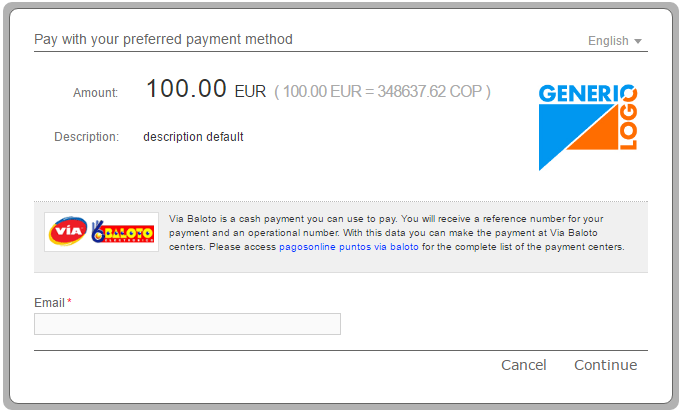

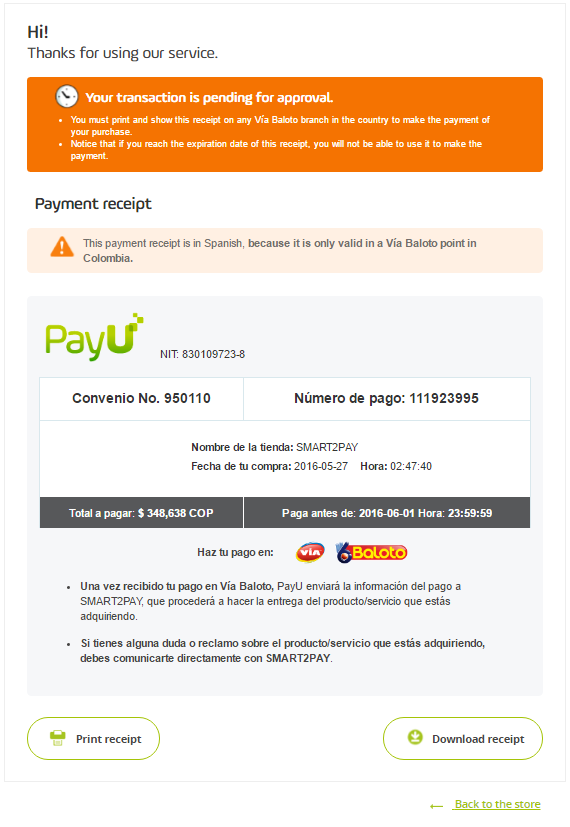

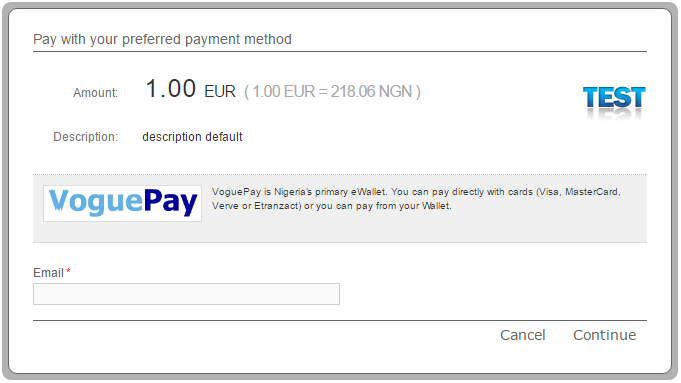

Cash Payment Colombia Test Data

For Cash Payment Colombia payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

Cash Payment Colombia Payment Flow

-

The customer enters his Email Address, Name and CC, and chooses his preferred payment option from the given list. Please note that for Colombia the CustomerSocialSecurityNumber parameter consists of CC. For more information about the CC please click here.

-

The customer sees the payment summary and chooses the payment option.

-

The customer needs to enter the necessary details in order to complete the transaction.

-

The customer receives the voucher number and payment details. He needs to pay the exact amount at any Efecty, Davivienda, Baloto, Boleto Bancolombia branch.

-

Upon completion of the payment flow the customer is redirected back to your ReturnURL.

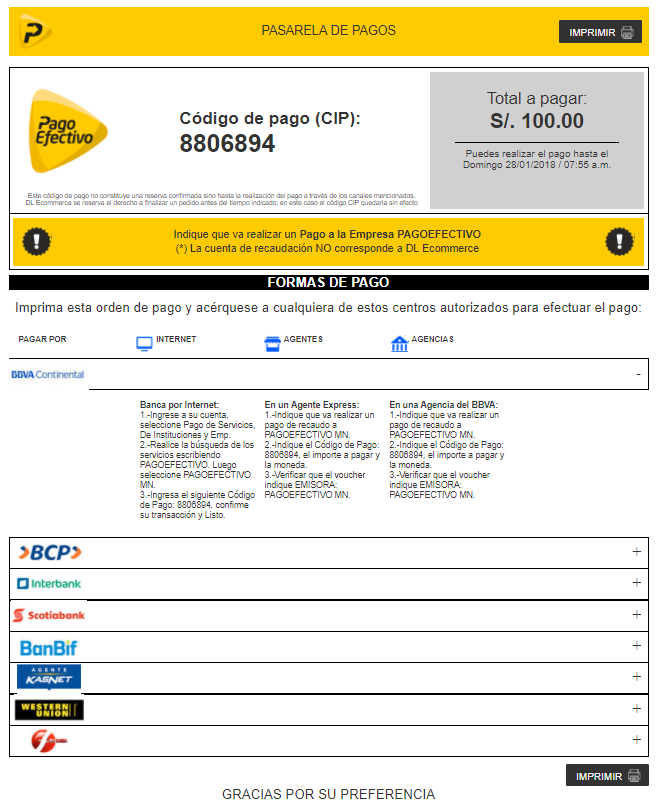

Cash Payment Peru Test Data

For Cash Payment Peru payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

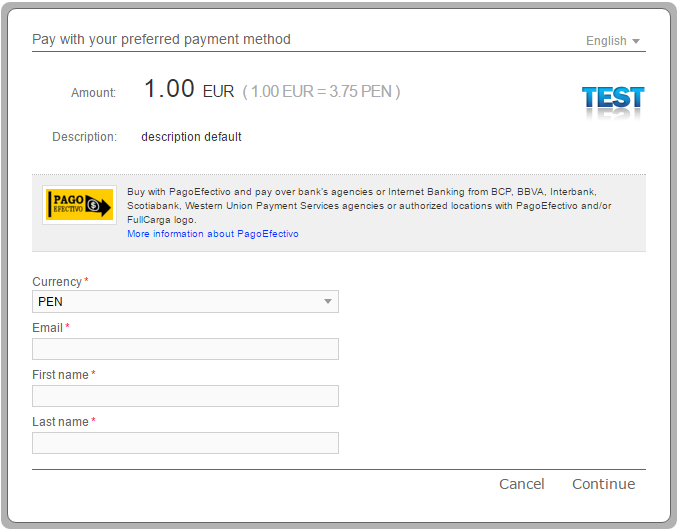

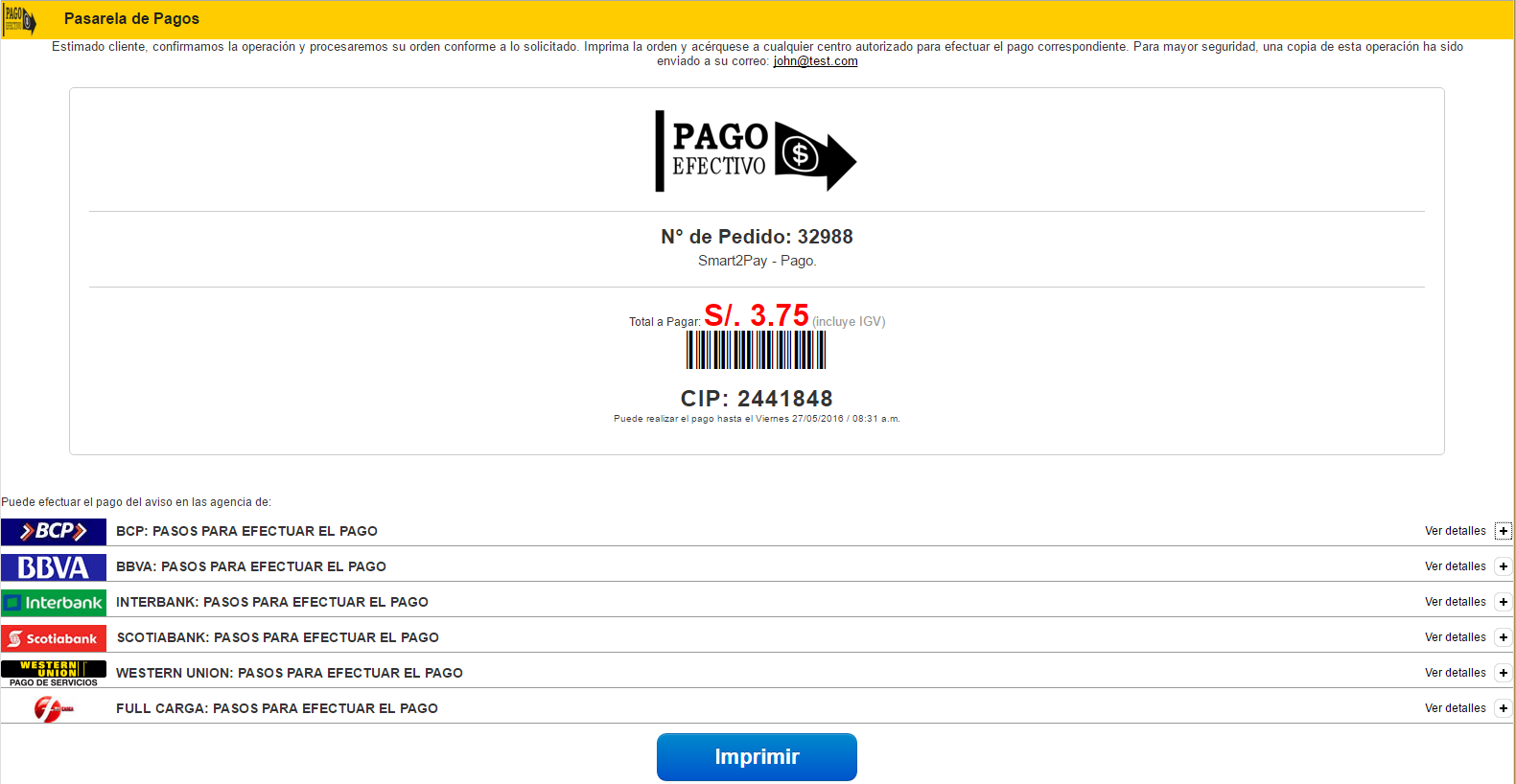

Cash Payment Peru Payment Flow

-

The customer enters his Email Address, Name and DNI.

Please note that for Peru the Customer Social Security Number parameter consists of DNI. For more information about the DNI please click here. -

The customer receives the printable payment details in order to complete the payment.

-

Upon completion of the payment flow the customer is redirected back to your ReturnURL.

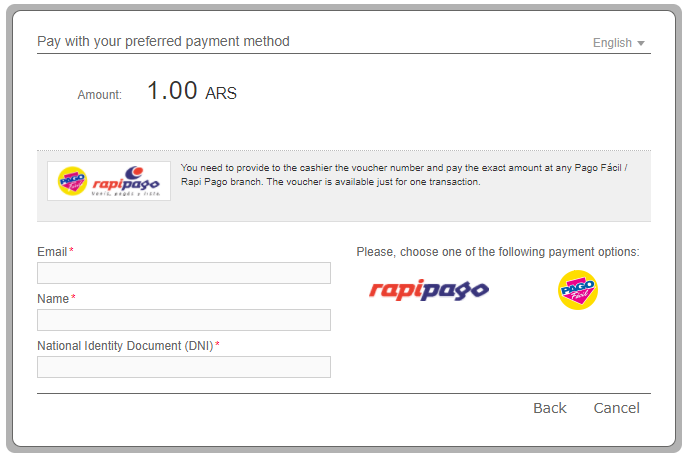

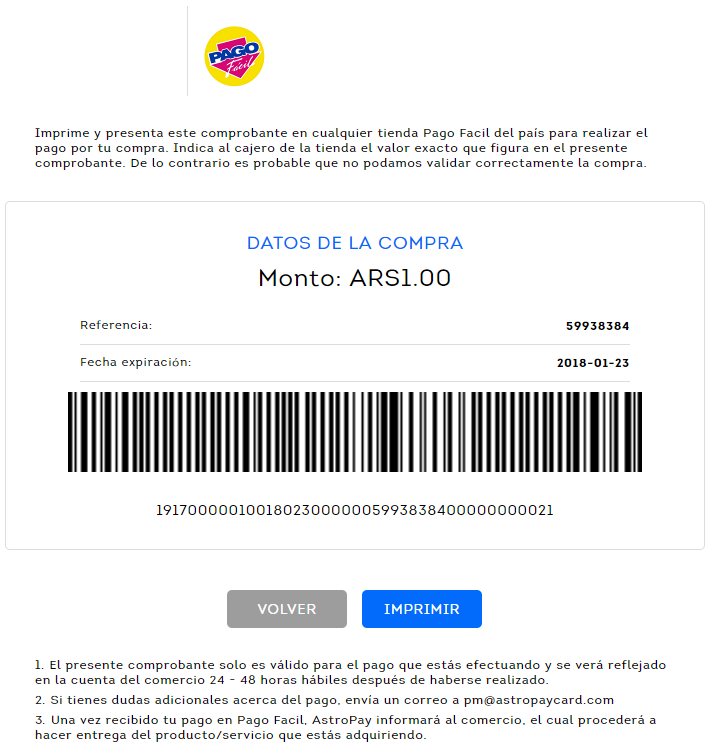

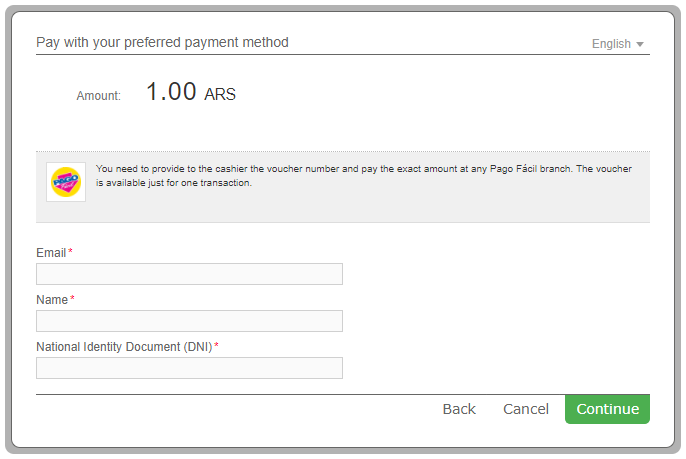

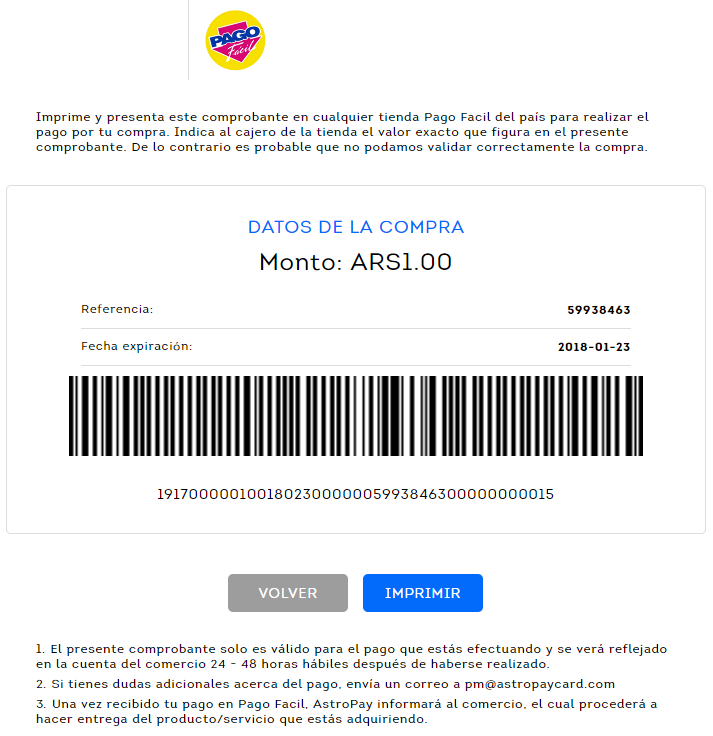

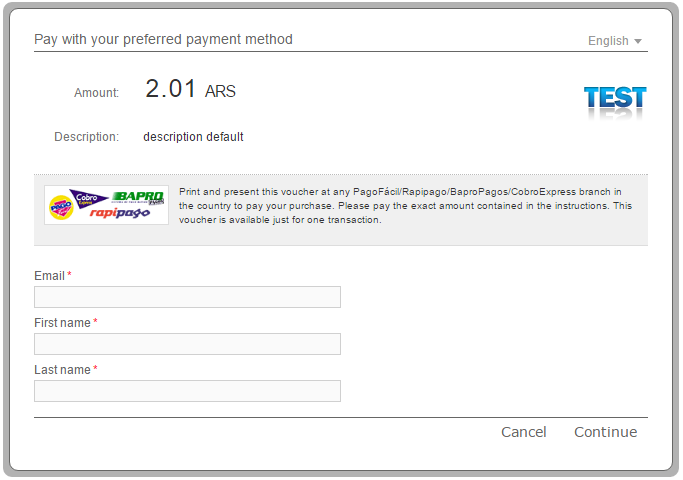

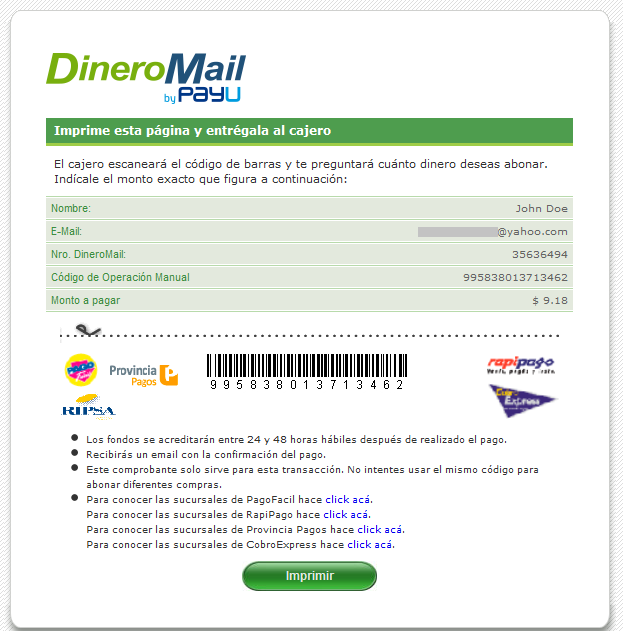

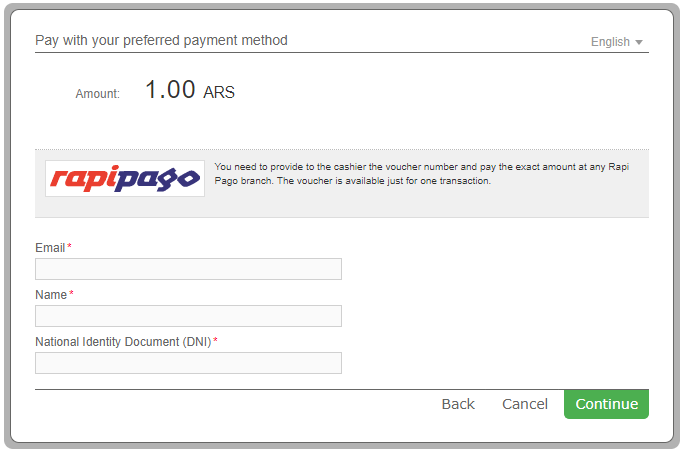

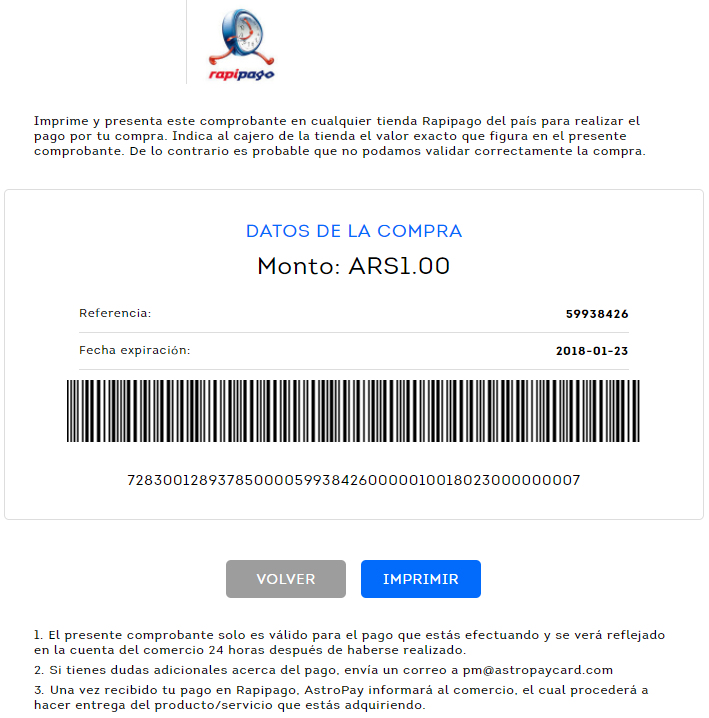

Cash Payments Argentina Test Data

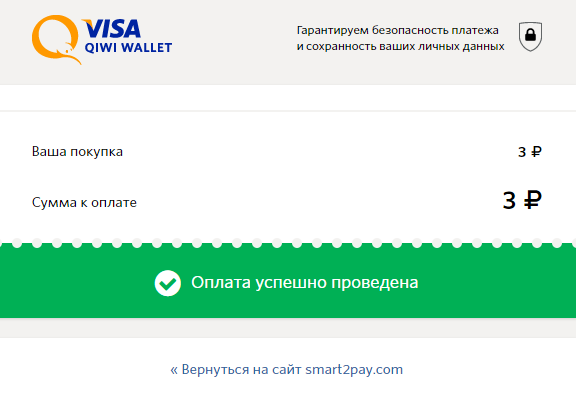

For Cash Payments Argentina payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

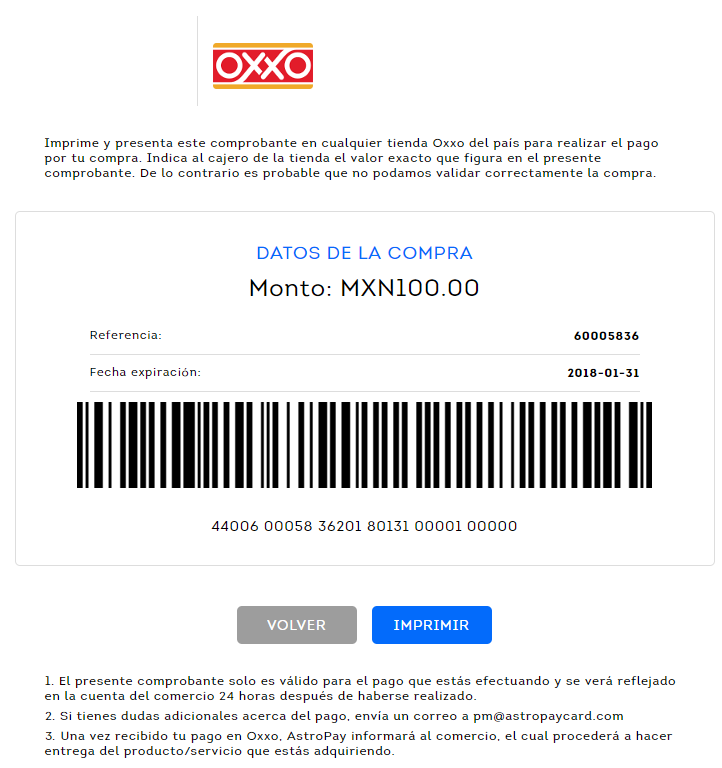

Cash Payments Argentina Payment Flow

-

The customer enters his Email Address, Name and National Identity Document (DNI), and chooses his preferred payment option from the given list. Please note that for Argentina the Customer Social Security Number parameter consists of DNI. For more information about the DNI please click here.

-

The customer receives the printable voucher. In order to complete the payment, he needs to print the voucher and present it to any Rapi Pago or Pago Fácil store in his area to make the payment.

-

Upon completion of the payment flow the customer is redirected back to your ReturnURL.

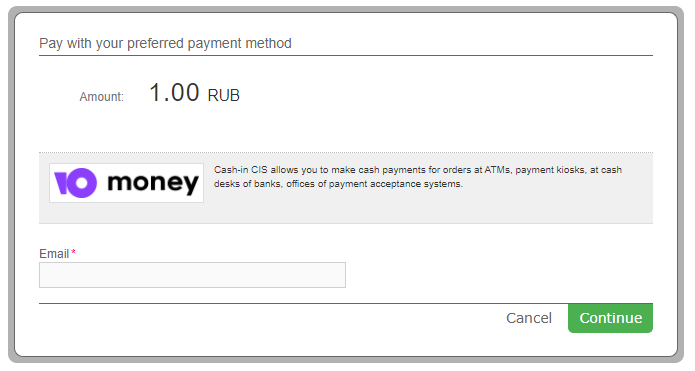

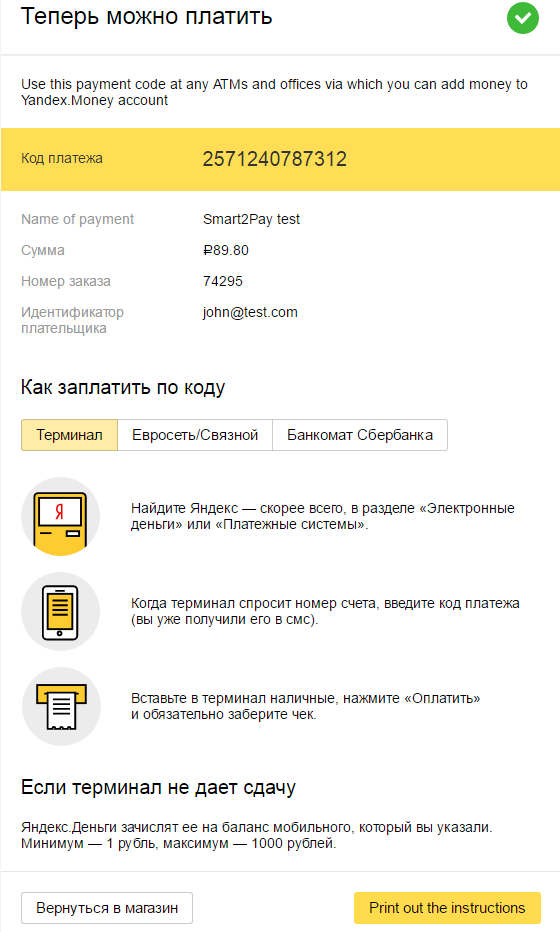

Cash-in CIS Test Data

For Cash-in CIS payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

Cash-in CISPayment Flow

-

The Customer enters his email address.

-

The Customer receives the payment details and the order number with which he can complete the payment at any ATM or office and clicks Pay in order to complete the transaction.

- Upon completion of the payment flow, the customer is redirected to your ReturnUrl.

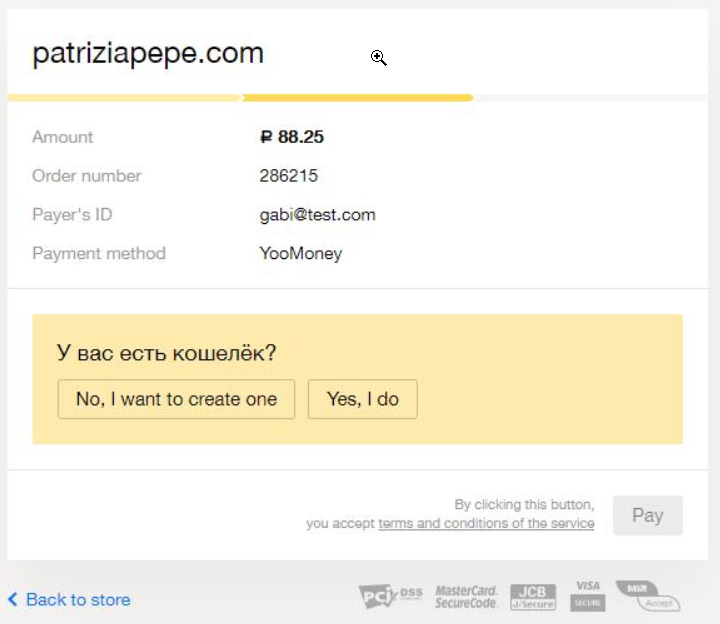

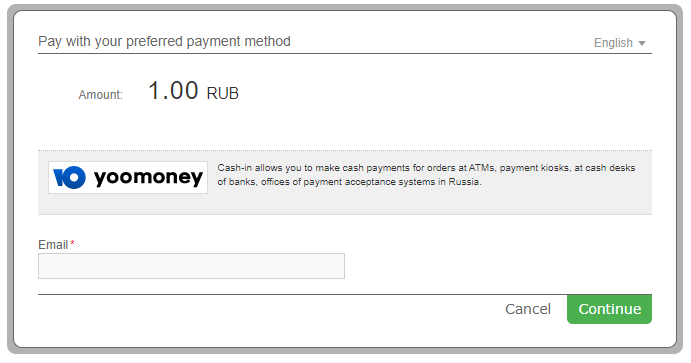

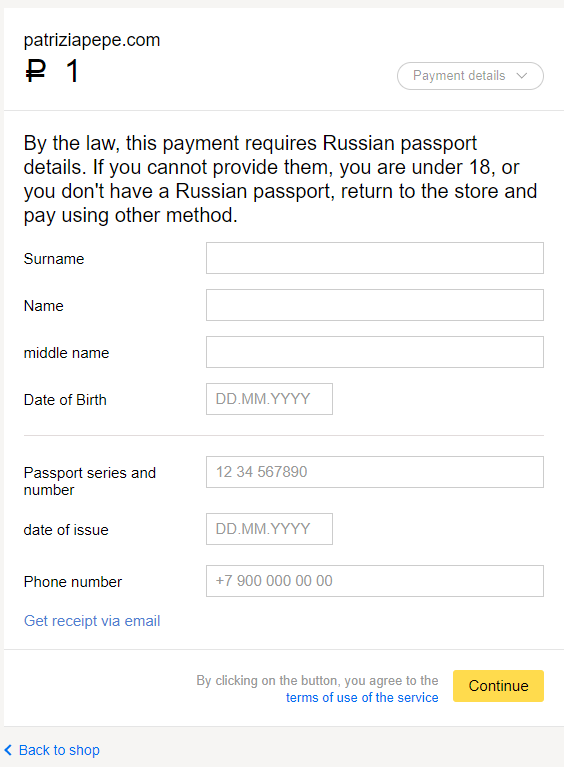

Cash-in Test Data

For Cash-in payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

Cash-in Payment Flow

-

The Customer enters his email address.

-

The customer needs to enter the details of his Russian passport in order to continue the payment.

-

The Customer receives the payment code with which he can complete the payment at any ATM or office. He also has the possibility to print the payment instructions.

- Upon completion of the payment flow, the customer is redirected to your ReturnUrl.

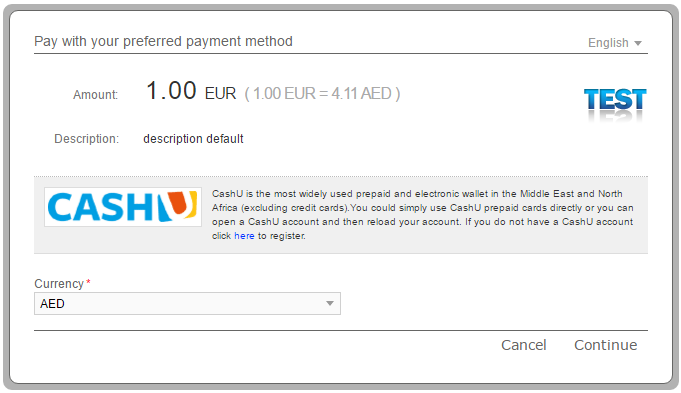

CashU Test Data

In order for you to test CashU payment method successfully, please use the below test data.

| CashU Test Data | ||

|---|---|---|

| Data | Value | |

| Account ID: | JwLqCa621762953@cashUcard.com | |

| Password: | 67l6Yoyied115 | |

For test purposes, please initiate payments using only small amounts.

CashU Payment Flow

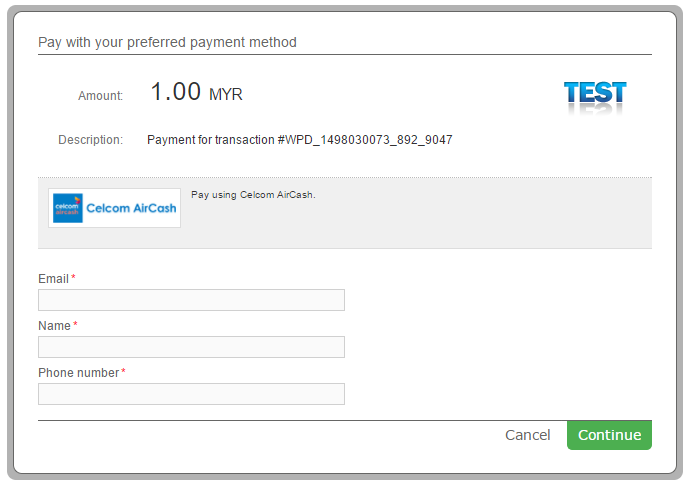

Celcom AirCash Test Data

For Celcom AirCash payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

Celcom AirCash Payment Flow

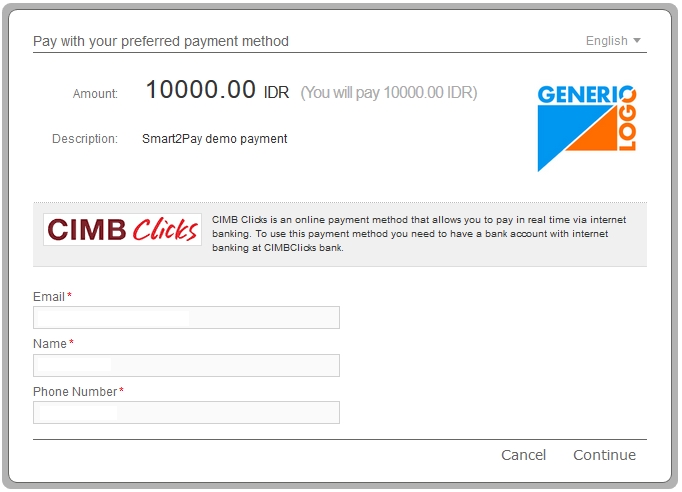

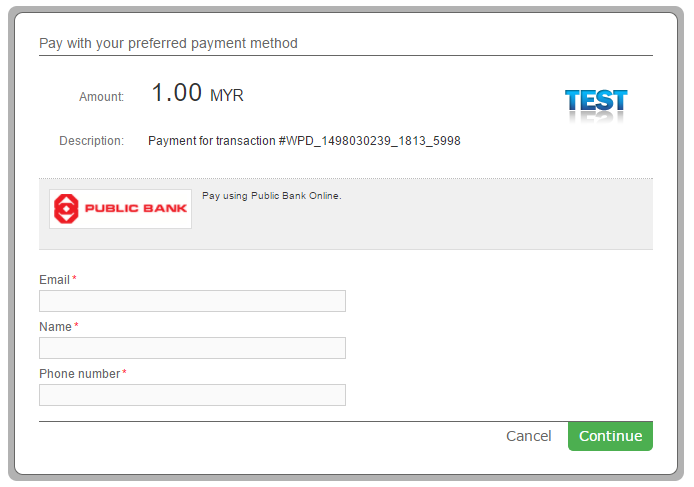

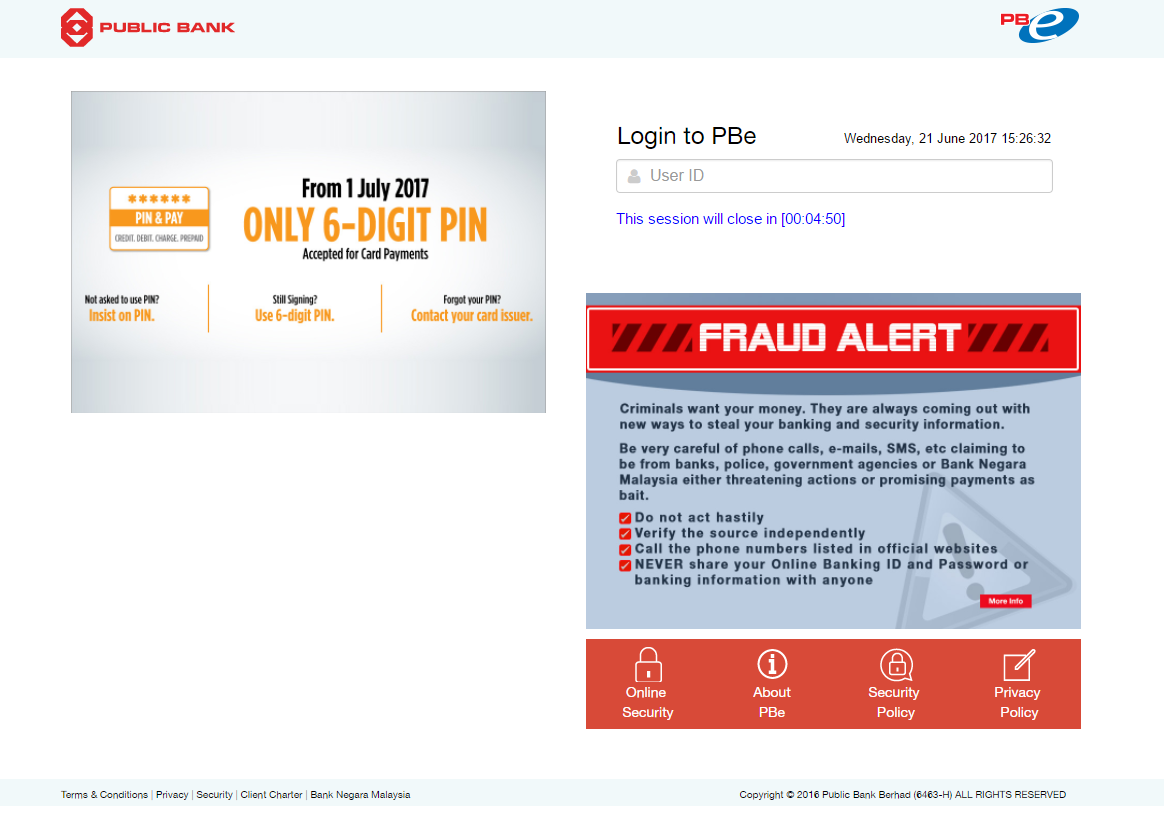

CIMB Clicks Test Data

For CIMB Clicks payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

CIMB Clicks Payment Flow

-

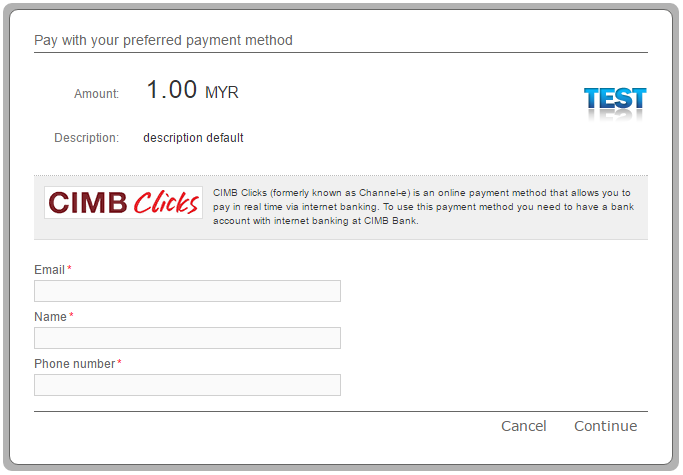

The customer enters his email address, name and phone number.

-

The customer is shown the details of his payment and proceeds to pay with CIMB Clicks.

-

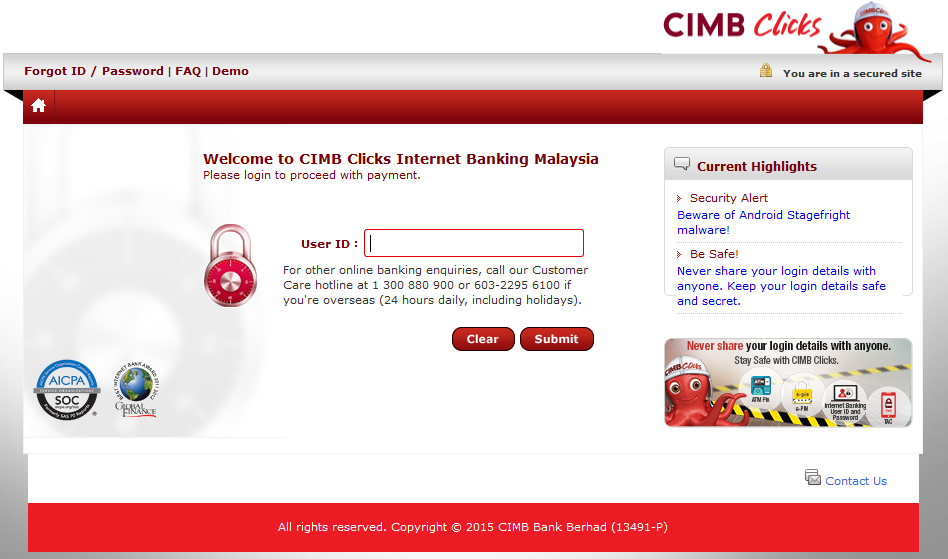

The customer logs in to his account by entering his User ID and completes the payment.

-

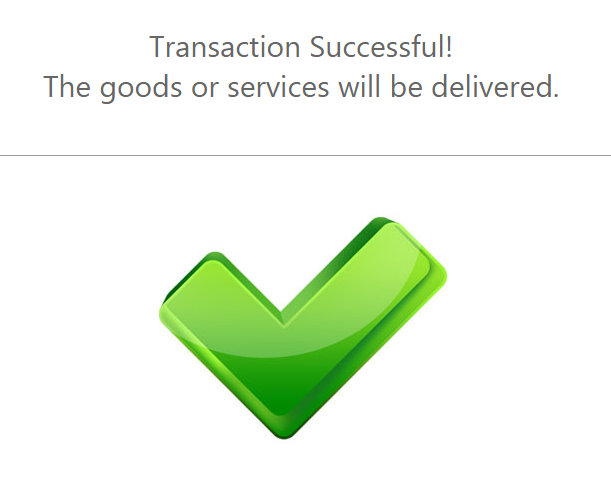

Upon completion of the payment flow, the customer is redirected back to your ReturnURL.

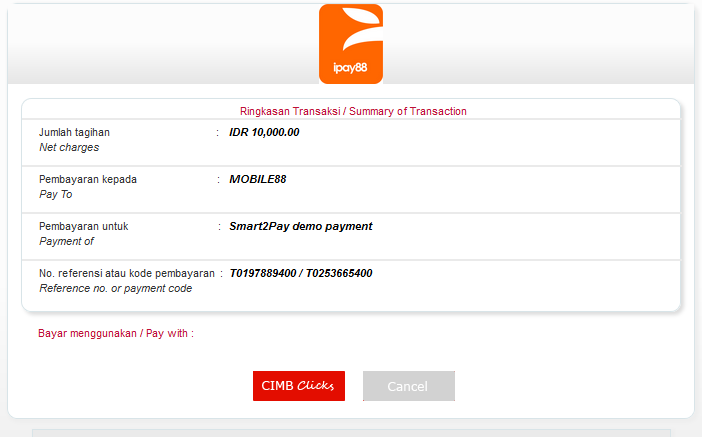

CIMB Clicks Test Data

For CIMB Clicks payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

CIMB Clicks Payment Flow

-

The customer enters his email address, name and phone number.

-

The customer receives the details of the payment and proceeds to pay with CIMB Clicks.

-

The customer logs in to his account by entering his User ID and makes the payment.

-

Upon completion of the payment flow, the customer is redirected back to your ReturnURL.

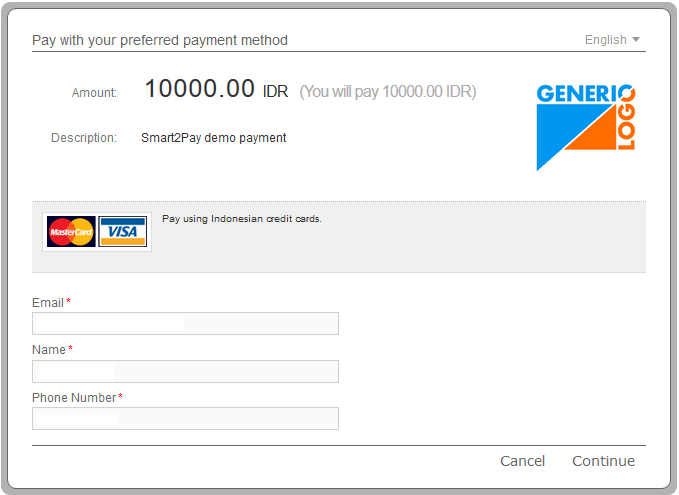

Credit Card Test Data

For Credit Card (Indonesia) payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

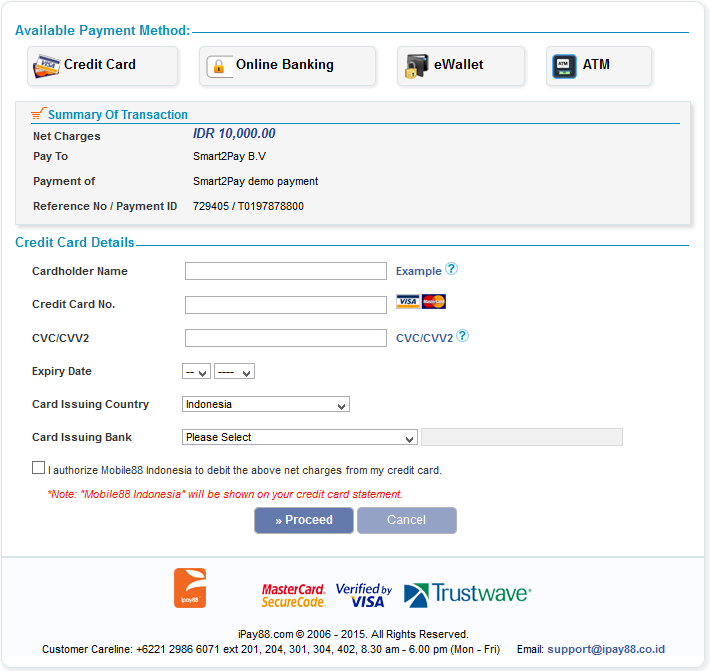

Credit Card Payment Flow

-

The customer enters his email address, name and phone number.

-

The customer enters his card details (Cardholder Name, Credit card No, CVC/CVV2, Expiry Date, Card Issuing Country, Card Issuing Bank) and finalizes the payment.

-

Upon completion of the payment flow, the customer is redirected back to your ReturnURL.

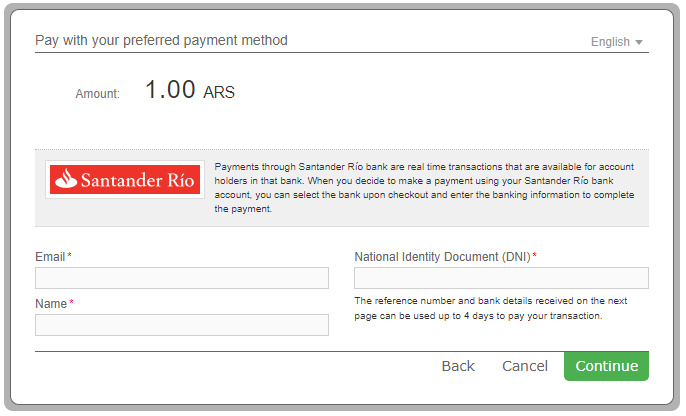

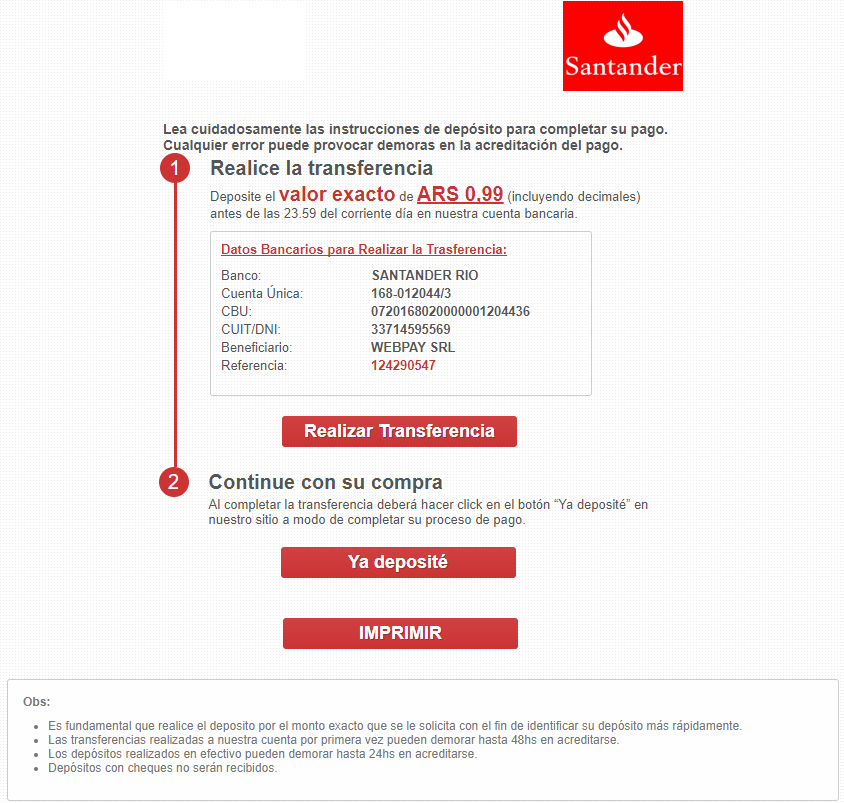

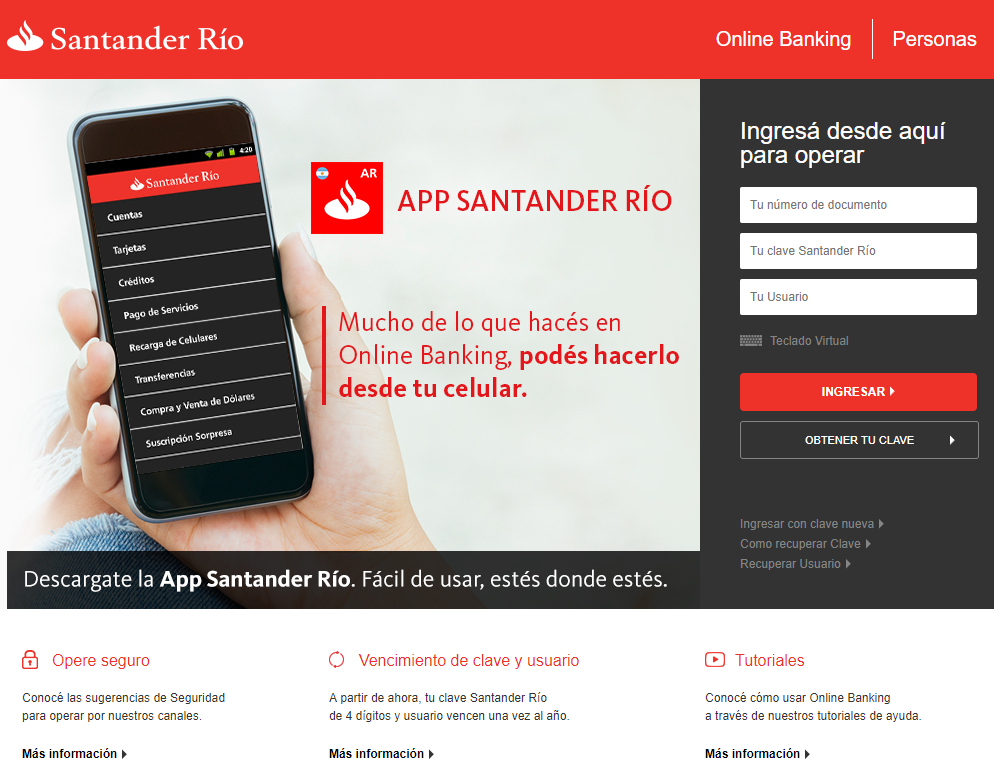

Credit Cards Argentina Test Data

For Credit Cards Argentina payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

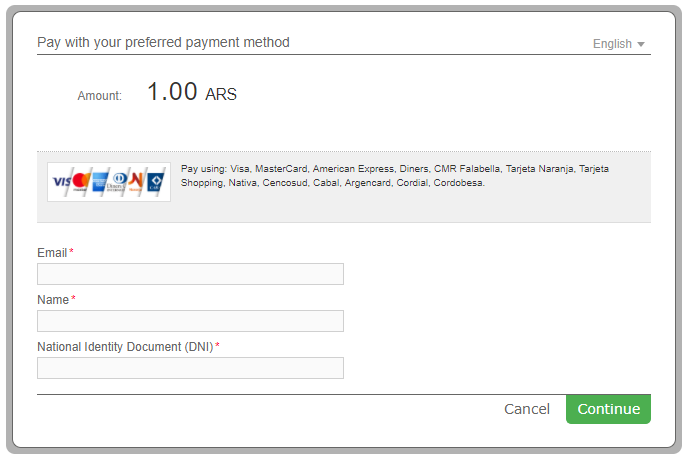

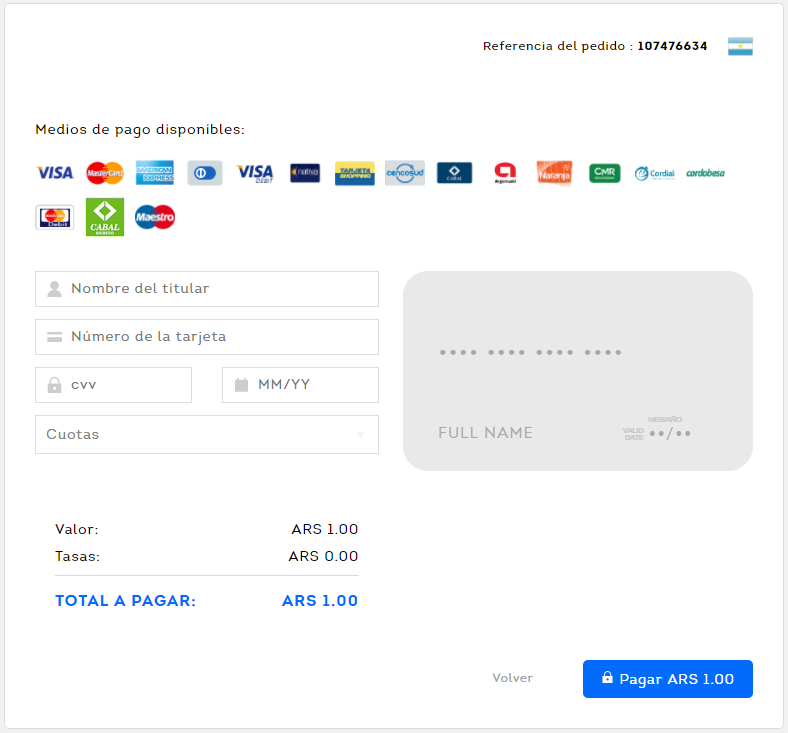

Credit Cards Argentina Payment Flow

-

The customer enters his Email Address, Name and National Identity Document (DNI).

Please note that for Argentina the Customer Social Security Number parameter consists of National Identity Document (DNI)! For more information about the DNI please click here. -

The customer enters his name and card details: Card Number, CVC (CSC) and Expiration Date, and finalizes the payment by using the Pay button.

-

Upon completion of the payment flow the customer is redirected back to your ReturnURL.

Credit Cards Brazil Test Data

For Credit Cards Brazil payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

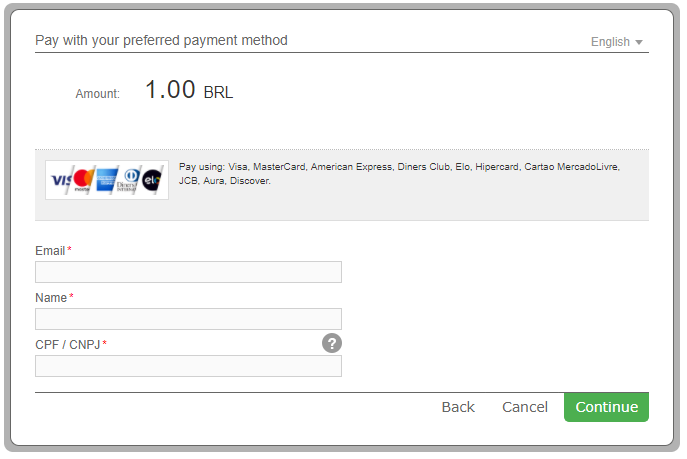

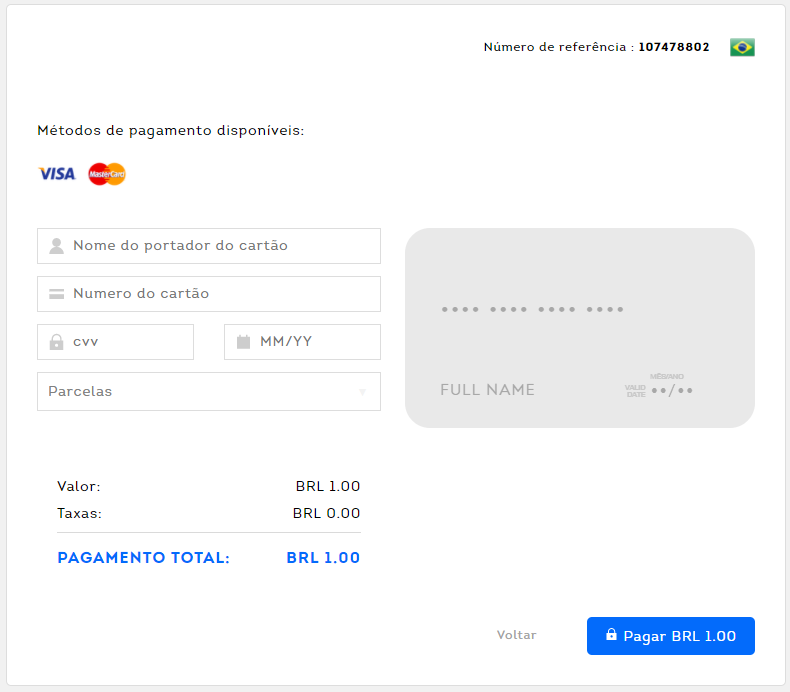

Credit Cards Brazil Payment Flow

-

The customer enters his Email Address, Name and CPF / CNPJ.

Please note that for Brazil the Customer Social Security Number parameter consists of CPF / CNPJ. For more information about the CPF / CNPJ please click here. -

The customer enters his name and card details: Card Number, CVC (CSC) and Expiration Date. He finalizes the payment by using the Pay button.

-

Upon completion of the payment flow the customer is redirected back to your ReturnURL.

Credit Cards Chile Test Data

For Credit Cards Chile payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

Credit Cards Chile Payment Flow

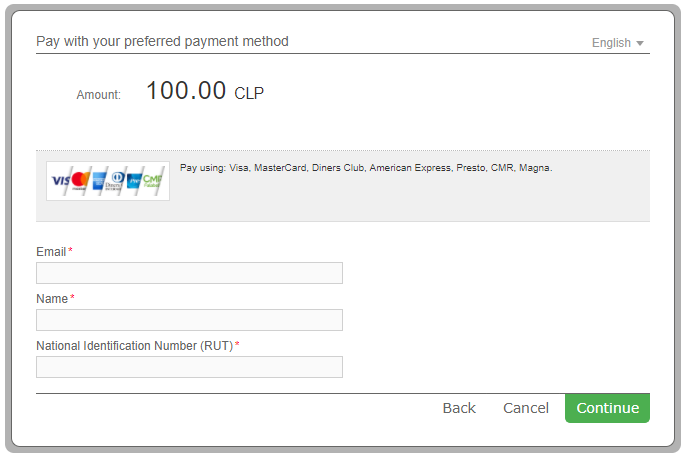

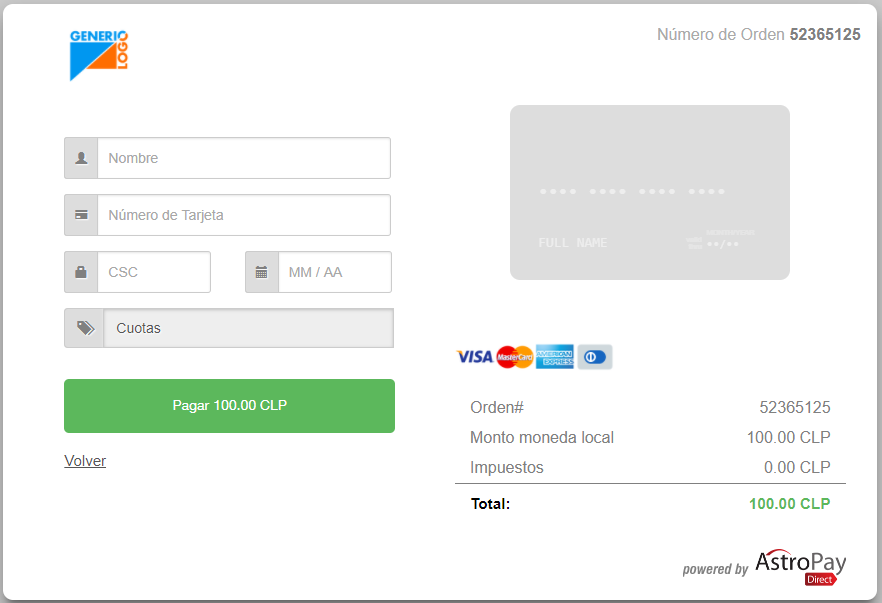

-

The customer enters his Email Address, Name and RUT. Please note that for Chile the CustomerSocialSecurityNumber parameter consists of RUT. For more information about the RUT please click here.

-

The customer enters his email address, name and card details: Card Number, CVC (CSC) and Expiration Date. He finalizes the payment by using the Pay button.

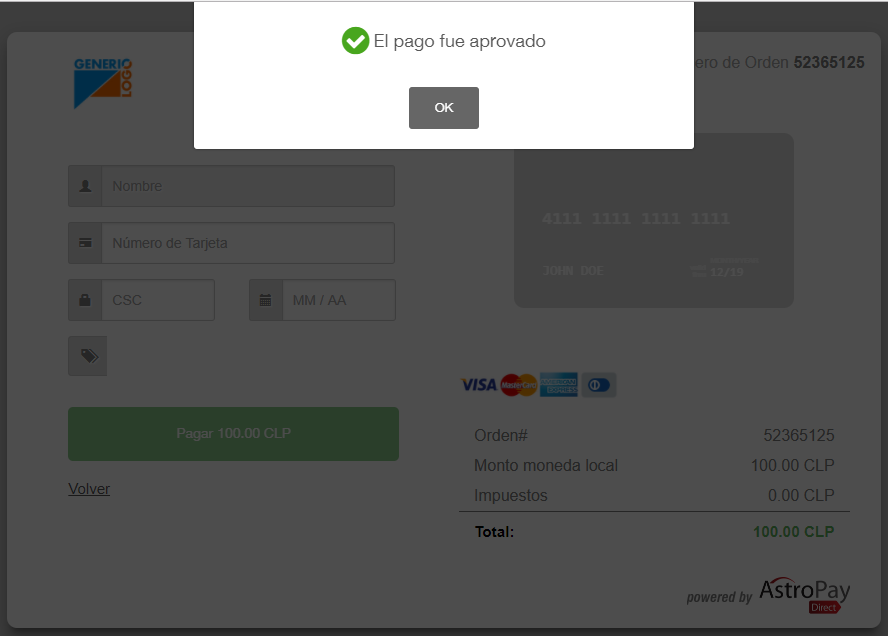

-

The customer receives a message that the payment has been completed correctly.

-

Upon completion of the payment flow the customer is redirected back to your ReturnURL.

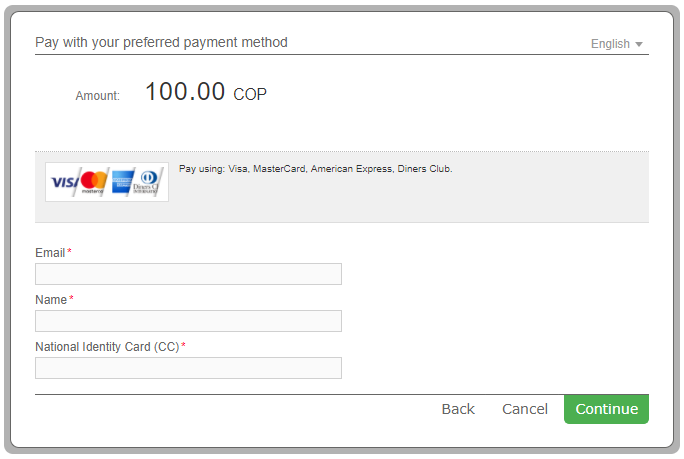

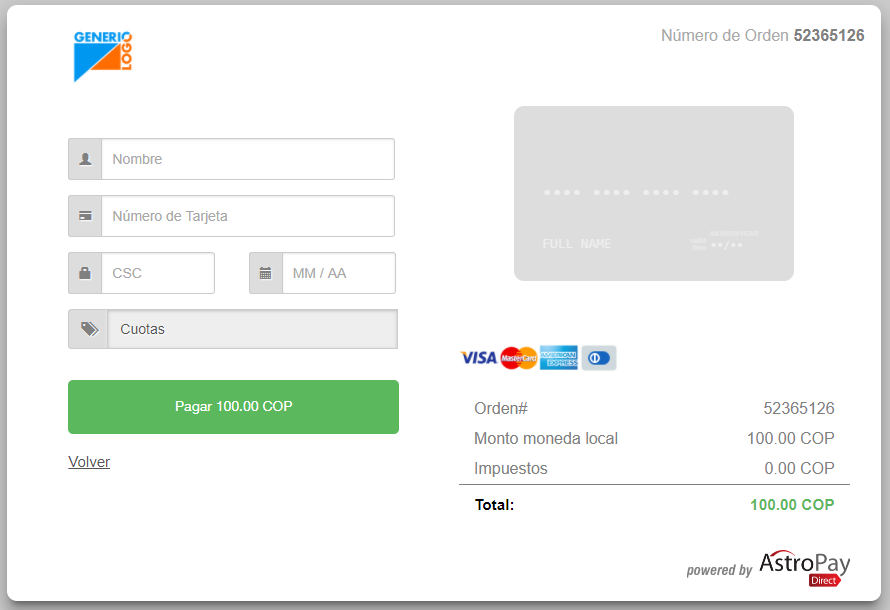

Credit Cards Colombia Test Data

For Credit Cards Colombia payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

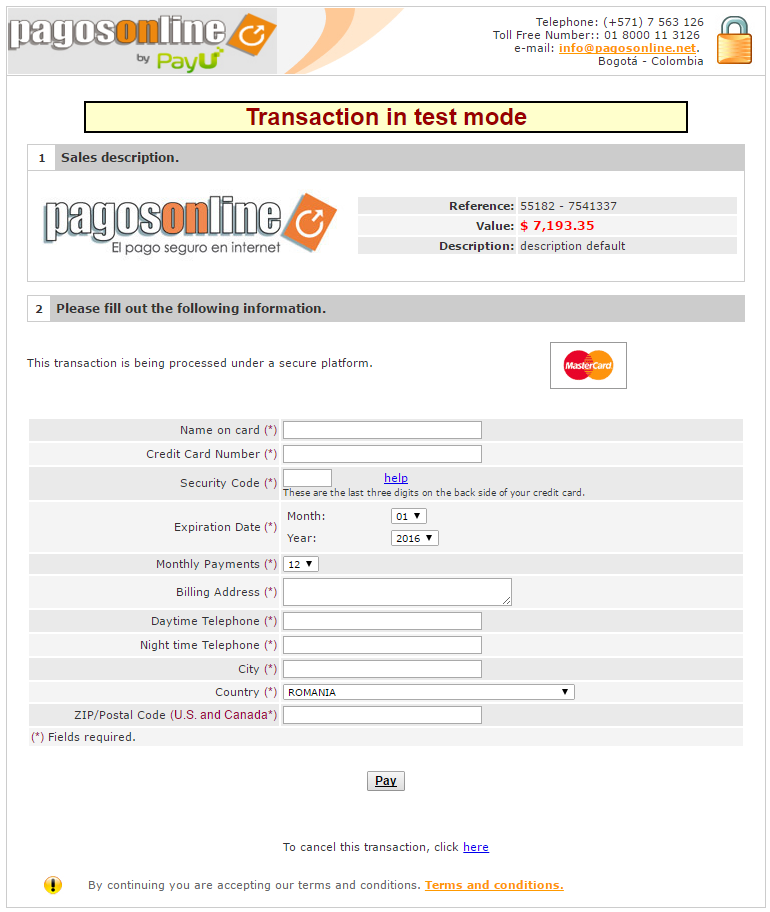

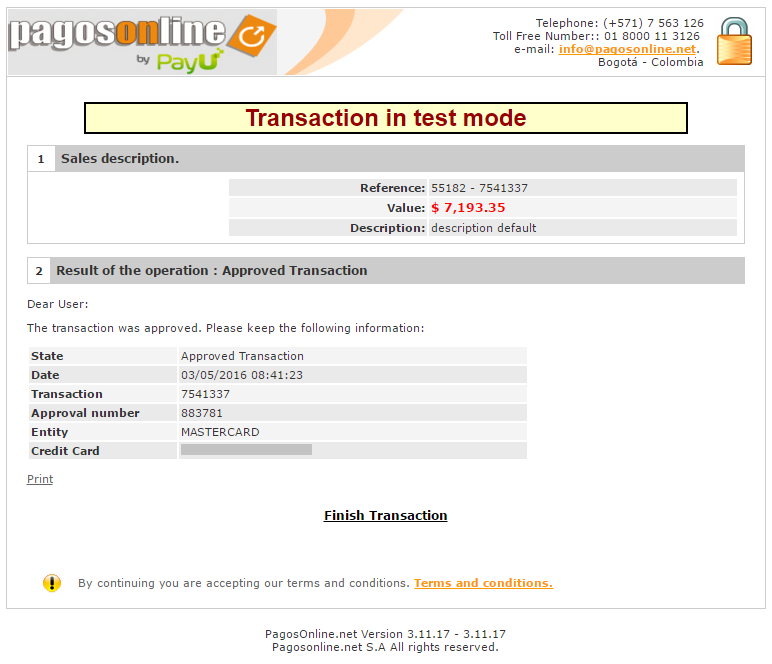

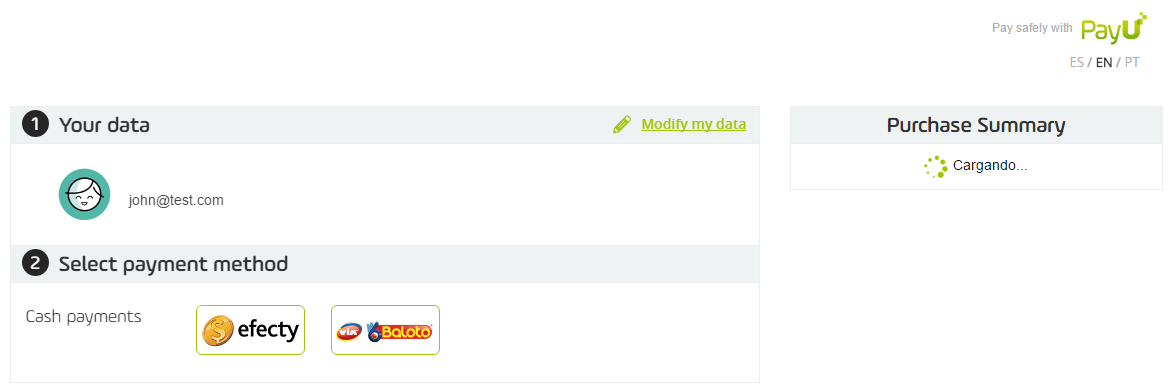

Credit Cards Colombia Payment Flow

-

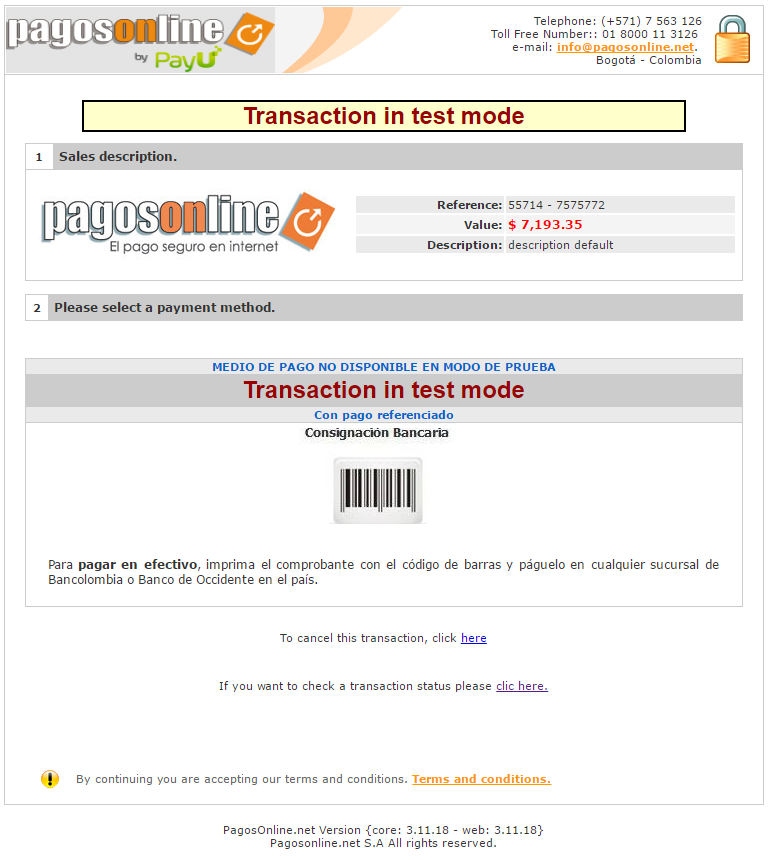

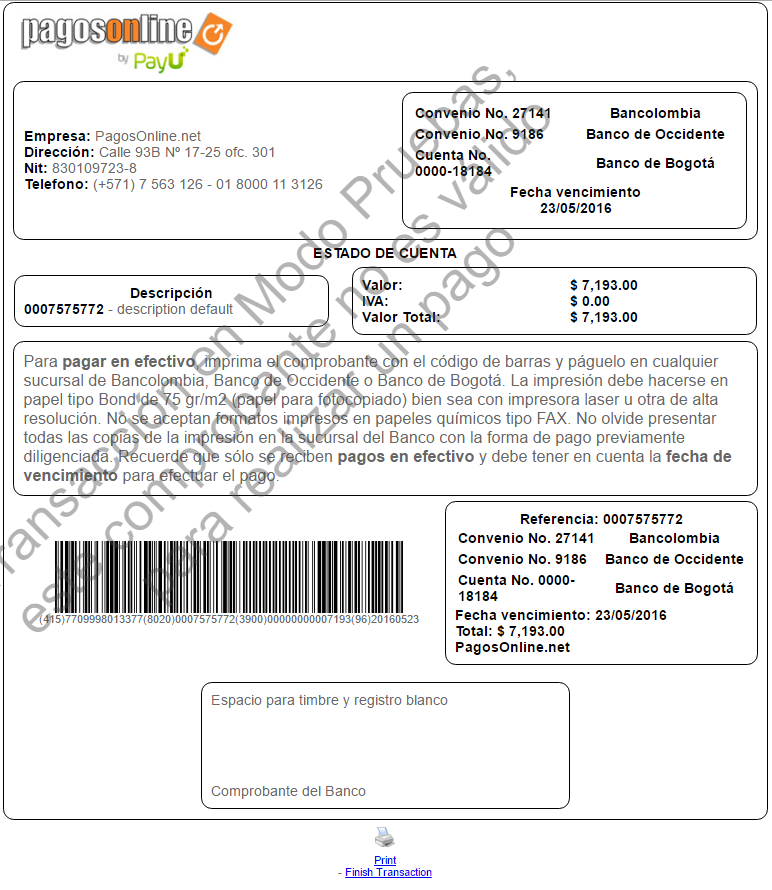

The Customer enters his email address.

-

The customer selects his preferred payment method from the list.

-

After selecting the payment method, the customer has to enter the required information. He has to fill out a form with the required card and customer details.

-

The customer receives a message that the payment was successfully processed. He also has the possibility to print the transaction details.

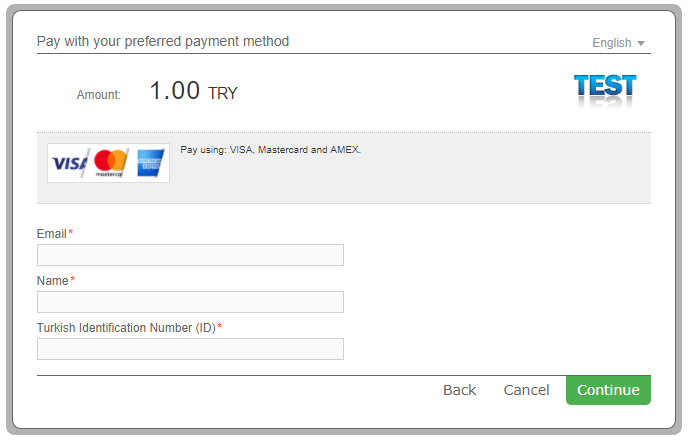

Credit Cards Turkey Test Data

For Credit Cards Turkey payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

Credit Cards Turkey Payment Flow

-

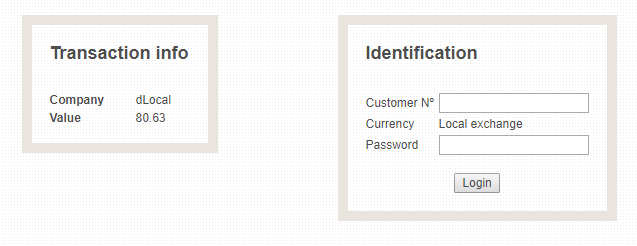

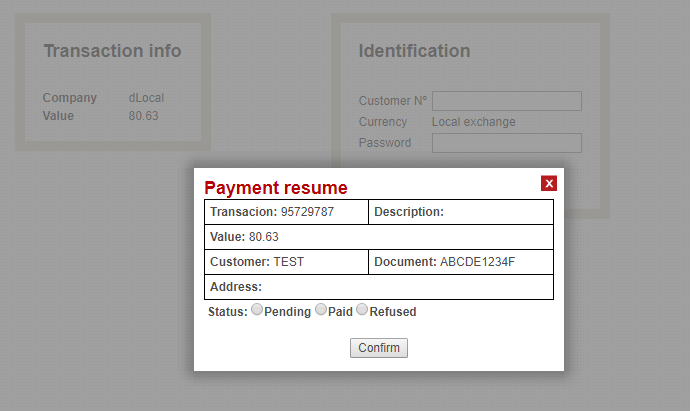

The customer enters his Email Address, Name and Turkish Identification Number (ID).

Please note that for Turkey the CustomerSocialSecurityNumber parameter consists of ID. For more information about the ID please click here. -

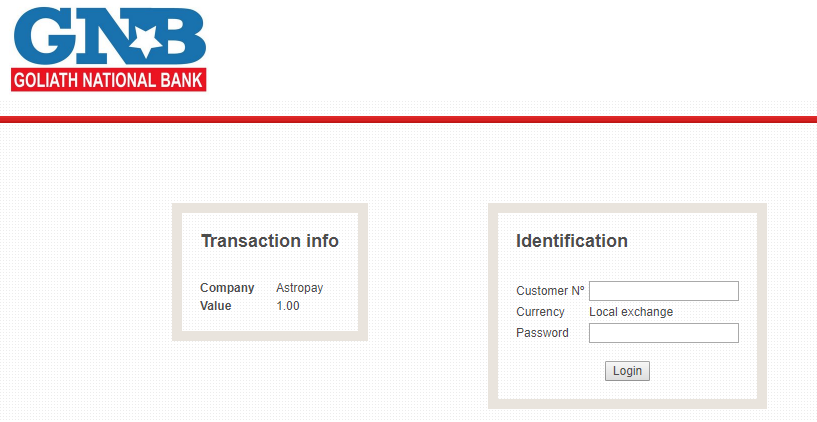

The customer logs in to his account by entering his Customer ID and password.

-

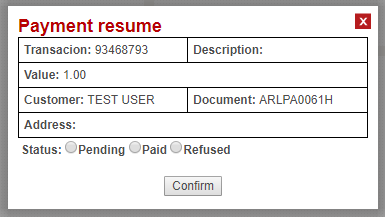

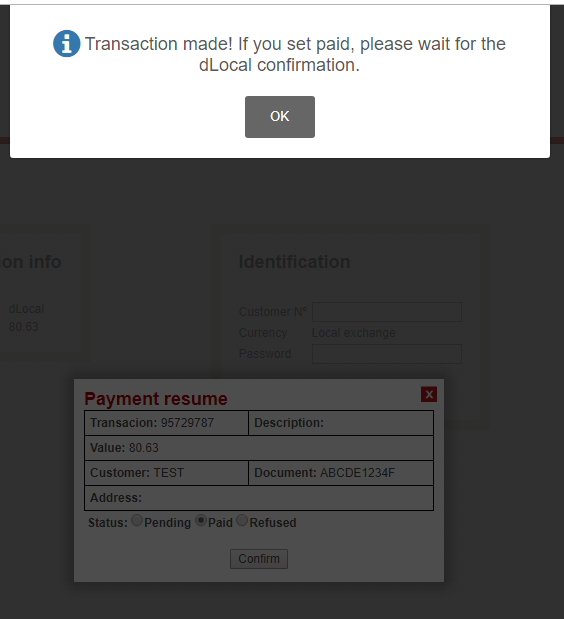

The Customer checks the payment resume and proceeds with the payment by clicking on the Confirm button.

-

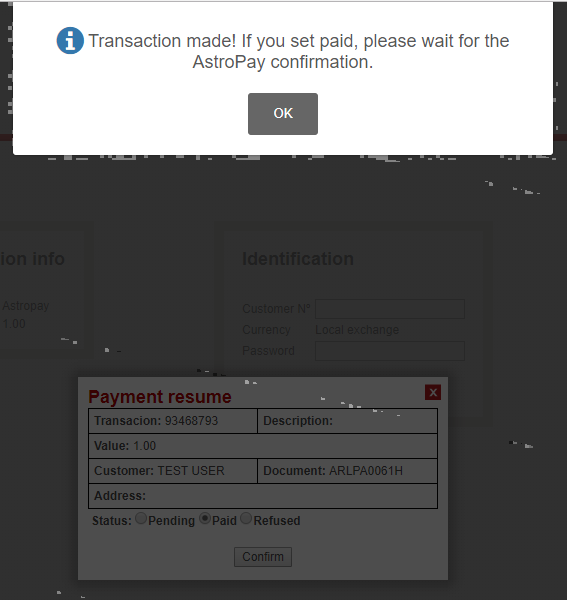

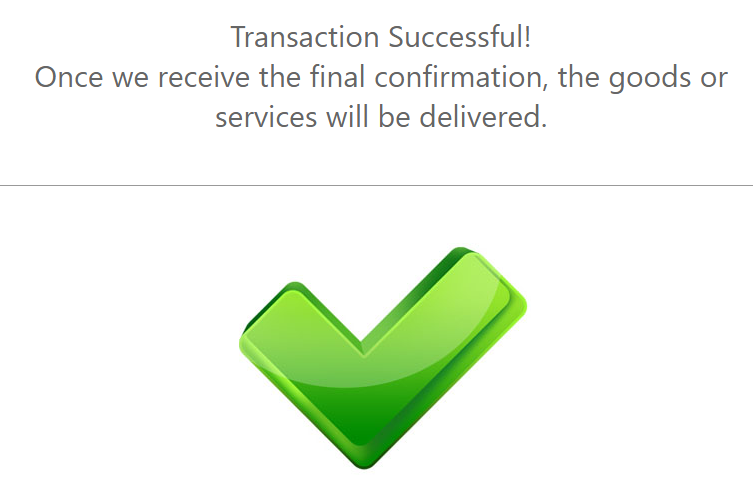

The customer receives a message that the payment has been completed correctly.

-

Upon completion of the payment flow the customer is redirected back to your ReturnURL.

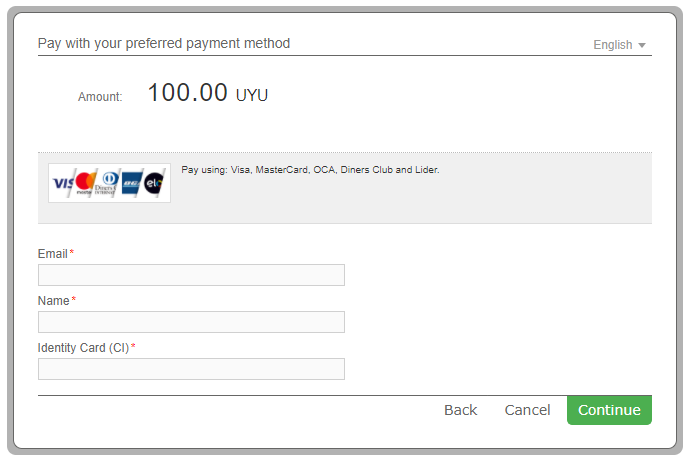

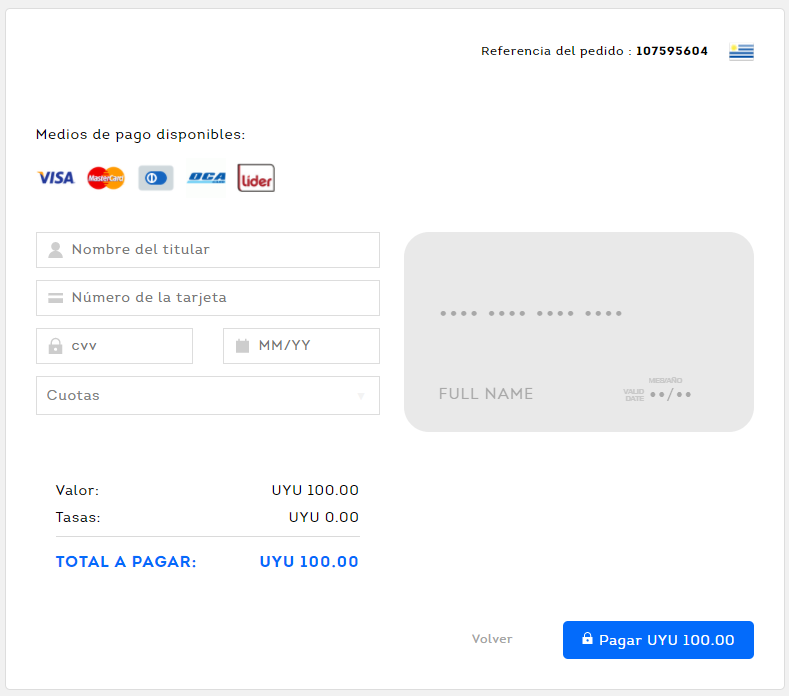

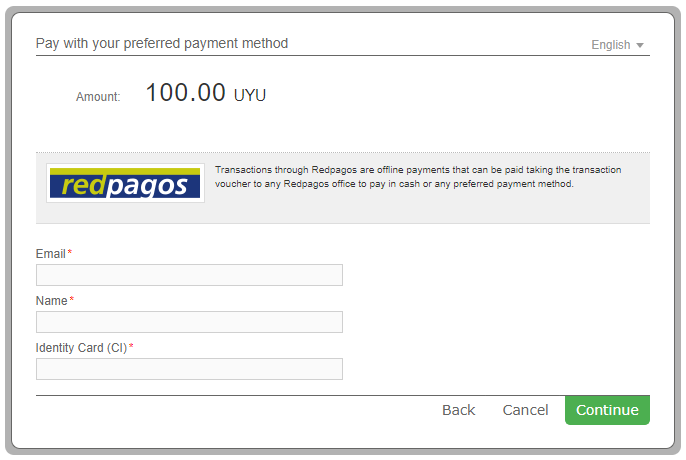

Credit Cards Uruguay Test Data

For Credit Cards Uruguay payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

Credit Cards Uruguay Payment Flow

-

The customer enters his Email Address, Name and Identity Card (CI).

Please note that for Uruguay the Customer Social Security Number parameter consists of Identity Card (CI). For more information about the CI please click here. -

The customer enters his name and card details: Card Number, CVC (CSC) and Expiration Date. He finalizes the payment by using the Pay button.

-

Upon completion of the payment flow the customer is redirected back to your ReturnURL.

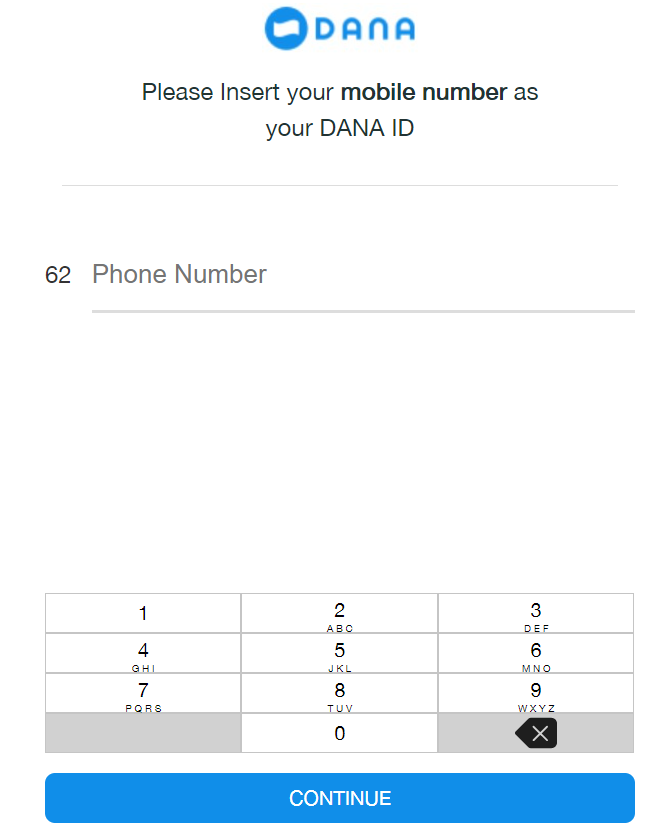

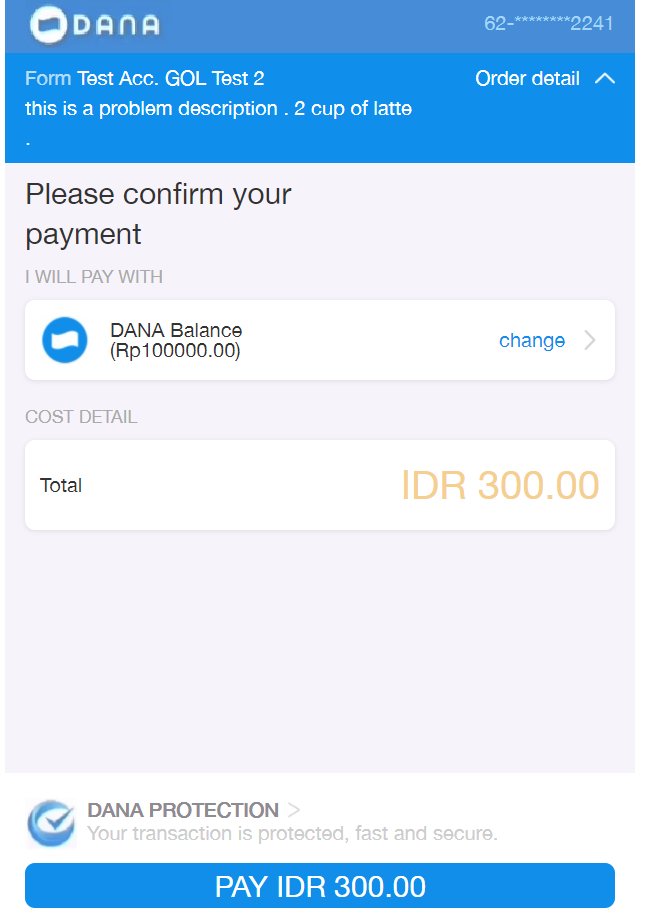

Dana Test Data

In order for you to test the Dana payment method successfully, please use the below test data.

| Dana Test Data | ||

|---|---|---|

| Data | Value | |

| Phone Number: | Enter any 11 digit number. Example: 12345678123 | |

| PIN number: | Enter any 6 digit number. Example: 123456 | |

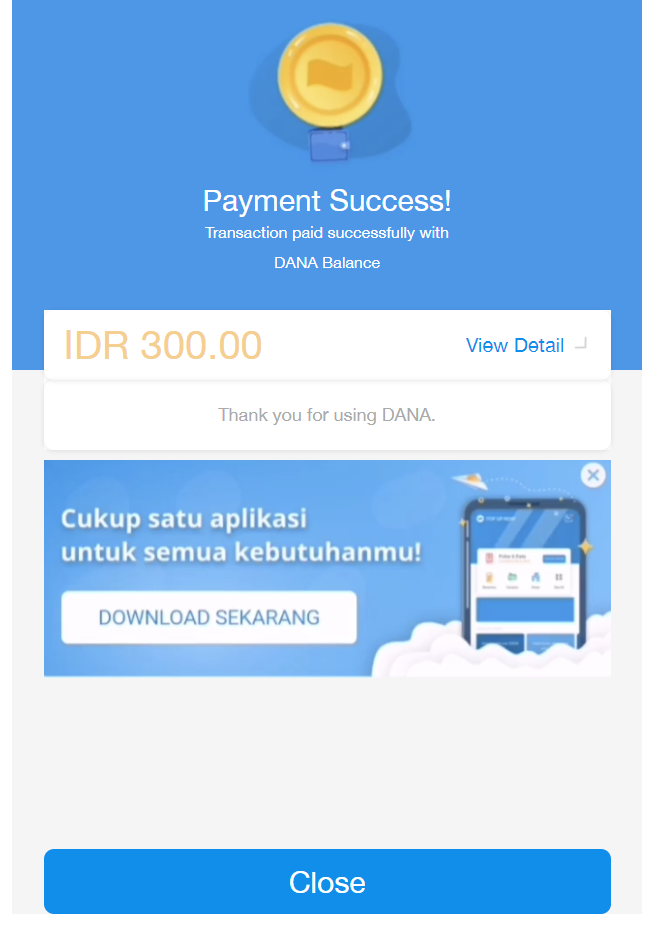

Dana Payment Flow

- The customer is redirected to Dana page where he needs to add his phone number.

- The customer needs to enter the PIN number.

- The customer sees the payment details and confirms the payment.

- The customer receives a message confirmation of the payment.

- Upon completion of the payment flow, the customer is redirected to your ReturnUrl.

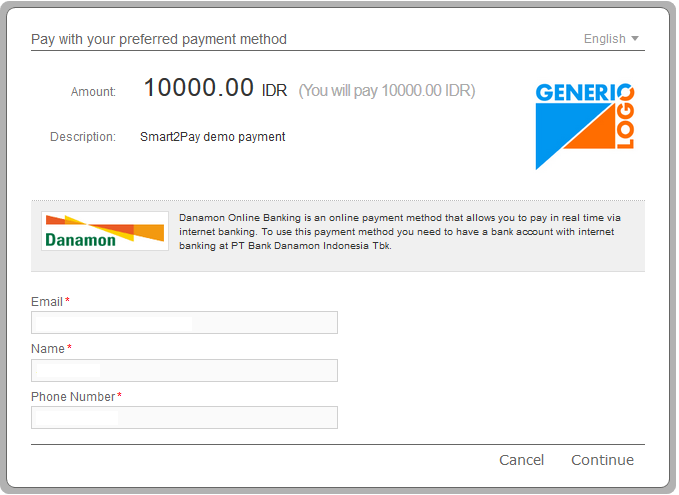

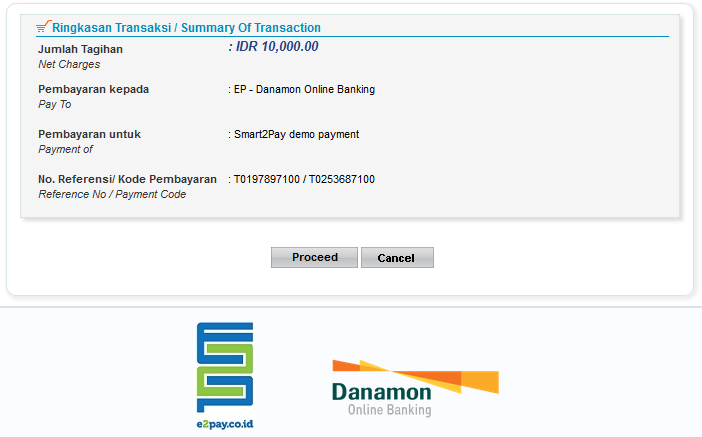

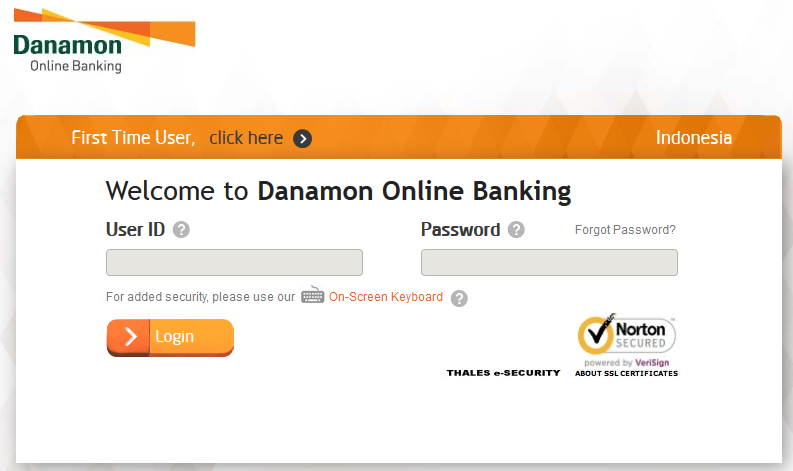

Danamon Online Banking Test Data

For Danamon Online Banking payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

Danamon Online Banking Payment Flow

-

The customer enters his email address, name and phone number.

-

The payment details are displayed and the customer can proceed with the payment on Danamon Online Banking page.

-

The customer logs in to his account with his User ID and password and completes the payment.

-

Upon completion of the payment flow, the customer is redirected back to your ReturnURL.

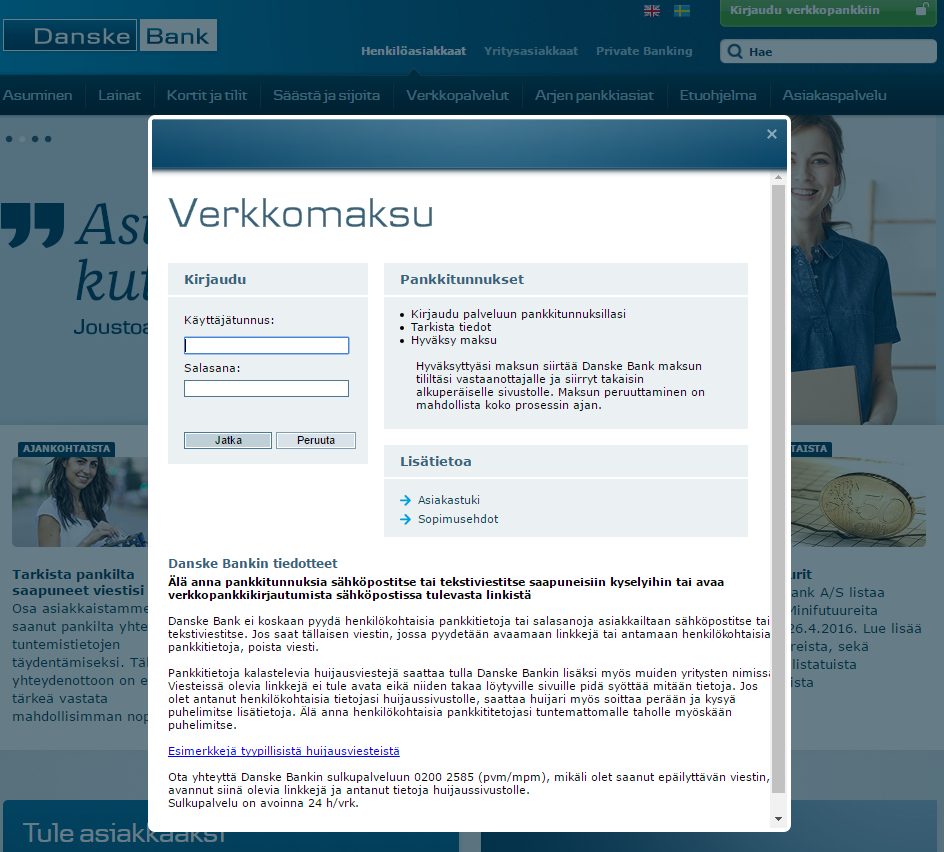

Danske Test Data

For Danske payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

Danske Payment Flow

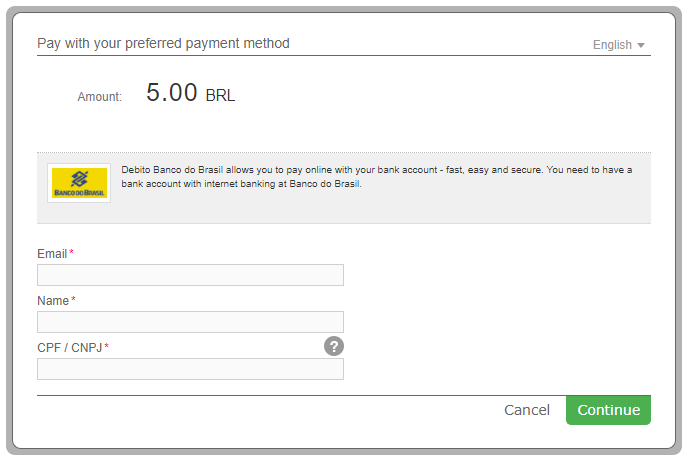

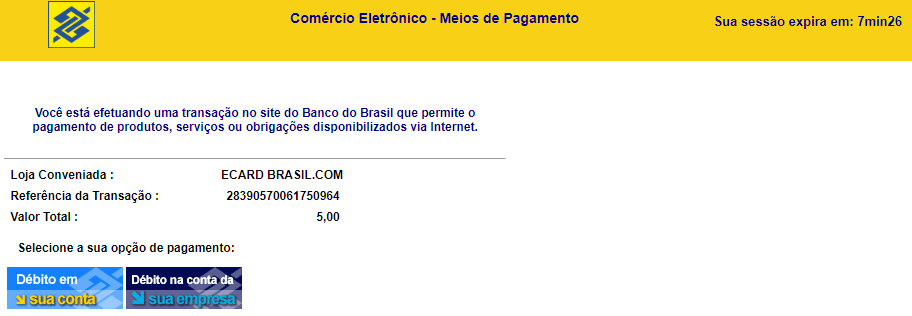

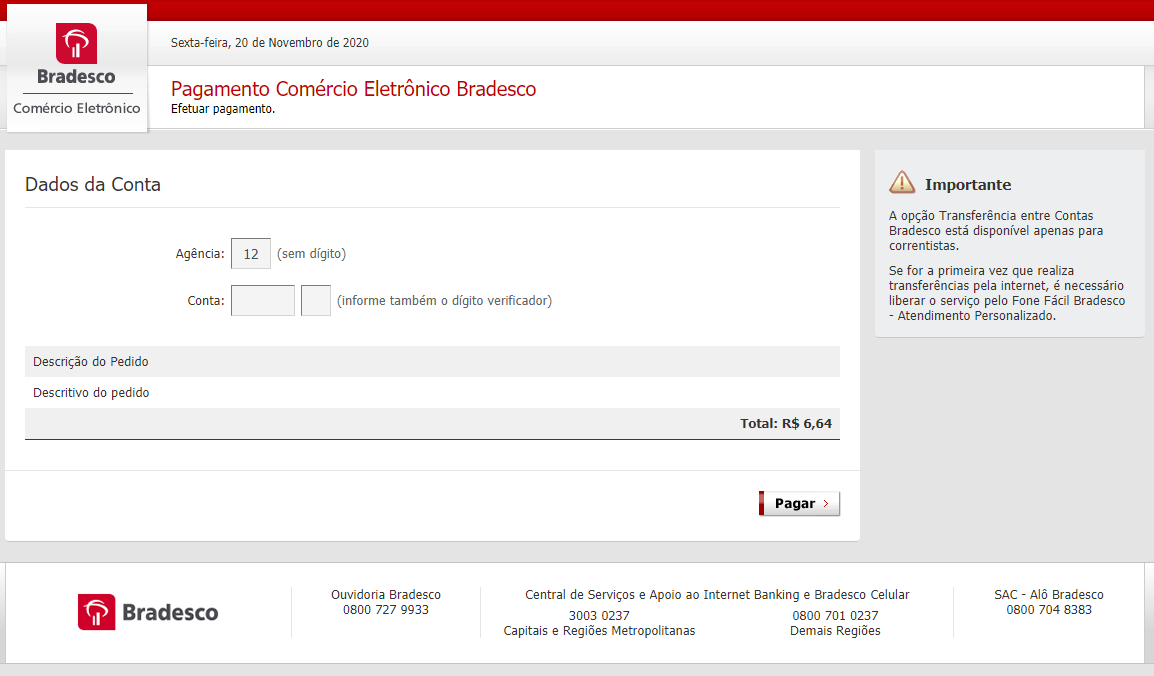

Débito Banco do Brasil Test Data

For Débito Banco do Brasil payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

Débito Banco do Brasil Payment Flow

-

The customer enters his Email Address, Name and CPF/CNPJ. Please note that for Brazil the Customer Social Security Number parameter consists of CPF/CNPJ. For more information about the CPF/CNPJ please click here.

-

The Customer chooses his account type.

-

The customer logs in to his account by entering the login details and authorizes the payment.

-

Upon completion of the payment flow the customer is redirected back to your ReturnURL.

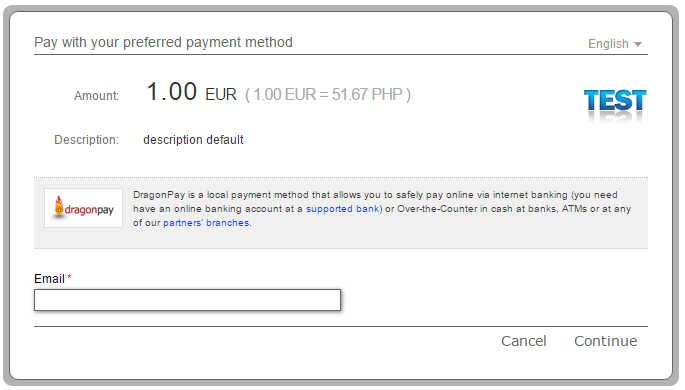

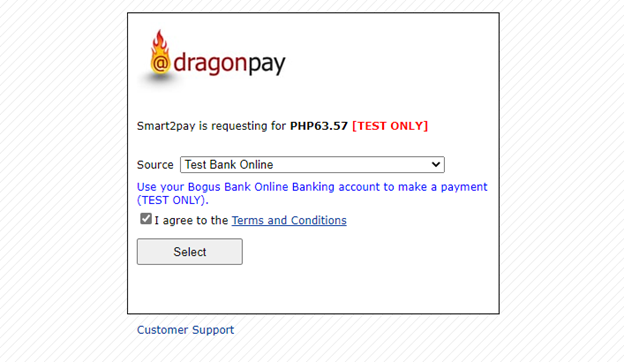

DragonPay Test Data

In order for you to test the DragonPay payment method successfully, please use the below test data.

| DragonPay Test Data | ||

|---|---|---|

| Online Banking | Bank Name: | Test Bank Online |

| Login ID: | pwd | |

| Password: | pwd | |

| Over-the-Counter / ATM banking | Bank Name: | Test Bank Online Over-the-Counter |

| You will get an email and you will follow the link and confirm the payment | ||

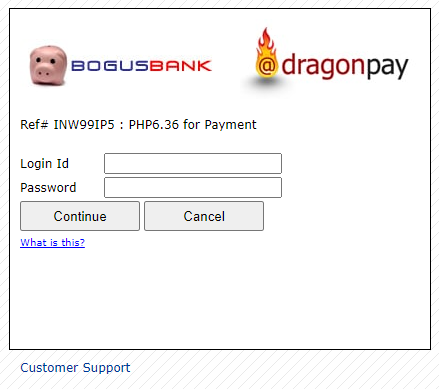

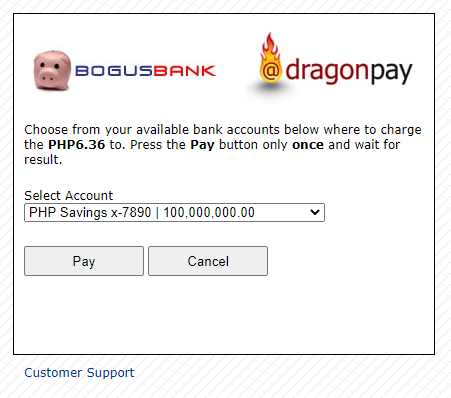

DragonPay Payment Flow

- The Customer enters his email address.

- The customer selects his bank. For test purposes, please select for Online Banking: Test Bank Online, and for Over-the-Counter/ATM Banking: Test Bank Online Over-the-Counter.

- The customer enters his login details. The test Login ID is pwd and the test password is pwd.

- The customer selects his available bank account. For test purposes, please select one of the bank accounts given in the form.

- Upon completion of the payment flow, the customer is redirected to your ReturnUrl.

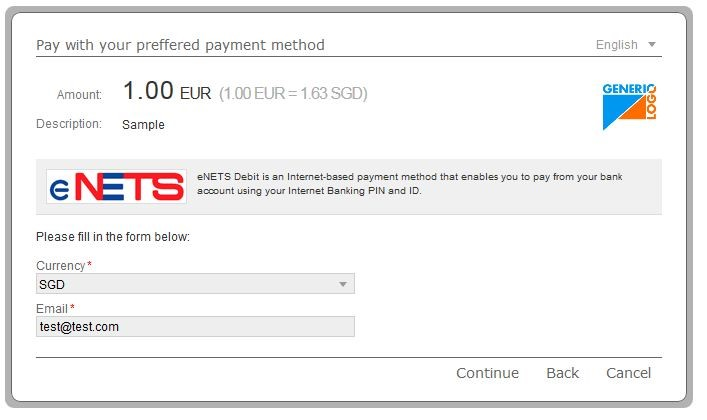

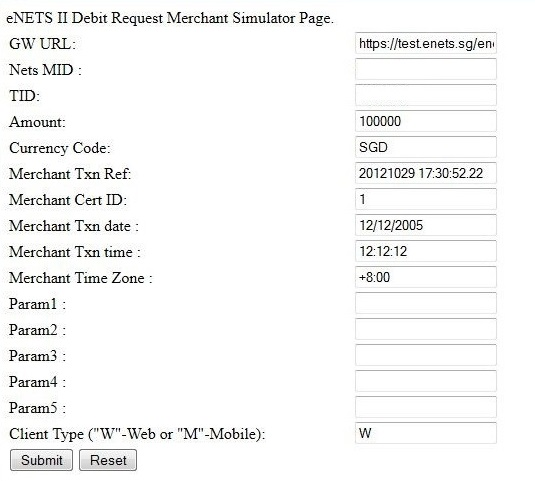

eNETS Debit Test Data

For eNETS Debit payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

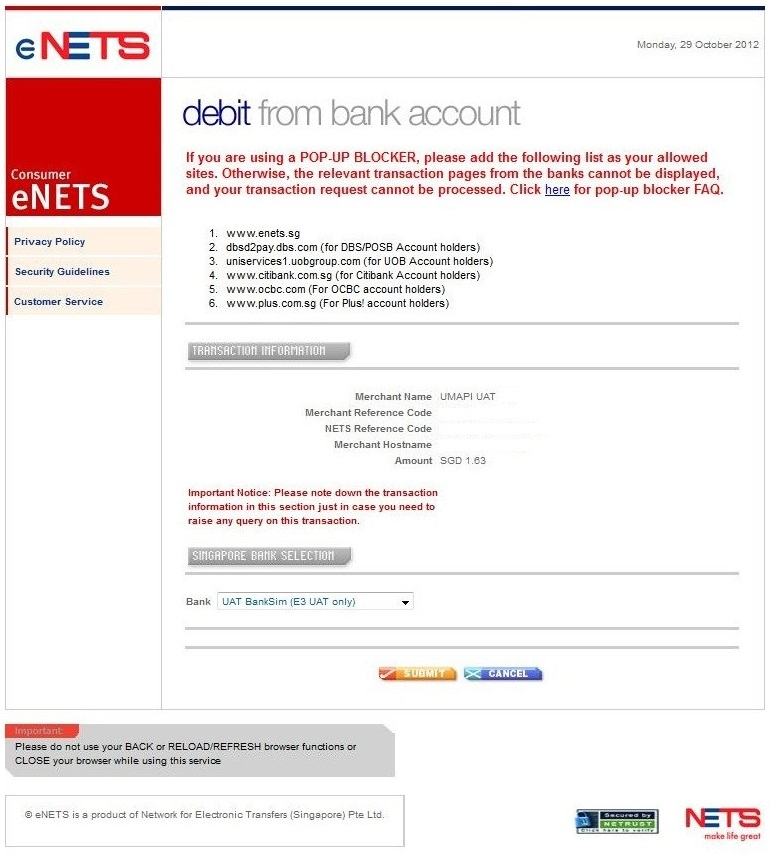

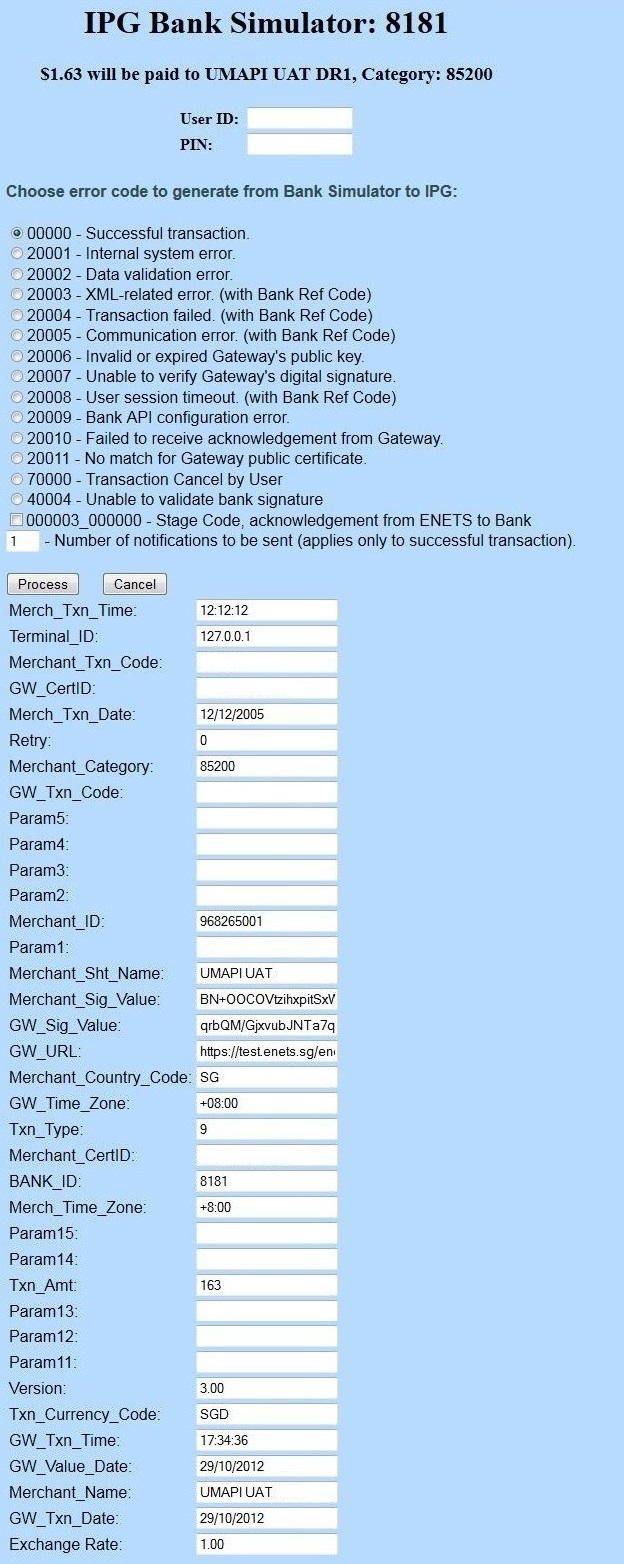

eNETS Debit Payment Flow

-

The Customer selects the preferred currency from the list and enters his email address.

-

The customer needs to enter the correct payment details and he continues the payment by using the Submit button.

-

The customer chooses his preferred bank from the list.

-

The customer logs in to his bank account by entering his User ID and PIN.

-

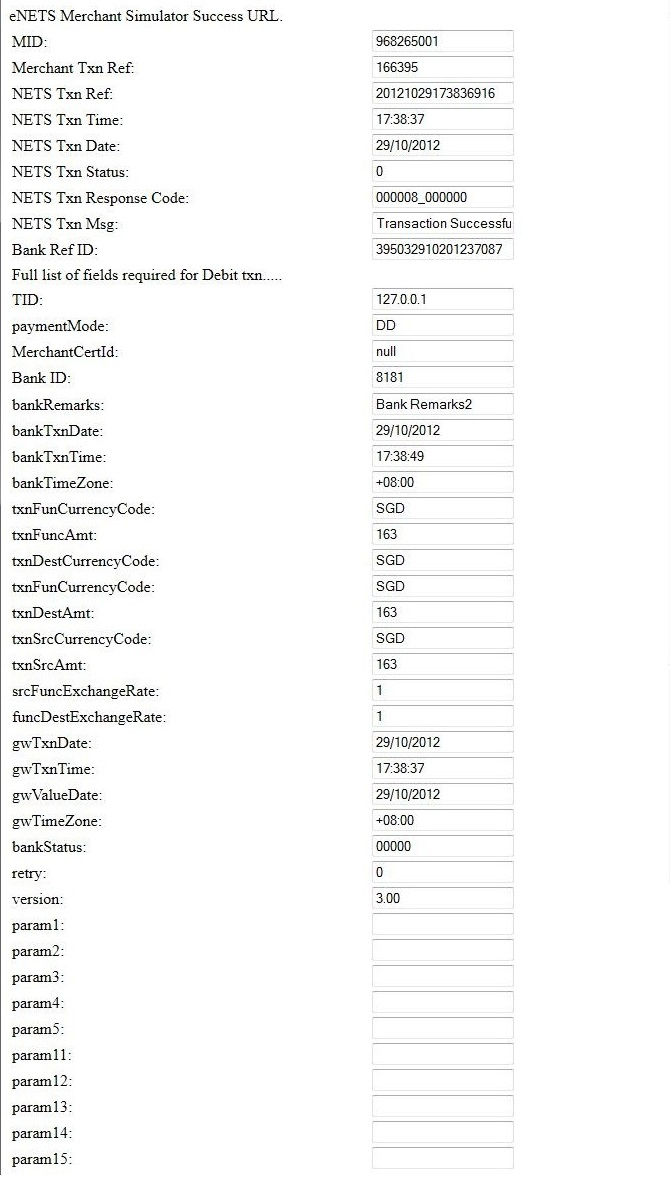

The customer receives a notification with the final status of the payment.

-

A printable receipt will appear in a separate browser window.

-

All the payment details will also appear in a new window of the browser.

EPS Test Data

In order for you to test EPS payment method successfully, please use the below test data.

| New EPS Test Data | |

|---|---|

| Data | Value |

| BIC | STZZATWWXXX (PSA (Stuzza) Bank) |

| IBAN | AT938900000001100509 |

| Login | 1002823 |

| Password | EK38]X^=y9uUtf$ |

| Old EPS Test Data | |

|---|---|

| Data | Value |

| BIC | HYPTAT22XXX |

| Verfügernummer | 123456 |

| Verfügername | Enter any name (example: John) or leave it empty, and click Login |

| PIN | Enter any number (example: 123) or leave it empty, and click Login |

| Mobile TAN | Enter any number (example: 1234) or leave it empty, and click OK |

| Old EPS Test Data | |

|---|---|

| Data | Value |

| BIC | STZZATWWXXX |

| IBAN | AT648900000001100449 |

| Login | 1004649 |

| Password | gKFQ’w3m>-Y?9k_#nUE8 |

| Old EPS Test Data | |

|---|---|

| Data | Value |

| BIC | STZZATWWXXX |

| IBAN | AT918900000001100448 |

| Login | 1009853 |

| Password | gKFQ’w3m>-Y?9k_#nUE8v |

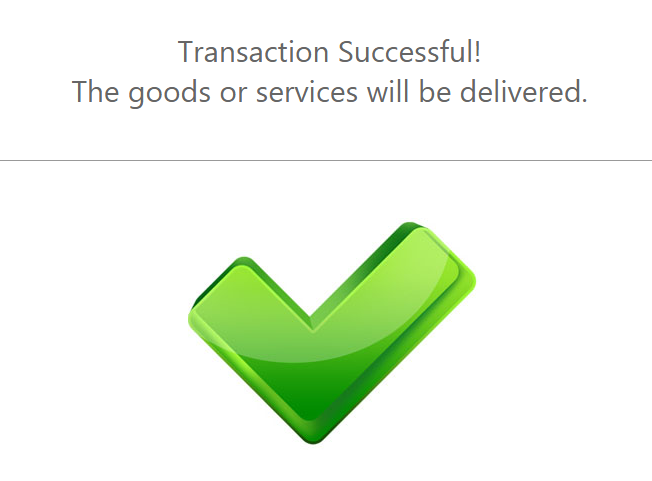

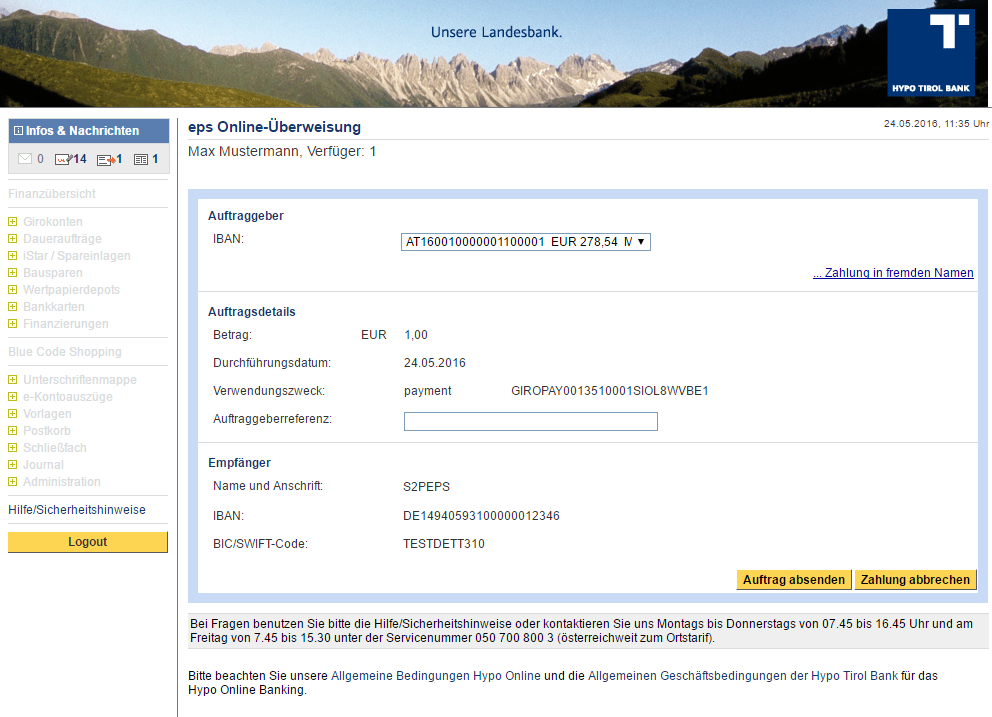

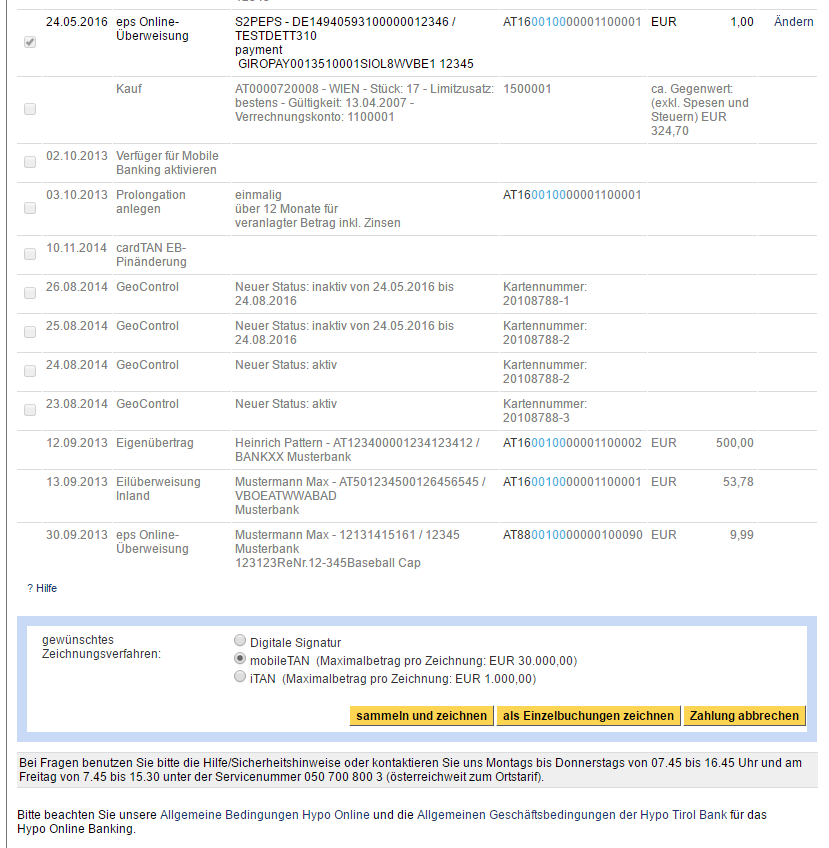

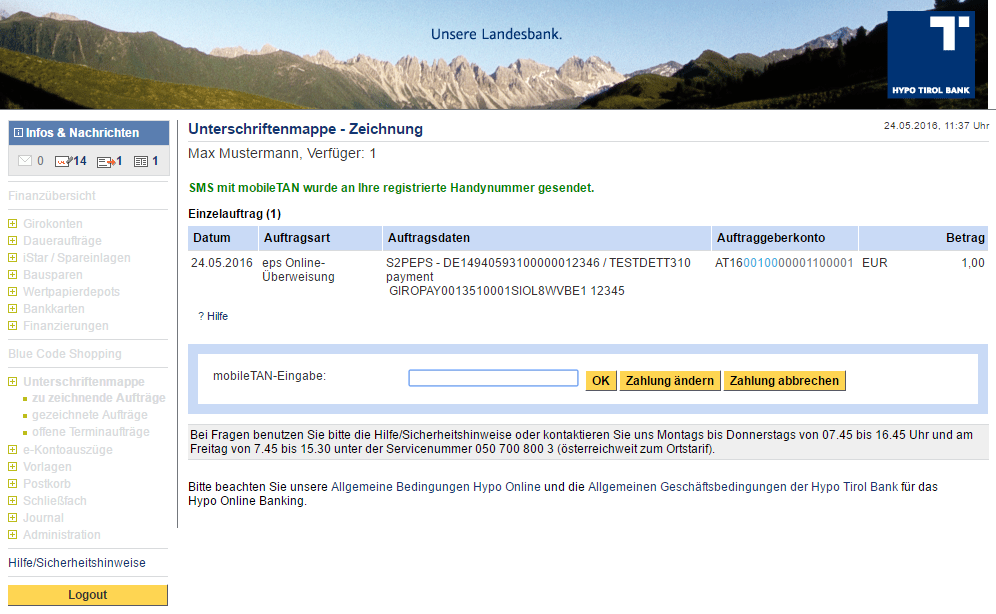

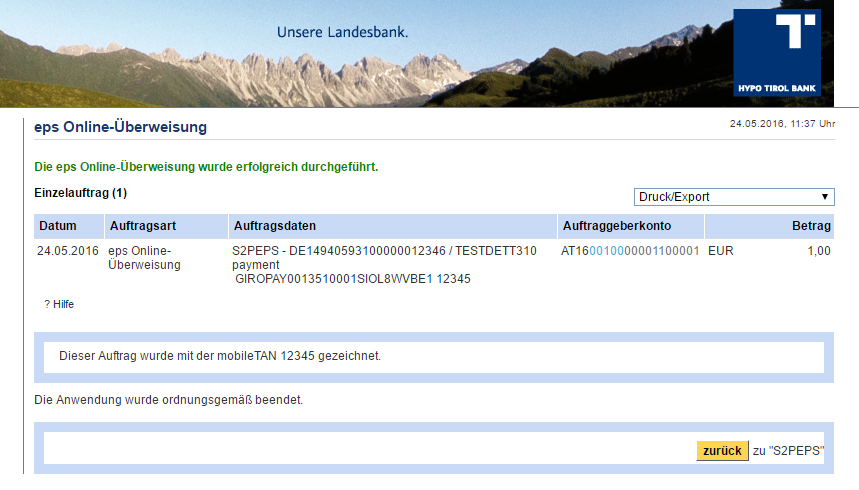

EPS Payment Flow

- The Customer enters the BIC and selects his preferred bank. The test BIC is: HYPTAT22XXX.

- The customer enters his login details. For test purposes you don’t need to enter any data (name or PIN), just click on the Login Button.

- The customer reviews the payment details and proceeds with the payment.

- The customer chooses to confirm the payment using mobile TAN.

- The customer confirms the payment by using the TAN number.

- The customer receives a message that the EPS online transfer was successful.

- Upon completion of the payment flow the customer is redirected back to your ReturnURL.

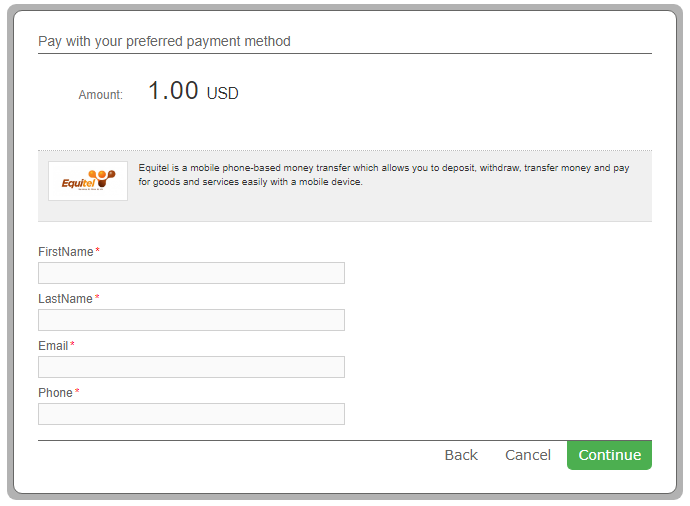

Equitel Test Data

In order for you to test Equitel payment method available in Kenya, please use the below test data.

| Equitel (Kenya) Test Data | |

|---|---|

| Data | Value |

| Phone | 254725362916 |

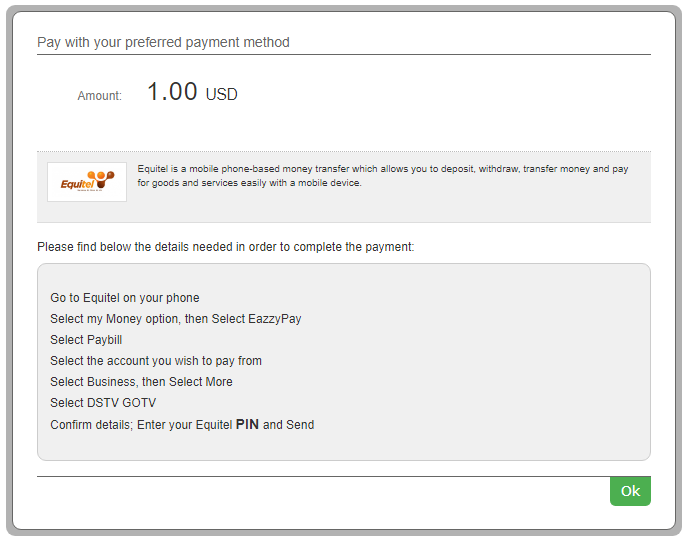

Equitel (Kenya) Payment Flow

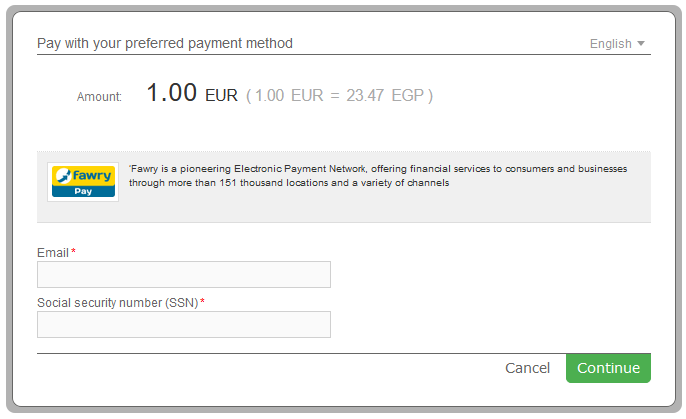

Fawry Wallet Test Data

For Fawry Wallet payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

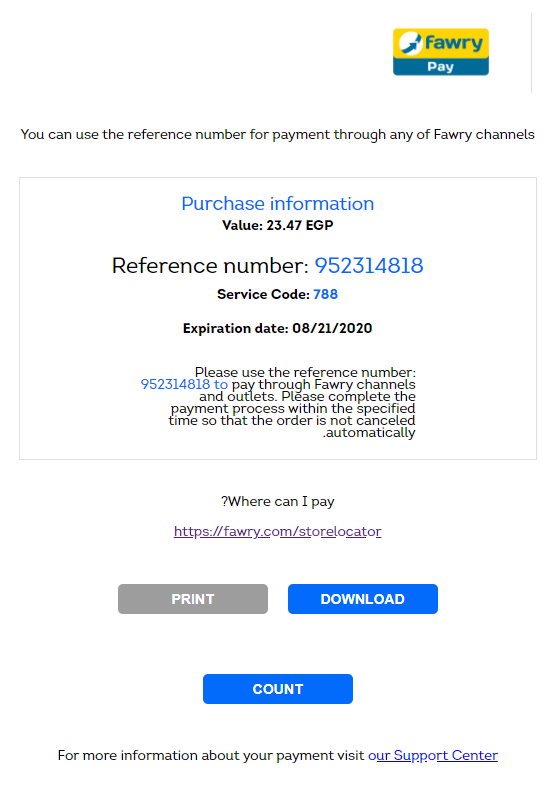

Fawry Payment Flow

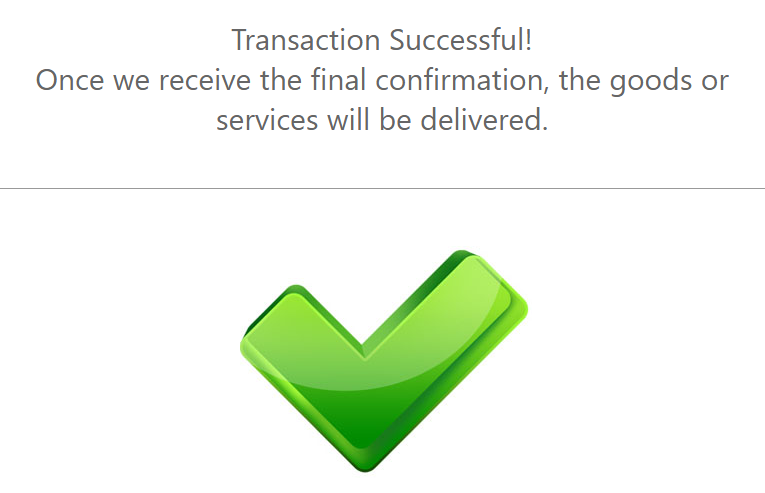

- The customer enters his Email Address and his Social Security Number (SSN).

- The customer receives the necessary information to make the payment, including a reference number. The customer will use the reference number to pay through Fawry channels and outlets within the specified time.

- Upon completion of the payment flow the customer is redirected back to your ReturnURL.

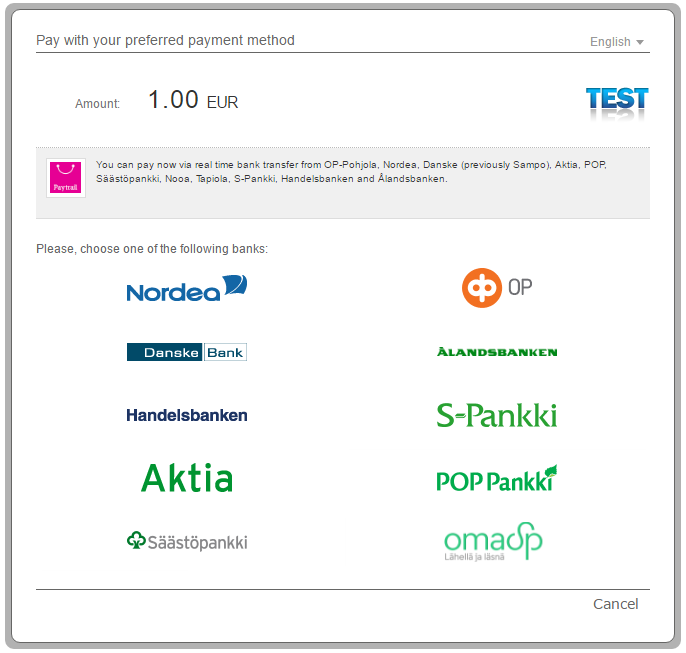

Finnish Banks Test Data

In order for you to test the Finnish Banks payment method successfully, please use the below test data.

| Finnish Banks Test Data | ||

|---|---|---|

| Bank Name | Data | Value |

| Nordea | User ID | 123456 |

| Password | 1234 | |

| Confirmation code | Any 3 digit number

Example: 123 |

|

| OP-Pohjola (Osuuspankin) | User ID | 123456 |

| Password | 7890 | |

| Key number | Any number

Example: 123 |

|

| Danske | Use your own user ID for testing. | |

| Ålandsbanken | User ID | 12345678 |

| Password | 1234 | |

| Key number | Any 4 digit number

Example: 1234 |

|

| Handelsbanken | User ID | 11111111 |

| Password | 123456 | |

| Security code | 123456 | |

| S-Pankki | User ID | 12345678 |

| Password | 9999 | |

| Security code | 1234 | |

| Aktia | User ID | 12345678 |

| Password | 123456 | |

| Security code | 1234 | |

| POP Pankki | User ID | 11111111 |

| Password | 123456 | |

| Security code | 123456 | |

| Säästöpankki | User ID | 11111111 |

| Password | 123456 | |

| Security code | 123456 | |

| Oma Säästöpankki | User ID | 11111111 |

| Password | 123456 | |

| Security code | 123456 | |

The MethodOptionID parameter for Finnish Banks method can have the following values:

| Finnish Banks Method Option IDs | ||

|---|---|---|

| Method Option ID | Description | |

| 60 | Nordea | |

| 61 | OP-Pohjola (Osuuspankki) | |

| 62 | Danske | |

| 64 | Ålandsbanken | |

| 65 | Handelsbanken | |

| 67 | S-Pankki | |

| 298 | Aktia | |

| 299 | POP Pankki | |

| 300 | Säästöpankki | |

| 322 | Oma Säästöpankki | |

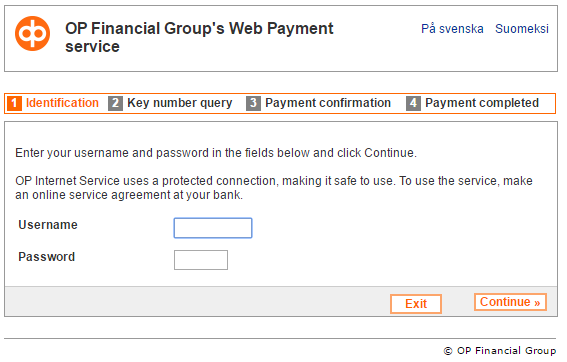

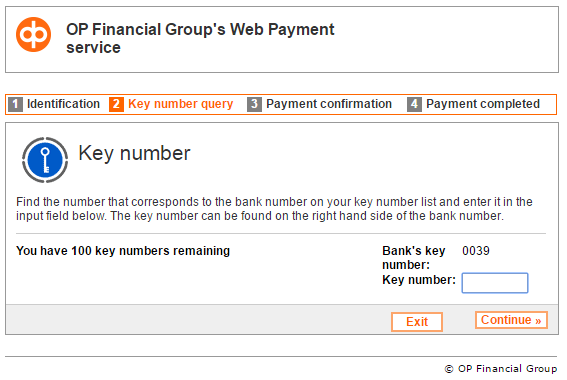

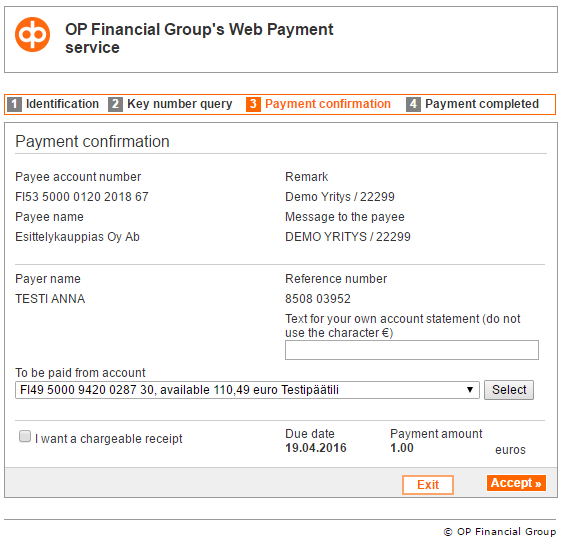

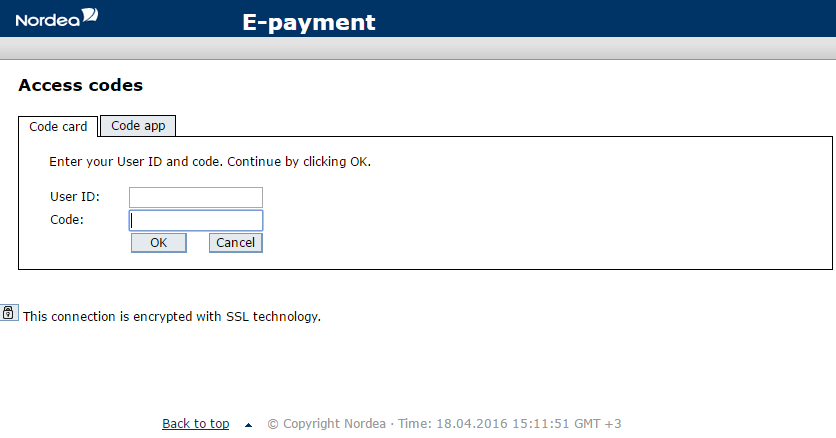

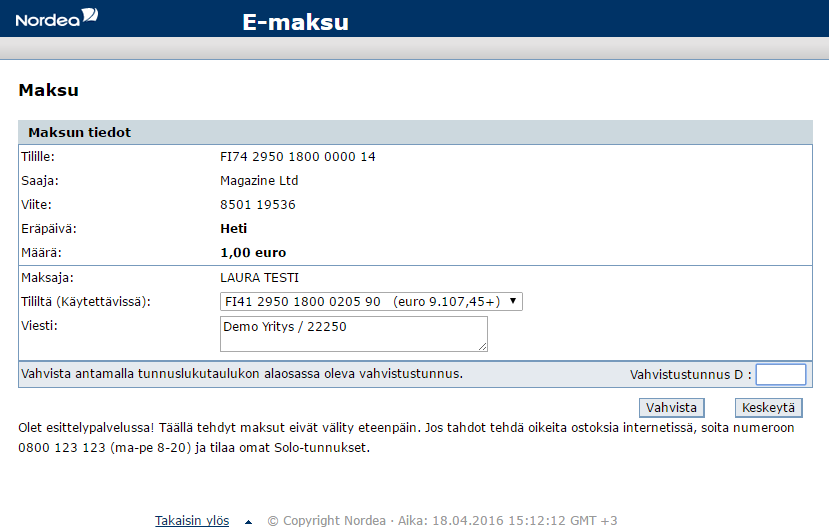

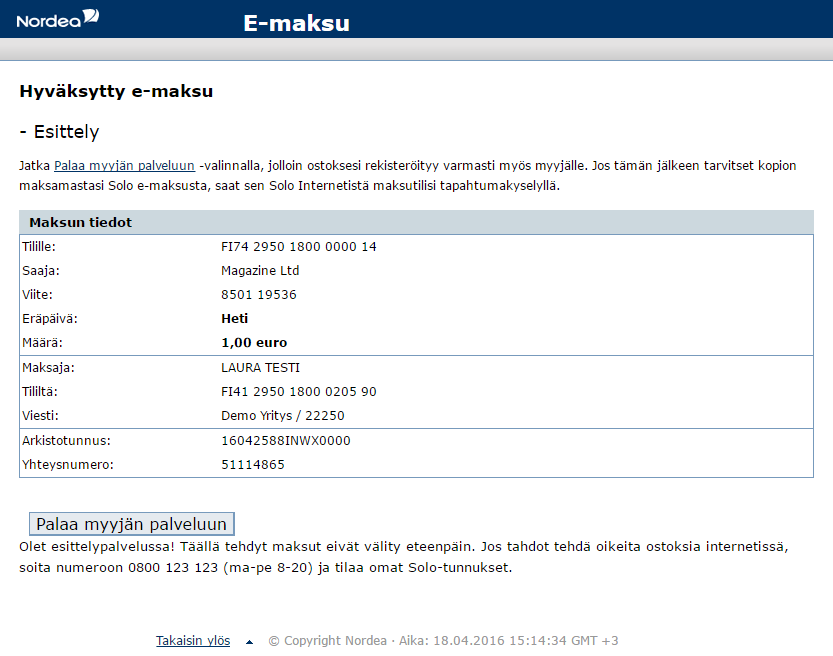

Finnish Banks Payment Flow

- The Customer chooses his Bank from the list.

- The Customer enters the payment details. He must fill the form with his User ID and password. The test User ID is 123456 and the test password is 1234.

- The customer enters the confirmation code and confirms the payment. The test confirmation code is formed by any number; example: 123

- The customer is redirected to the provider’s confirmation page where he sees the payment details.

- Upon completion of the payment flow, the customer is redirected to your ReturnUrl.

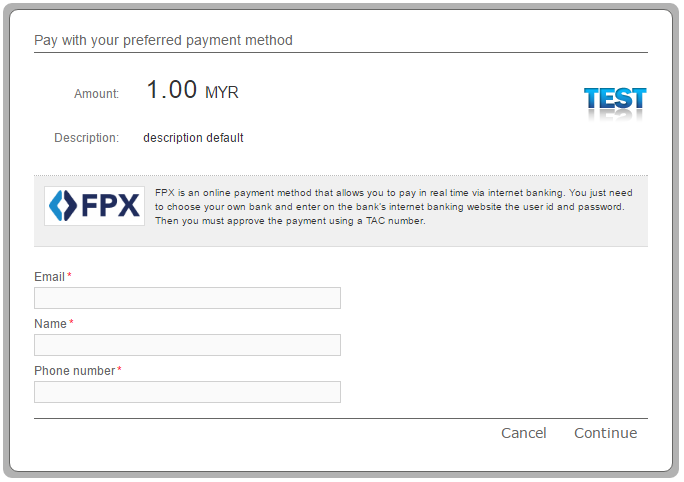

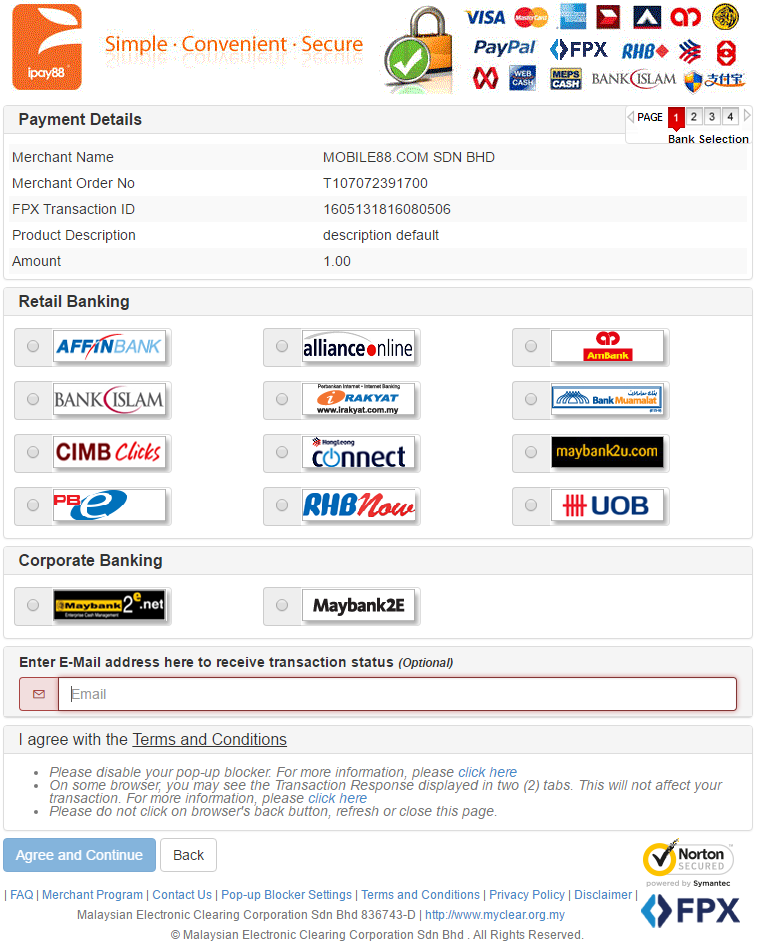

FPX Test Data

For FPX payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

FPX Payment Flow

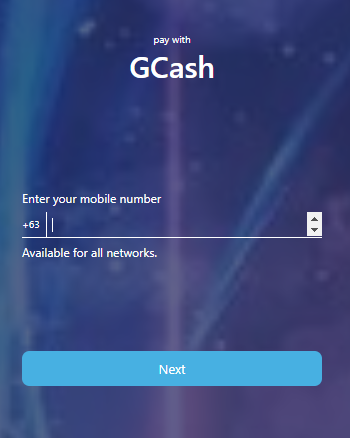

GCash Test Data

In order for you to test the GCash payment method successfully, please use the below test data.

| GCash Test Data | ||

|---|---|---|

| Data | Value | |

| Phone Number: | Enter any 10 digit number. Example: 1234567812 | |

| Authentication code: | Enter any 6 digit number. Example: 123456 | |

| PIN number: | Enter any 4 digit number. Example: 1234 | |

GCash Payment Flow

- The Customer enters his mobile phone number.

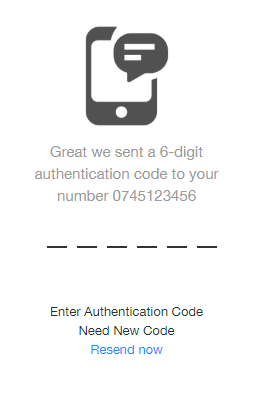

- The Customer enters the authentication code that was send to his mobile phone number.

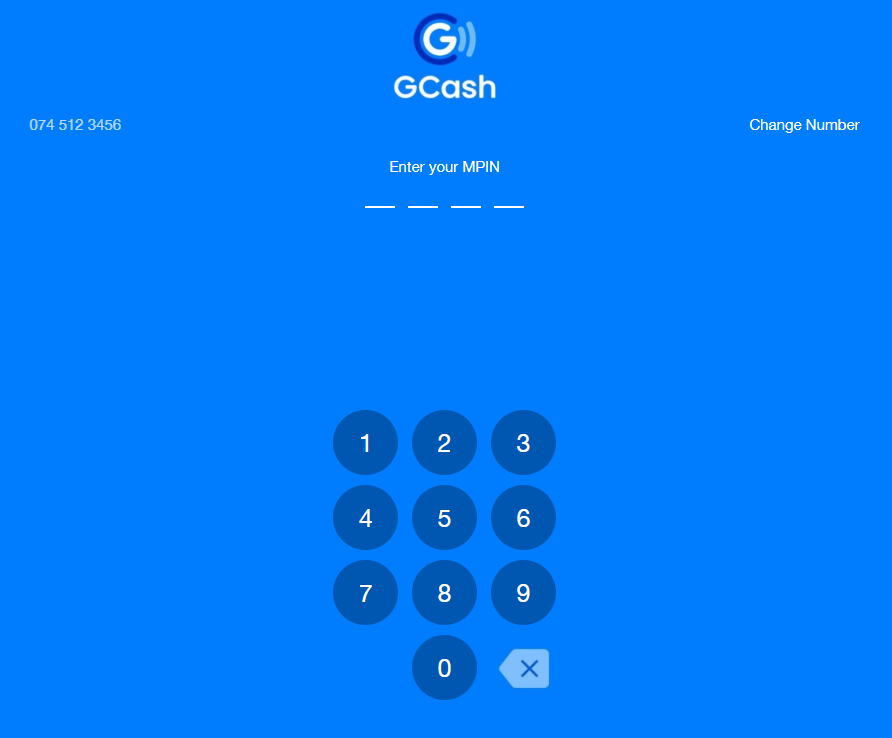

- The customer logs in to his GCash account by entering his PIN number.

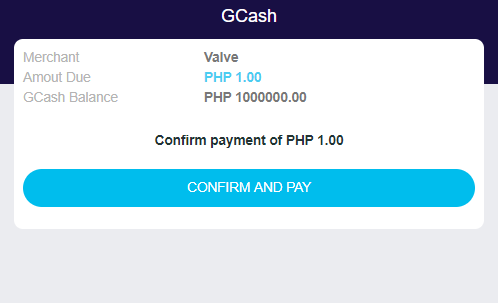

- The customer reviews the payment details and confirms the payment.

- Upon completion of the payment flow, the customer is redirected to your ReturnUrl.

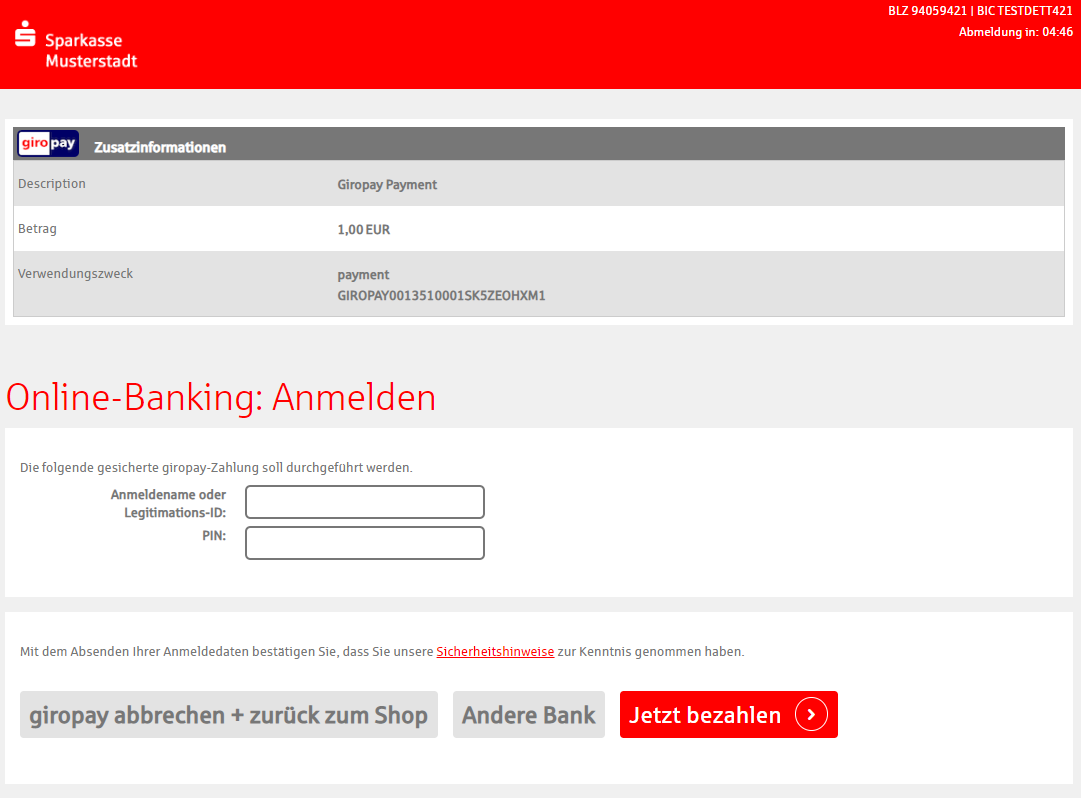

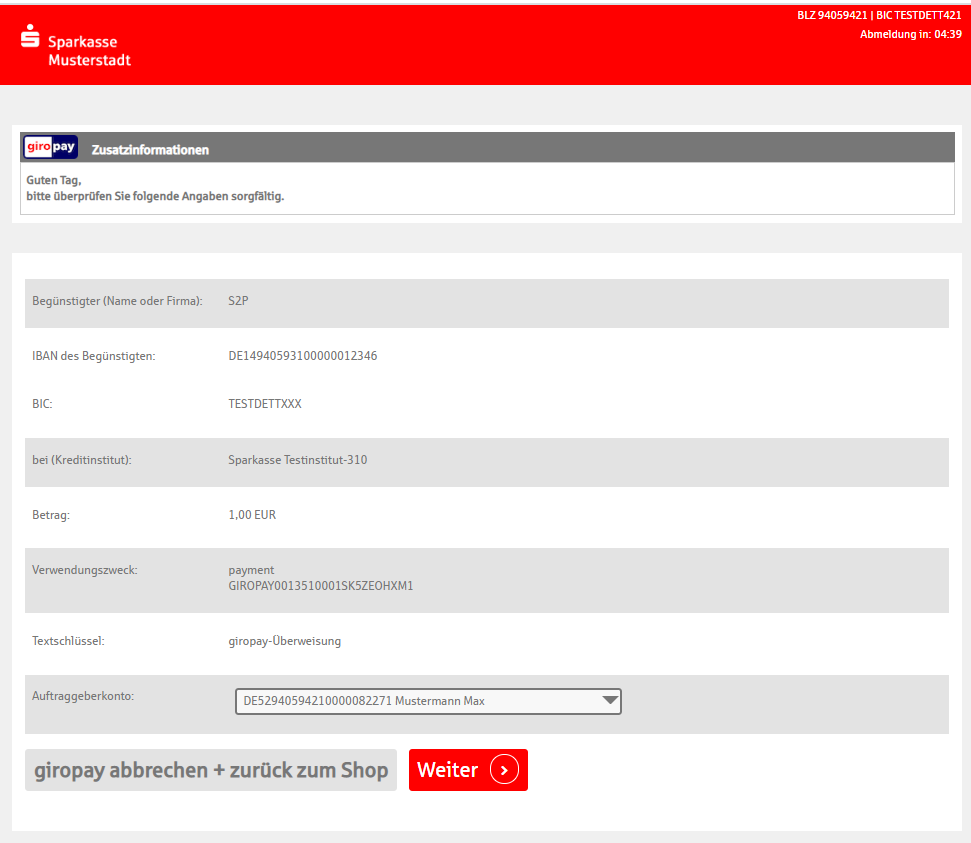

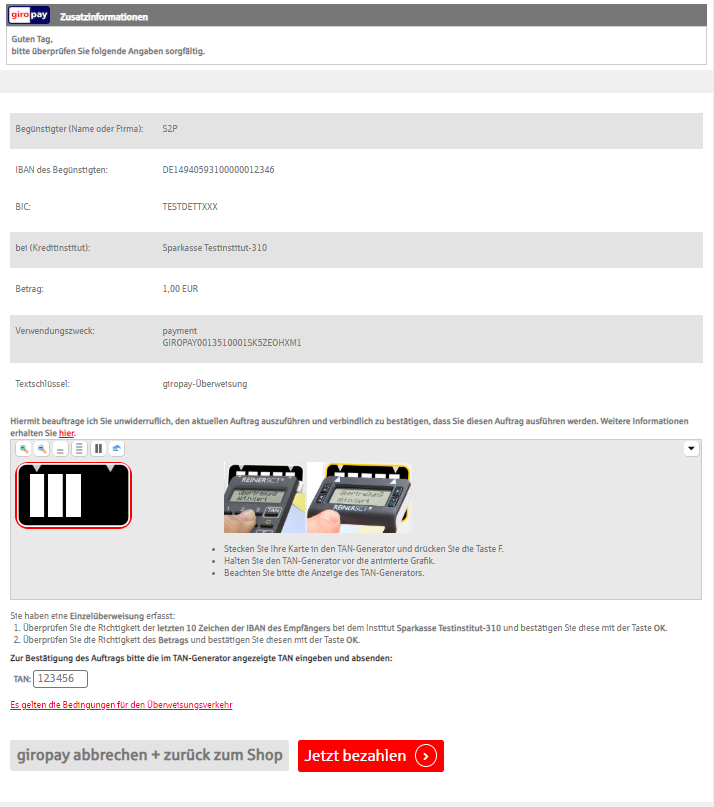

Giropay Test Data

Testing details for merchant integration using Giropay are not available

The payment status can have the following values: Open, Success, Failed and Cancelled.

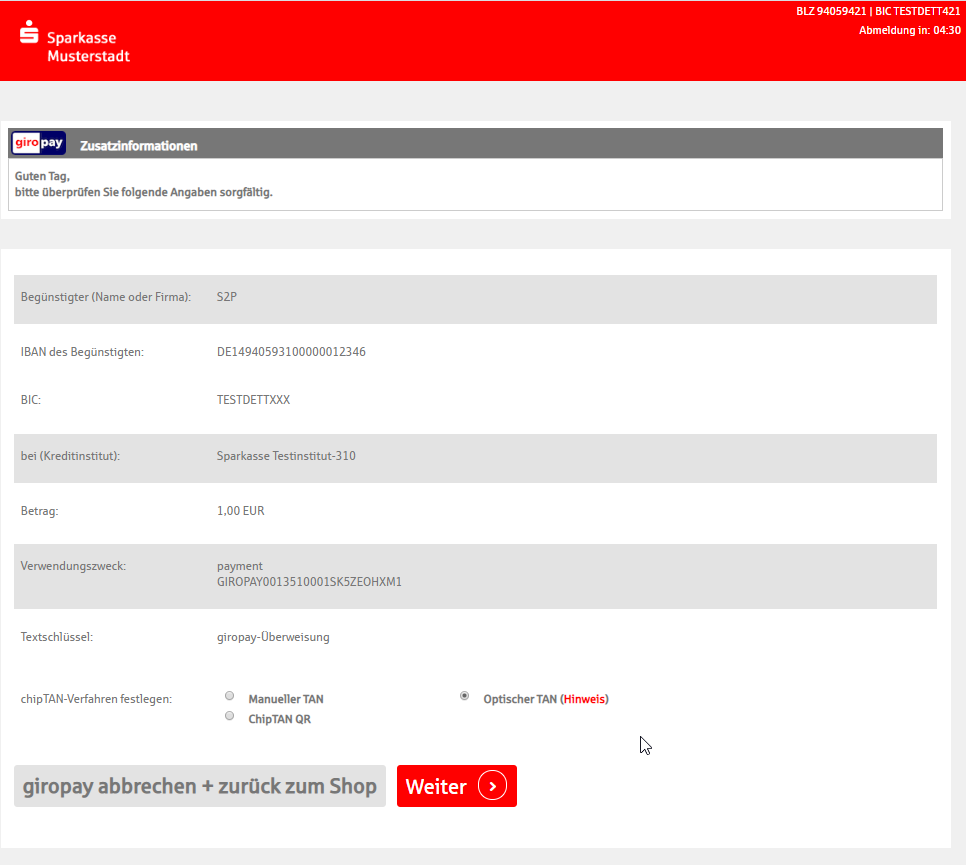

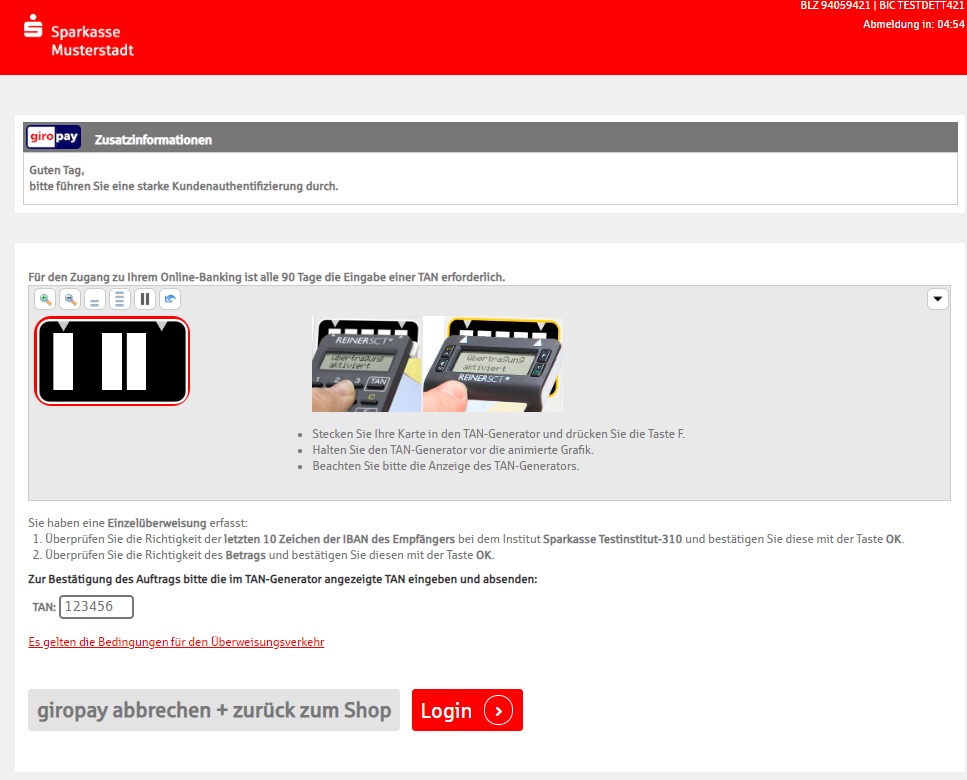

Giropay Payment Flow

-

The Customer searches and selects his bank from the list. The test Bank must contain the BIC: TESTDETT421!

-

The Customer enters his Login Name and PIN. The test Login Name is chiptanscatest2 and the test Pin is formed from a 5 digit number: 12345.

-

The Customer selects a mobile device for SMS confirmation:

-

The customer verifies the payment details received and enters the TAN number to confirm the order. The test TAN number to be used: 123456.

-

The customer is redirected to the provider’s confirmation page, where the user can confirm the Client account to be used to complete the payment:

-

After choosing the account, the customer is required to confirm the TAN again:

-

Upon completion of the payment flow, the customer is redirected back to your ReturnURL.

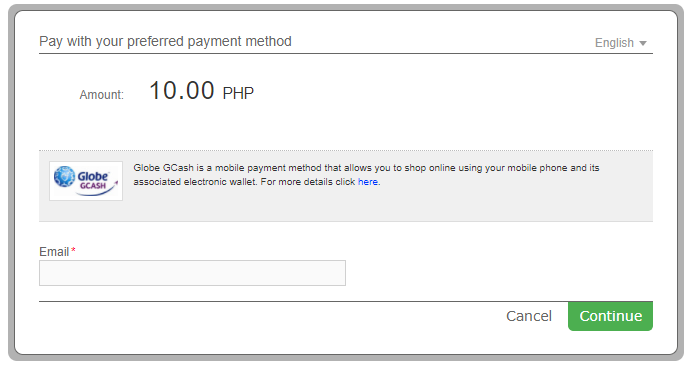

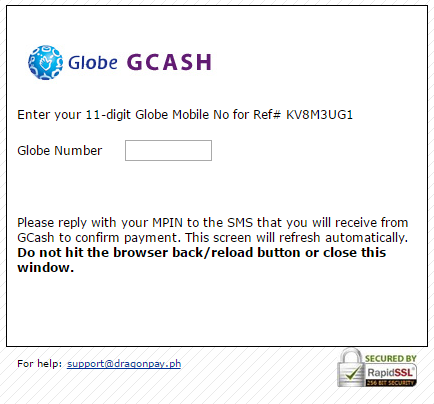

Globe GCash Test Data

For Globe GCash payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

Globe GCash Payment Flow

-

The Customer enters his email address.

-

The Customer enters his Globe phone number.

-

The customer receives an SMS from GCash and confirms the payment by responding with his received MPIN.

-

Upon completion of the payment flow the customer is redirected back to your ReturnURL.

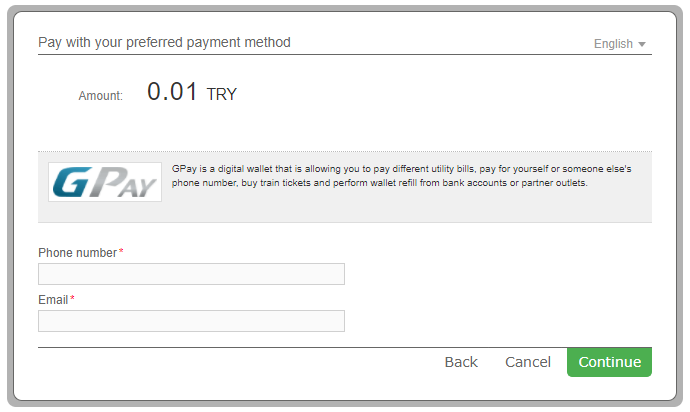

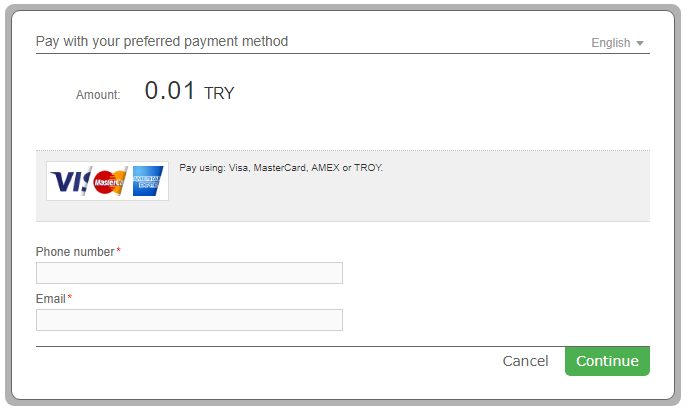

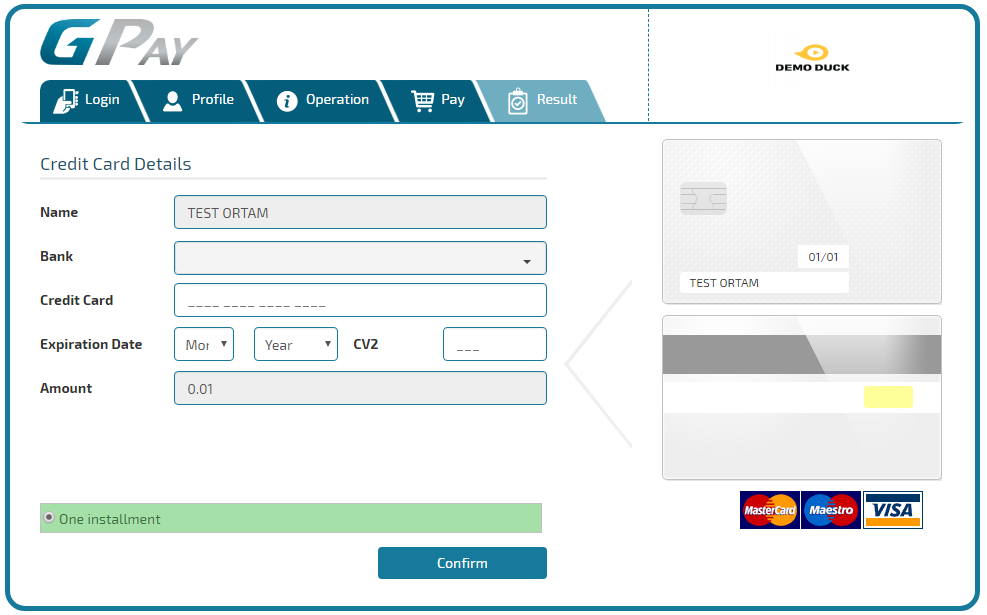

GPay Test Data

For GPay payment method test data is available on demand. Please contact our support department at technicalsupport-s2p@nuvei.com for more information.

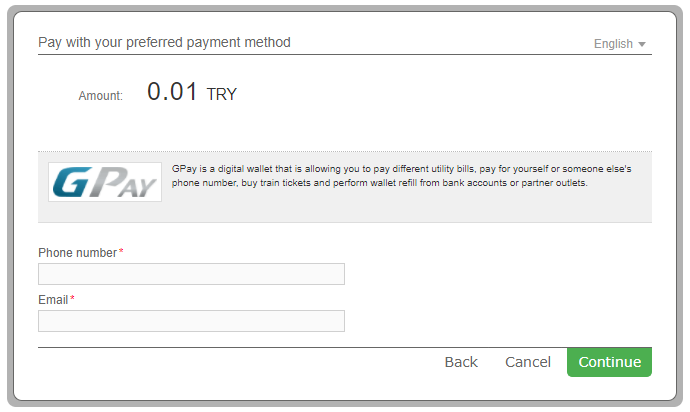

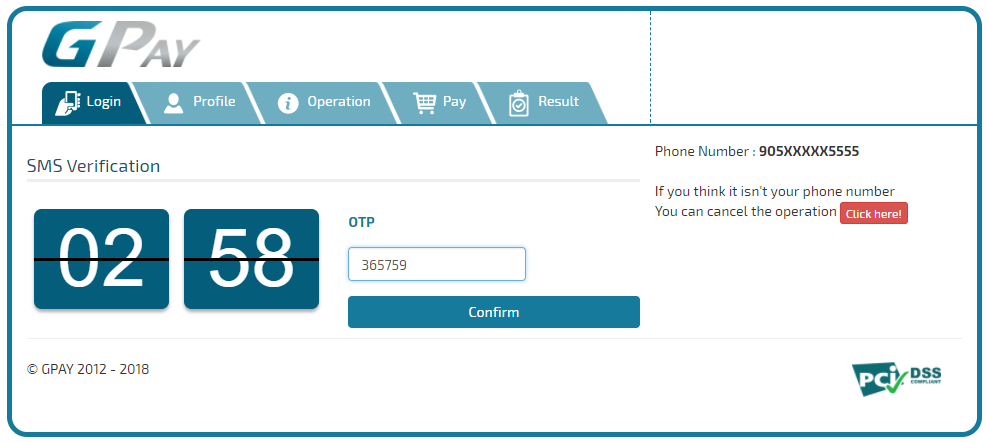

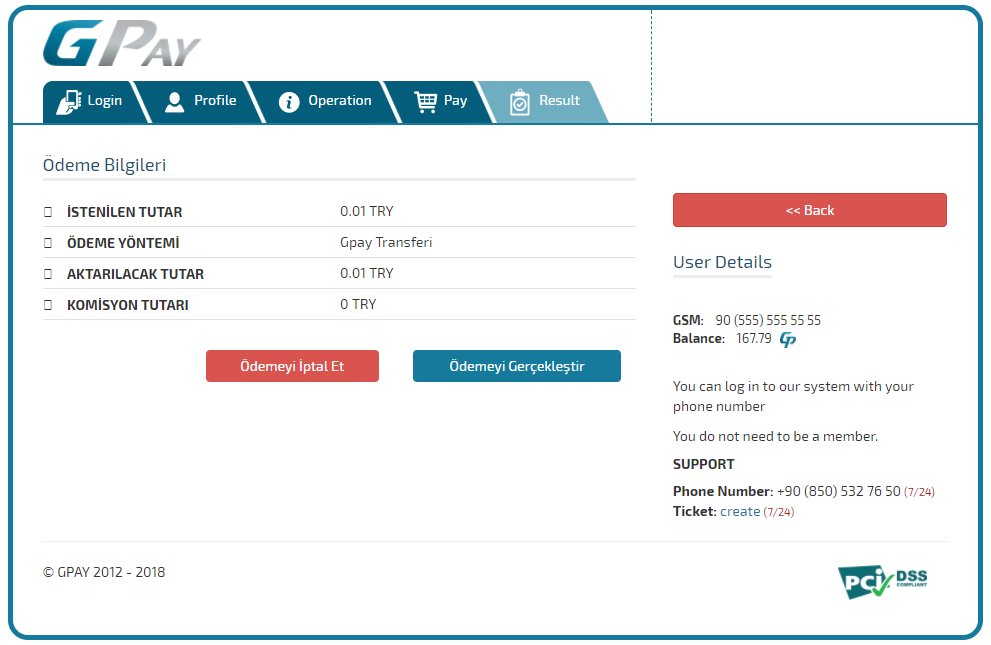

GPay Payment Flow

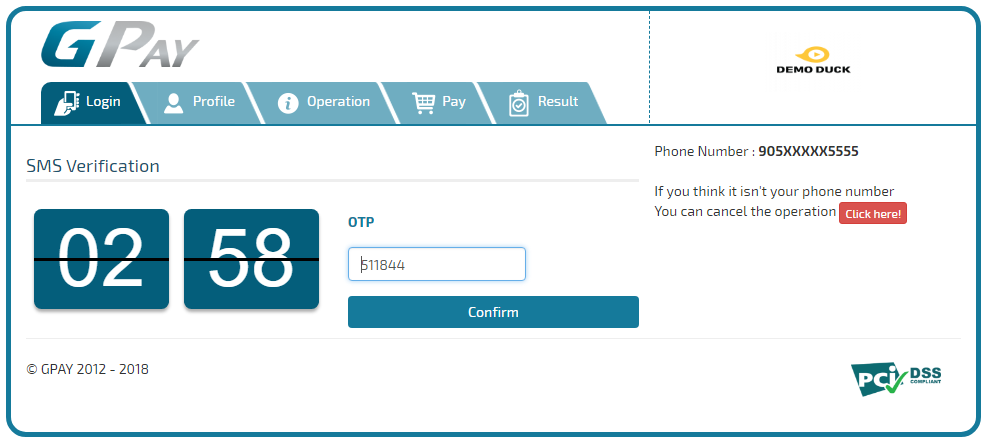

- The customer enters his phone number and his email address.

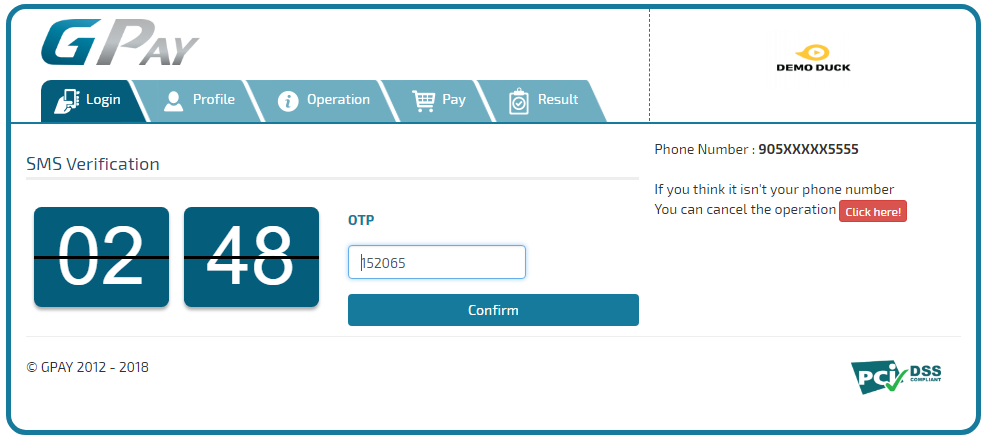

- The customer receives a 6-digit verification code at the phone number that he previously added. He needs to enter the 6-digit code and click the Confirm button.

- The customer sees the payment details and he needs to choose the payment option in order to complete the payment.

- The customer verifies the payment information and the user details and completes the transaction by clicking on the Perform Payment button.

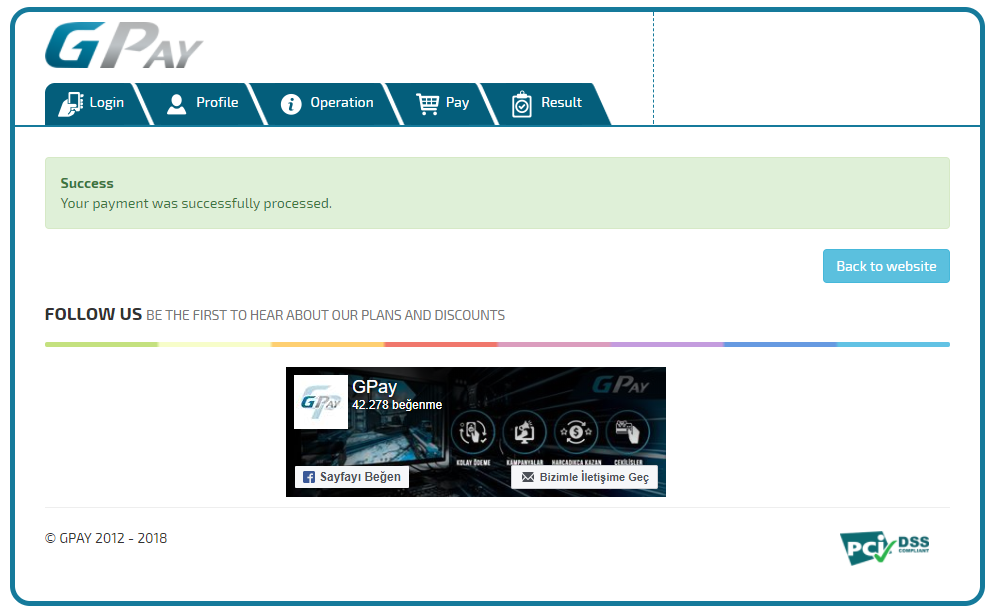

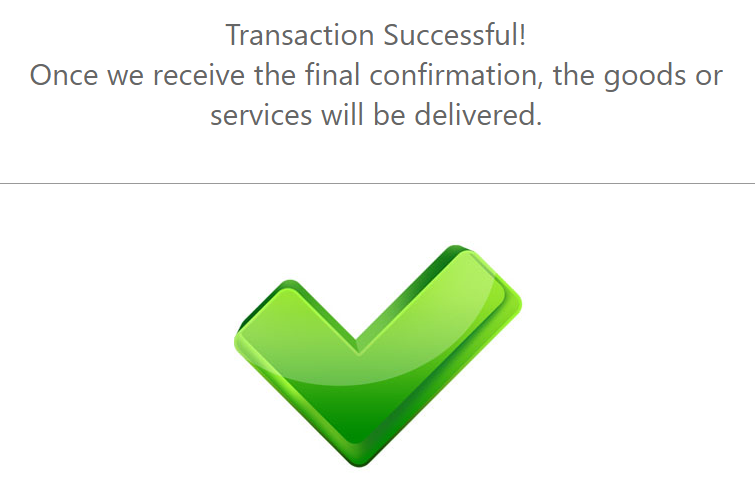

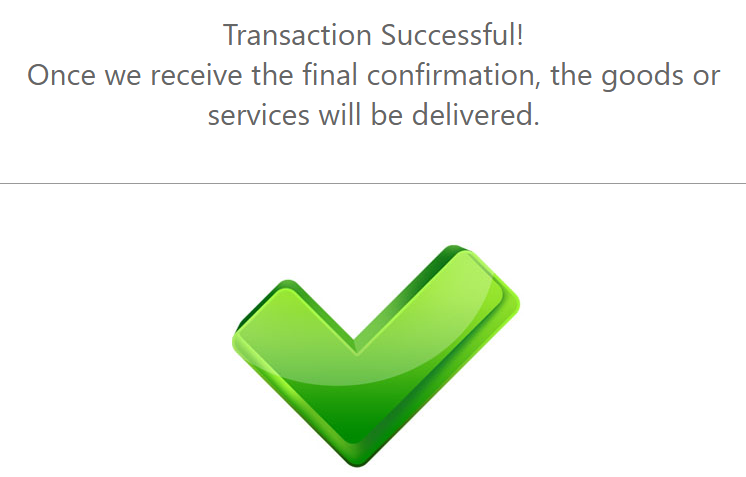

- The customer receives a message that the payment has been completed correctly.

- Upon completion of the payment flow, the customer is redirected to your ReturnUrl.

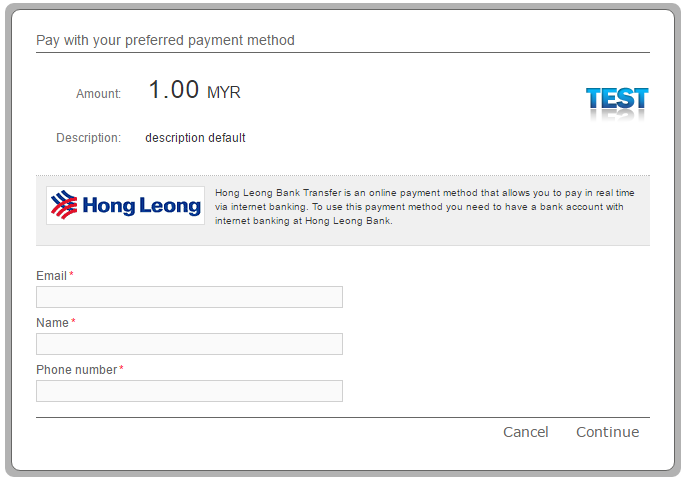

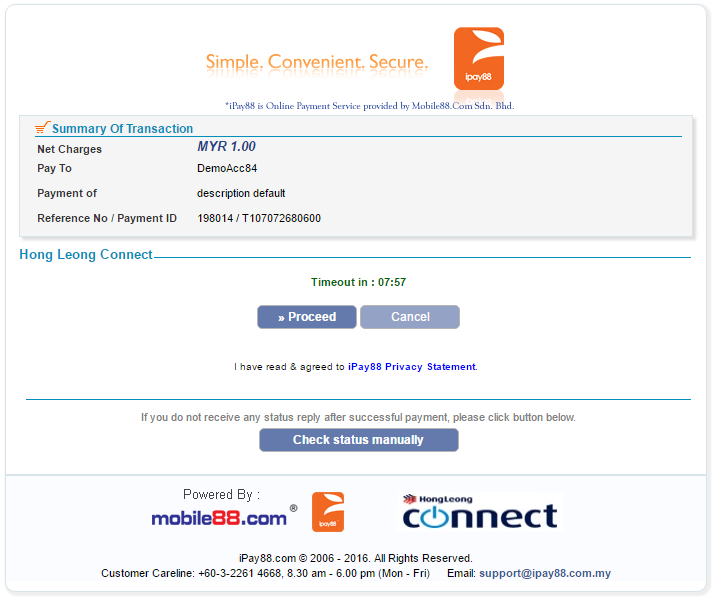

Hong Leong Bank Transfer Test Data

For Hong Leong Bank Transfer payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

Hong Leong Bank Transfer Payment Flow

-

The customer enters his email address, name and phone number.

-

The customer is shown the details of his payment and proceeds to pay with Hong Leong Bank Transfer.

-

The customer logs in to his account and completes the payment.

-

Upon completion of the payment flow, the customer is redirected back to your ReturnURL.

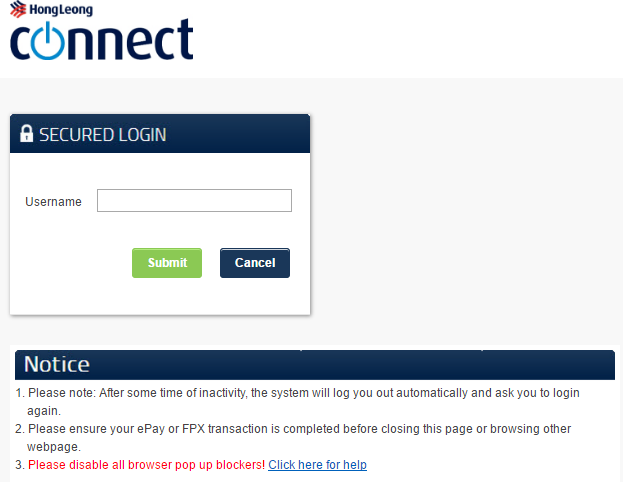

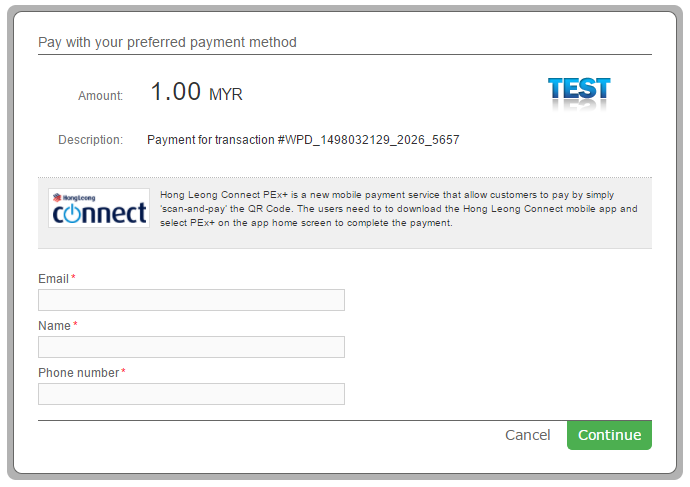

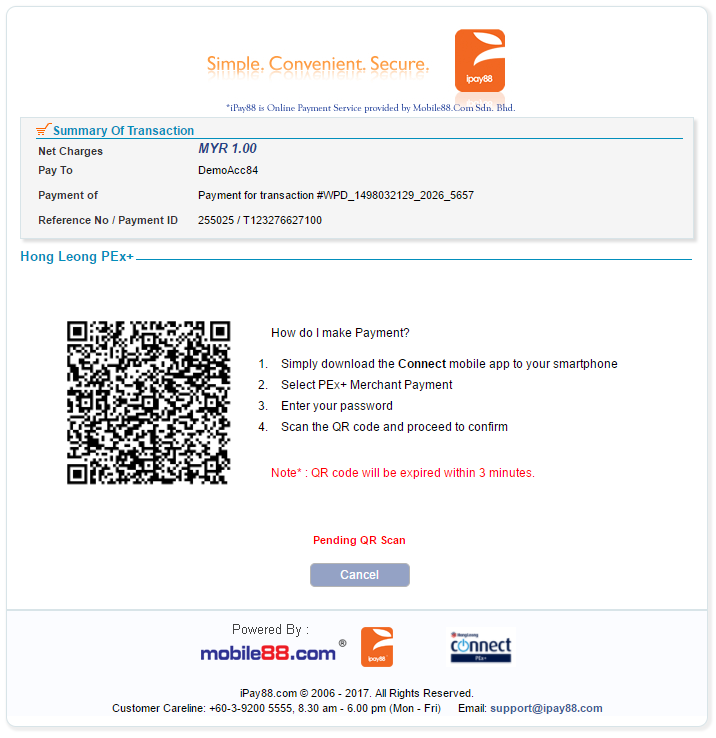

Hong Leong Connect PEx+ Test Data

For Hong Leong Connect PEx+ payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

Hong Leong Connect PEx+ Payment Flow

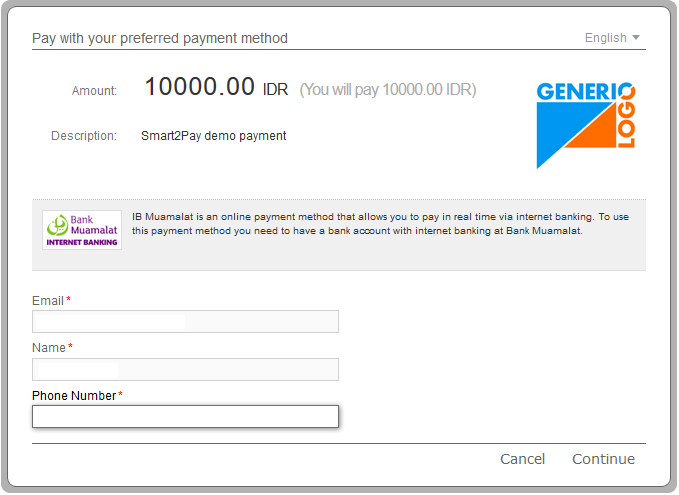

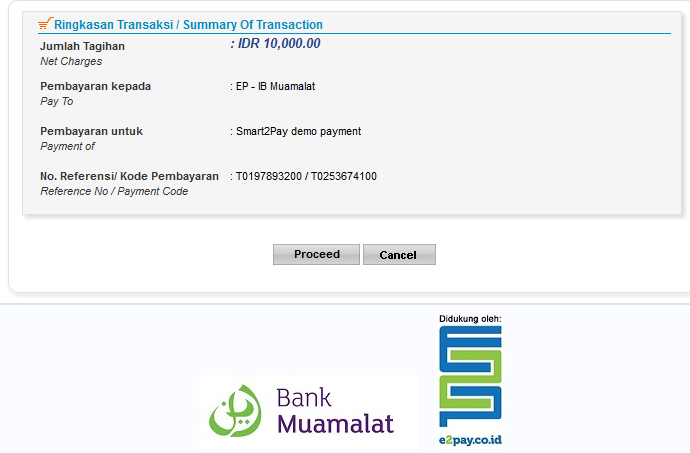

IB Muamalat Test Data

For IB Muamalat payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

IB Muamalat Payment Flow

-

The customer enters his email address, name and phone number.

-

The customer receives the details of the payment and proceeds to pay with IB Muamalat.

-

The customer logs in to his account with his User ID and password and makes the payment.

-

Upon completion of the payment flow, the customer is redirected back to your ReturnURL.

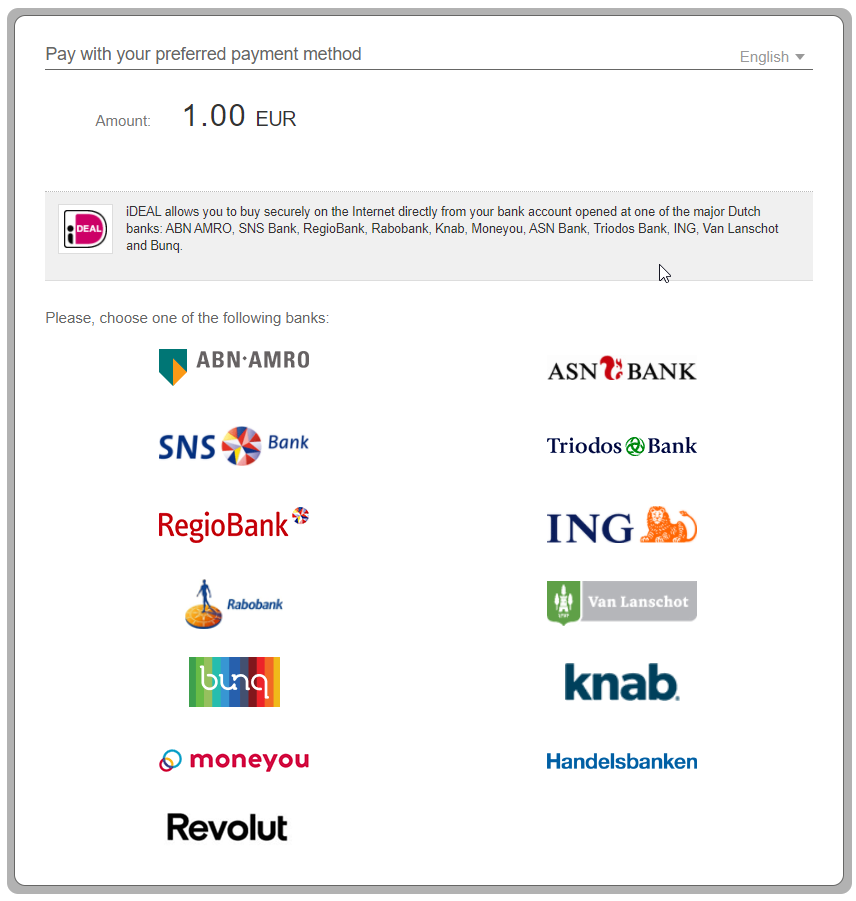

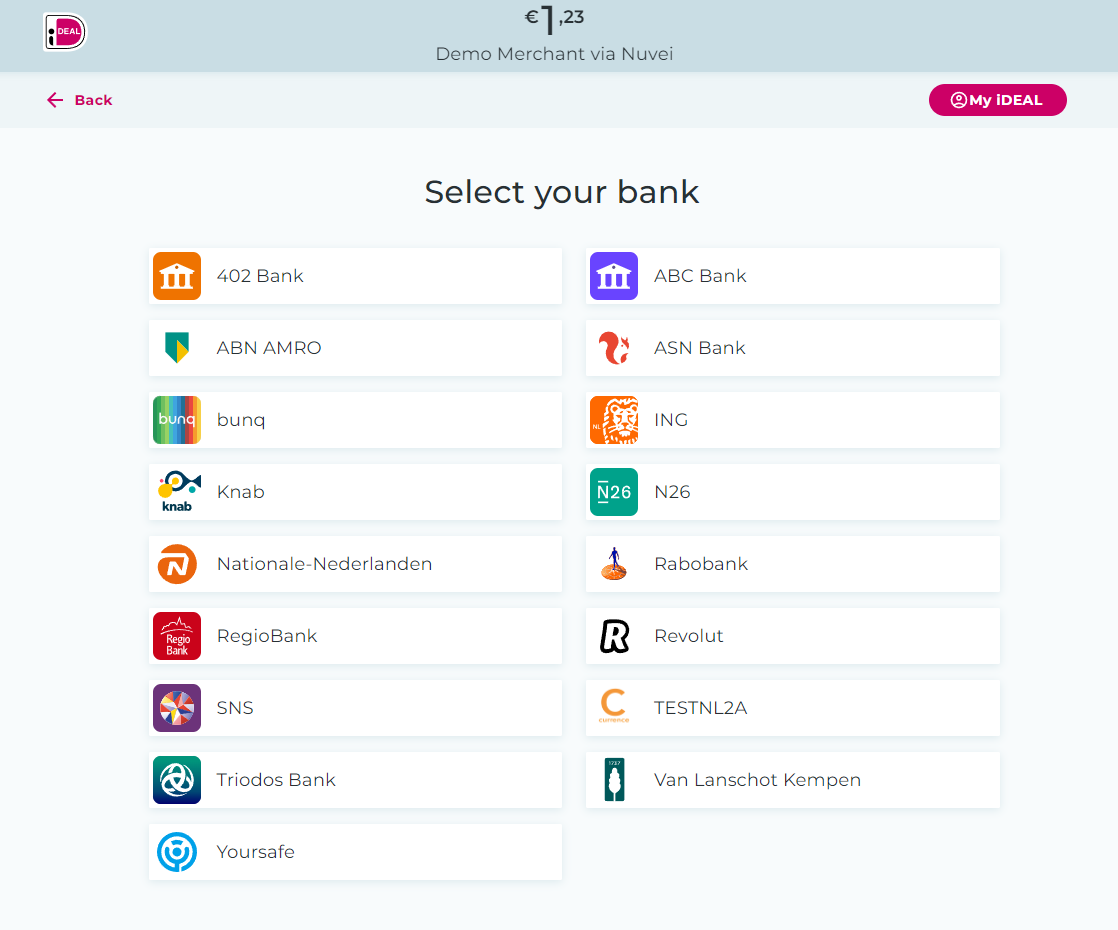

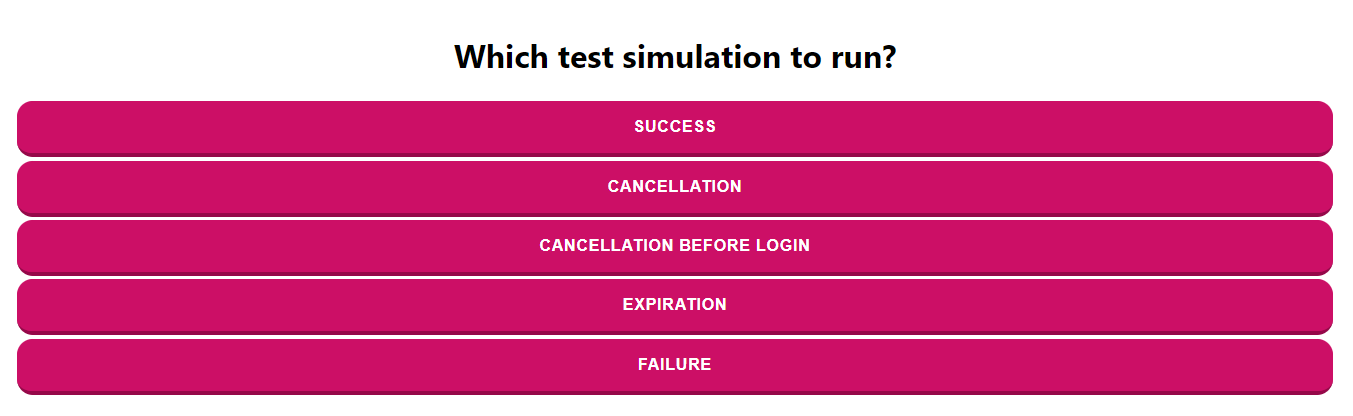

iDEAL Test Data

In order for you to test the iDEAL payment method successfully, please use the below test data.

| iDEAL Test Data | |

|---|---|

| Data | Value |

| Your bank: | InternalIssuerSimulation (for Fortis) |

| Issuer Simulator (for ING) | |

| iDEAL Test Data | ||||||

|---|---|---|---|---|---|---|

| Amount | Value | 100 | 200 | 300 | 400 | 500 |

| Status | Success | Cancelled | Expired | Open | Failed | |

The MethodOptionID parameter for iDEAL method can have the following values:

| iDEAL Method Option IDs | ||

|---|---|---|

| Method Option ID | Description | |

| 10 | ABN AMRO | |

| 11 | ASN Bank | |

| 13 | SNS Bank | |

| 20 | Triodos Bank | |

| 21 | RegioBank | |

| 37 | ING | |

| 38 | Rabobank | |

| 39 | Van Lanschot Bankiers | |

| 45 | Knab | |

| 321 | Bunq | |

| 391 | Moneyou | |

| 421 | Handelsbanken | |

| 438 | Revolut | |

| 566 | N26 | |

| 573 | Nationale-Nederlanden | |

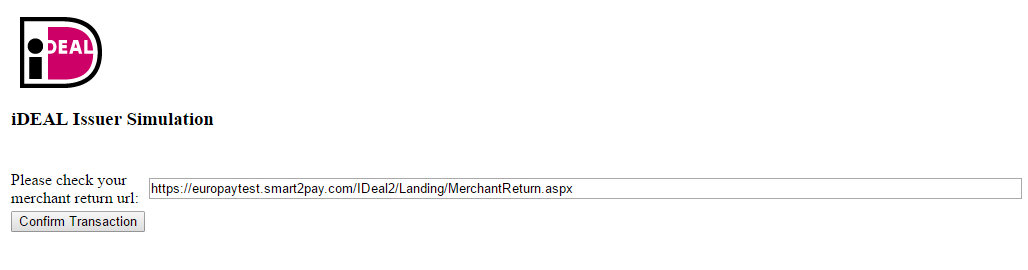

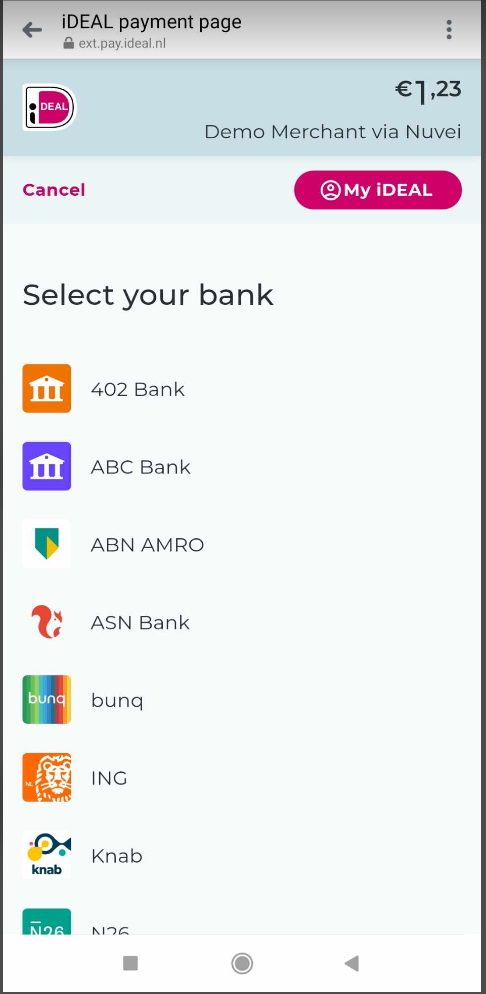

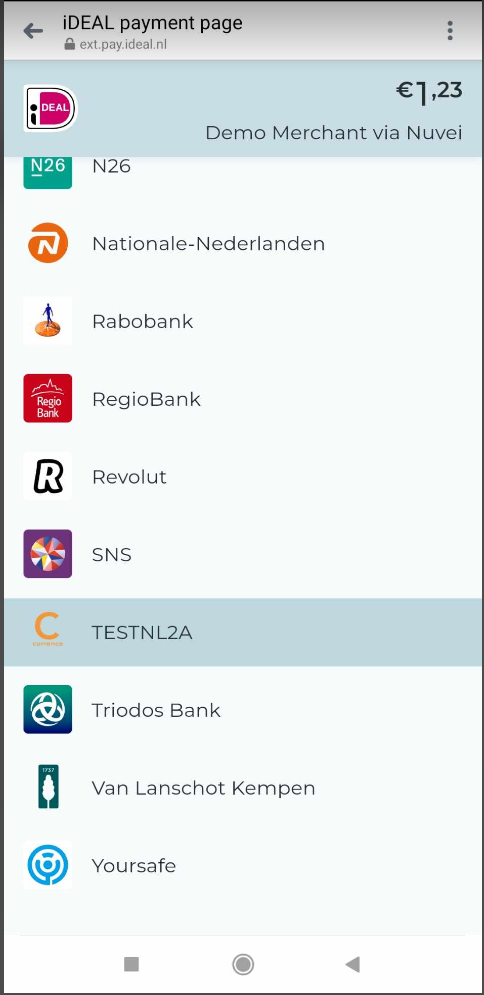

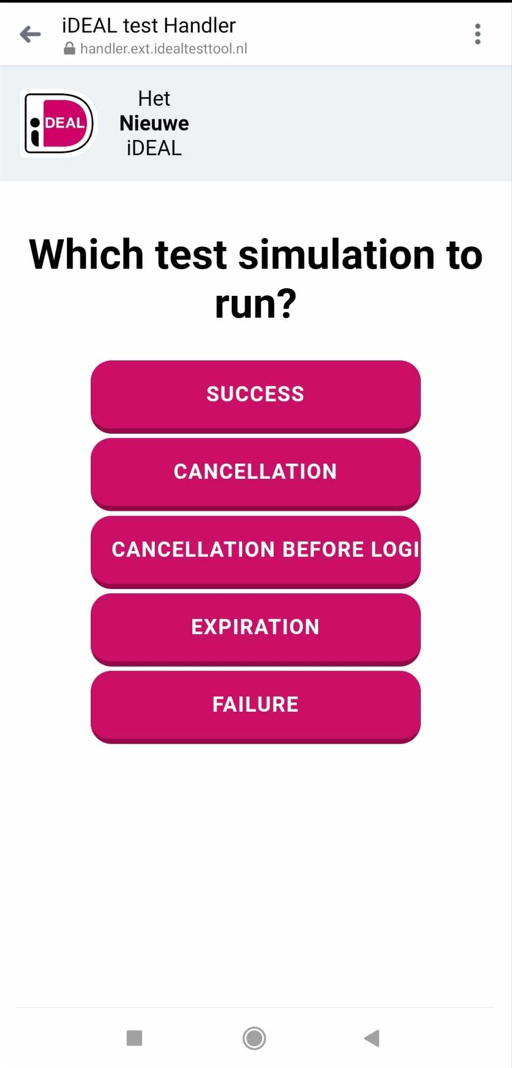

iDEAL Payment Flow

- The customer selects the bank from the list.

- The customer confirms the transaction by clicking on the Confirm Transaction button.

- Upon completion of the payment flow, the customer is redirected to your ReturnUrl.

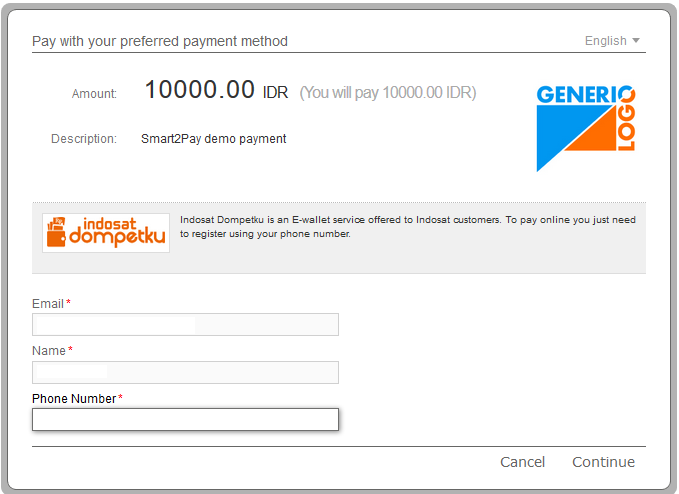

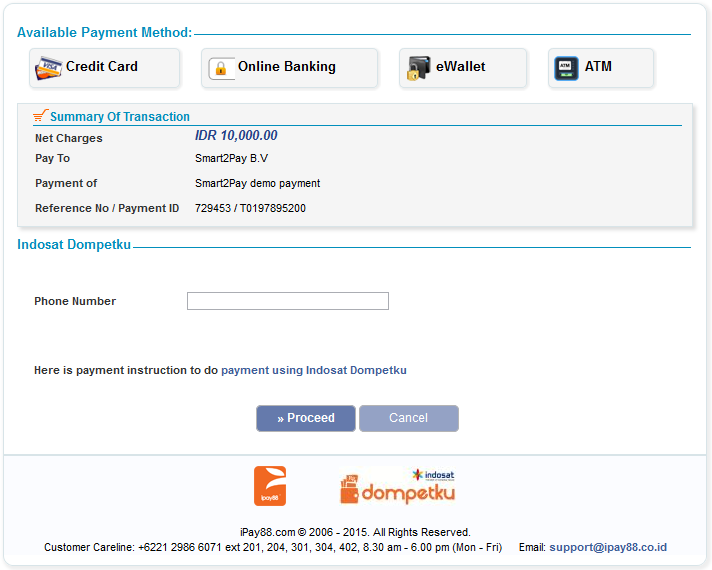

Indosat Dompetku Test Data

For Indosat Dompetku payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

Indosat Dompetku Payment Flow

Ininal Test Data

For Ininal payment method test data is available on demand. Please contact our support department at technicalsupport-s2p@nuvei.com for more information.

Ininal Payment Flow

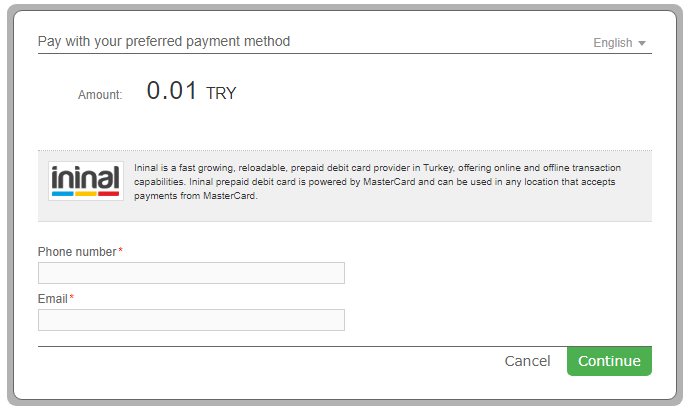

- The customer enters his phone number and his email address.

- The customer receives a 6-digit verification code at the phone number that he previously added. He needs to enter the 6-digit code and click the Confirm button.

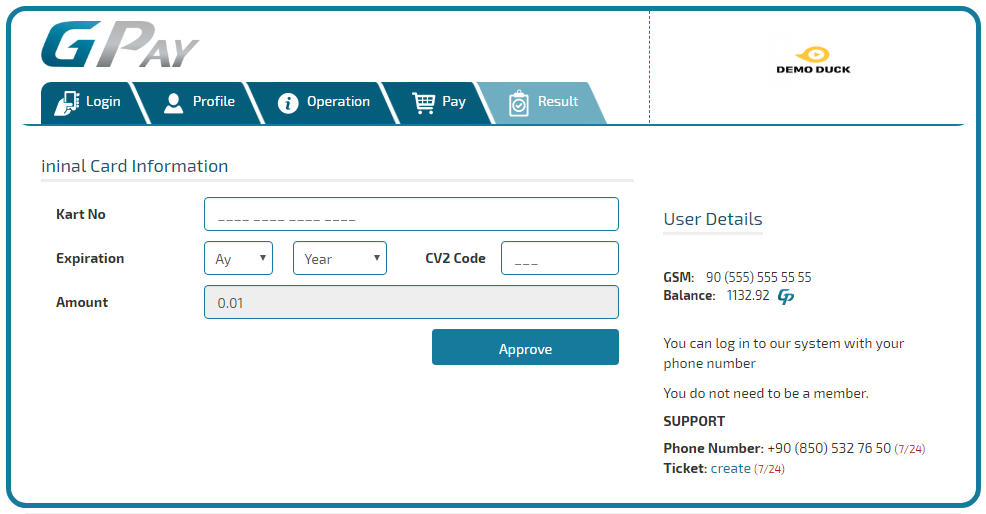

- The Customer enters his Ininal card information and confirms the payment.

- Upon completion of the payment flow, the customer is redirected to your ReturnUrl.

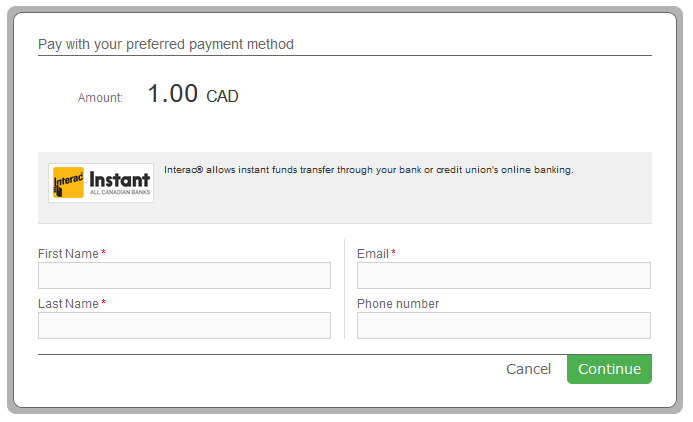

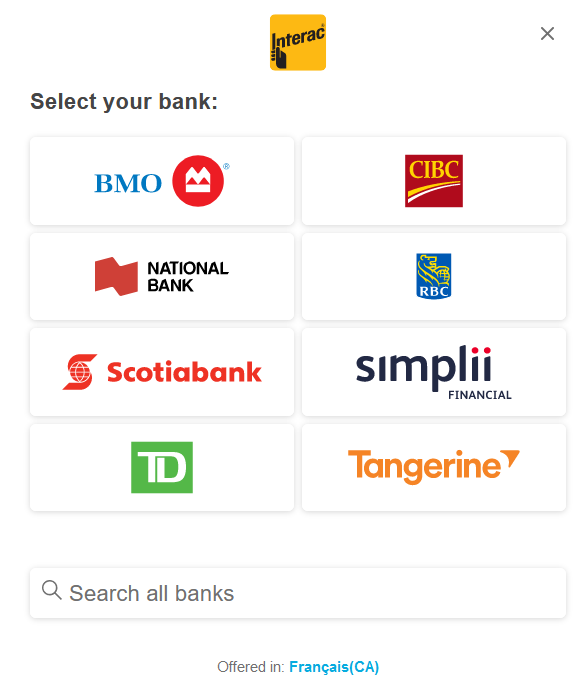

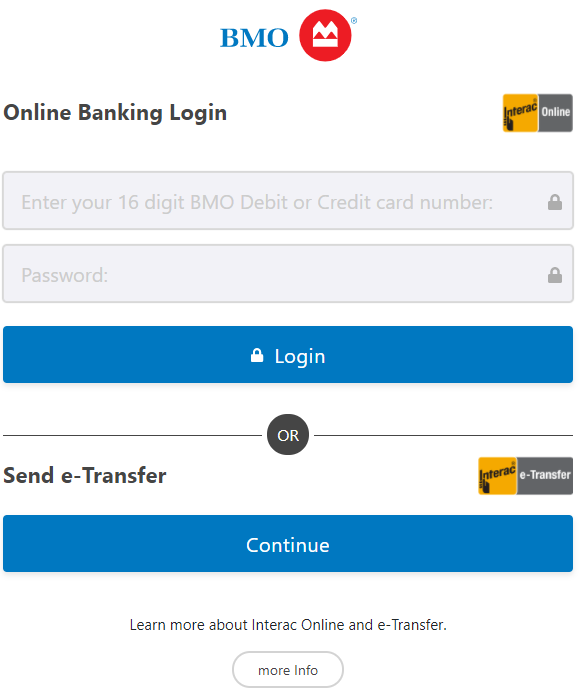

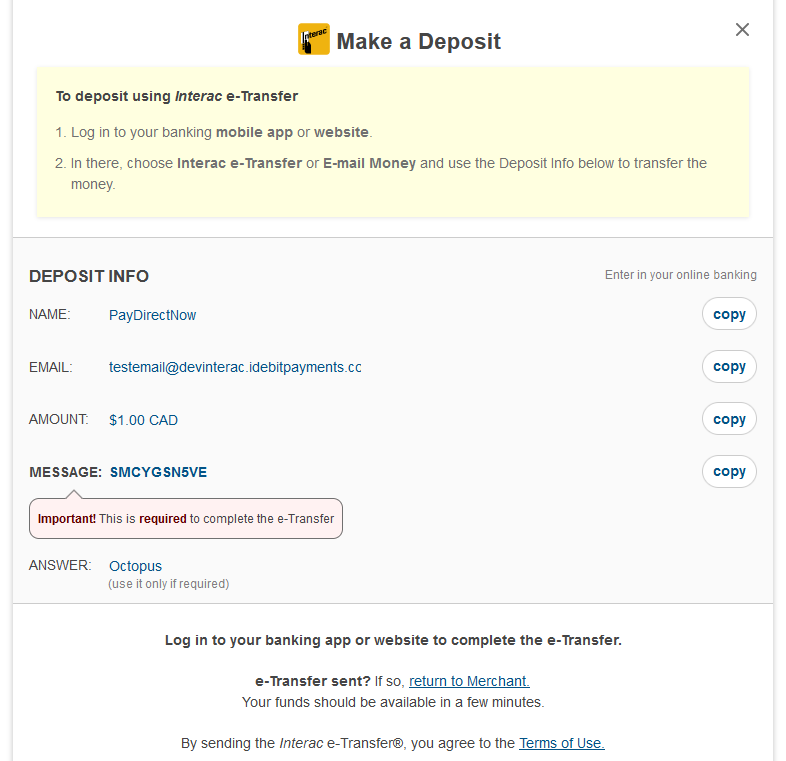

Interac Instant Test Data

See how Interac Instant works with the payment flows for Interac e-Transfer. In order for you to test the Interac Instant payment method successfully, please use the test data provided. You will need a Canada VPN connection in order to successfully perform an end to end test.

Interac Instant – Interac e-Transfer Payment Flow

| Interac Instant Test Data – Interac e-Transfer Option | ||

|---|---|---|

| Data | Value | |

| First Name: | Larry | |

| Last Name: | Johnson | |

| Email Address: | Enter any valid email address. Example: person@test.com | |

| Phone Number: | Enter any 10 digit number. Example: 0745123456 | |

- The customer enters his email address, name and phone number.

- The customer is redirected to the Interac Instant app where he chooses his Bank.

- The customer chooses to pay via Interac e-Transfer.

- The customer is redirected to the payment info page where he can see all the information needed to make an Interac e-Transfer deposit. The customer needs to go to his bank’s mobile app or website to complete the transfer.

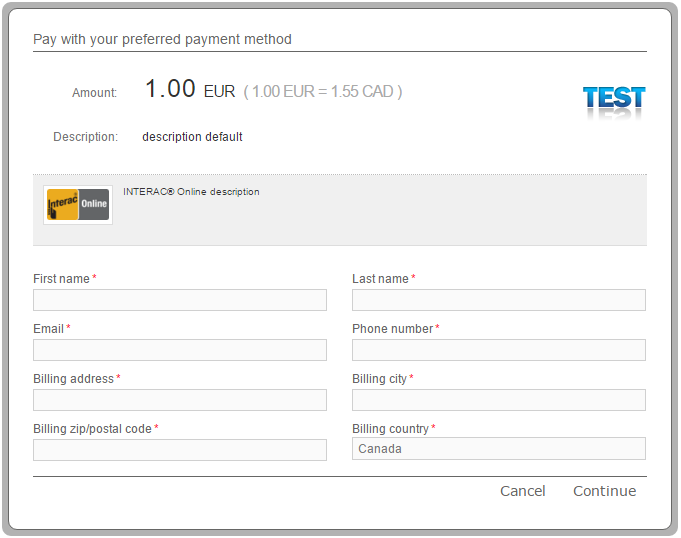

INTERAC@Online Test Data

For INTERAC@Online payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

INTERAC@Online Payment Flow

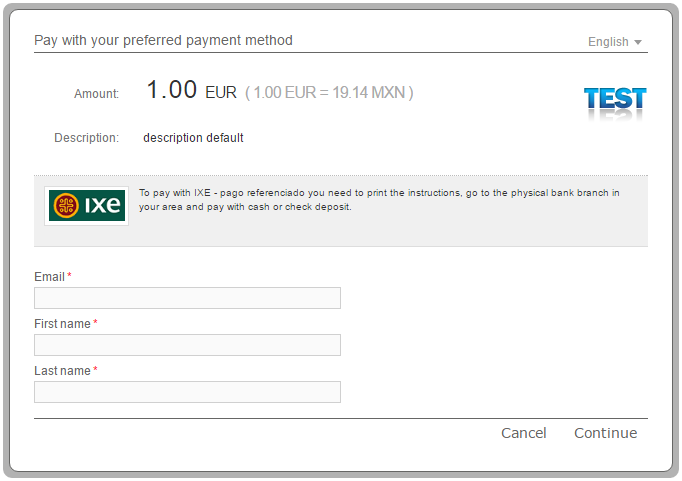

IXE Pago referenciado Test Data

In order for you to test IXE Pago referenciado payment method successfully, you don’t need any given test data.

IXE Pago referenciado Payment Flow

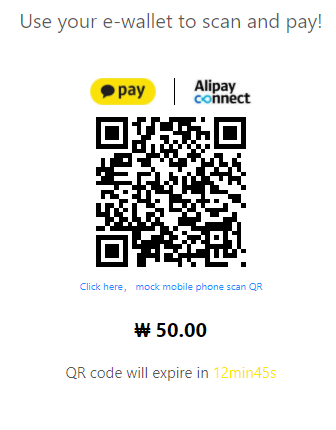

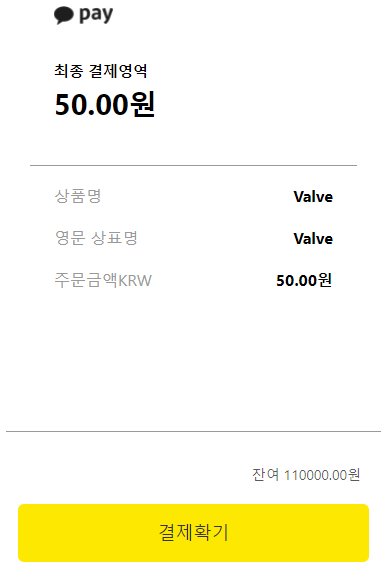

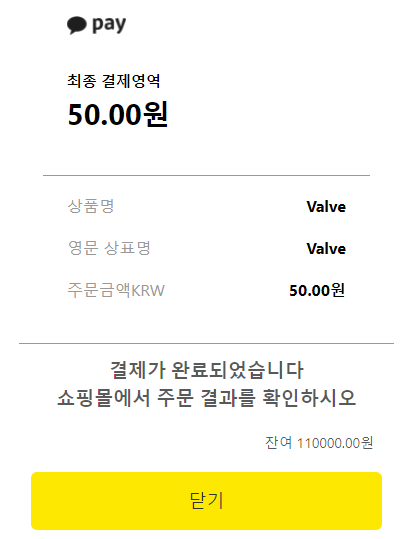

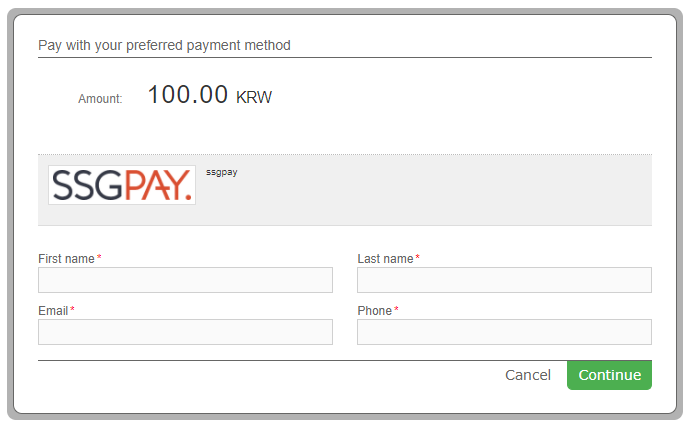

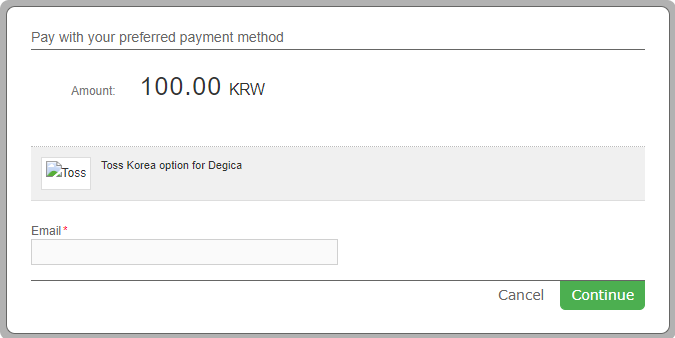

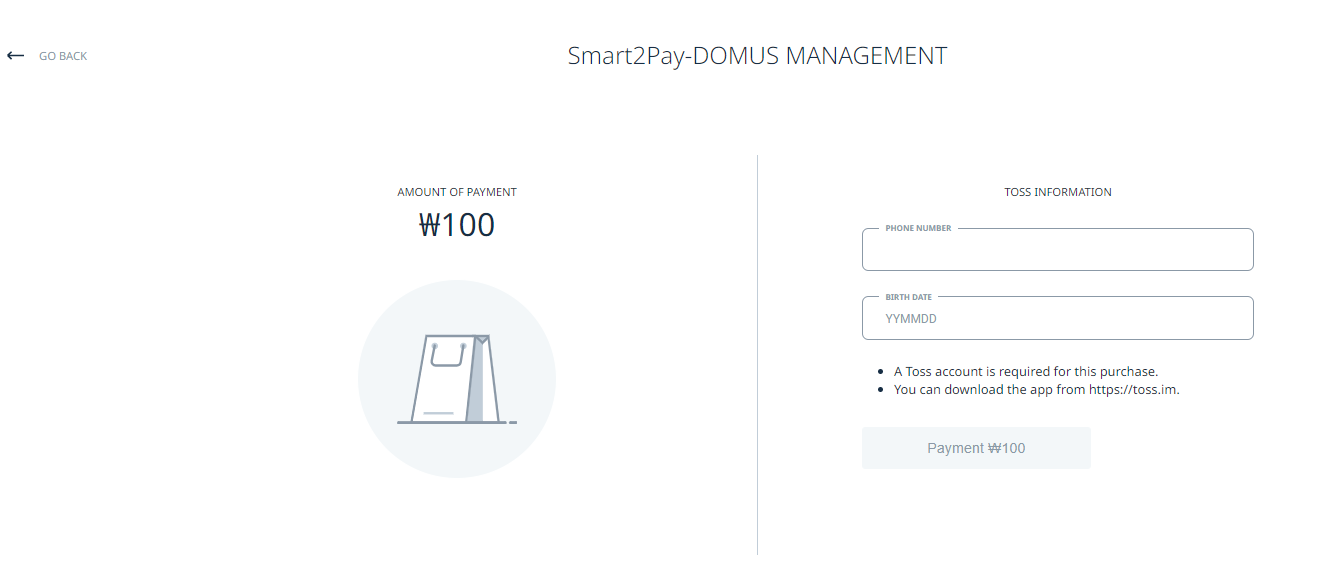

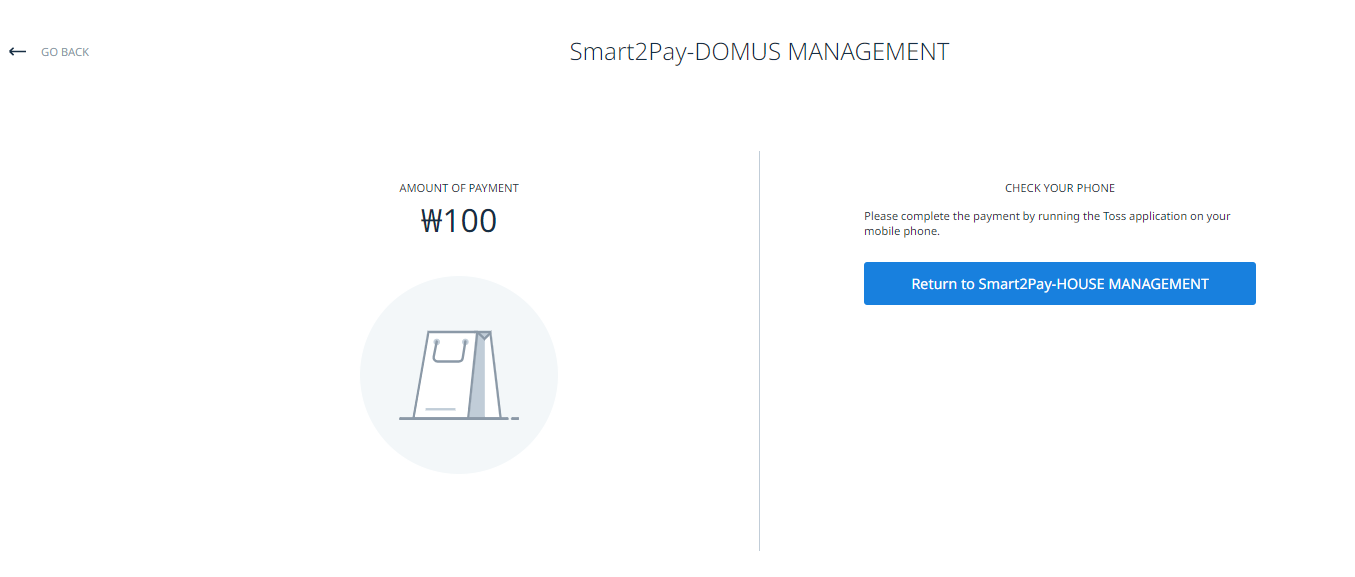

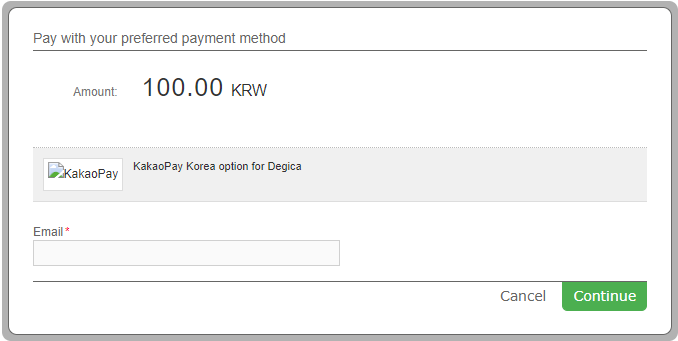

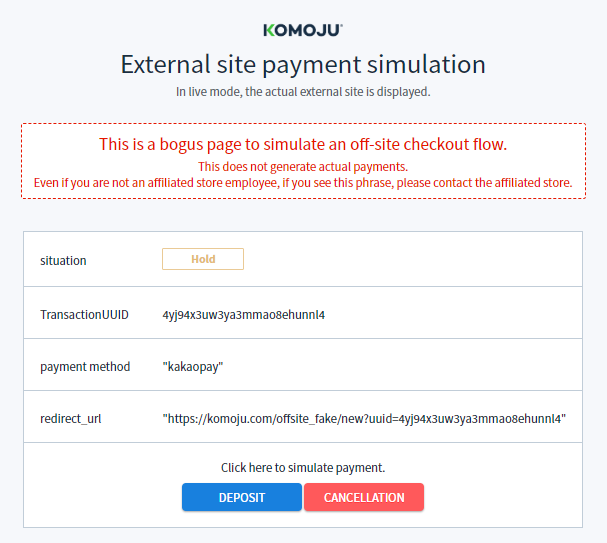

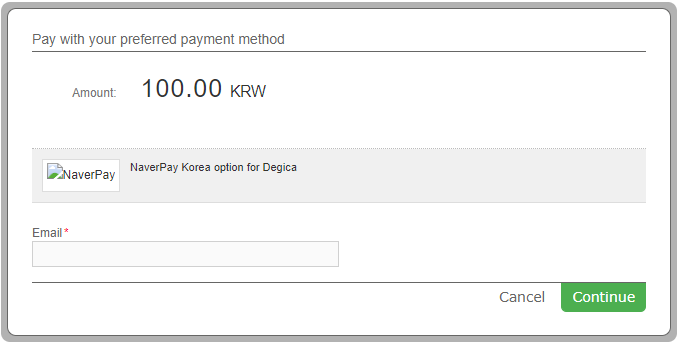

KakaoPay Test Data

For KakaoPay payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

Kakaopay Payment Flow

- The customer is redirected to the KakaoPay website where they are prompted to scan a QR code using the KakaoPay app. For testing purposes the minimum payment amount is 50 KRW.

- The customer confirms the payment using biometric verification or their 6-digit PIN.

- The customer sees the payment details and a message confirmation of the payment.

- Upon completion of the payment flow, the customer is redirected to your ReturnUrl.

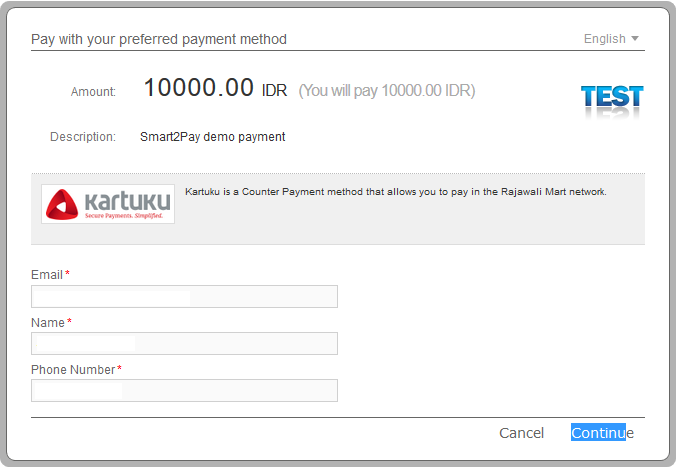

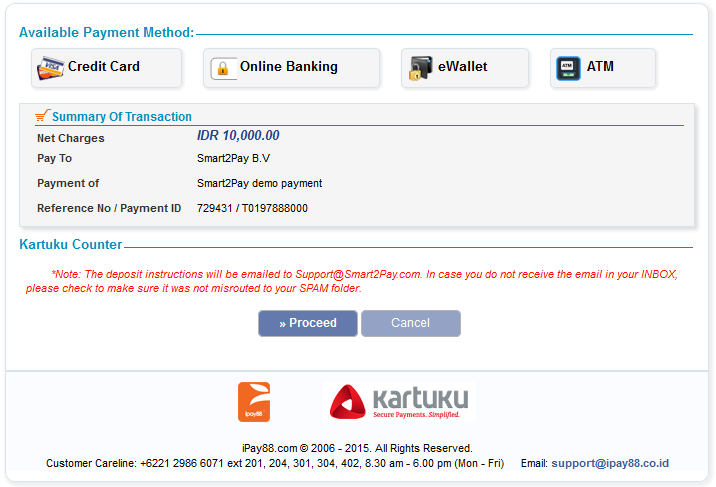

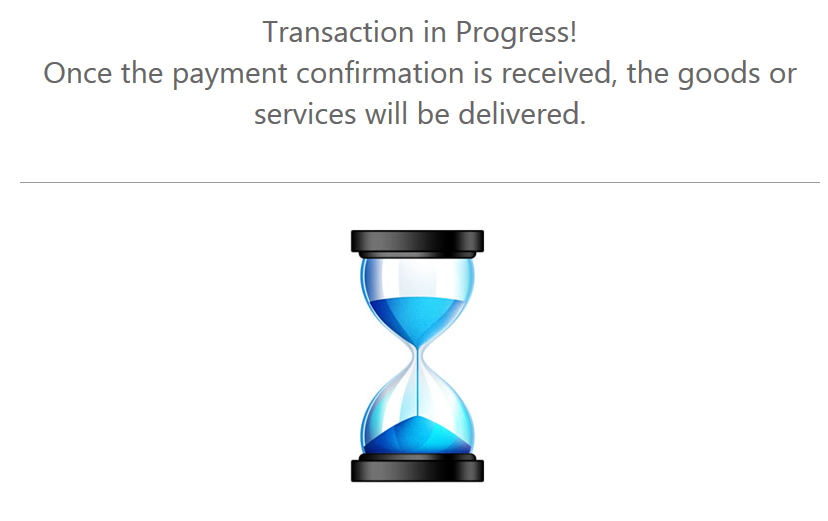

Kartuku Test Data

For Kartuku payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

Kartuku Payment Flow

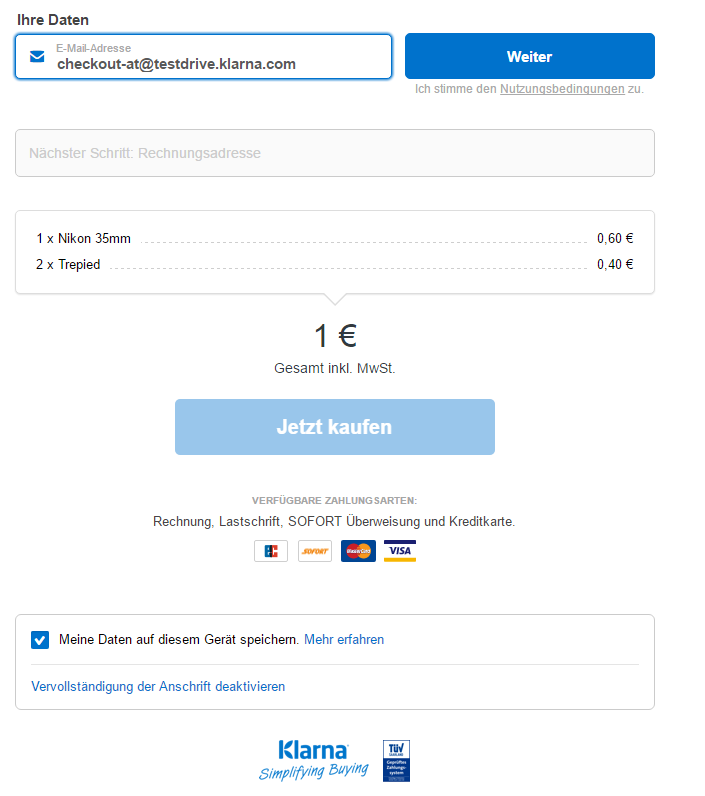

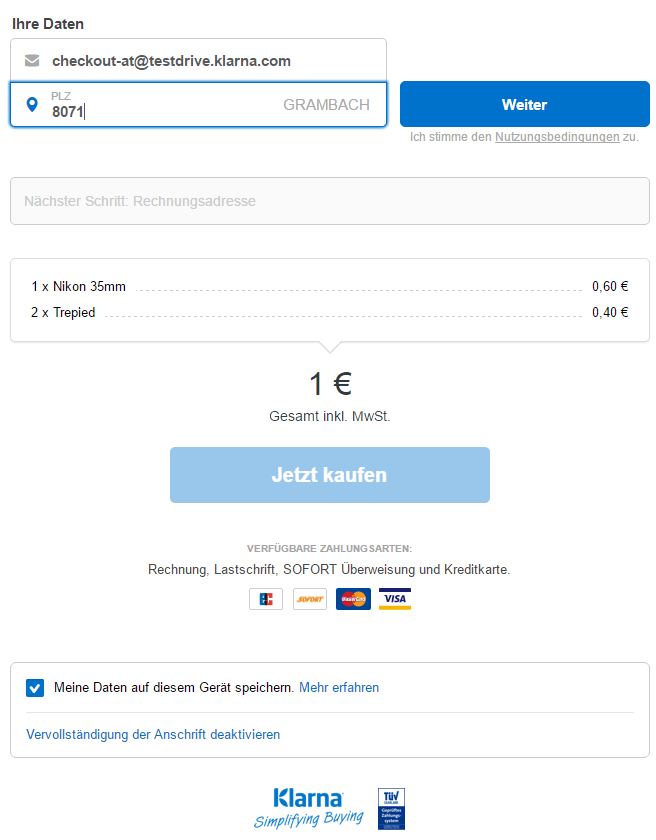

Klarna Checkout Test Data

In order for you to test Klarna Checkout payment method successfully, please use the below test data.

| Austria | ||

|---|---|---|

| Testing environment | https://checkout.testdrive.klarna.com | |

| Merchant ID (eid) and shared secret | Please use the Merchant ID (eid) and shared secret provided to you by Klarna. | |

| Email address | checkout-at@testdrive.klarna.com | |

| Postal code | 8071 | |

| First name | Testperson-at | |

| Last name | Approved | |

| Street | Klarna-straße 1/2/3 | |

| House number | 1 | |

| City | Hausmannstätten | |

| Phone number | 0676 2600000 | |

| The information above is exemplary, any credentials will work | ||

| Denmark | ||

|---|---|---|

| Testing environment | https://checkout.testdrive.klarna.com | |

| Merchant ID (eid) and shared secret | Please use the Merchant ID (eid) and shared secret provided to you by Klarna. | |

| The information above is exemplary, any credentials will work | ||

| Finland | |

|---|---|

| Testing environment | https://checkout.testdrive.klarna.com |

| Merchant ID (eid) and shared secret | Please use the Merchant ID (eid) and shared secret provided to you by Klarna. |

| Email address | checkout-fi@testdrive.klarna.com |

| Postal code | 28100 |

| Personal identity number | 190122-829F |

| Address | Kiväärikatu 10 |

| City | Pori |

| Phone number | 0401234567 |

| Germany | ||

|---|---|---|

| Testing environment | https://checkout.testdrive.klarna.com | |

| Merchant ID (eid) and shared secret | Please use the Merchant ID (eid) and shared secret provided to you by Klarna. | |

| Email address | checkout-de@testdrive.klarna.com | |

| Postal code | 41460 | |

| First name | Testperson-de | |

| Last name | Approved | |

| Street | Hellersbergstraße | |

| House number | 14 | |

| City | Neuss | |

| Phone number | 01522113356 | |

| The information above is exemplary, any credentials will work | ||

| Norway | |

|---|---|

| Testing environment | https://checkout.testdrive.klarna.com |

| Merchant ID (eid) and shared secret | Please use the Merchant ID (eid) and shared secret provided to you by Klarna. |

| Email address | checkout-no@testdrive.klarna.com |

| Postal code | 0563 |

| Personal identity number | 01087000571 |

| First name | Testperson-no |

| Last name | Approved |

| Address | Sæffleberggate 56 |

| City | Oslo |

| Phone number | 40 123 456 |

| Sweden | |

|---|---|

| Testing environment | https://checkout.testdrive.klarna.com |

| Merchant ID (eid) and shared secret | Please use the Merchant ID (eid) and shared secret provided to you by Klarna. |

| Email address | checkout-se@testdrive.klarna.com |

| Postal code | 12345 |

| Personal identity number | 410321-9202 |

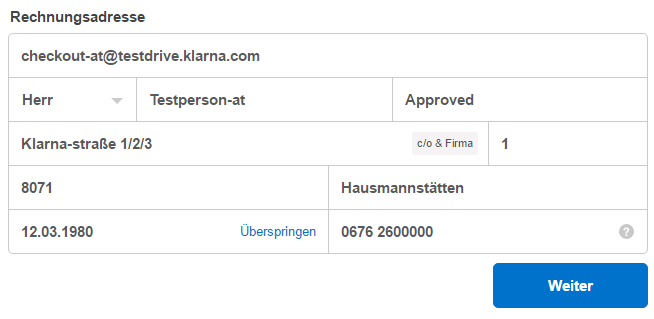

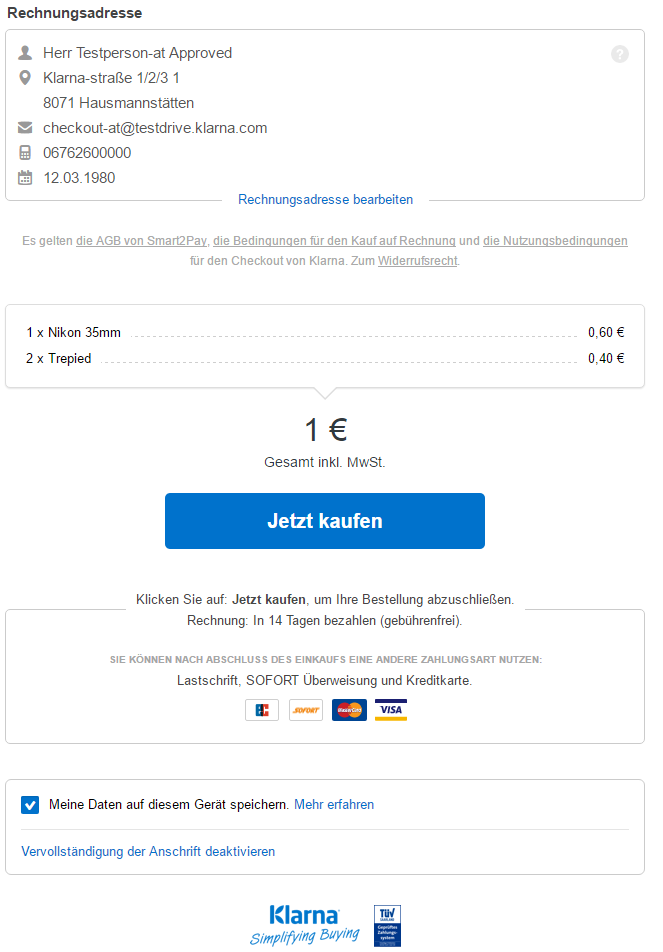

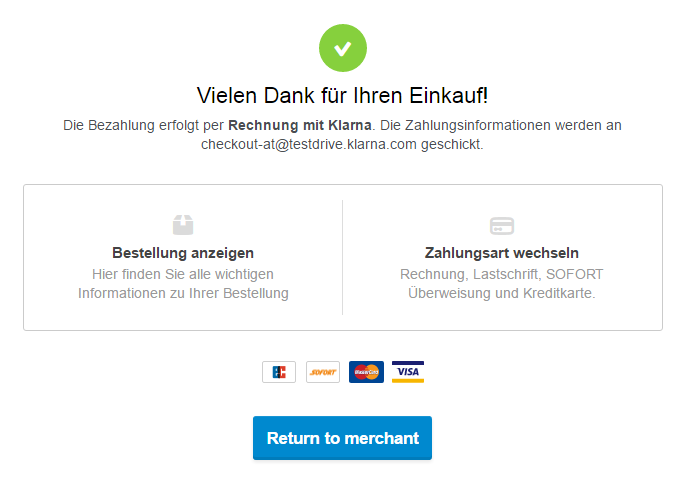

Klarna Checkout Payment Flow

-

The Customer enters his email address.

-

The customer enters the postal code.

-

The Customer fills in the form the required details for the billing address.

-

The customer reviews the transaction details and confirms the payment.

-

The customer receives the payment confirmation.

-

Upon completion of the payment flow the customer is redirected back to your ReturnURL.

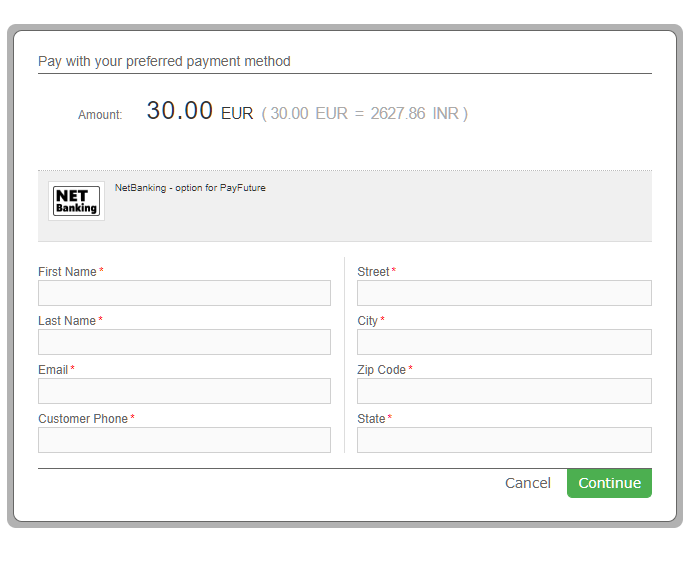

Klarna Payments Test Data

| Test Data | ||||||

|---|---|---|---|---|---|---|

| Data | Value | |||||

| Email: | Enter any valid email. Example: youremail@email.com | |||||

| First Name: | Enter any name. Example: Doe | |||||

| Last Name: | Enter any name. Example: Test | |||||

| Phone Number: | Enter any number up to 15 characters. See below table for format per country | |||||

| City | Enter any city. Example: London | |||||

| Street | Enter any street. Example: Street 1 | |||||

| Zip Code | Enter any number. Example: 12345 | |||||

| State | Mandatory to be sent for country US. Enter any valid state.

Example: CA. |

|||||

| Country: | Austria(AT), Belgium(BE), Canada(CA), Denmark(DK), Finland(FI), France(FR), Germany(DE), Ireland(IE), Italy(IT), Netherlands(NL), Norway(NO), Poland(PL), Portugal(PT), Spain(ES), Sweden(SE), Switzerland(CH), United Kingdom(UK), United States(US), Mexico(MX), Australia(AU) and New Zeeland(NZ) | |||||

| Countries supported in production: | Austria(AT), Belgium(BE), Canada(CA), Denmark(DK), Finland(FI), France(FR), Germany(DE), Ireland(IE), Italy(IT), Netherlands(NL), Norway(NO), Poland(PL), Portugal(PT), Spain(ES), Sweden(SE), Switzerland(CH), United Kingdom(UK), United States(US), Mexico(MX), Australia(AU) and New Zeeland(NZ) | |||||

| Article Type: | 4 = Discount, 5 = Physical, 6 = Shipping_fee, 7 = Sales_tax, 8 = Digital, 9 = Gift_card, 10 = Store_credit, 11 = Surcharge | |||||

Please note that depending on the country chosen by the customer, further personal details may be required from the customer, like: Date of Birth or Social Security Number (Personal ID Number):

| Additional Test Data required from the customer on the provider’s page | ||||||

|---|---|---|---|---|---|---|

| Country | Social Security Number (Personal ID Number) | |||||

| Sweden (SE): | 410321-9202 4103219202 |

|||||

| Finland (FI): | 190122-829F 190122829F |

|||||

| Norway (NO): | 1087000571 | |||||

| Denmark (DK): | 801363945 | |||||

| Additional Test Data required from the customer on the provider’s page | ||||||

|---|---|---|---|---|---|---|

| Country | Date of Birth | |||||

| For all supported countries: | Format is Day/Month/Year (DD-MM-YYYY) Enter any date. |

|||||

| Additional Test Data required from the customer on the provider’s page | ||||||

|---|---|---|---|---|---|---|

| Country | Phone number (format) | |||||

| Austria (AU): | +4306762600456 | |||||

| Belgium (BE): | +4306762600456 | |||||

| Canada (CA): | +15197438620 | |||||

| Denmark (DK): | +4542555628 | |||||

| Finland (FI): | +358401234567 | |||||

| France (FR): | +33689854321 | |||||

| Germany (DE): | +49017614284340 | |||||

| Ireland (IE): | +353855351400 | |||||

| Italy (IT): | +393339741231 | |||||

| Netherlands (NL): | +31689124321 | |||||

| Norway (NO): | +4740123456 | |||||

| Poland (PL): | +48795222223 | |||||

| Portugal (PT): | +351935556731 | |||||

| Spain (ES): | +34672563009 | |||||

| Sweden (SE): | +46701740615 | |||||

| Switzerland (CH): | +41758680000 | |||||

| United Kingdom (UK): | +447755564318 | |||||

| United States (DE): | +13106683312 | |||||

For more details about the specific personal details required please go to our section: Payment flows per country.

On-Site Messaging

Nuvei supports Klarna’s On-site messaging solution, which enables merchants to add tailored messaging that informs customers about available Klarna payment options as they browse the merchant’s online store, even before they decide to buy.

Merchants integrate Klarna’s On-site messaging separately from their Nuvei integration. For instructions, see the On-site messaging section of the Klarna Docs website.

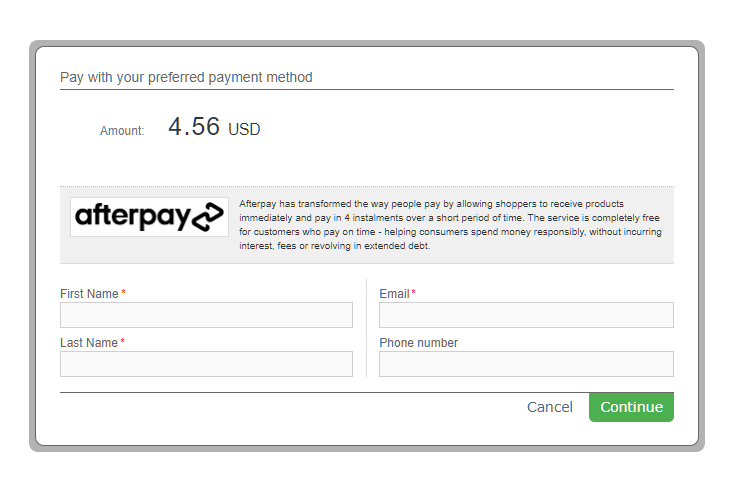

Klarna Payments Payment Flow

-

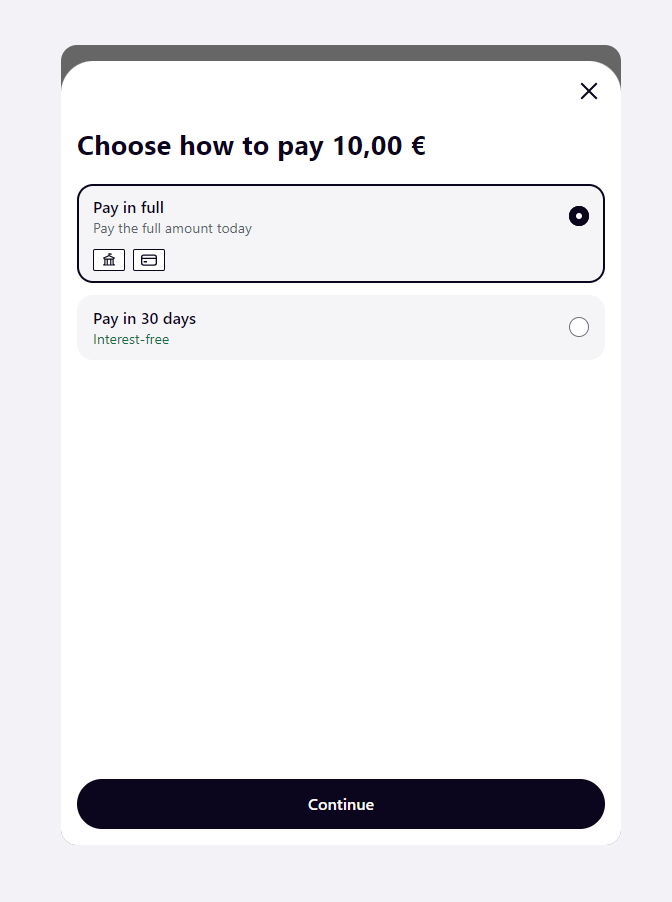

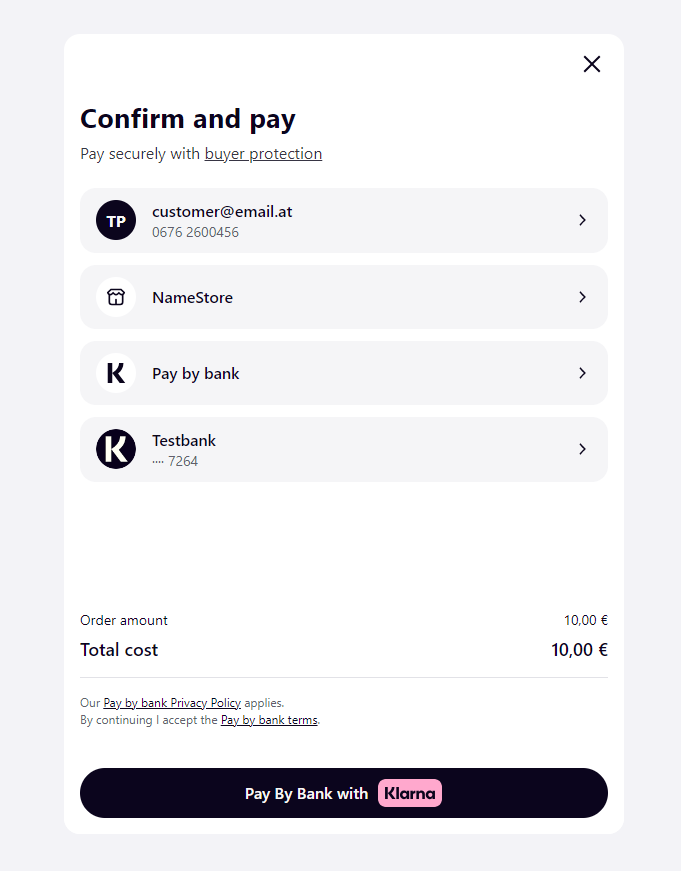

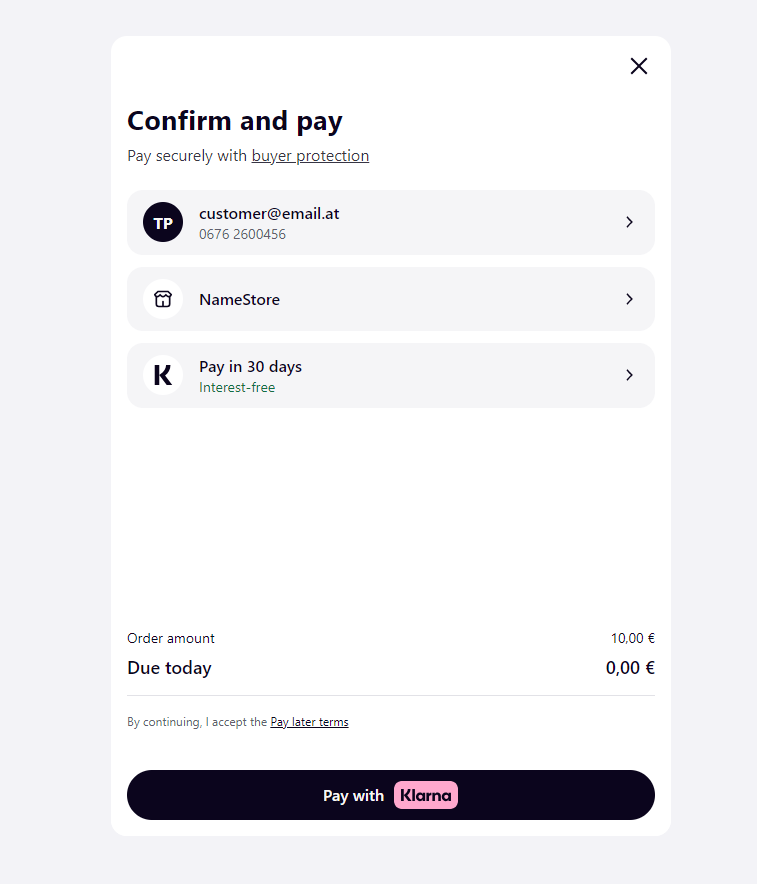

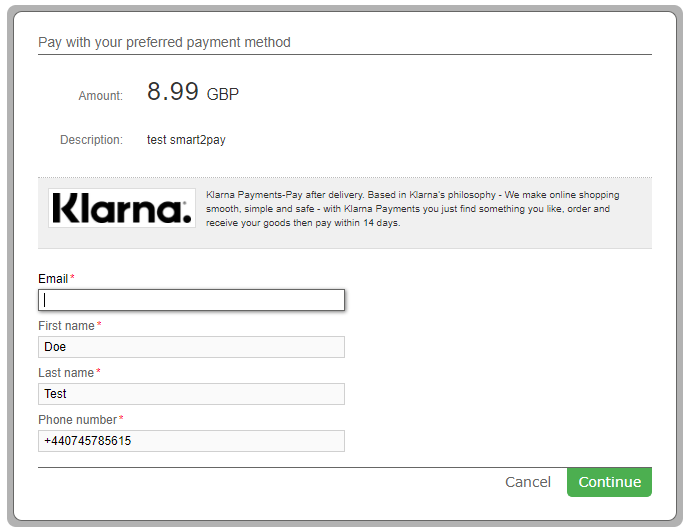

- This is a standard payment flow where the customer selected Austria (AU) country. For test purposes, please use the above test data depending on the country used. The Customer fills in the form with his personal details and then they are redirected to Klarna’s page where they are presented with the Confirm and Pay page.

For Austria, they can choose a payment option from the given list: to pay in full or to in 30 days (with interest). When clicking on the pay option, they are presented with one of the 2 options:

For the Pay in full option (Pay by Bank), they need to click on Pay by Bank with Klarna button.

For the Pay in 30 days option, they need to click on Pay with Klarna button:

- This is a standard payment flow where the customer selected Austria (AU) country. For test purposes, please use the above test data depending on the country used. The Customer fills in the form with his personal details and then they are redirected to Klarna’s page where they are presented with the Confirm and Pay page.

- If the customer hasn’t provided in the first step one of the required personal details: email, name or phone, he will provide this info on a further intermediary page. Please note that if Shipping Address is not sent, then by default it will have the same value as Billing Address.

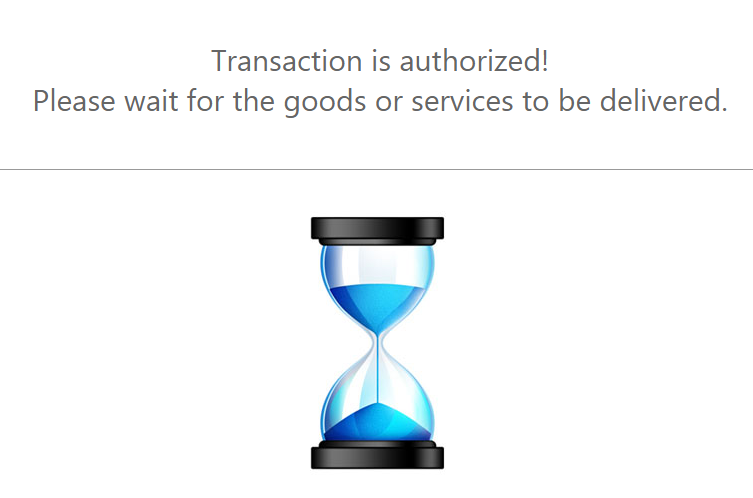

- If the details are filled correctly by the Customer, the transaction is completed and you will receive a notification with the Authorized status. Meanwhile the customer is redirected to your ReturnURL.

- The last step of the payment flow is the capture action when the transaction becomes successful. Simply do a capture request – POST /v1/payments/{id}/capture, where the ID is the GlobalPay Payment ID. In the response we will return the new status as being Success.

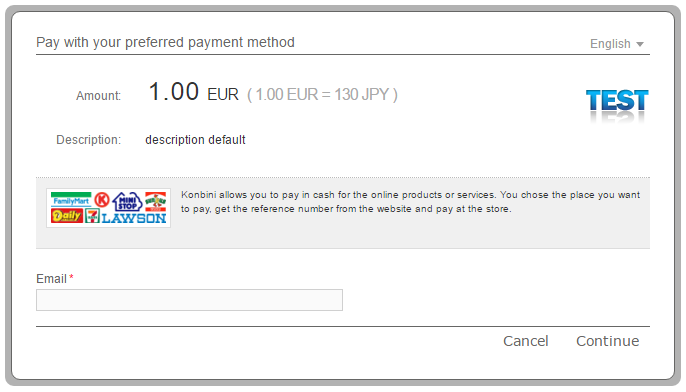

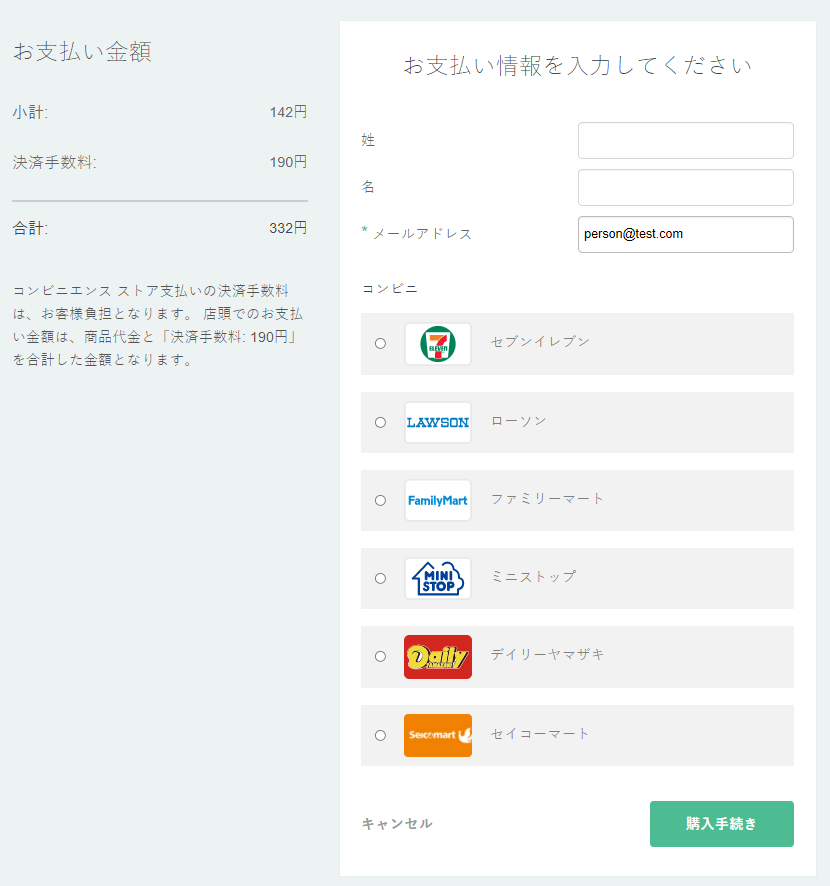

Konbini Test Data

In order for you to test Konbini payment method successfully, please use the below test data.

| Konbini Test Data | |

|---|---|

| Data | Value |

| Email address: | Enter valid email address: person@test.com |

Konbini Payment Flow

- The Customer enters his email address.

- The Customer must provide his first name and last name and choose his preferred convenience store to complete the payment.

- The customer is redirected to the provider’s confirmation page where he sees the payment summary and details. He will also receive an email containing further instructions for completing the purchase. The customer needs to save the barcode or payment slip number and tell the cashier to “pay online”.

- Upon completion of the payment flow, the customer is redirected to your ReturnUrl.

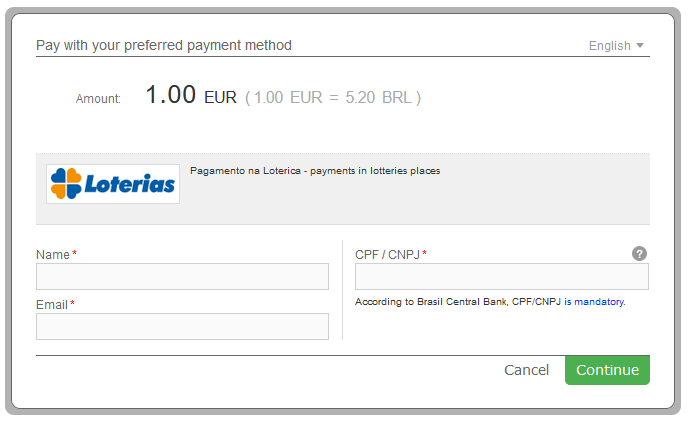

Loterica Test Data

For Loterica payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

Loterica Payment Flow

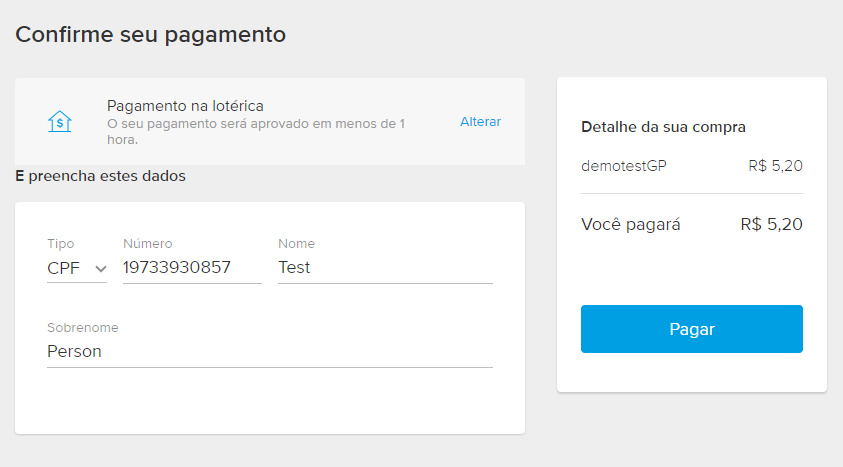

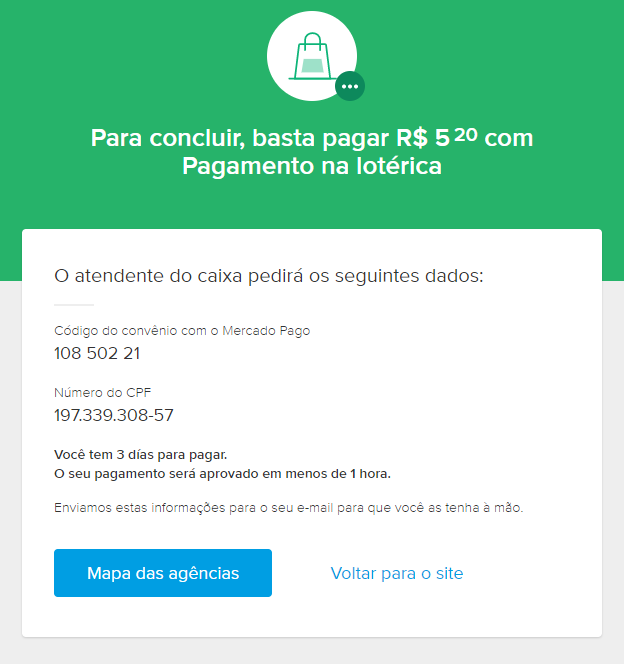

- The customer enters his Email Address, Name and CPF/CNPJ.

Please note that for Brazil the Customer Social Security Number parameter consists of CPF/CNPJ. For more information about the CPF/CNPJ please click here. - The customer confirms the payment after reviewing all the details of the payment.

- The customer receives the code necessary to make the payment. He will also receive via email all the payment data. In order to complete the payment, he needs to go to a physical bank branch in his area in 3 days time. The payment will be approved in less than one hour..

- Upon completion of the payment flow the customer is redirected back to your ReturnURL.

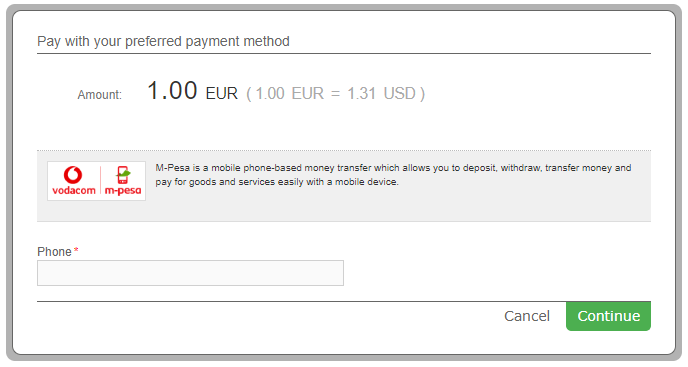

M-Pesa (Tanzania) – Test Data

In order for you to test M-Pesa payment method available in Tanzania, please use the below test data.

| M-Pesa (Tanzania) Test Data | |

|---|---|

| Data | Value |

| Phone | 255653560949 |

M-Pesa (Tanzania) Payment Flow

- The customer fills in the Phone number.

- The customer receives the details needed to complete the payment.

- Upon completion of the payment flow, the customer is redirected back to your ReturnURL.

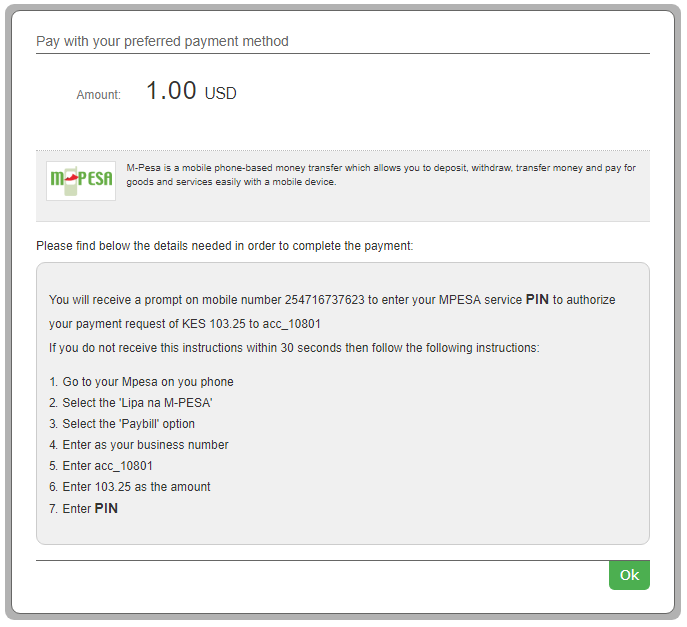

M-Pesa Test Data

In order for you to test M-Pesa payment method, please use the below test data.

| M-Pesa Test Data | |

|---|---|

| Data | Value |

| Phone | 254716737623 |

For M-Pesa payment method available in Tanzania, you can see how it works with the payment flow given here: M-Pesa (Tanzania) – DirectPay Payment Flow.

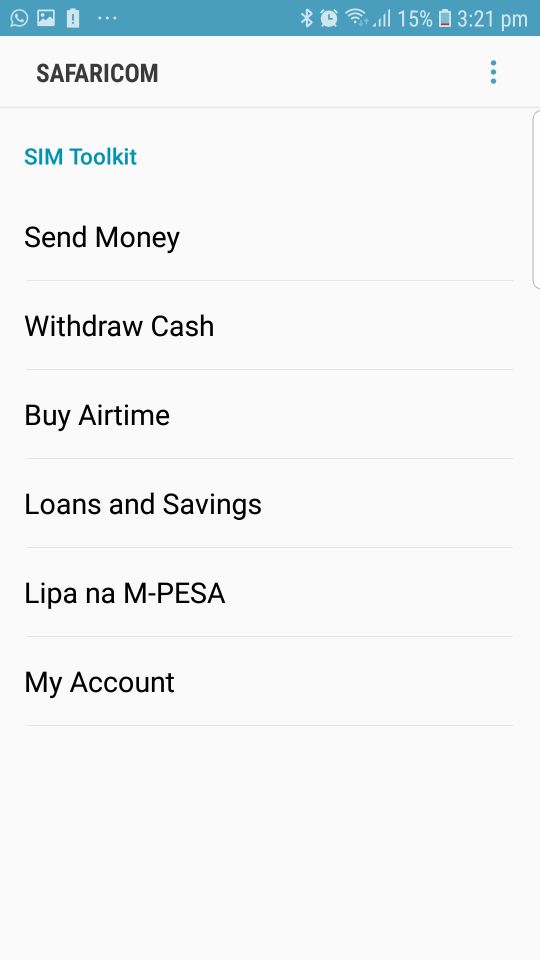

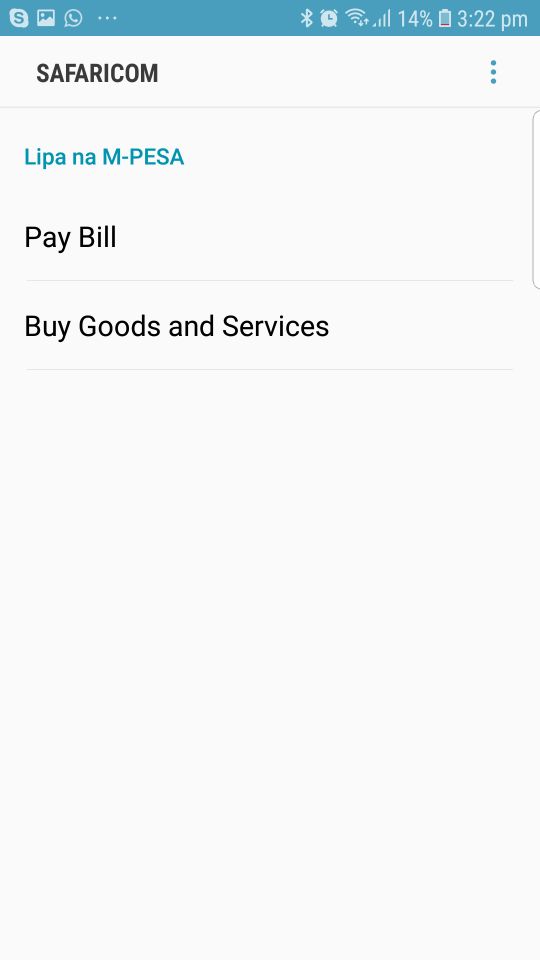

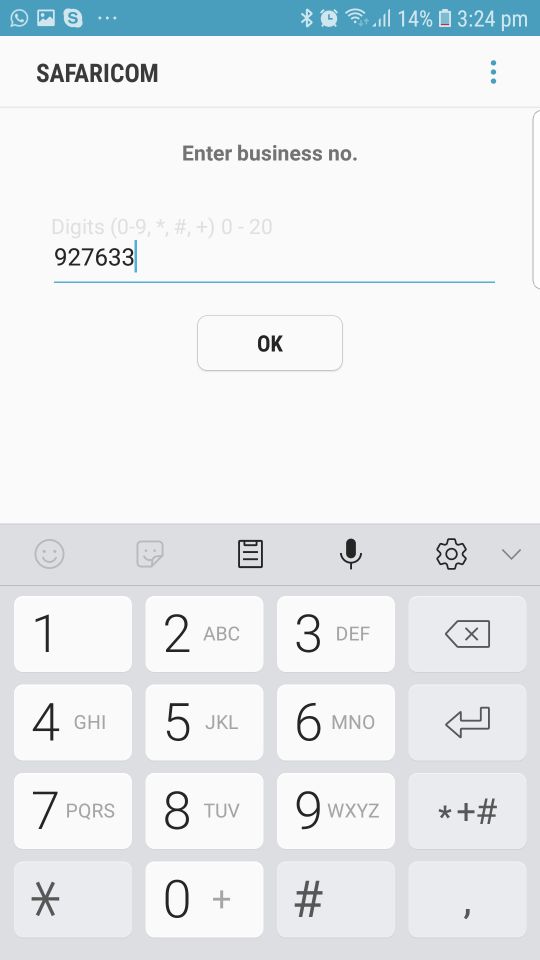

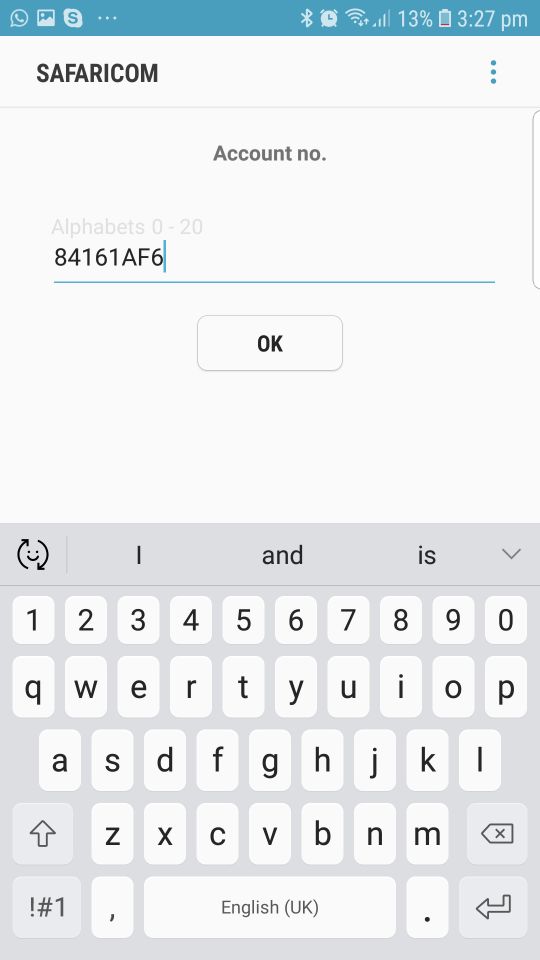

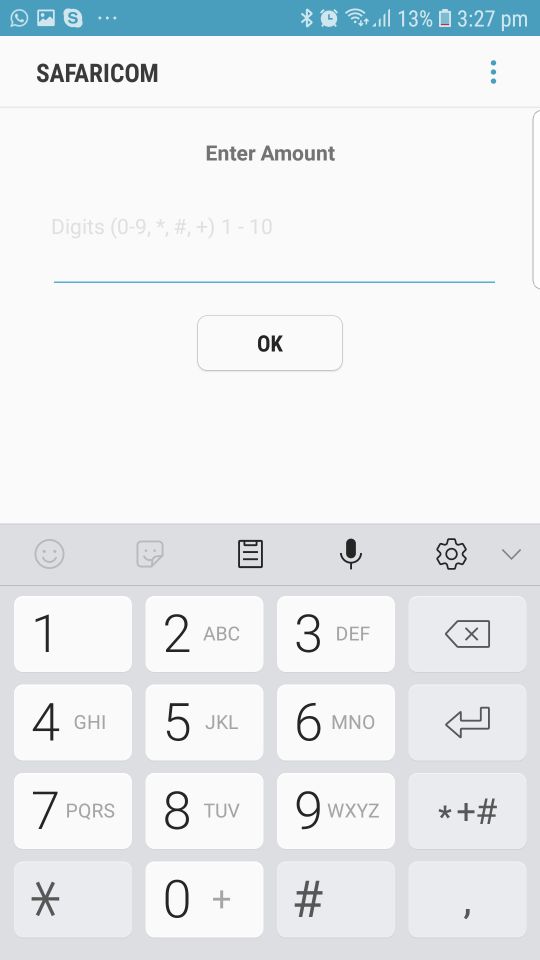

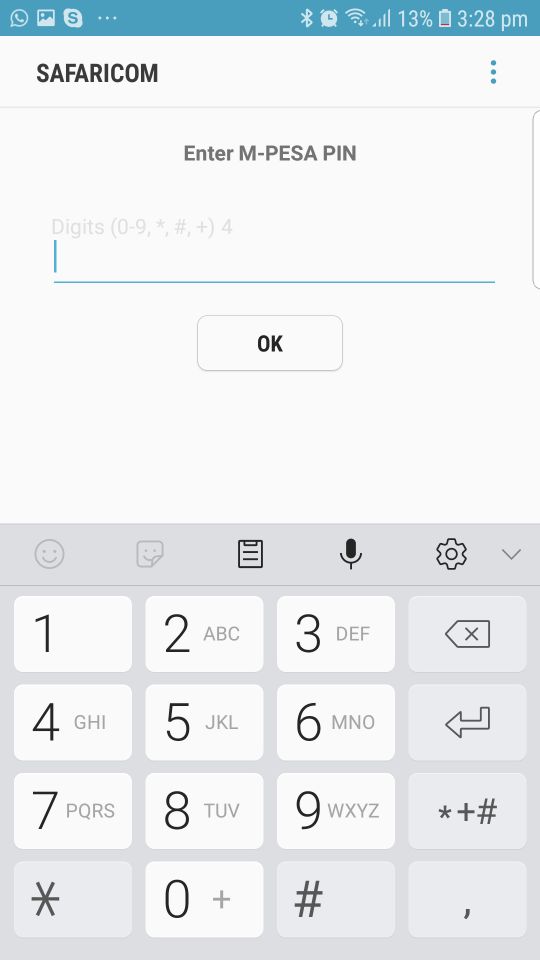

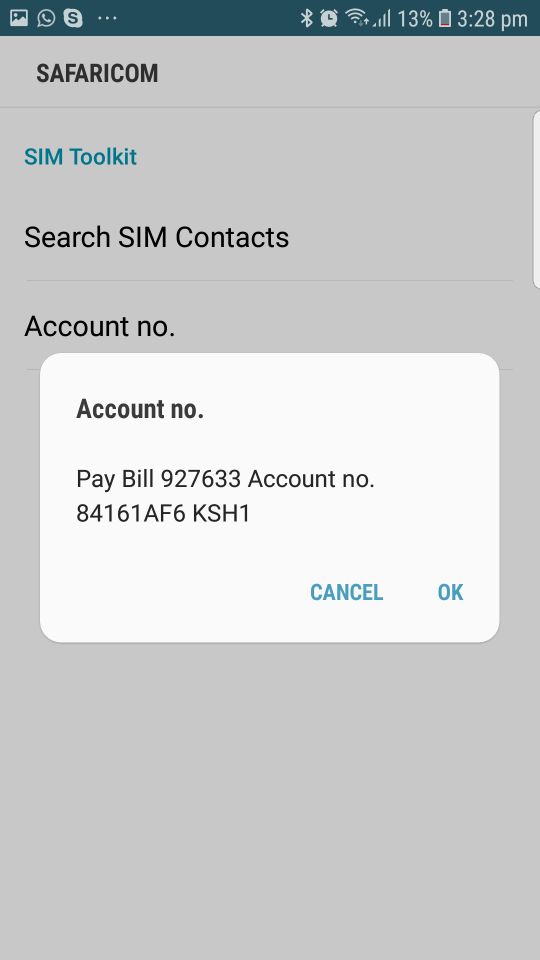

M-Pesa (Kenya) Payment Flow

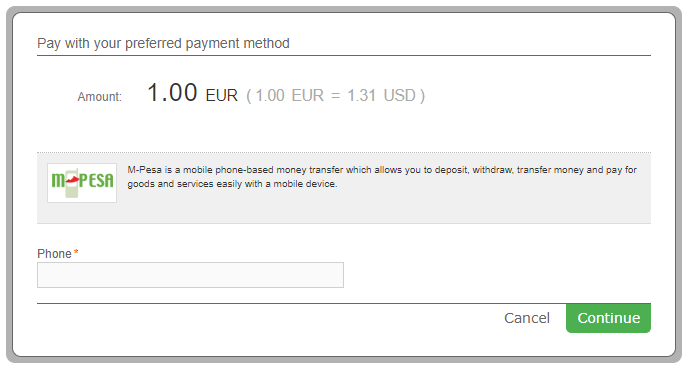

- The customer fills in the Phone number.

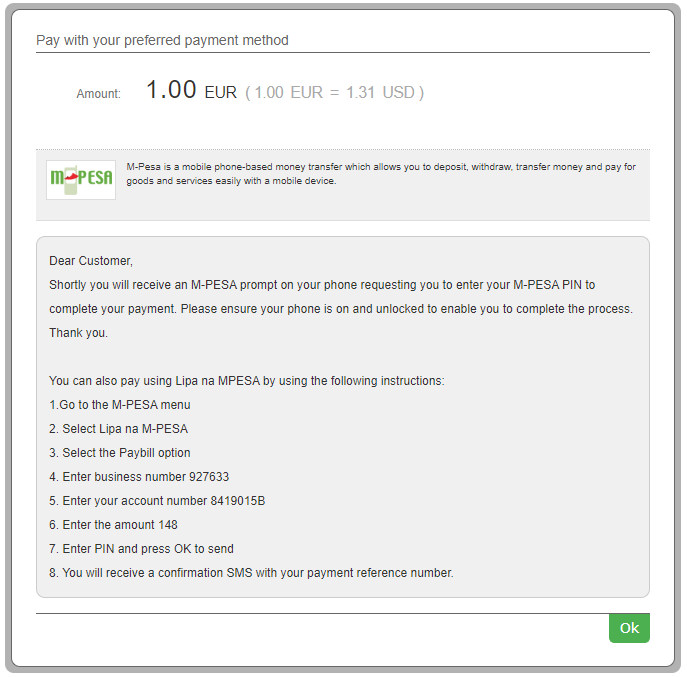

- The customer receives the details needed to complete the payment.

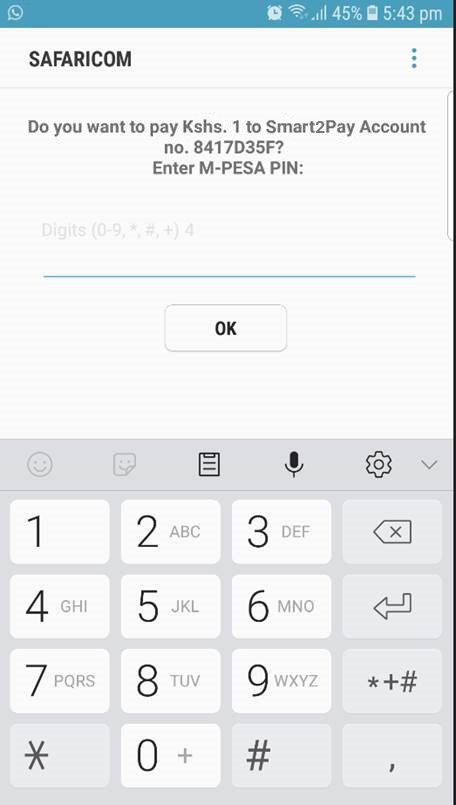

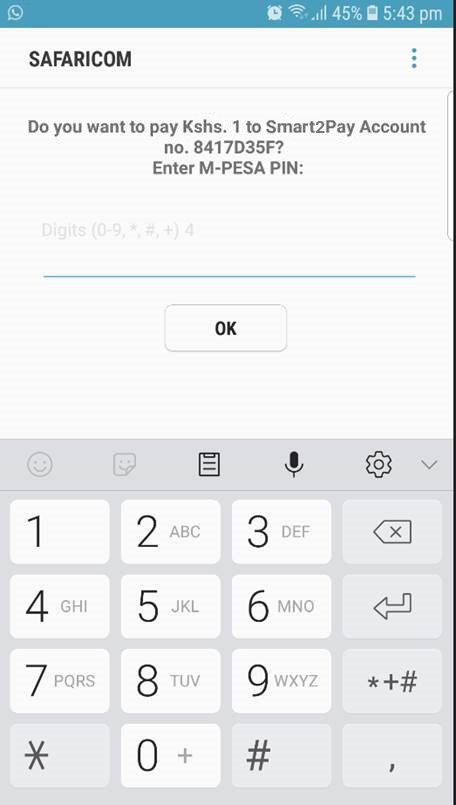

- The customer receives a push notification to his mobile and confirms the payment.

- In case the customer has not received the M-Pesa prompt on his phone, there is another possibility to complete a M-Pesa payment flow by following the instructions:

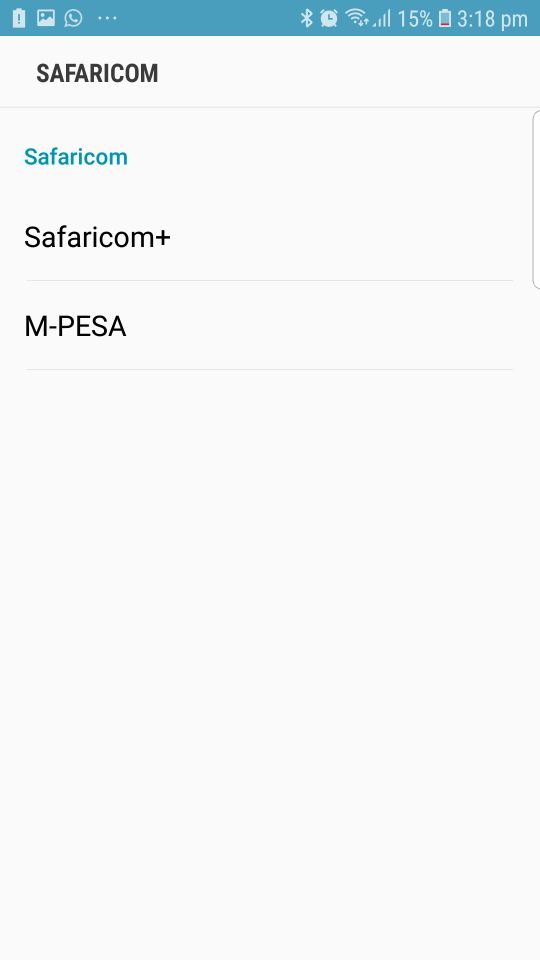

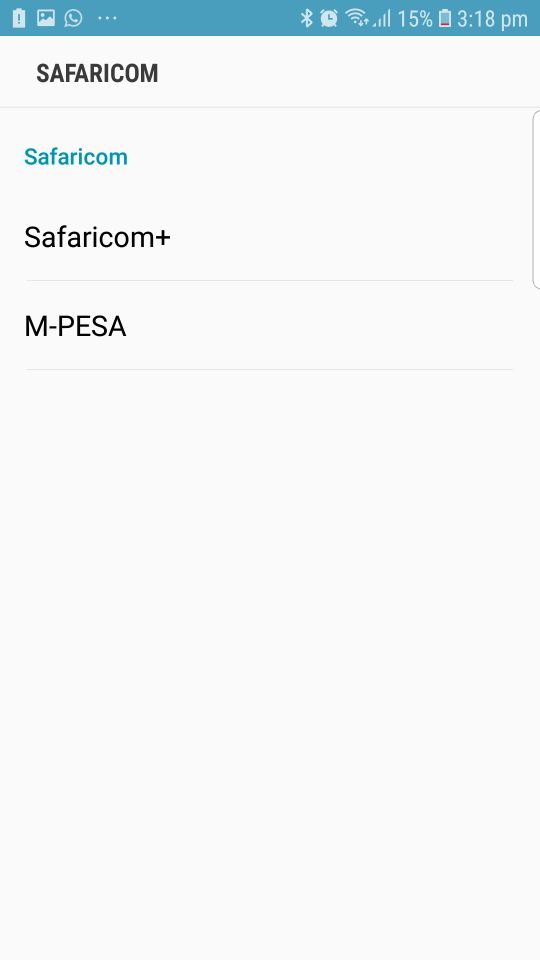

- The customer opens the SIM Tool Kit and selects “M-Pesa” menu.

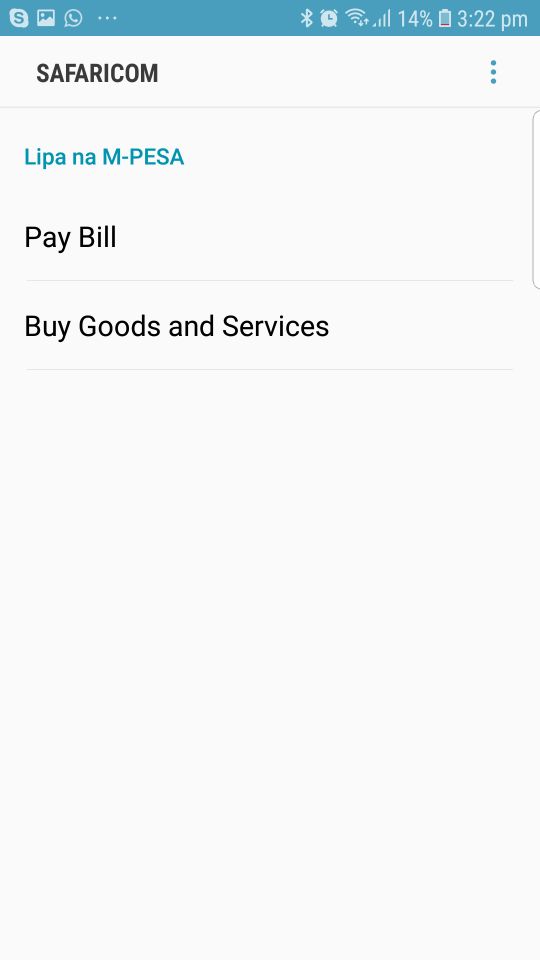

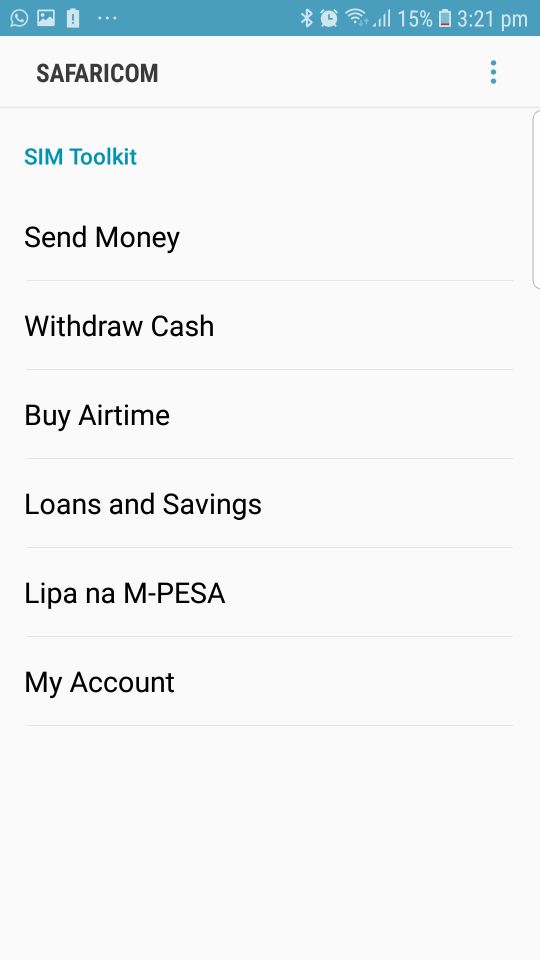

- The customer selects “Lipa na M-Pesa”.

- The customer selects the “Pay Bill” option.

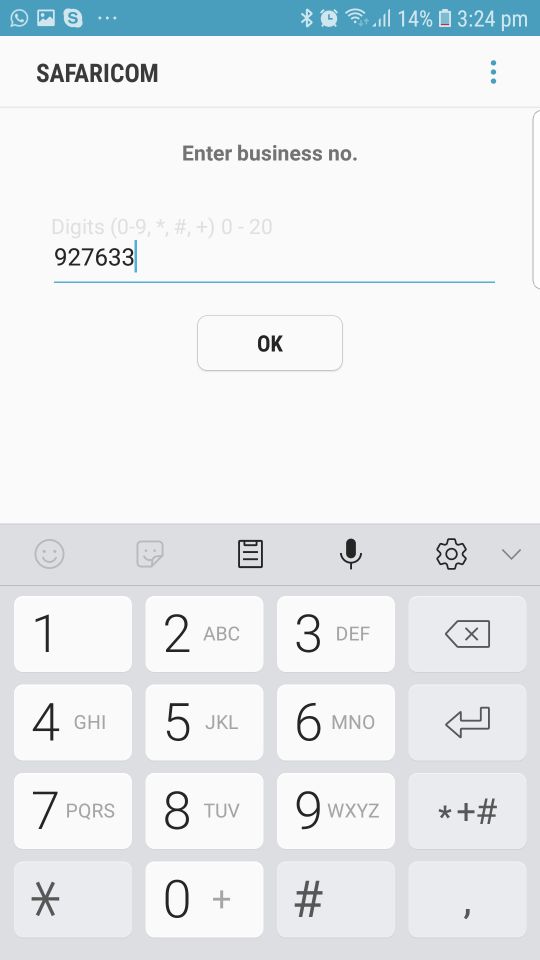

- The customer enters his business number.

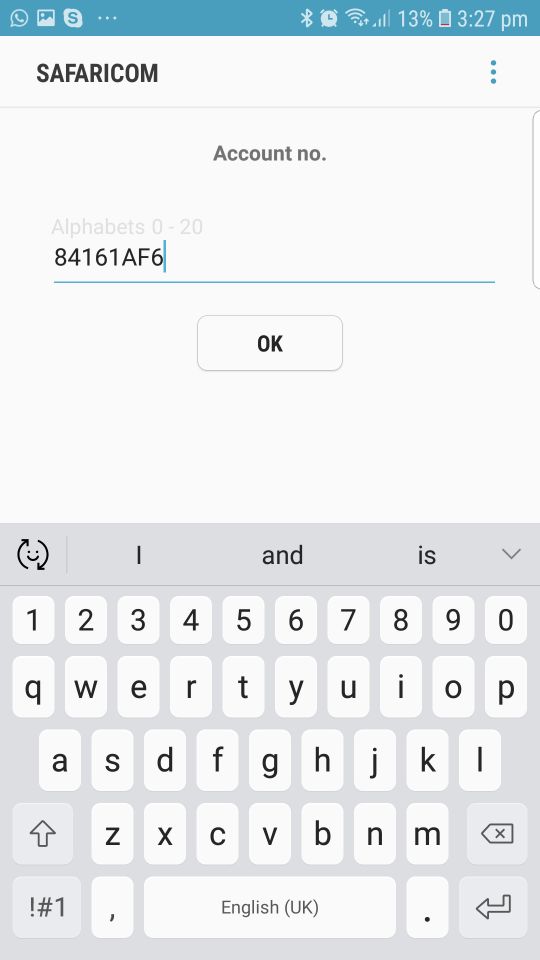

- The customer enters his account number.

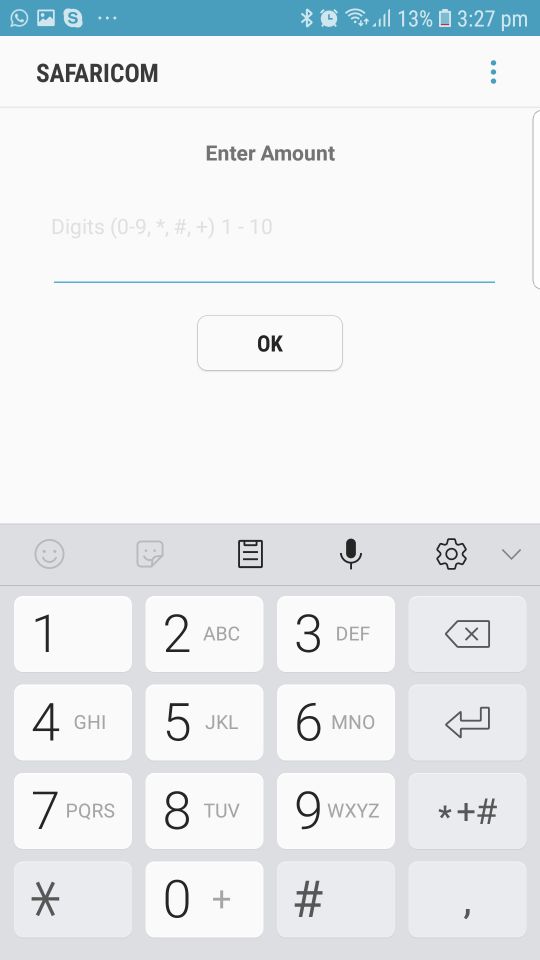

- The customer needs to enter the amount.

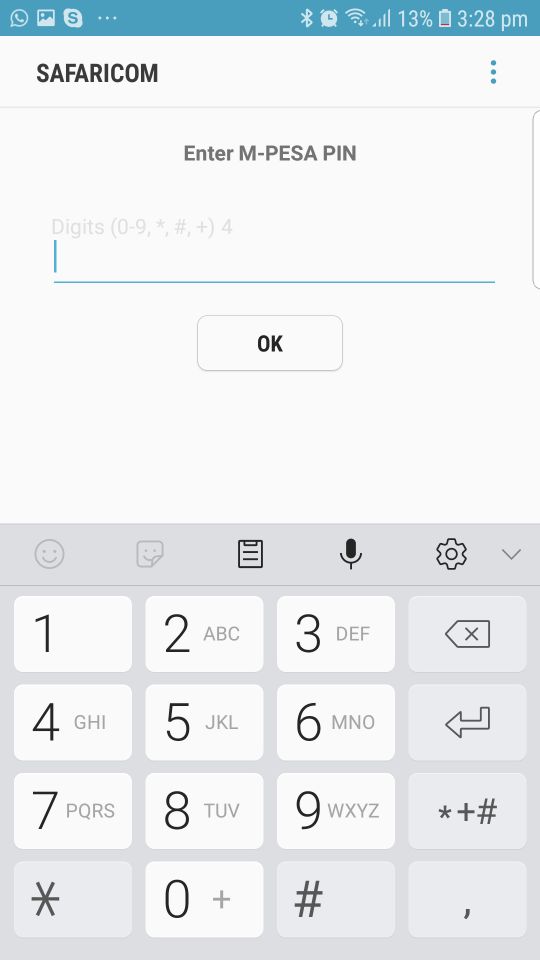

- The customer needs to enter his M-Pesa PIN number and press “OK” button to complete the payment.

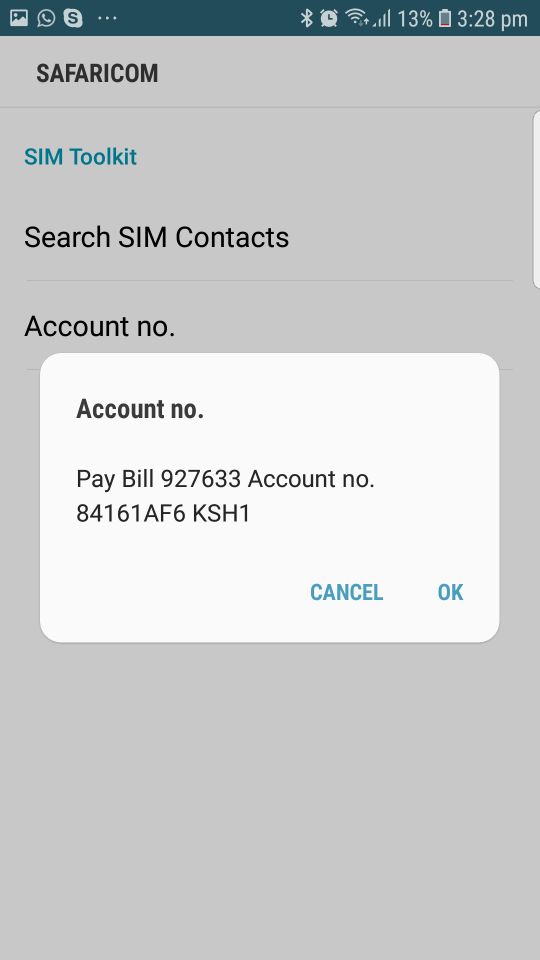

- The customer receives the payment details. If the details are correct he needs to press “OK” button to confirm the payment.

M-Pesa Test Data

In order for you to test M-Pesa payment method, please use the below test data.

| M-Pesa Test Data | |

|---|---|

| Data | Value |

| Phone | 254716737623 |

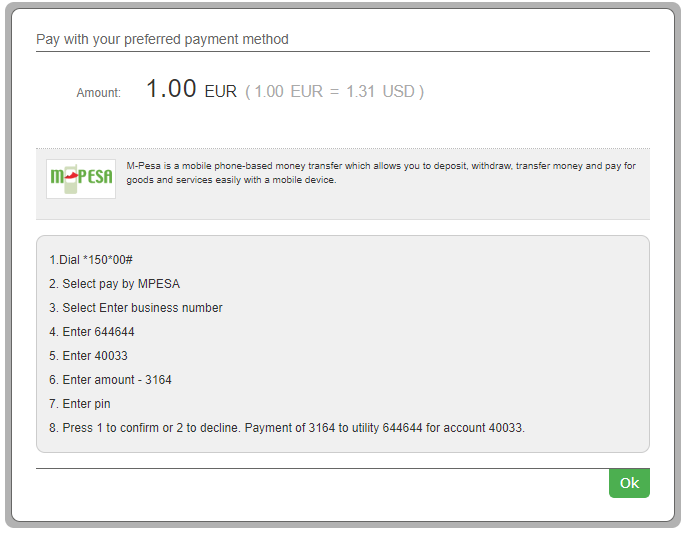

M-Pesa (Kenya) Payment Flow

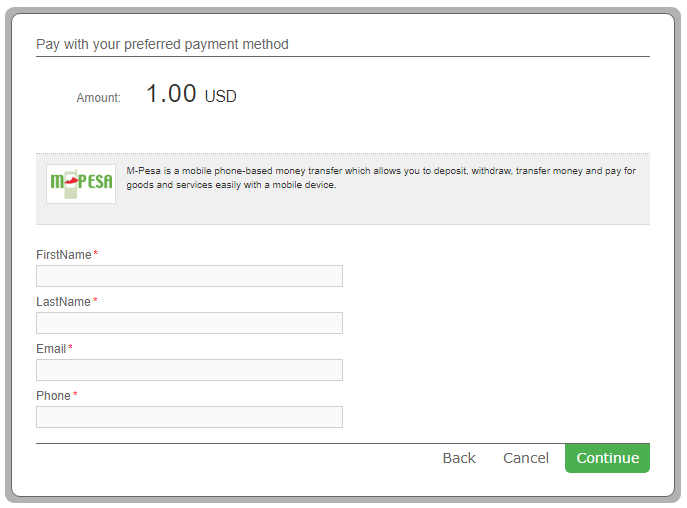

- The customer fills in his first and last name, his email address and his phone number.

- The customer receives the details needed to complete the payment.

- The customer receives a push notification to his mobile and confirms the payment.

- In case the customer has not received the M-Pesa prompt on his phone, there is another possibility to complete a M-Pesa payment flow by following the instructions:

- The customer opens the SIM Tool Kit and selects “M-Pesa” menu.

- The customer selects “Lipa na M-Pesa”.

- The customer selects the “Pay Bill” option.

- The customer enters his business number.

- The customer enters his account number.

- The customer needs to enter the amount.

- The customer needs to enter his M-Pesa PIN number and press “OK” button to complete the payment.

- The customer receives the payment details. If the details are correct he needs to press “OK” button to confirm the payment.

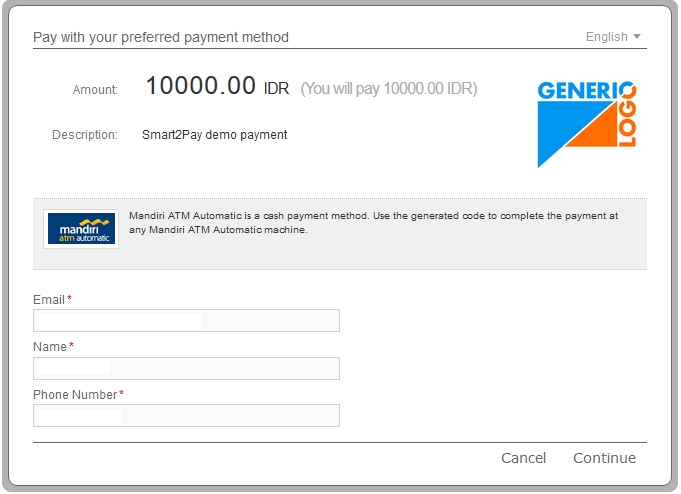

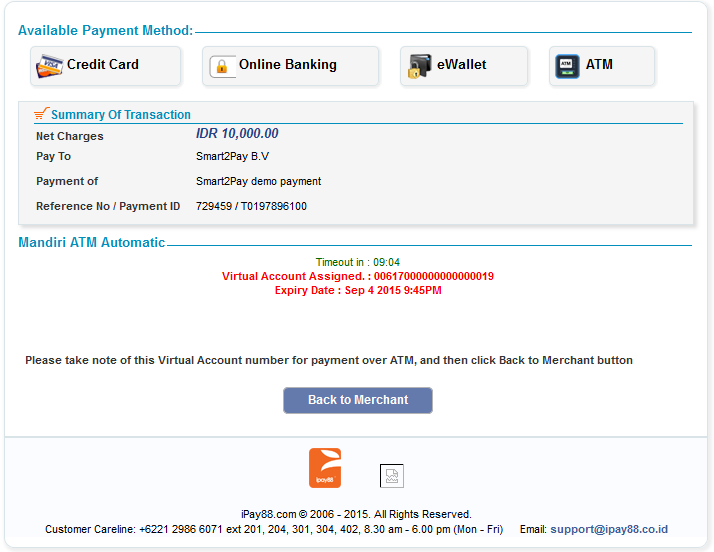

Mandiri ATM Automatic Test Data

For Mandiri ATM Automatic payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

Mandiri ATM Automatic Payment Flow

Mandiri Clicks Test Data

For Mandiri Clicks payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

Mandiri Clicks Payment Flow

Mandiri e-Cash Test Data

For Mandiri e-Cash payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

Mandiri e-Cash Payment Flow

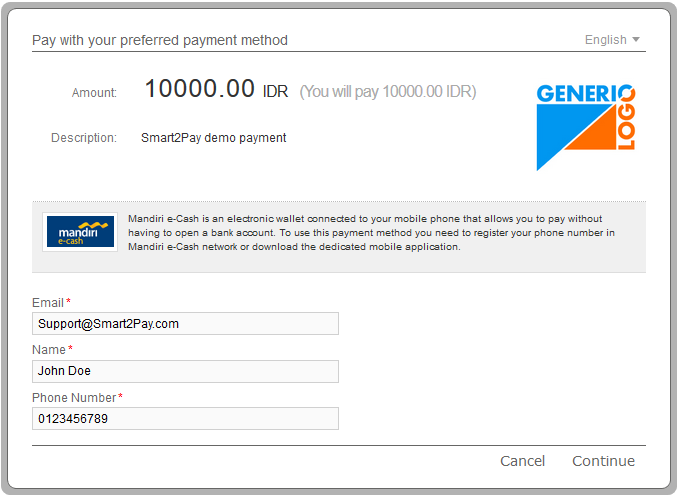

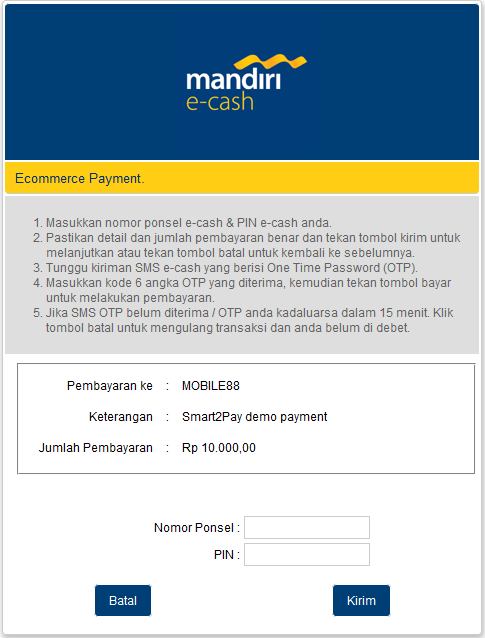

-

The customer enters his email address, name and phone number.

-

The customer receives the details of the payment and proceeds to pay with Mandiri e-Cash.

-

The customer logs in to his account by entering his phone number and PIN and makes the payment.

-

Upon completion of the payment flow, the customer is redirected back to your ReturnURL.

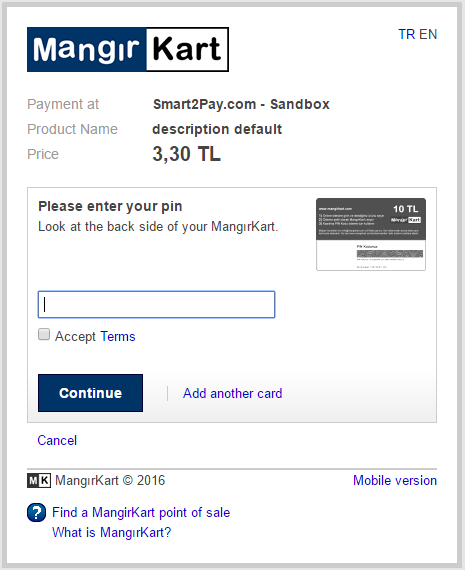

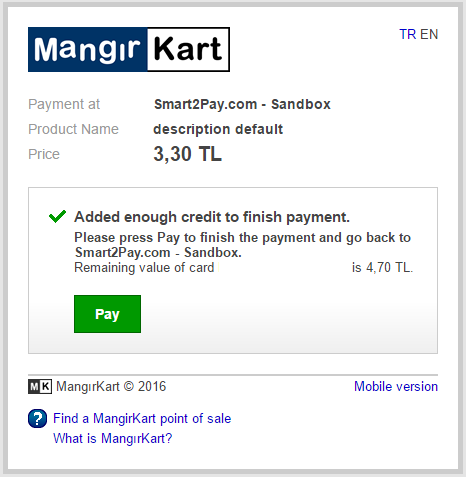

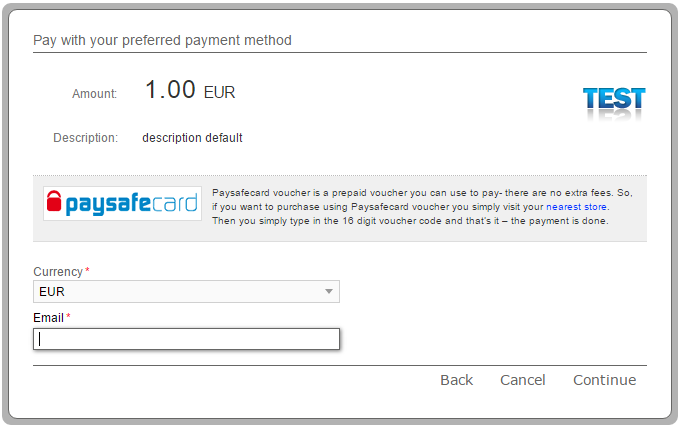

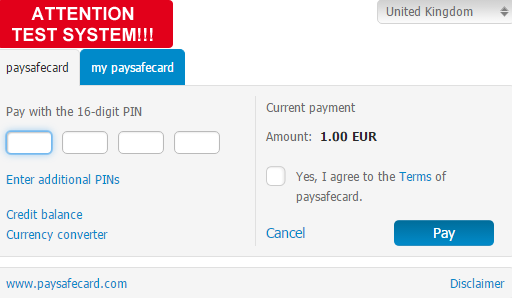

MangirKart Test Data

For MangirKart payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

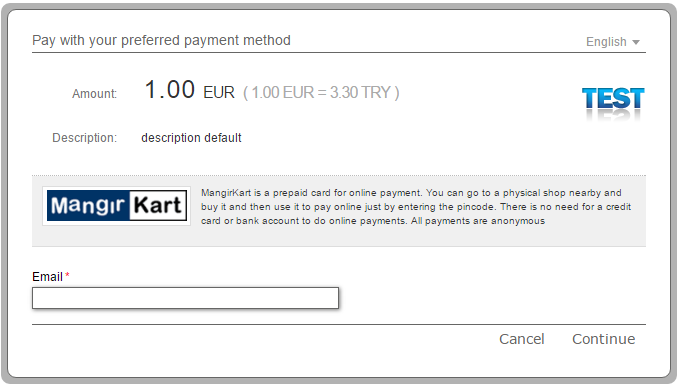

MangirKart Payment Flow

-

The Customer enters his email address.

-

The Customer enters the 16 digit PIN. He also has to check and agree to the Terms of MangirKart before proceeding with the payment.

-

The customer sees the payment summary and details. He completes the transaction by clicking on the Pay button.

-

Upon completion of the payment flow the customer is redirected back to your ReturnURL.

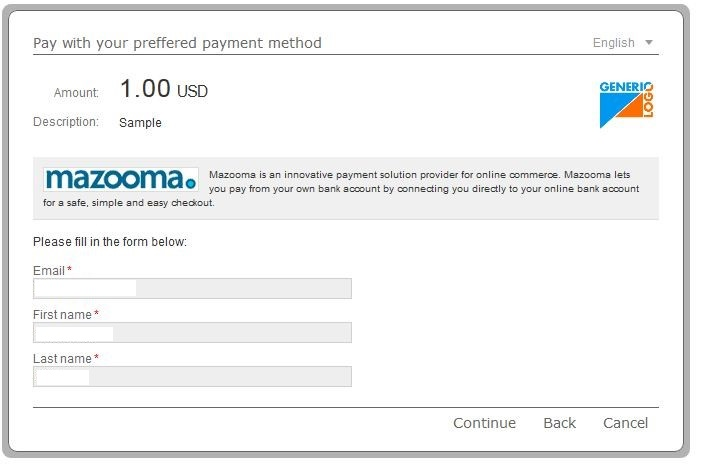

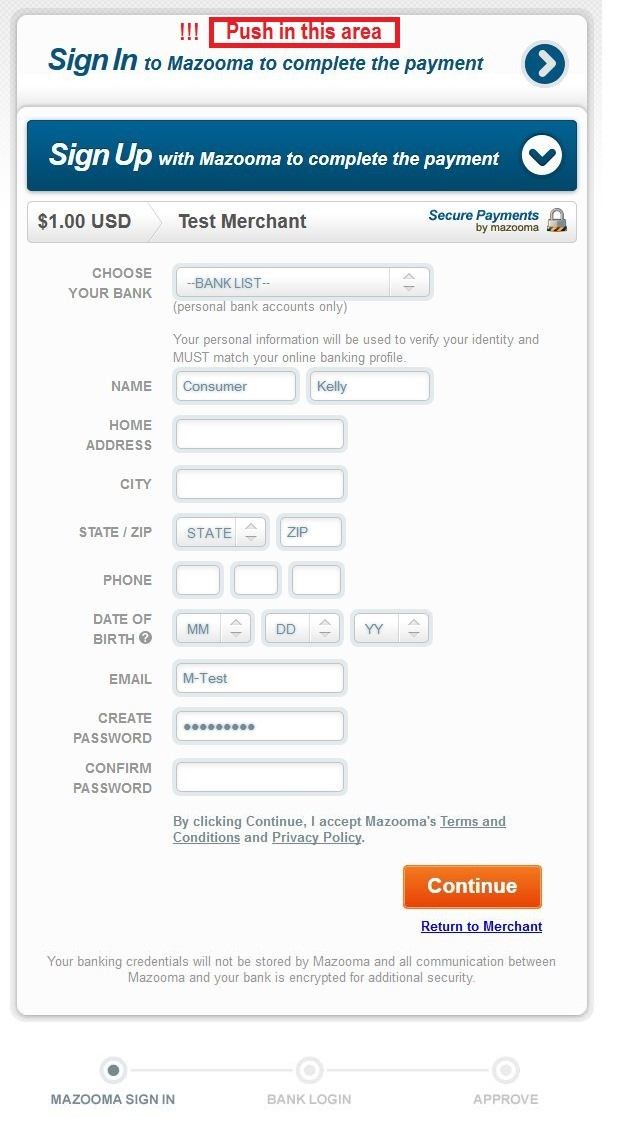

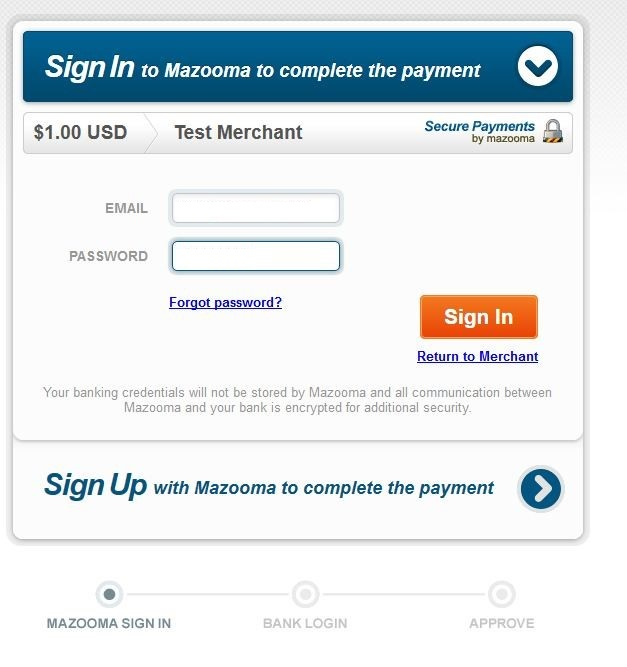

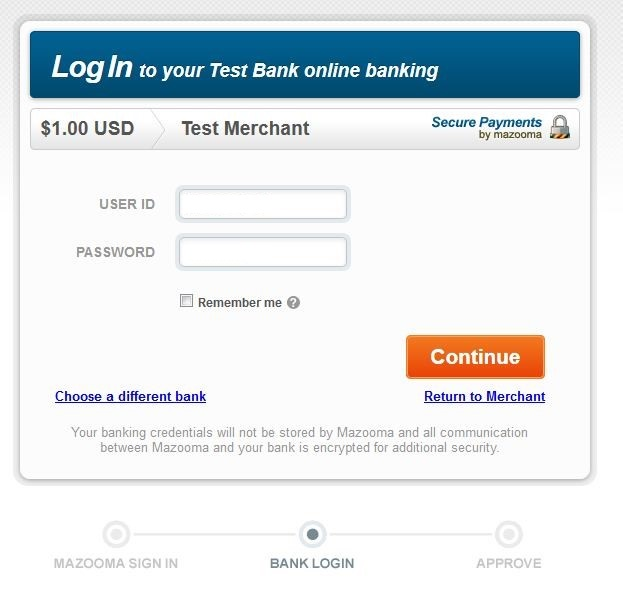

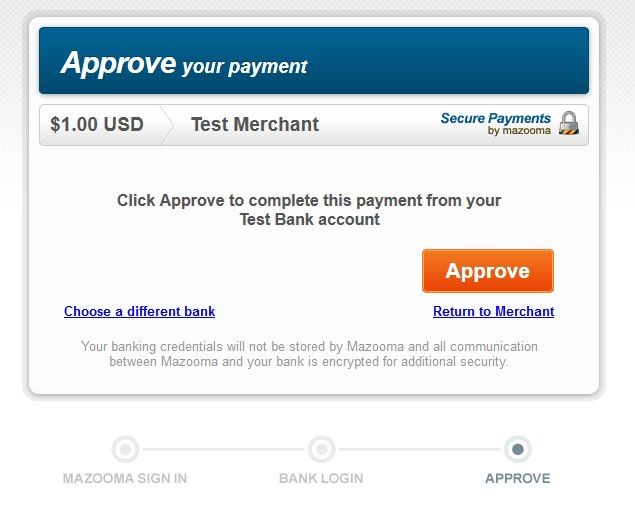

Mazooma Test Data

For Mazooma payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

Mazooma Payment Flow

-

The Customer enters his email address, first name and last name.

-

Once the customer arrives at provider’s page he chooses to Sign In. If he arrives at Sign Up area he must go to Sign In area.

-

The customer logs in to his Mazooma account by entering his email address and password.

-

The customer logs in to his Test Bank online banking account by entering his User ID and password.

-

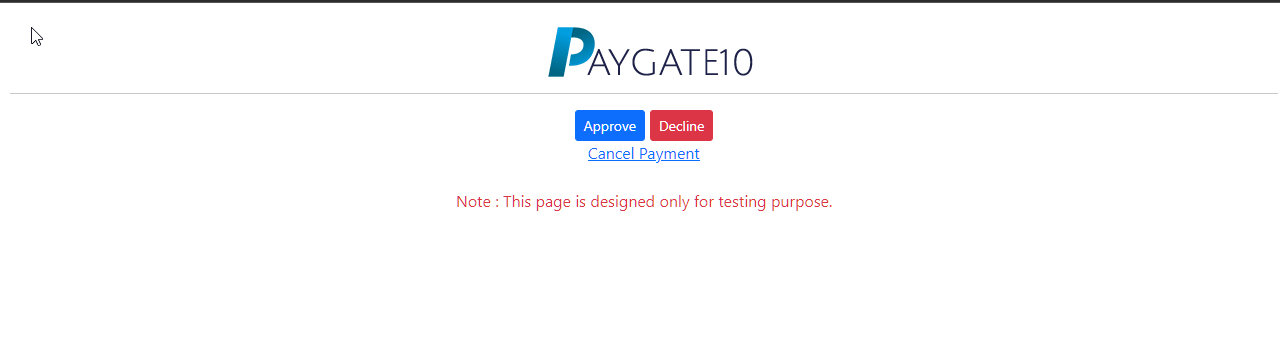

The customer confirms the payment by using the Approve button.

-

Upon completion of the payment flow the customer is redirected back to your ReturnURL.

MercadoPago Test Data

In order for you to test MercadoPago payment method successfully, please use the below test data.

| Test Users Brazil | |||

|---|---|---|---|

| Test User 1 | Test User 2 | ||

| test_user_83022133@testuser.com | test_user_4432956@testuser.com | ||

| Nickname | TETE4663724 | Nickname | TETE5993983 |

| Password | qatest9001 | Password | qatest9857 |

| Credit Cards Brazil | |||

|---|---|---|---|

| Card type | Card number | Security code | Expiration date |

| Mastercard | 5031 4332 1540 6351 | 123 | 11/25 |

| Visa | 4235 6477 2802 5682 | 123 | 11/25 |

| American Express | 3753 651535 56885 | 1234 | 11/25 |

| To test different payment results, complete the information you want in the cardholder’s name: | |

|---|---|

| APRO: | Payment approved. |

| CONT: | Payment pending. |

| OTHE: | Refused due to general error. |

| CALL: | Refused with validation to authorize. |

| FUND: | Refused for insufficient amount. |

| SECU: | Refused due to invalid security code. |

| EXPI: | Refused due to a problem with the due date. |

| FORM: | Refused due to an error in the form. |

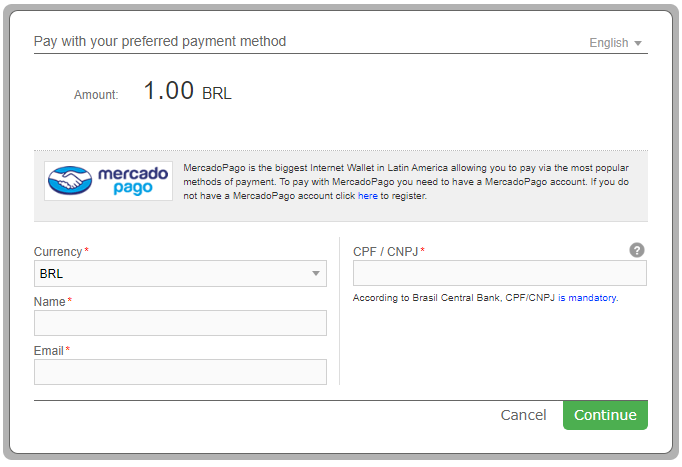

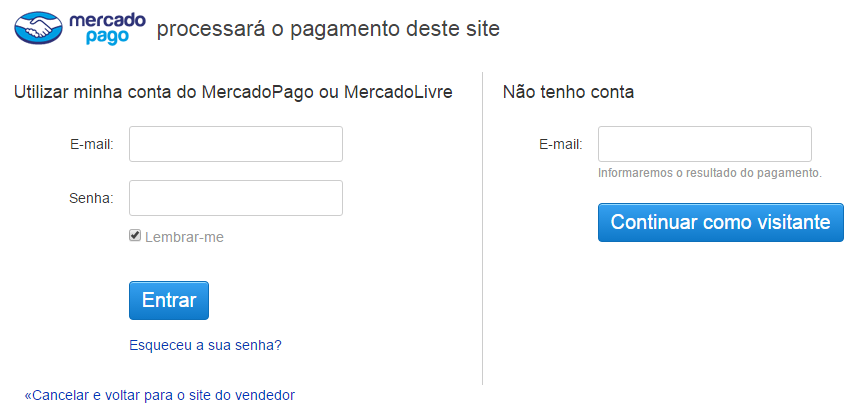

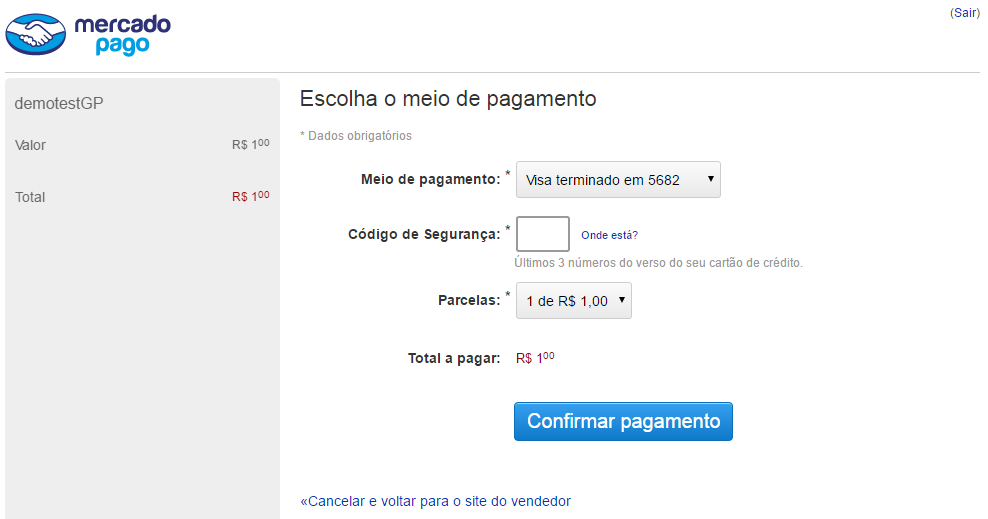

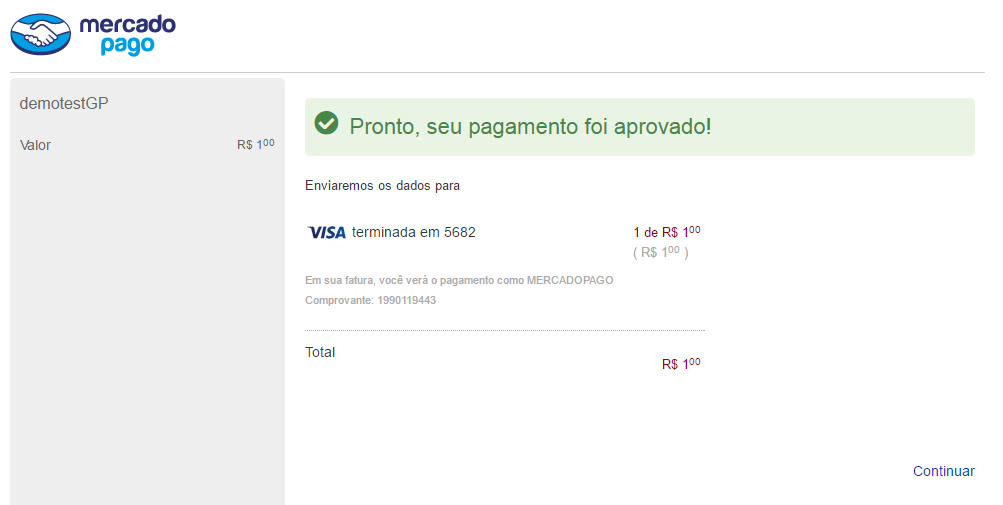

MercadoPago Payment Flow

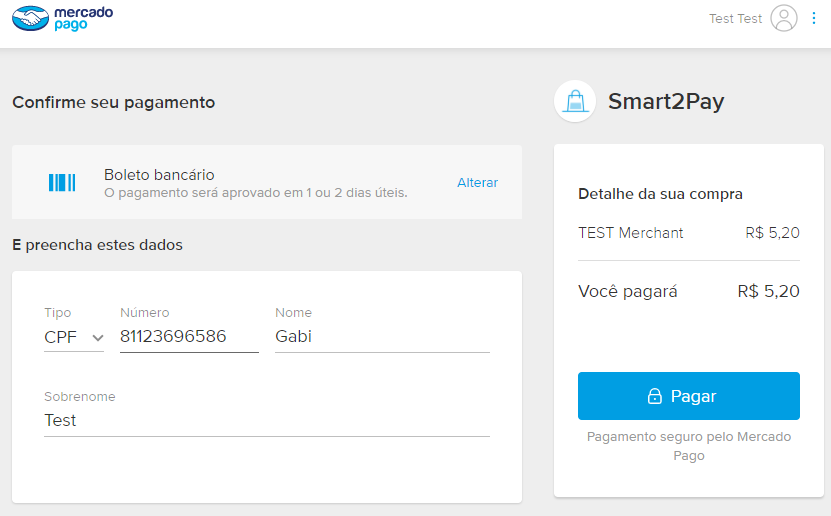

- The Customer enters his name, email address and CPF/CNPJ. He can also change his desired currency from the given list.

- The customer logs in to his MercadoPago account by entering his email address and password. If the customer doesn’t have a MercadoPago account yet, he will continue the payment as a guest.

- The customer selects and verifies the payment option from the list, enters the card’s security code and confirms the payment.

- The customer receives a message that the payment was successfully approved and all the payment data will be sent to the customer via his registered email address.

- Upon completion of the payment flow the customer is redirected back to your ReturnURL.

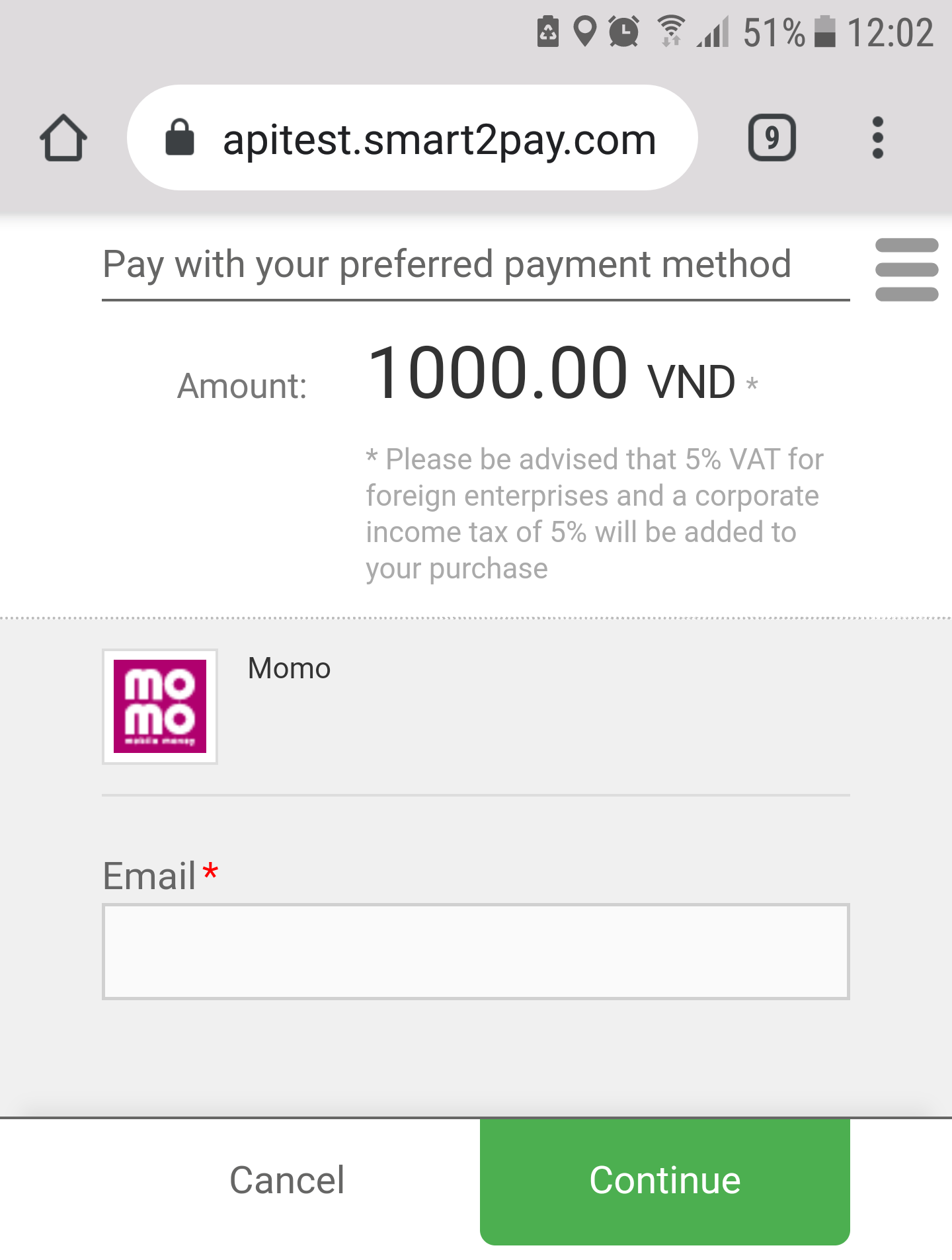

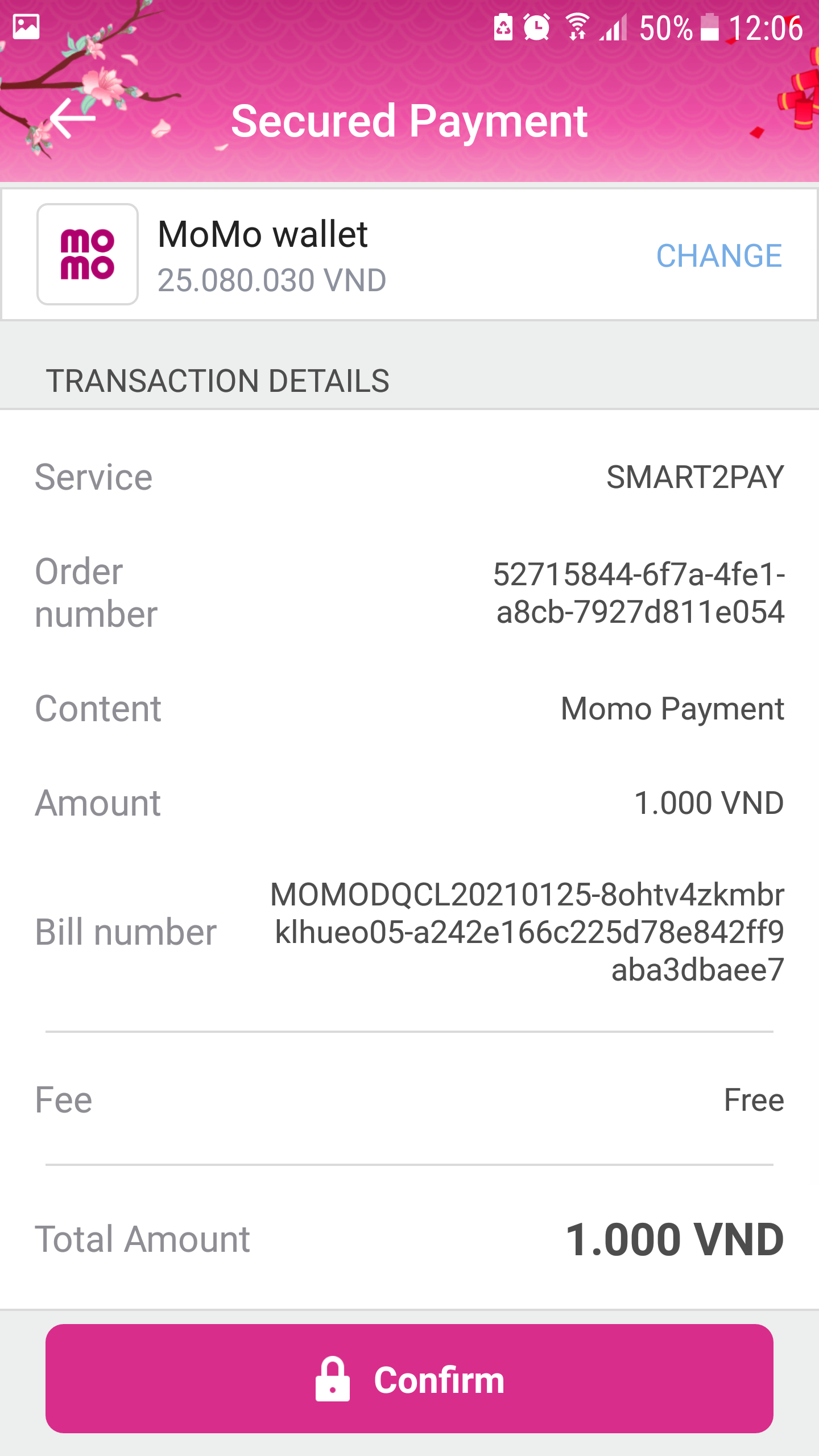

Momo Test Data

In order for you to test the Momo payment method successfully, please use the below test data. You can also see how it works with the payment flows given below for Desktop and for Mobile devices. For testing purposes, you need to have installed the Momo application on your mobile device.

| Momo Test Data | ||

|---|---|---|

| Data | Value | |

| Phone Number: | 01228038440 | |

| Verification code: | 000000 | |

| Payment password: | 000000 | |

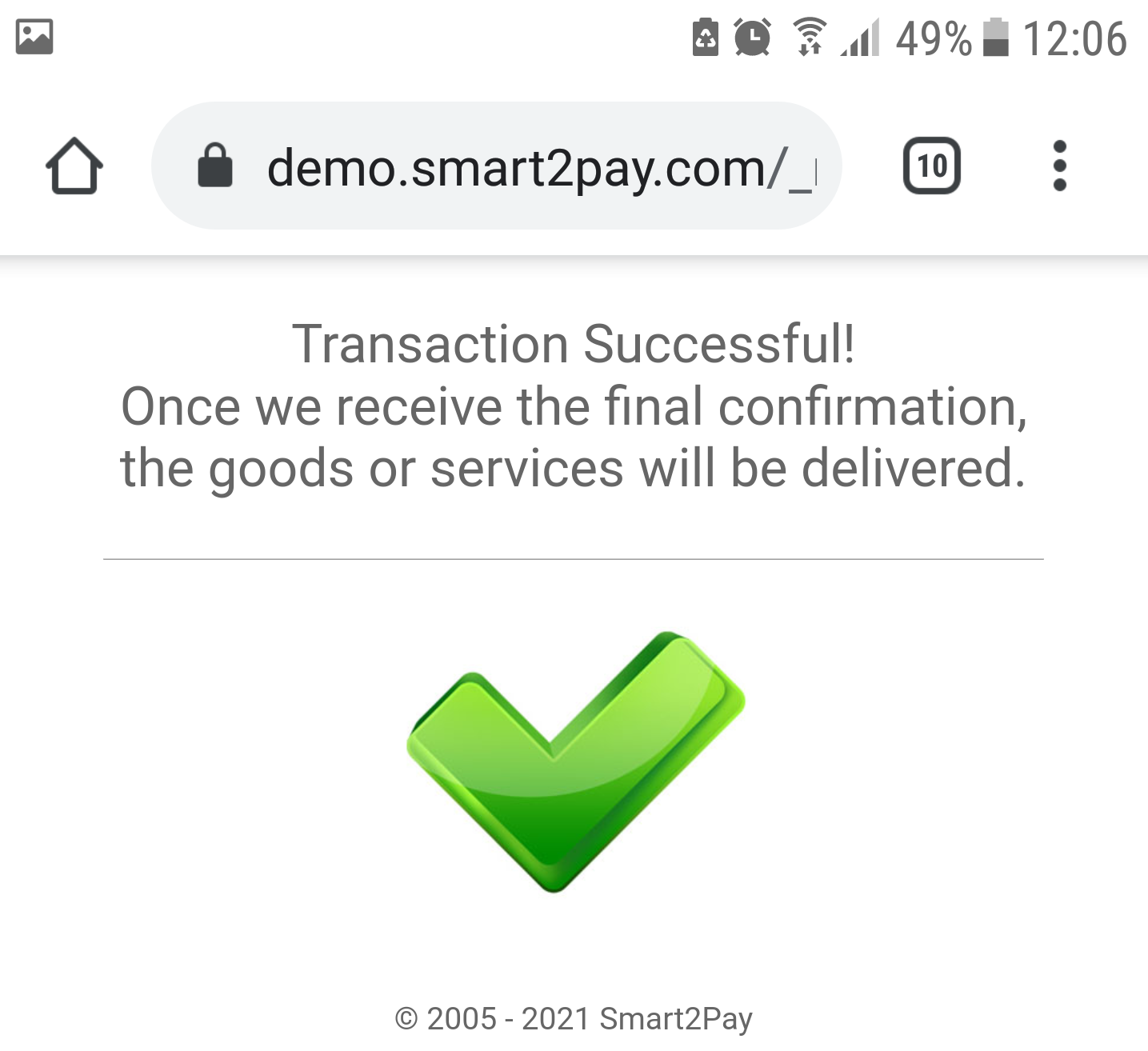

Momo Desktop Payment Flow

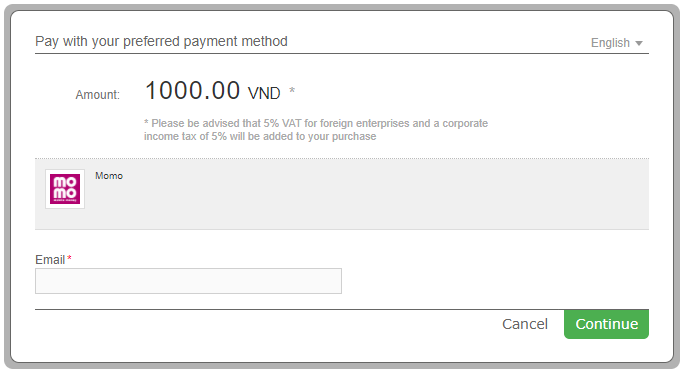

- The customer enters his email address.

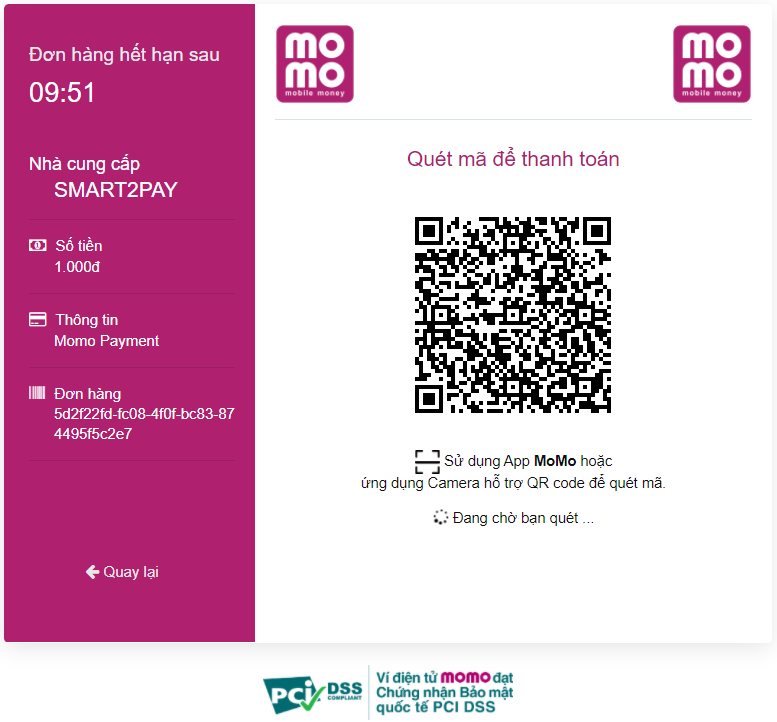

- The customer is redirected to the Momo payment page where he scans the QR Code using the Momo application already installed on his mobile phone. He has 10 minutes in order to successfully scan the QR Code.

- After the customer confirms the payment via his mobile phone application, the payment is successful and the user is redirected to the Momo payment confirmation page.

- Upon completion of the payment flow, the customer is redirected to your ReturnUrl.

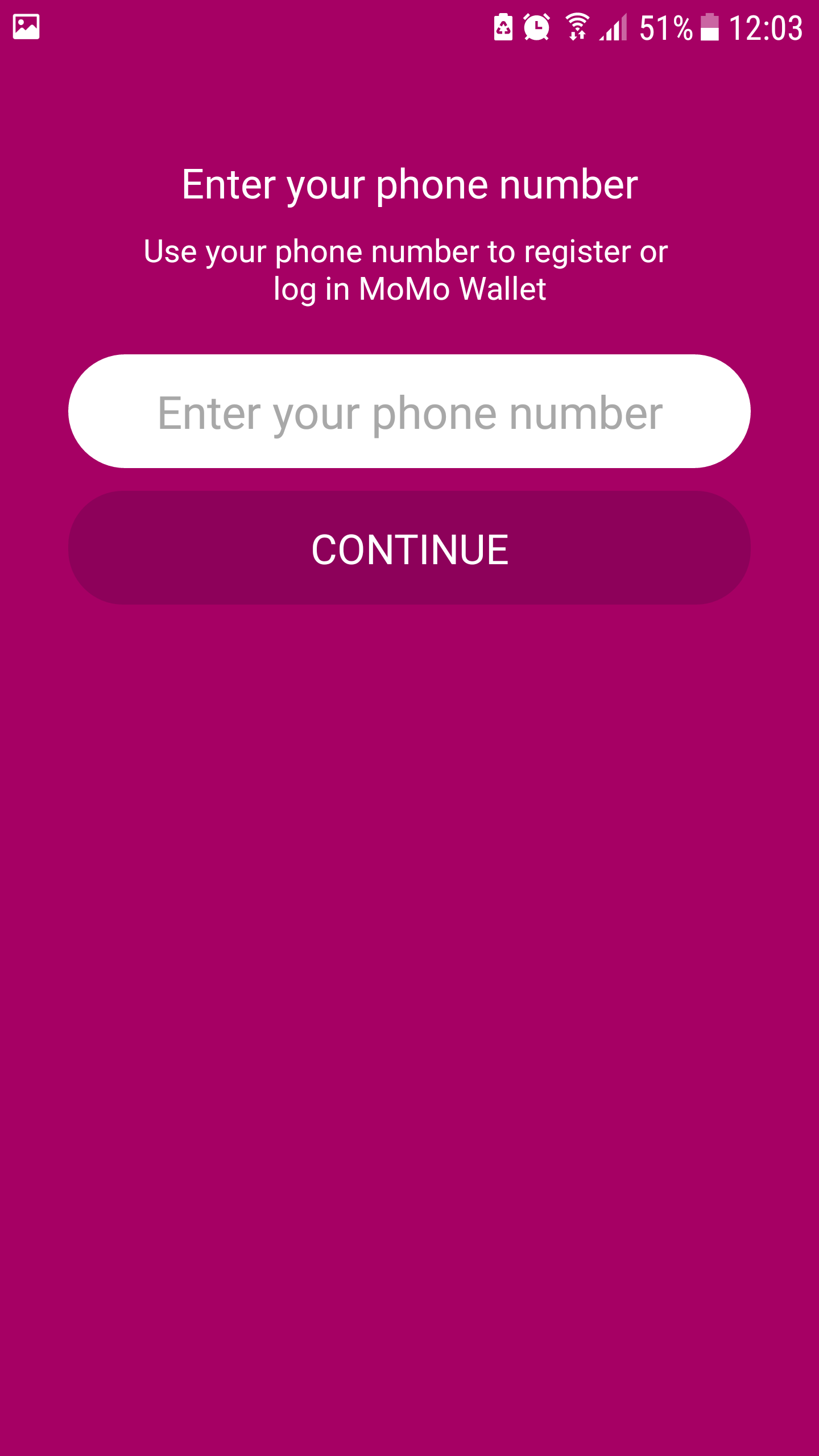

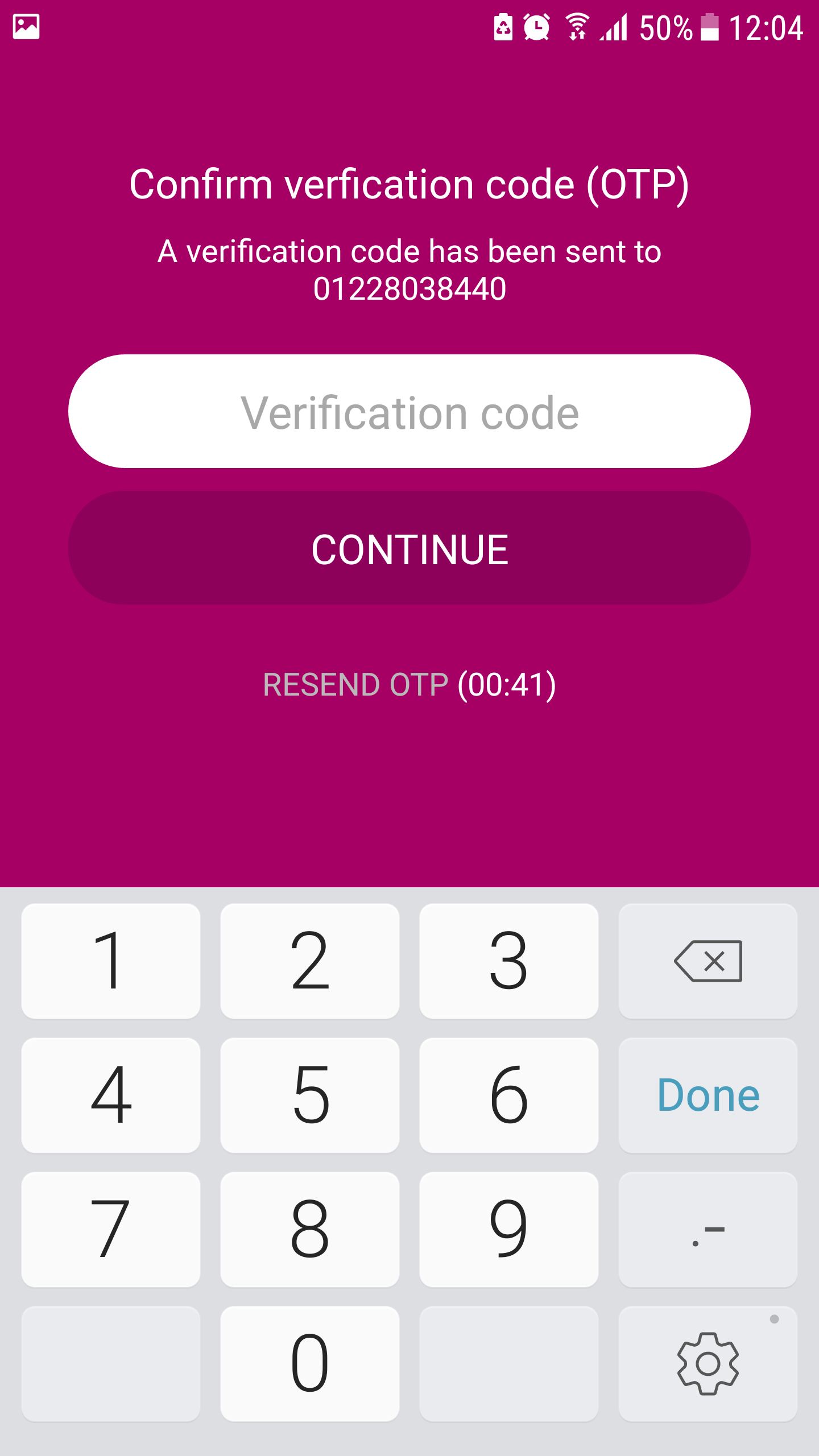

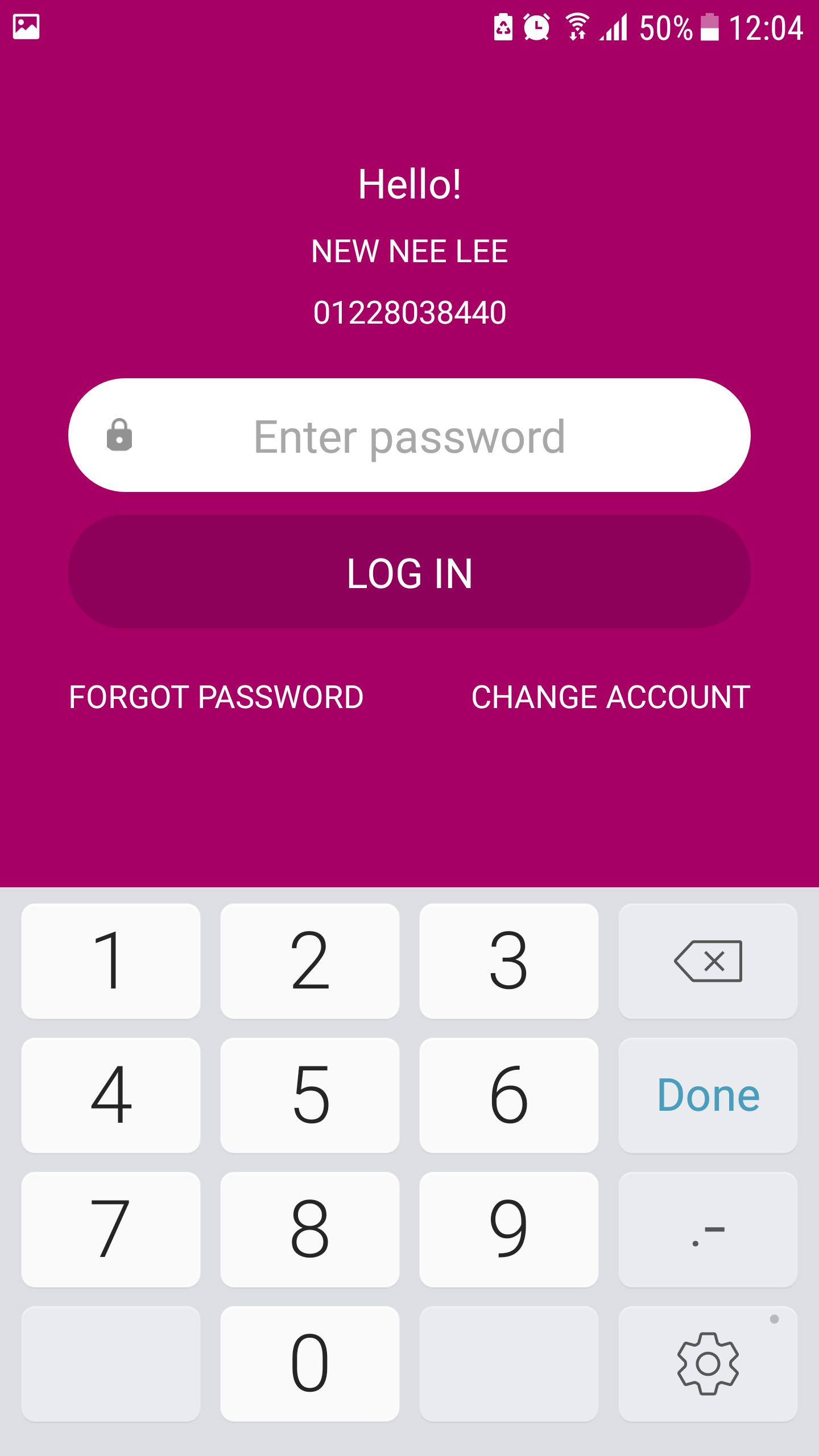

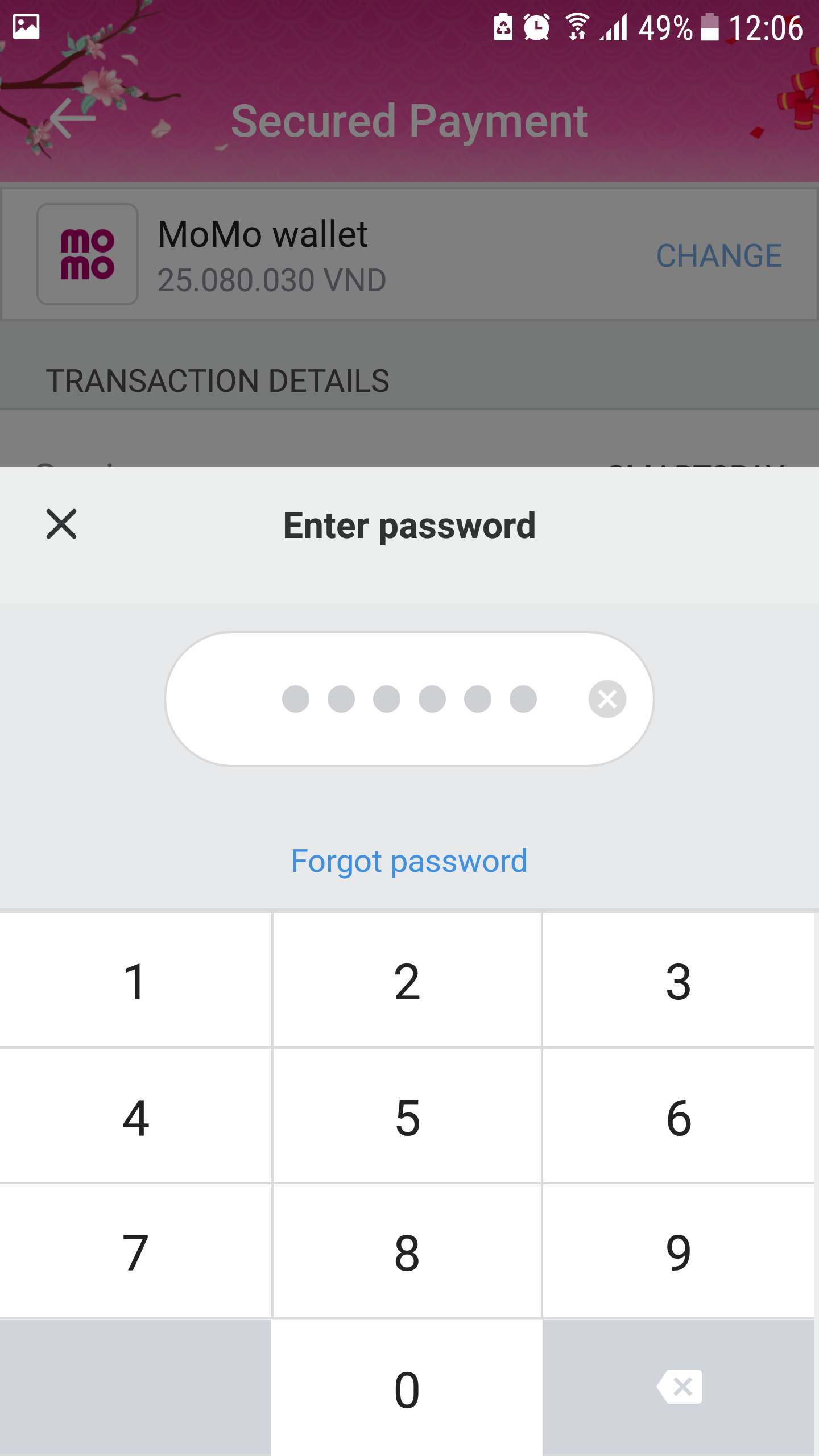

Momo Mobile Payment Flow

- The customer enters his email address.

- The customer is redirected to the Momo application already installed on his mobile phone where he logs into the Momo application using his phone number.

- The customer enters the verification code received via his mobile phone.

- The customer logs into Momo application by entering his password.

- The customer is redirected to the payment details form where he confirms the payment by clicking on the Confirm button.

- The customer enters his account password in order to complete the payment.

- Upon completion of the payment flow, the customer is redirected to your ReturnUrl.

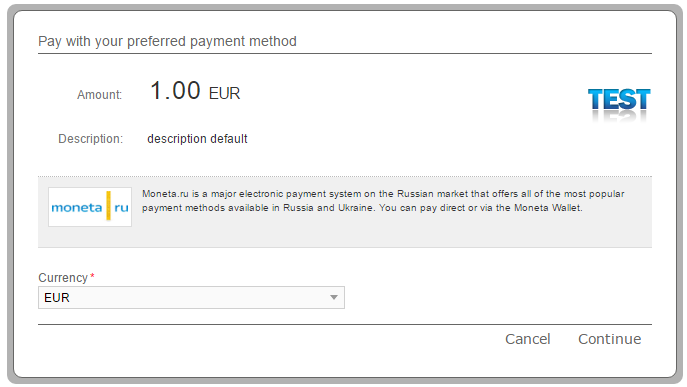

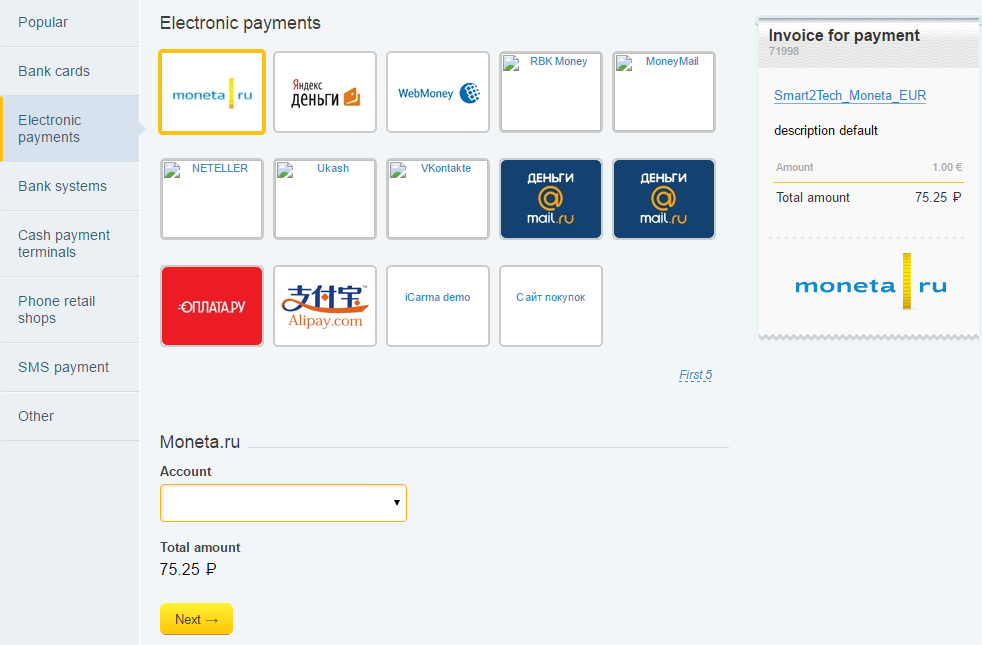

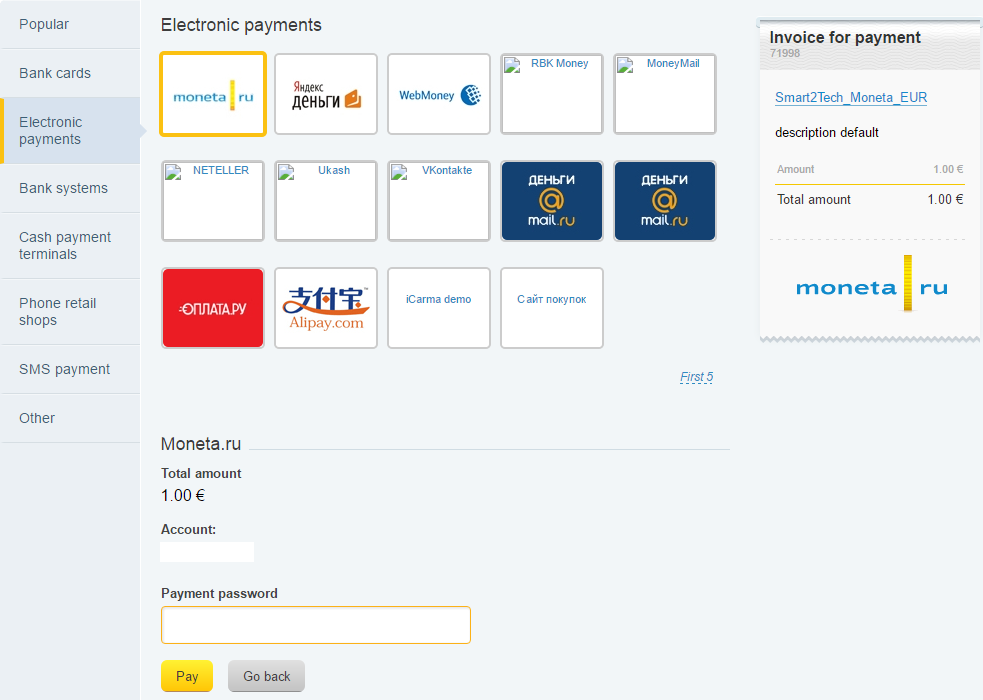

Moneta.ru Test Data

For Moneta.ru payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

Moneta.ru Payment Flow

-

The Customer selects the preferred currency from the list.

-

The Customer enters the login details. He must fill the form with his email and password and continue the transaction using the Next button.

-

The Customer selects the bank account he wants to transfer money from and continue the transaction using the Next button.

-

The Customer enters the password of the payment and uses the Pay button to finish the payment.

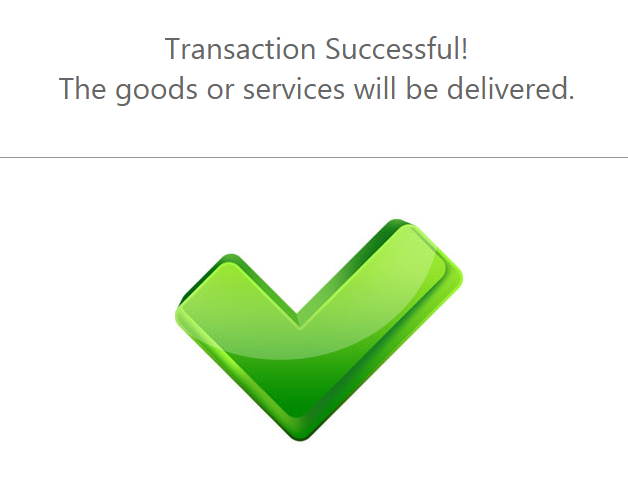

-

Upon completion of the payment flow, the customer is redirected back to your ReturnURL.

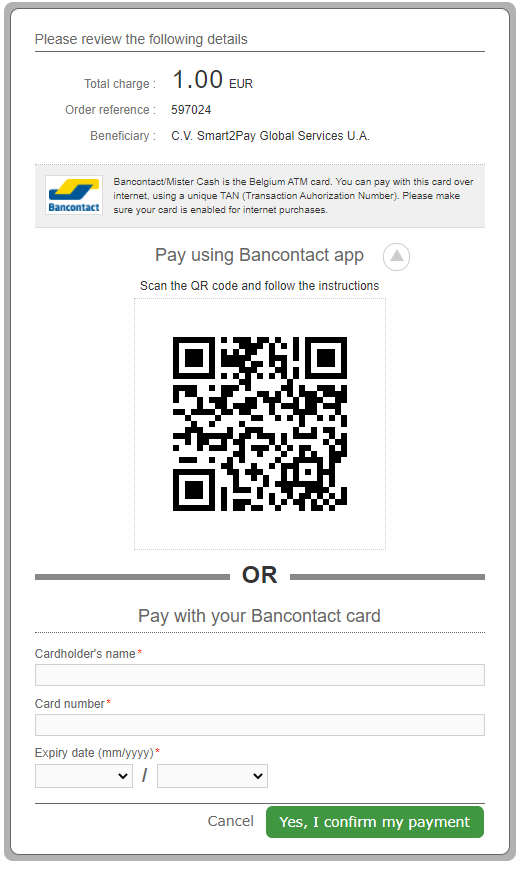

MrCash Test Data

In order for you to test MrCash payment method, please use the below test data.

| MrCash Test Data | |

|---|---|

| Data | Value |

| Card number | 67030000000000003 |

| Cardholder’s name | Enter any name: e.g. John Doe |

| Expiry date | Choose a month and a year at least equal than the current month and year |

MrCash Payment Flow

- The Customer introduces the card details required.

- The customer needs to confirm the payment.

- The customer is redirected to the provider’s confirmation page where the identification process is confirmed.

- Upon completion of the payment flow, the customer is redirected to your ReturnUrl.

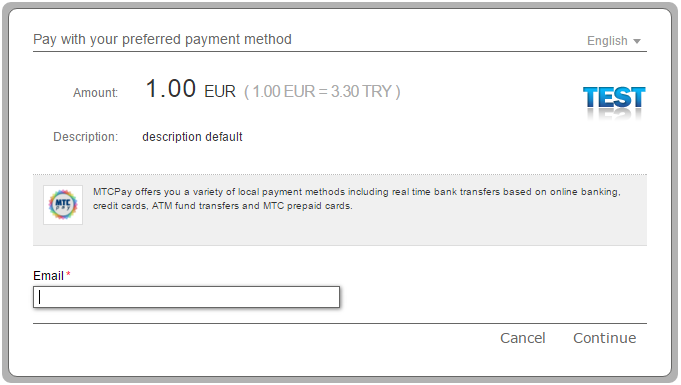

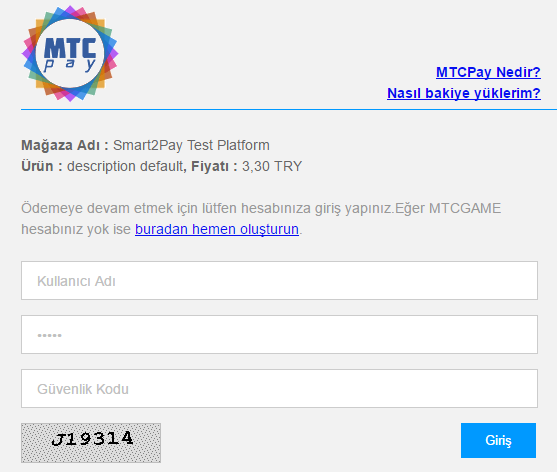

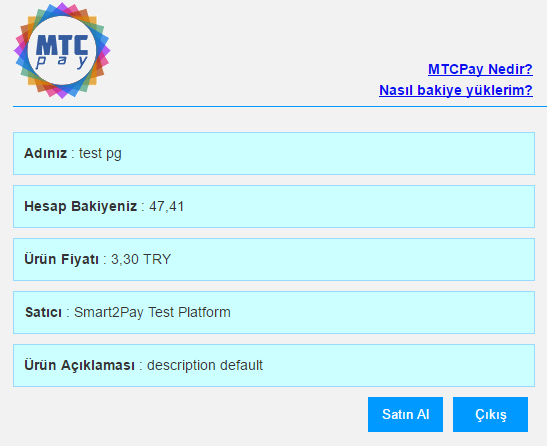

MTCPay Test Data

For MTCPay payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

MTCPay Payment Flow

-

The Customer enters his email address.

-

The Customer logs in his MTCPay account with his username and password. He also has to enter the code given in the security box before proceeding with the payment.

-

The customer sees the payment summary and he completes the transaction by clicking on the Pay button.

-

Upon completion of the payment flow the customer is redirected back to your ReturnURL.

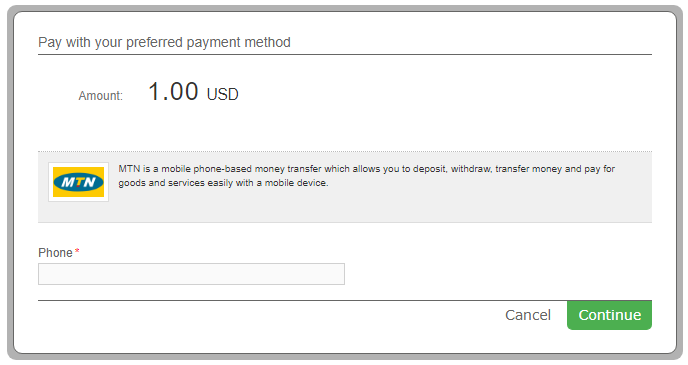

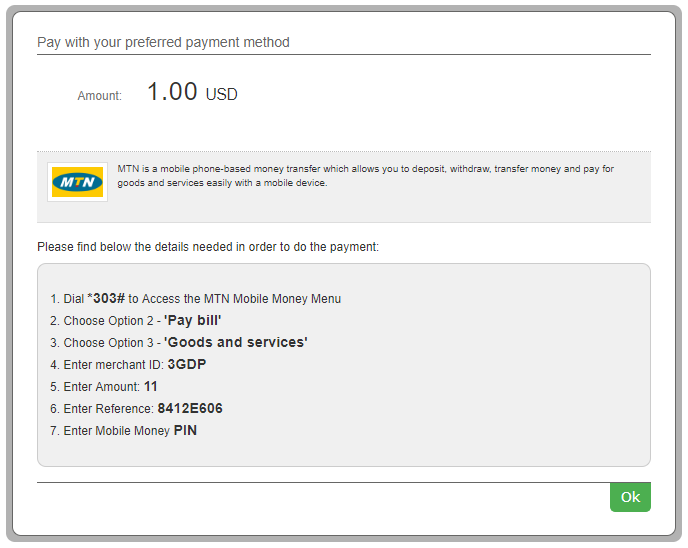

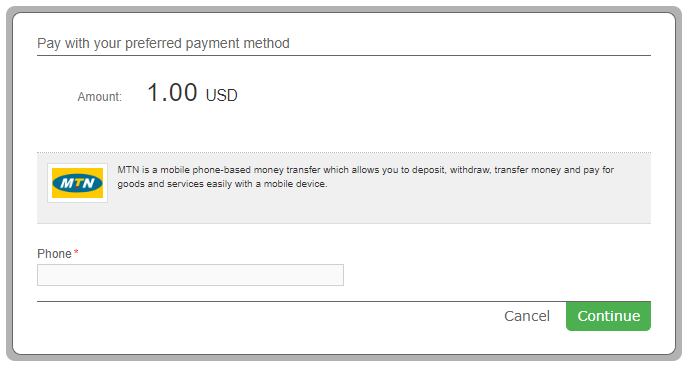

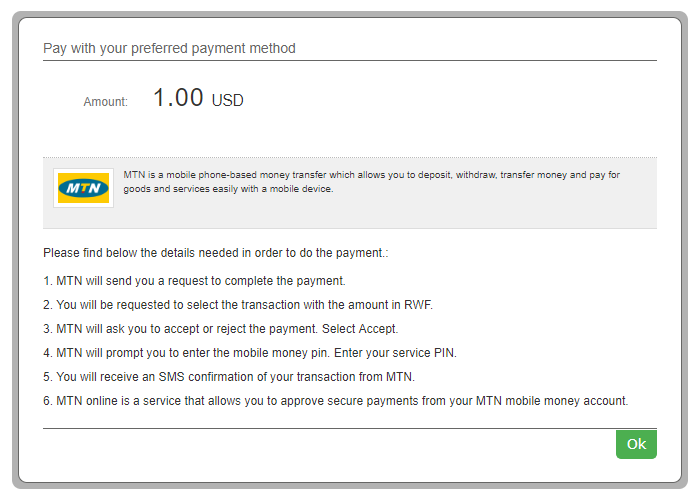

MTN (Rwanda) Test Data

For MTN payment method there aren’t any test data available, but you can see how it works with the payment flow given below.

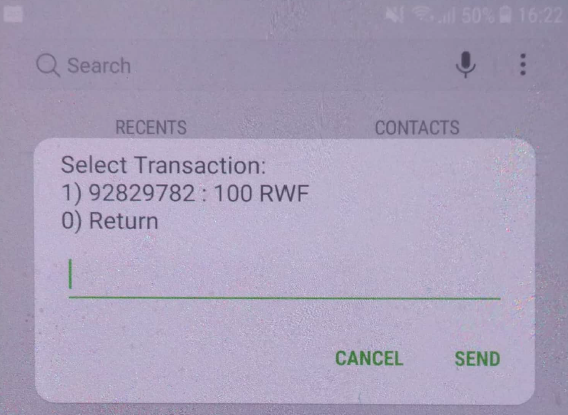

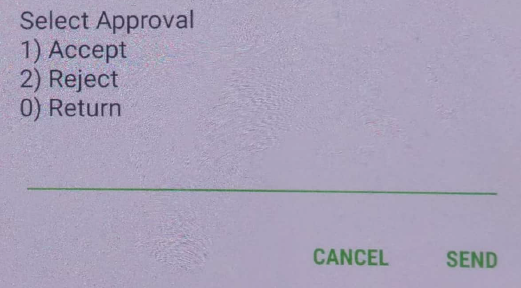

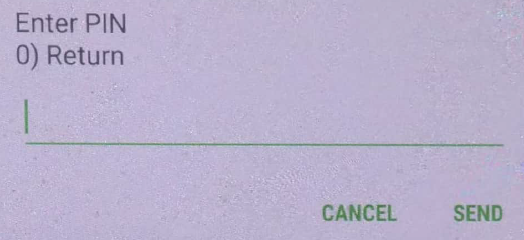

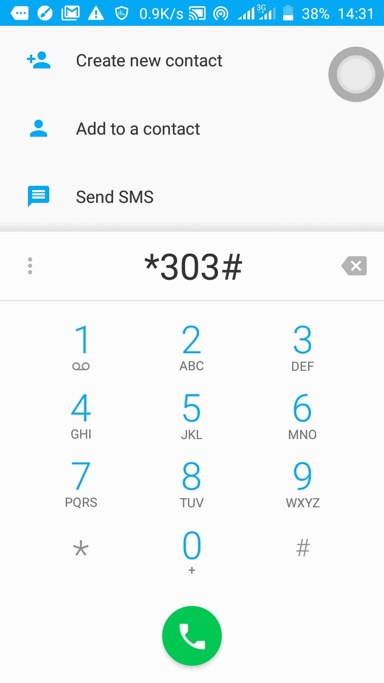

MTN (Rwanda) Payment Flow

- The customer fills in the Phone number.

- The customer receives the details needed to complete the payment.

- The customer receives a mobile request to complete the payment. He has to select the transaction with the amount in RWF currency.

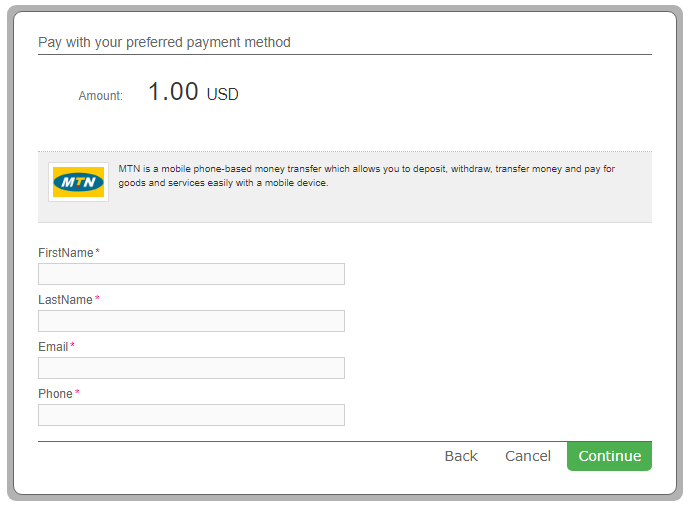

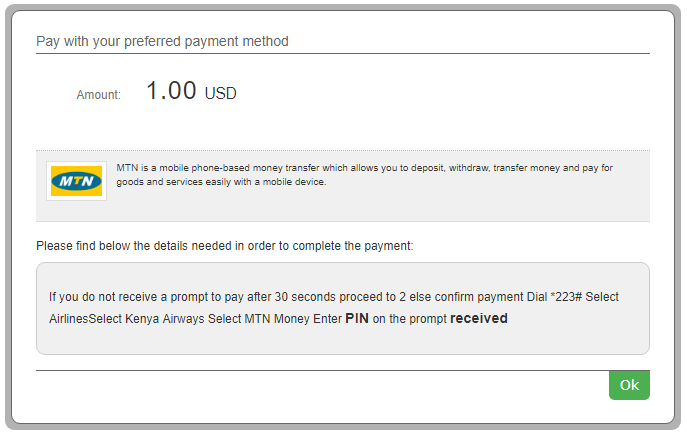

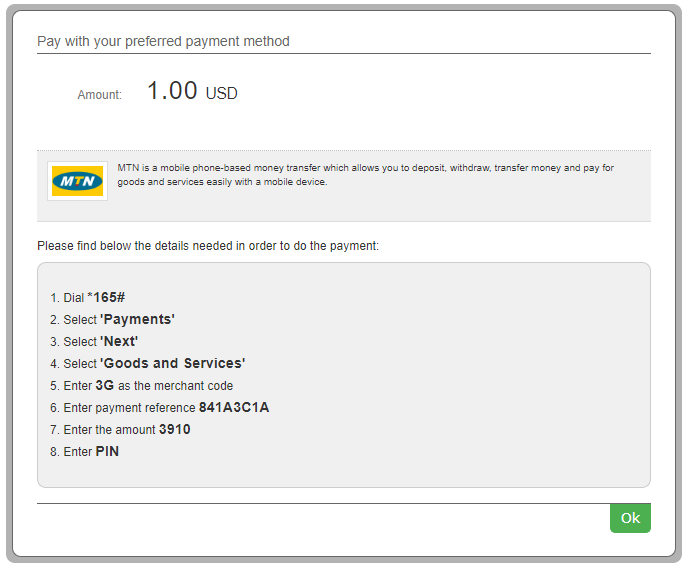

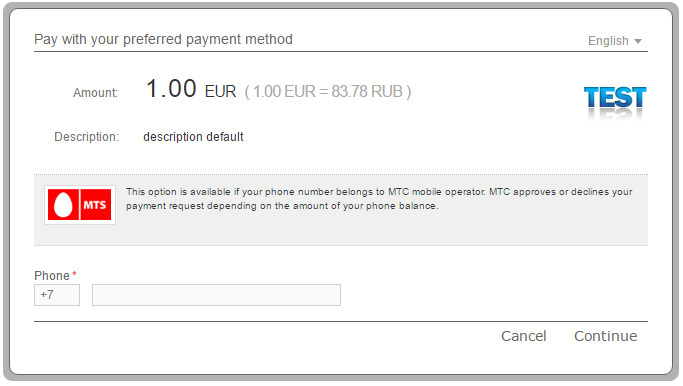

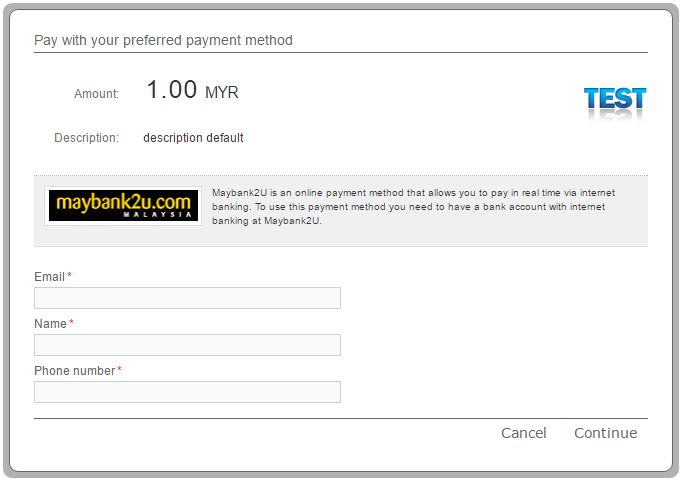

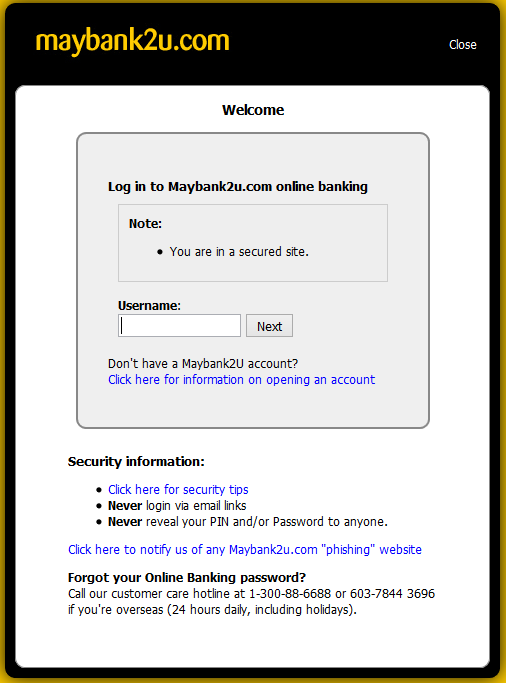

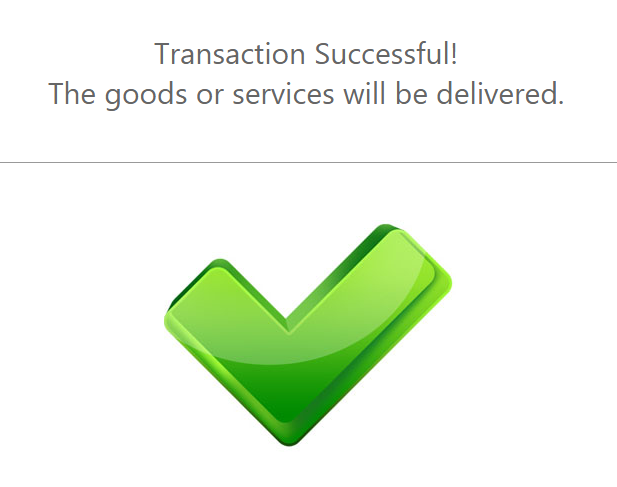

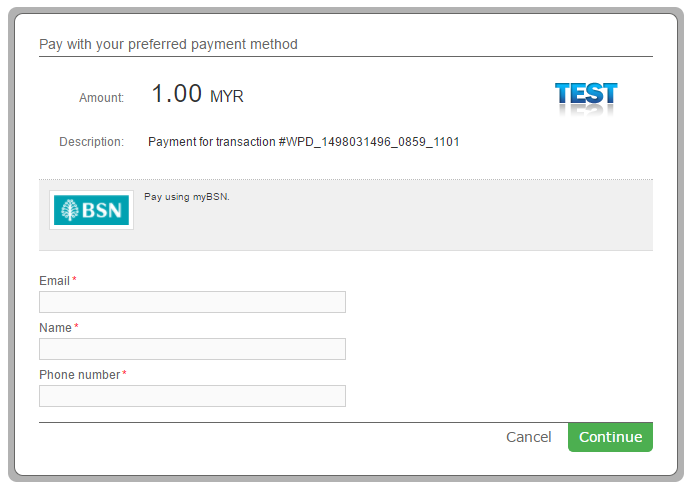

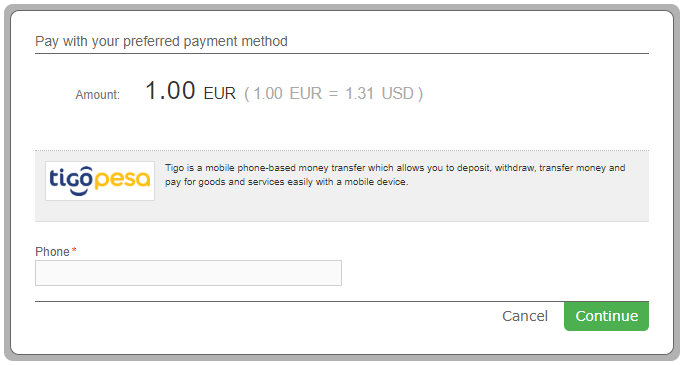

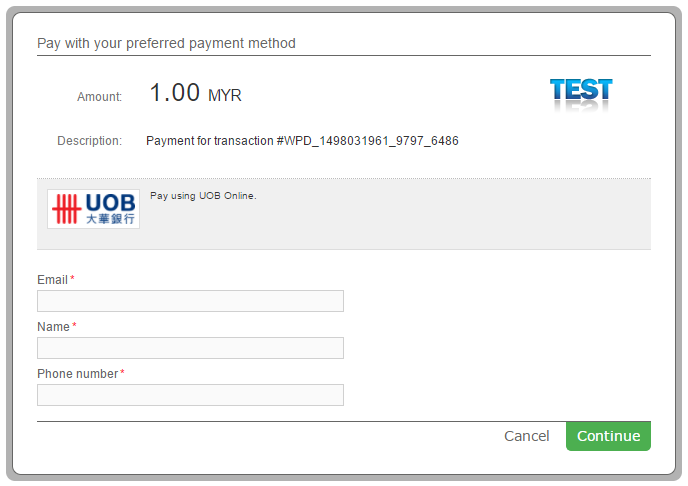

- The customer accepts or rejects the payment.